Spot Rate: Overview, How It Works, And Its Limitations

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

One of the most liquid markets in the world is foreign exchange, also known as the “forex” or “FX” market, where currencies are traded in trillions. Many investors and pro traders are tempted to trade in this market because of its high liquidity to gain maximum profits. And one of the most preferred methods is spot rate.

The spot rate is the most common approach. It's the amount one currency will trade for another at a certain moment. The phrase comes from an adage about on the spot. The trade needs to be completed as fast as possible. Also, the foreign exchange markets control the spot rates. This is where currency traders and countries make their investments. The spot date's value is usually two days after the transaction date. The USD/CAD pair is an exception, as it is traded a day before the agreed date in the forex market.

To understand the spot rate, we have got Ezekiel Chew, the CEO of Asia Forex Mentor, to explain it in detail. Ezekiel Chew is a full-time Forex trader and coach known for his unique no-nonsense approach to trading and coaching. We will discuss his take on the spot rate, trading exchange rate, how to find forward rate, and much more.

What is Spot Rate

A spot rate is the asset price like interest rates, exchange price, or a commodity in a transaction that involves immediate delivery. The transaction that settles on the spot date is known as a “spot transaction.” Like all other prices, the spot rate is determined by the demand and supply in the market. The spot market is also called the physical or cash market, as the payments are traded immediately.

When a deal is agreed upon, the buyer and seller must complete the transaction within two business days. It is the most widely used type of transaction in foreign exchange and interest rate markets. Most of the time, two business days are sufficient for exchanging currencies. Therefore, the delivery of foreign currency exchanges usually takes place on the second business day after the trade date.

Despite the settlement date, the buyer and seller contract is performed right on the spot based on the existing quantity and prevailing price. It also contrasts with the forward and futures markets, where both parties agree to trade at the future price of an asset. Forward/futures markets, on the other hand, make a contract today but expect payment to take place in the future. Spot markets may exist wherever there is a foundation for such activities.

Trading the Exchange Rate

The phrase “spot value” appears in some circles to be interchangeable with “value.” As a result, it's critical to keep any use of these terms precise. Occasionally, it's characterized as trading for value funds rather than value spots. As a result, there is a distinct distinction between the dates at which settlement on the trade and the trade itself must occur.

The currency pairs in the forex market are distributed on the spot value date. The transaction is immediate, and there is no time lag between when the trade is made and when it settles. Also, it is called value spot trading.

Spot Trade Example

You've decided to enter the Forex market and want to perform a spot transaction by buying USD 200,000 rather than YEN. The market maker offers you an exchange rate of 1.2861, the dominant spot rate for that currency pair. If you accept to deal at this rapid exchange price, you will start a spot trade that will be delivered in 2 business days.

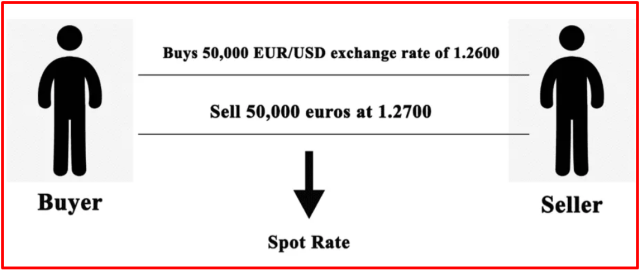

If you believe the EUR/USD exchange rate will rise, you will buy 50,000 EUR rather than the USD for the value spot. The rate is 1.2600, so you will acquire 50,000 EUR at this price. If the expected market exchange price of EUR/USD reaches 1.2700, you may sell your 50,000 euros for 1.2700. That will result in a profit of €50,000 x (1.2700 – 1.2600) = $500.

However, if your market prediction is incorrect and the rates fall to 1.25, you need to close your deal at 1.25 for a loss of €500,000 x (1.2600 – 1.2500) = $500. Therefore, it is essential to properly understand the market conditions before entering any spot trade.

Two Prices at Once

It is essential to know that in the FX market, two prices are usually offered for a currency pair. It is strange but can be possible, especially when you are trading commodities. Whether it is gold, crude oil, any agricultural product, or any other good, there are always two prices, i-e, spot price, and futures price.

