SOFR Rate: An In-Depth Guide for Beginners (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

SOFR is a term that Forex market participants require to understand. More so, the implications it has and over what timelines. This adds to the knowledge of the past decisions and helps in figuring out the future implications as regards interest rates.

Interest rates are a huge trigger that seems to markets react across every currency pair and commodity. And by extension, the same reactions affect any derivatives markets contracts relating to them. Therefore, every trader has an obligation to grasp drastic decisions around interest rates.

As part of our efforts to churn helpful posts, we reach out to Ezekiel Chew – a Forex trading trainer and analyst under Asia Forex Mentor. With over 20 years in the markets, he will help us understand SOFR. And more specifically- a brief history, the transition timelines, and the challenges along the same.

Readers should expect a better positioning regarding how they take on analyzing fundamental insight with respect to their trading aspirations. As an in-depth guide, we’ll arm you with a key component of following closely at interest rates – but more specifically, what stakeholders have on schedule in how SOFR comes up and its key implementation timelines.

What is SOFR or Secured Overnight Financing Rate?

SOFR refers to the Secured Overnight Financing Rate. In other words, it's the secured interbank overnight interest rate.

SOFR is a guiding reference rate, and it’s taken as the benchmark of interest rates by financial institutions. And it will, in the course of time, come to replace LIBOR. LIBOR, or the London Interbank Offered Rate, has for many decades been the benchmark.

SOFR will feature as the most acceptable rate for most loans and derivative products that prefer the USD or the United State Dollar.

On a daily schedule, the SOFR is a reflection of repurchases within the treasury securities markets. Ideally, investors in stocks offer banks overnight loans. Of course, the loans have bond assets as collateral.

SOFR presents a more significant benchmark of rates with growing markets and, more specifically, the derivatives market. SOFR as a benchmark relies on the actual costs of transactions.

The repurchase agreements act under the collateral, securing them via government bonds. The FED considers the SOFR as a less risky rate when put to comparison with the LIBOR. Plus, SOFR applies an entirely different approach to calculating it.

Accordingly, some experts believe that the overnight financing rate SOFR ensures that the cost of capital for companies is both lower and hence less risky. Given that SOFR is a calculation of already closed transactions, it defeats LIBOR.

History of Secured Overnight Financing Rate (SOFR)

SOFR is a culmination of the global economic crisis that hit markets specifically from 2007 to 2008.

One key inference of the crisis was that banks and other key financial institutions around the globe would manipulate the applicable rates. At the time – LIBOR.

So as part of a curative solution, it was decided that market regulators steer away from LIBOR as the benchmark. By then, LIBOR was the guide holding together the financial systems. At stake were an estimated $ 300 Trillion in loans and other forms of derivatives and instruments in multi-currencies.

The FED guidelines set 2021 as the final year of the transitions to take place. All firms to steer away from LIBOR to other alternatives by the set dates. The transition received a boot in July 2019. The FED and SEC president by then – John Williams, makes a call to institutions to transition earlier and not wait for the lapses of deadlines.

Among the benchmarks, SOFR was more agreeable. In the process, smaller banks unable to switch on faster were to reduce their lending volumes first. And companies reduced the ability to hedge interest rates. As a result, in 2019, the Bank of China sold public dollar bonds. Others following in that order were the World bank – selling in February of 2021. Next, the Korean Development Bank sold in March 2021.

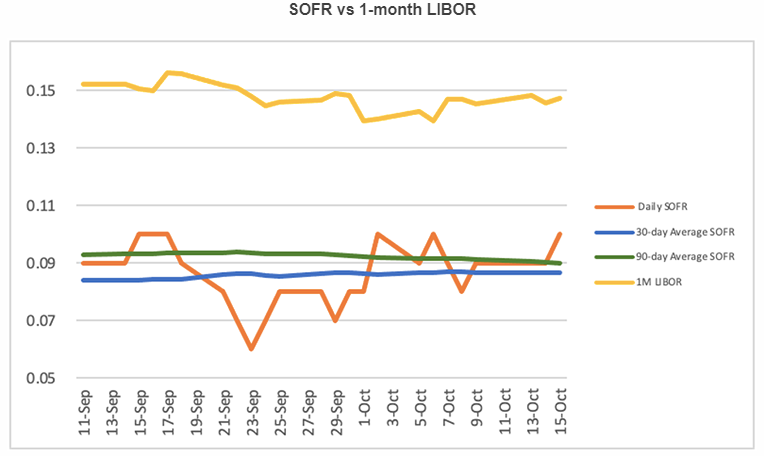

SOFR benchmark has rates applicable with updates on a daily basis. Other than the daily updates, other key policy rates are made public. They are the averages for one month (30 days), Two months (Sixty days), and Three months (90 days). And they come as the SOFR averages.

LIBOR Index vs. SOFR (Secured Overnight Financing Rate)

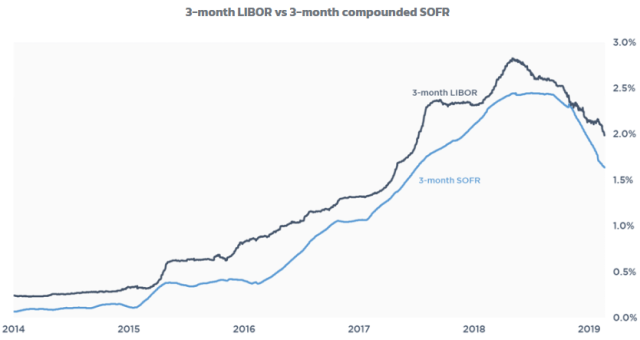

Notably, one key difference is that SOFR works on the basis of actual transactions – in the Treasury repurchase market or risk-free rate. In contrast, LIBOR pegs reliance on quotes from banks – which may not be actual.

