What Is Spread Betting And How Does It Work (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The Forex industry has many terms. And as knowledge remains to be power, it's far more helpful to have in-depth knowledge of most of them. One such term is – Spread Betting.

A point spread bet helps traders to profit from financial markets by risking portions of margin through leverage. Since it's a complex topic, we'll approach it by way of inviting experts to help us thoroughly understand how it applies.

In that order, we'll call upon Ezekiel Chew – a prominent forex trader and markets analyst from AFM – Asia Forex Mentor, to guide us through this post. He scores more than 20 years of trading in the financial markets. He has expert knowledge of trading stocks, Forex pairs, commodities, and cryptocurrencies.

If you are an upcoming trader, you stand a big opportunity to benefit from expertly crafted Vlogs and blogs via the Asia Forex Mentor. Those comprise a portion of his way of sharing knowledge as a way of giving back to society.

What is Spread Betting?

In a simple explanation, spread betting is a derivative product. Therefore, point spread betting takes the form of speculations against the price directions of another asset.

On a specific note, therefore, one taking on point spread betting has no obligation to own the asset. Rather, they make money by speculating on its price directions. Hence, the derivative nature of spread betting.

Since point spread betting works with contracts, betting on the direction of prices derives from a broad base of assets. So betting may base on the price direction of the following:

- Forex pairs like EUR/USD, GBP/JPY, and NOK/SEK

- Indices like the DJIA, DAX, FTSE, and S&P 500 (US 500)

- Commodities like Gold, Wheat, Coffee, Silver, Copper, and Palladium

- Shares like Meta (Facebook), and Alphabet (Google Inc.) Amazon (AMZN), among many others

Basically, the spread betting contract derives from a speculator's analysis and belief. The price will either rise or else fall. In other words, the bullish and bearish scenarios apply – with specific price points.

The other significant fact with spread betting is – it's a leveraged product. And the leverage applies as it does in ordinary Forex markets. In finer details, leverage in spread betting helps you to amplify the profits.

If you compare spread betting and traditional investing, you'll find more enticing opportunities with spread betting. And that arises from the fact that it's leveraged. If a trader opens a position, they'll only require a small portion of equity.

To lay more emphasis on leverage, as most experts refer to it, it's a – Double-edged sword. The decisions with risk and opportunity management are largely left upon the traders to best decide how to navigate the markets.

It's also very important to lay emphasis here regarding spread betting and leverage. In as much as it allows speculators to take up huge profits with little equity, the reverse applies. Or, should the prices go unfavorably against a speculator, they lose equally huge portions of equity.

Therefore, spread betting is plagued by similar risks as you'd find with a trader on Forex pairs. So, spread betting calls for stringent risk management practices to ensure traders do not lose all capital in an account.

Also worth mentioning here is that spread betting is tax-free in a few jurisdictions across the globe. It's best to verify this with the capital markets authorities or securities exchange commissions from the geographical areas from where you trade.

According to details, spread betting has been around the markets for quite a long time. Almost hitting half a century! Since 1974, spread betting has advanced – allowing speculations based on many markets like the American odds.

If you compare the traditional model of buying and holding assets, spread betting only comes in to add more opportunities. And, of course, riding on one critical factor – whether prices will fall or rise – speculators sell or buy the underlying market or asset.

How Does Point Spread Betting Work?

In this section, we'll go over the finer details of how practical spread betting works.

The core of spread betting is working with tracking the value of another asset concurrently.

Therefore, a spread better takes a position depending on the price movements of the asset they select.

One clear note is that one must not have ownership of the asset they base the speculation on.

As peculiar with every opportunity, spread betting is subject to a few concepts. And we'll expound on three key ones:

Short and long point spread betting odds

Typically, a short point spread bet is a sell position. It's a position where market prices are expected to decline within the timeframes the bet is active.

Next is a long spread bet is a buy position. It is hoped that market prices will increase in the time frames the betting contract remains active.

Leverage in a point spread betting

Leverage simply implies using capital that is borrowed. In traditional investments, leverage conforms to taking a bank loan for a business.

However, in the context of spread betting, brokers allow contract owners to gain further exposure to the market. And that is allowed with only a small fraction of the cost of an underlying asset.

If we consider leverage by way of an example – an investor looking to take a position with Amazon shares. Basically, the plan would involve the prospective owner paying for the number of shares at full value. So, approaching the same with spread betting will amount to providing a small portion. The upfront amount can be, say 20% of the amount of the total shares.

To reiterate – leverage amplifies the opportunities with high profits. Conversely, it amplifies the chances of high losses. The leveraged bet sizes are calculated based on the full values of open positions – profits and losses.

With the risk-reward opportunity in mind, it's upon the speculator to approach markets skillfully and avoid losing all capital instantly.