In the spot market, you will have cash and forward prices. The forward rate is always higher than the cash price because it includes a premium, the interest rate differential between the two currencies. When trading in the spot market, you will always trade at the current market price. The prices are quoted in real-time and constantly change as the market moves. You can check live prices on our website.

On the other hand, the futures market is a bit different. In the futures market, you will have a contract price that you will trade at. The contract price is the price you have agreed to trade the currency pair, which is valid for a specific period. The contract price is fixed, and you will not have to pay any interest.

The most significant difference between the spot market and the futures market is that in the futures market, you are not trading the actual currency pair. Instead, you are only trading a contract that will give you the right to buy or sell the currency pair at a specific price and date.

Forward Rate

A forward contract is an agreement to buy or sell a currency at a future date at a rate agreed upon today. The forward price is the settlement price of the contract. Spot prices can predict the future price depending on your buying asset. Also, spot rates are used to calculate forward rates.

The finance charges should be subtracted from the difference in spot and forward prices. In addition, any profits that are owed to the security owner. The price difference between the spot rate and the forward is considered when distributing dividends throughout time minus interest on the purchase price.

The forward rate must be changed from the winning spot rate. The interest rate divergence in currencies and the delivery date's distance are used to establish it. It is calculated using the current delivery date and the difference between rates, and traders can attach or remove a specific number of swap points based on their preference.

Forward Price

The forward price is the settlement price of a forward contract. The forward rate is set when the contract is entered into and does not change during the contract's life. The forward price is normally quoted for a specific delivery date and is usually higher than the spot price. The price difference between the spot and the forward rate is due to the interest rate differential between the two currencies.

When you are trading and buying a higher currency interest rate, you can receive swap points for forward rollover. You will be paying swap points if you buy a lower interest rate currency. If a broker sells the higher interest rate currency to roll over their position later, he will have to finance swap points. He'll lose his exchange rate if he does a rollover, and he'll have to accept a bad deal.

Remember that swap points are known for forwarding pips. So, if you are a forward trader, you can use it to calculate the difference in interest rates on deposits in the two currencies that make up a currency pair.

How to Find Forward Rate

The forward rate is the settlement price of a forward contract. The forward rate is set when the contract is entered into and does not change during the contract's life. The traders usually calculate them from the swaps and spot rates as they happen between expected future delivery dates. Also, they are interpolated in a linear fashion.

Spot rates and swaps are the most popular information sources, which allow FOREX traders to compute forward rates. In addition, financial market data sources provide FOREX contracts that forex traders may utilize in conjunction with spot rates to determine forward premiums.

Limitations of Spot Rate

The forward market doesn't exist for all currency pairs, and the spot market is used instead. In addition, there is no secondary market for forwarding contracts, so they cannot be bought or sold before their delivery date.

Spot rates may be beneficial in certain circumstances, but they can't forecast future rates or the market's direction. In a bearish market, it might provide smaller profits to a seller. Spot rate contracts on a specific rate that gives a reasonable profit when sold are possible with the aid of items that deal with long-term rates.

Market situations have an impact on the spot rate. The performance and price of the market can be affected by political events and environmental activities. The potential upside is that these events influence the market as a whole. It can grow rapidly and change every second.

Because of this, buyers must concentrate on buying and selling at all times to avoid big losses. It is the simplest contract form and doesn't require much analysis.

Best Forex Trading Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Spot Rate

Rates are critical to consider when beginning in the FOREX market as it indicates the market movement. The movement in the spot rates and the swaps can help traders determine their forward rates. Understanding how these work and how they are interconnected to make the most out of trading in the FOREX market is essential.

You should consider the spot rate when it might provide smaller profits as a seller. When buying, focus on long-term rates to lock in a reasonable profit. And finally, as a beginner, learn as much as possible about the market and don't be afraid to ask for help from more experienced traders.

Spot Rate FAQs

How do you calculate spot rate?

The spot rate is the price at which a buyer would be willing to trade a zero-coupon bond in exchange for one that earns interest. As a result, they have different interest rates for various terms before maturity.

What is the treasury spot rate?

The spot rate is an expected yield curve that uses Treasury spot rates rather than yields to construct it. This spot rate is an important benchmark for bond prices on the market.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.