Other than the above, other notable differences between SOFR and LIBOR are:

SOFR looks backward into time. It’s the reason it relies on actual data of past transactions (borrowing cash overnight collateralized). Conversely, LIBOR is forward-looking, relying on estimated borrowing rates or futuristic rates.

While with LIBOR, a borrower already knows the reference rate at which they can borrow a loan. With SOFR, borrowers do not know their exact rate – not until the expiry of the loan period.

LIBOR applicable rates are unsecured. It’s an average interest rate for lending that factors in no collateral. As such, it incorporates some credit risk premiums. So regarding SOFR, it’s a rate that’s secured. The transactions include collateral or security in the form of treasuries. So, the rates are not cook-ups to include any credit risk premiums.

However, SOFR realistically adds the credit spreads. It makes room for more realistic pricing, especially when dealing with products with adjustable rates.

Transition to SOFR (Secured Overnight Financing Rate)

Following the financial crisis from 2007 to 2008, experts were able to identify Dollar LIBOR rate benchmarks as a catalyst with a broad measure.

The York FED made policy changes to adopt a more robust benchmark and replace USD LIBOR or Dollar LIBOR. So SOFR rates came onto the policy guidelines. The approach was to phase out LIBOR and retain SOFR at the tail end.

As of June 2020, FED set guidelines for the final phase-out of LIBOR by June 2023.

In that order, banks were to stop commercial loans on secured loans contracting via LIBOR alternatives benchmark rates by the period ending December 2021. And finally, phase out all LIBOR contracts by the close of June 30, 2023.

Transition Challenges

One significant challenge with transition is the outstanding contracts written out on LIBOR basis. However, FED will keep updates all through to the lapse deadlines in 2023. Most contesting is the estimated $200 trillion outstanding 3 -month USD contracts.

Contract revaluations are complex tasks, especially with wide arrays of forms in the picture. And the main focus is fair play and literally handing avoiding arbitrage advantages out of a process.

Agreeably, one most hit markets are the derivatives. And next is consumer credit advances like study loans and mortgages on rates that are flexible against the benchmark interest rate.

Last on the list are the impacts of overnight cash borrowers. More specifically on security arrangement with commercial papers and the compounding of SOFR averages

Best Forex Trading Course

If you are looking for a way to create wealth, learn a new skill, or diversify your portfolio; then one core program is for you. What is one core program? It is a forex/CFD trading course specially packaged by Ezekiel Chew and available from the Asia forex mentor website. It is the best forex trading course available today. It is comprehensive and requires no prior trading knowledge.

Who is Ezekiel Chew? He is a renowned forex trader and facilitator who have trained several bank traders, forex managers, and successful traders. He has been trading forex and other financial markets for the last 20 years. He has become a multimillionaire and has also made other people millionaires from his training.

What is the content of the program? The program comprises over 50 video lessons where the course is taught in simple clear language. The strategies taught in the program are based on mathematical probability which produces efficient results. His students are already making millions from trades using the strategies learned from the program. You too can join and become a millionaire.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: SOFR or Rate

SOFR refers to the Secured Overnight Financing Rate which culminates from closed or observable transactions under the ambit of the FED or Federal Reserves Bank. In the future timelines, SOFR as the benchmark will replace the long-serving benchmark – LIBOR or the London Interbank Offered Rate.

The whole policy move culminates out of findings incriminating LIBOR as the key trigger for the global financial crisis of 2007 – 2008. Ideally, financial institutions could manipulate the rates significantly. And consequently, lead to financial catastrophes across the globe.

As a form of remedy, adopting SOFR was the target, albeit the challenges with policy guidelines, time constraints, and outstanding LIBOR base contracts. However, market actors seem to realize the advantages of the realistic premises of SOFR against the drawbacks of LIBOR.

The approach by the federal reserve board was partial coexistence of LIBOR and SOFR, with phasing out of LIBOR at the later stages. Of course, the repricing of the contracts has significant effects on market liquidity and unnecessary arbitrage realignments.

SOFR Rate FAQs

Is SOFR better than LIBOR?

SOFR is better as a benchmark. Industry experts say it allows for a cheaper cost of capital for companies. And it allows for s reasonable time for markets to adjust to drastic changes in credit risk and market sentiments.

LIBOR, a compounded average that are forward-looking, has the loophole where bankers would manipulate the rates and hand in faulty data. SOFR as a benchmark rate relies on actuals, not estimates of data for the cost of borrowing cash.

What is SOFR based on?

SOFR as a benchmark picks closed transactions as a basis for the risk-free rate. Also, the updates within a daily timespan allow for a realistically reasonable timespan for market conditions to price and reprice the benchmark rate.

On the contrary, LIBOR works with future estimates of dollars worth of financial products. Taking as short as a month is rather too long for LIBOR to realistically adjust to market realities with further information. If anything, the globe has no need to recreate the replica of what transpires as the culprit of the global financial crisis 2007 – 2008.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.