Margin in point spread betting

Practically, a spread bet requires you commit an initial deposit. Usually, it's a small amount – which is the margin. It's the main reason why those trading on leverage often refers to it as – trading on margins.

Digging slightly deeper, there are two types of margins with spread betting. And next, we’ll discuss each to help speculators grasp the key differences.

They are deposit margin and maintenance margins.

Deposit margin in point spread betting

A deposit margin is the initial funding for a contract. It’s the minimum requirement to open any position, depending on the entire position value.

Deposit margins are usually presented as percentages or a fraction of the total trade or bet for assets and other markets.

Maintenance margin in point spread betting

Maintenance margin is an additional amount a speculator requires to hold positions.

If prices shift unfavorably, a point spread incurs losses. Therefore, to hold the position, the maintenance margin comes in handy.

The other scenario is, if your spread betting account only holds an equity or capital equal to the deposit margin, chances are you stand to lose all the bets. The reason is that you’ll most probably receive instantaneous margin calls.

Margin calls are notifications from a broker or trading platform. They are requests to add or deposit more funds into the trading account. Ignoring margin calls and if prices further spill adversely, brokers have no recourse except to closer the positions at the same amount.

One key point to consider is the margin rate. And margin rates with spread betting vary across the markets and trading platforms. For instance, a margin rate may be an average of 20% of trade sizes for stocks. On the other hand, for a point spread on forex pairs, it may be 3% of the position size on average.

Key Features with Point Spread Bets Contracts

Other than leverage, margin, and either long or short spread bets, there’re more peculiar features. There're three apply in spread betting as they do on Forex trades.

Next, we’ll look at three main features applicable to spread betting. Namely, they are the spreads, bet sizes, and bet durations.

Spread in Spread Betting

In a simple explanation, a spread is a difference between the buying and selling prices. Spreads revolve around the current market price of an underlying asset.

The spreads are normally two for each bet type – the bid and the offer. In that order, the bid is the highest price a buyer pays. And so, an offer is the lowest price a seller can take.

Let’s look at the spread from a Let'sical example of how a point spread works. Assume the FTSE 100 shows a trading market price of 5885.5, assuming it has a one-point spread. So, the offer or buy price goes to 5886. And the bid or sell price goes to 5885.

In summary, the point spread lines are divided into two. So there are three points. First is the price line. The other two are the buy and sell entry points – each is a plus sign and a minus sign of the entire spread.

Each half point (which is ½ or 0.5) is added to the market price to get the buy price. And the other half was deducted from the market price to get the selling price.

Trading platforms factor in the costs. So speculators usually buy slightly higher than the market price. Conversely, sellers sell slightly below the market price. Experts say that the wider the spread, the higher the risks and lack of liquidity in a market for an underlying asset.

The Bet Size

In spread betting, a bet size refers to the amount one targets to bet on per unit-price movement with respect to an underlying asset or market.

Normally, there are no limitations on the bet size – so long as it falls within the minimum acceptable standards within a market or trade platform.

When it comes to the profits or losses you make, the convention is – to get the difference between the entry and exit price and multiply it with the value of the bet.

Spread betting measures price movements using pints for an underlying market. On most occasions, it derives from two metrics. One is the market liquidity, and the second is the market volatility.

Further, to define a pint with respect to an underlying market – it could be representative of, say, one pound, one penny. Or even a hundredth penny. It’s important to verify the details of the amount each pint holds, depending on the market you trade on. Also, the deal tickets should have finer details.

Last note on this section: a practical explanation showing deal size. Assume a speculator opens a $2 per point – spread bet on the FTSE 100. Further, work under the assumption that the deal closes in favor – moving 60 points. Therefore, the profit will be $120. Or $2 x 60 points.

Conversely, in the above example, if the deal moves against the speculator with similar points, they lose the same – $120.

Bet Duration

A bet duration refers to the time it takes before expiry.

Spread bets work with time scales that are fixed. The shortest ones fall within a day, while longer ones take several months to expiry.

Speculators are free to close the spread bets at any point in time before the date of expiry hits, plus other house rules.

Here is a list of the spread bets you'll likely find with regard to timeframes before expiry:

Daily funded bets – they keep running for as long as a speculator wants to keep them open. Their dates of default expiry are placed into a distant future. Usually, they offer very tight spreads and are subject to overnight funding.

So, mostly they are applicable for short-term betting action positions.

Quarterly bets – there are futures bets that expire on a quarterly basis. Sometimes, speculators may be allowed to roll them over past a quarter – with adequate notice to the trading platforms. The spreads are usually very wide, but that also compensates for the low-cost requirements for funding. This model suits speculators who want to go for long-term contracts.

Example of Point Spread Betting

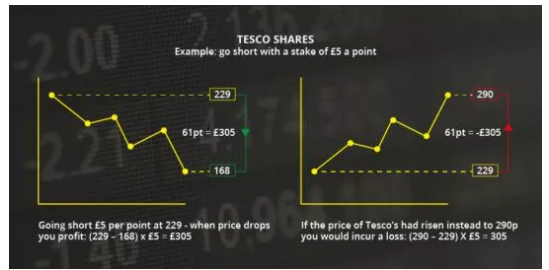

For example, with spread betting, we’ll use Tesco shares. So, assume the current market price per share is $229. And following your recent insights, you believe the prices will maintain a downtrend into the foreseeable future.

The factors you’ve put on the table are analysis of market news, upcoming events, and especially recent announcements by Tesco's board of management.

If all things go in line with your predictions, you go short, taking short bet contracts. Each is $5 per point, and the price swings right from $229 to $186 per share. Your contract will close with $302. That is 61 points, and each is multiplied by $5.

Again, there’s the possibility that prices go the other way – from $220 to $ 290 per share. Similarly, instead of gaining 61 points, you’ll end up losing $305 in total.

Therefore, as you can see from the above scenarios, spread bets have great potential. And you’ve to bear in mind that the bet works both ways – into profits or into losses.

From other points of application, spread betting action applies to common sports betting. The two sports are football and basketball. In the Scope of football and basketball, different spreads apply during game time. Each game comprises one bet as the popular form on a win or lose basis.

Actors in sports betting have alternative lines to ensure teams are evenly matched with most sportsbooks and margin of victory. For instance, football and basketball teams have varying power rankings from the different virtual game lands.

So, with that said and done, the best way to approach this is:

- Do adequate analysis and consider other factors before committing to the next bet

- Enter the spread bets contracts with s reasonable stop loss

The stop losses you place should be reasonable. Plus, the bet size should be reasonable, too, and within the picture of your risk-reward ratios. SL positions put you out of the market if conditions turn against you. Yet, they allow you to protect adequate capital for the limitless spread betting opportunities into the future.

How to Manage Risks

Leveraged products have higher risks than ordinary investments. The reason is that you may lose capital with only one greedy move. Not to mention that you may multiply it many times – in case a market moves favors you.

However, hitting a gold mine with one move is the too risky way. But wise and expert speculators have a unique way of facing the markets. They manage risks in smart ways – meaning they do not struggle to chase the markets. Rather, they build adequate analysis and punch the markets whenever the highest odds favor them.

Even then, they cover their capital with a stop loss. And there’s a smart way to work with stop loss positions. Whenever a move goes in favor of your prediction, you can keep adjusting it in favor of your huge chunk of capital and profit.

Therefore, if your spread bet already has a reasonable amount of profit – lock it with an SL position. You can keep moving it, allow price lines the room to breathe and move further into your favor.

What are the kinds of Stop Losses in Spread Betting?

Spread betting allows two types of stop-loss orders to cover positions should market conditions turn against your predictions.

Essentially, here, we’ll cover the two: a STOP and STOP LIMIT order.

First, a stop-loss position closes the contracts once a certain set price limit is hit by a price line. While speculators lose a small portion of equity – it’s worth it. It’s better to part with the utmost 2% instead of a margin call that will probably wipe out an entire account.

Secondly is the sell stop limit. This order automatically opens a sell in case a buy contract turns against you.

Oftentimes, the stops may be confusing. Speculators should take time to grasp what each stop does before they can actually use them in live accounts.

Best Forex Trading Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Spread Betting

There are many ways to approach financial markets and make profits from price action. One such unique way is spread betting. With spread betting, a speculator is able to benefit from derivative product contracts. In a better explanation, they must not even own the underlying asset.

Spread betting requires a careful approach – just as a trader in forex does. And it has similar components – margin as the minimum deposits to open trades and leverage to amplify the bet sizes. While profits are enticingly high, so are the losses if markets turn against predictions.

While spread betting works in forex markets, there are distinct features. And they are: bet spreads, bet sizes, and bet durations. Lastly, one critical component of successfully taking on spread betting is risk management. And risk management within the scopes of spread betting involves careful analysis, picking a reasonable bet size as well as using stop loss positions to protect capital.

Spread Betting FAQs

What is a spread betting margin?

A spread bet margin is the initial amount a trading platform requires from a trader to allow them to open contracts. It’s best to have an account with capital – to meet the margin initial margin requirements plus the maintenance margin.

A maintenance margin helps a speculator by enabling them to hold the contracts even if prices turn against them. However, for professional bettors, it's best to exit contracts with small losses via a stop-loss position.

What is a bet size?

Bet size is the amount a speculator aims at if the market moves in their favor.

Working with a reasonable small bet size helps.

A good bet size allows a trader to meet maintenance margins with ease. Else, you are able to lose small capital in case of large adverse price moves yet win reasonable profits to keep growing your accounts.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.