SmartProp Trader Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The financial and trading specialists at Dumb Little Man meticulously assess proprietary trading firms using an in-depth algorithm and rigorous criteria. Their analysis underscores key features including:

Their review of The Concept Trading identified exceptional performance in these critical aspects. With deep expertise in the brokerage market and steadfast support for its traders, The Concept Trading emerges as a leading figure in the proprietary trading arena. |

“Prop trading firms”, also known as proprietary trading firms, give traders access to capital and the resources, training, and support they need to succeed in the financial markets. In this market, SmartProp Trader sets itself apart by guaranteeing that it would improve traders' careers through better deals and all-encompassing advice.

Based on user reviews and the analysis of Dumb Little Man's trade gurus, this article functions as a review. In order to educate prospective traders about SmartProp Trader, it attempts to provide a fair and impartial assessment of the platform by fusing in-depth research with firsthand user accounts.

What is SmartProp Trader?

A reliable proprietary trading company created by traders for traders is called SmartProp Trader. It is notable for its comprehension of the particular requirements and goals of traders in the prop trading industry. By emphasizing its traders' performance, SmartProp Trader pledges to offer the assistance, resources, trading instruments, and trading platforms required to meet trading objectives and to maintain disciplined trading practices.

With an emphasis on tactics, assistance, and profit-sharing designed to increase traders' success, this platform is trader-focused. SmartProp Trader is among the fastest on the market because it places a high priority on quick payouts and effective onboarding, with a basis in speed and execution.

Its ideals are further defined by its dedication to education, operational transparency, and round-the-clock client service. With a support team constantly available to answer questions and resolve problems, SmartProp Trader provides traders with simple, easy-to-understand trading programs and an abundance of educational tools to help them succeed.

Pros and Cons of SmartProp Trader

Pros:

- Access to substantial trading capital

- Flexible trading strategies allowed

- Profit sharing starting at 85%, scaling up to 90%

- Educational resources and support

- Swift onboarding and payout processes

- Transparency in rules and no hidden fees

Cons:

- Prohibited trading strategies

- Strict drawdown limits

- Evaluation process to access funding

- Limited live support hours

- Fee for joining the evaluation challenge

Safety and Security of SmartProp Trader

SmartProp Trader prioritizes the safety and security of its trading environment. SmartProp Trader is a reputable proprietary trading firm founded by traders for traders. It stands out for its understanding of the unique needs and objectives of traders in the prop trading sector. By highlighting its traders' performance, SmartProp Trader commits to providing the support and tools needed to achieve trading goals.

This platform is trader-focused, emphasizing strategies, support, and profit-sharing meant to boost traders' success. Because it bases its speed and execution on prompt payouts and efficient onboarding, SmartProp Trader is among the fastest on the market.

Its commitment to education, operational openness, and 24-hour client service further define its beliefs. In addition to offering traders a wealth of instructional resources and straightforward, user-friendly trading systems, SmartProp Trader also boasts a support staff that is always on hand to address inquiries and assist with issues.

SmartProp Trader Bonuses and Contests

As of now, SmartProp Trader does not provide bonuses. It is recommended that traders remain vigilant regarding any prospective modifications to this policy. This strategy makes sure that customers are always aware of chances to participate in future contests or receive more perks.

For traders hoping to get the most out of the platform and increase their success rate, it can be helpful to pay attention to the announcements made by SmartProp Trader.

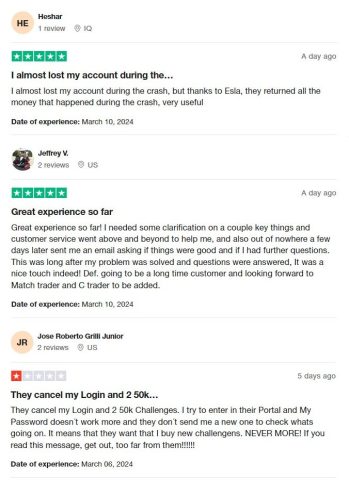

SmartProp Trader Customer Reviews

SmartProp Trader currently has a 4.7 Star rating on Trustpilot, which is deemed insufficient due to the broad range of client reviews it has received. Customer feedback emphasizes proactive follow-ups, positive customer service experiences, and a desire to go above and beyond to resolve issues.

Notable issues have also apparently been reported, such as account access issues and challenges that have been canceled without sufficient justification or resolution. This contradictory answer highlights how important it is for potential traders who are thinking about utilizing SmartProp Trader to think it through carefully and do their homework.

SmartProp Trader Commissions and Fees

SmartProp Trader prioritizes risk management and profit maximization by providing a comprehensive commission and leverage structure. By taking control of greater positions than they could with their capital alone, traders can increase their prospective returns by utilizing leverage. But it also raises the danger, therefore careful handling is required to keep possible losses within reasonable bounds. Stop-loss orders and position size limits are two methods for controlling leverage risk.

Fees for carrying out trades that vary according to trade volume, kind of securities, and brokerage agreements are known as commission expenses. The direct impact of these fees on trade profitability compels traders to refine their tactics in order to strike a balance between commission costs and profit maximization.

With commissions typically set at $7.00 per lot and leverage options ranging from 2:1 to 100:1, depending on the asset class, SmartProp Trader provides information about its commission structure and options for leverage across a number of asset classes, including FX Majors & Minors, FX Exotics, Spot Metals, Commodities, Indices, and Crypto. With this openness, traders are better able to make decisions that are specific to their trading objectives.

SmartProp Trader Account Types

To accommodate traders with varying degrees of capital and experience, SmartProp Trader provides a range of account kinds. To produce a reliable summary, the Dumb Little Man team of specialists investigated and verified these reports in-depth.

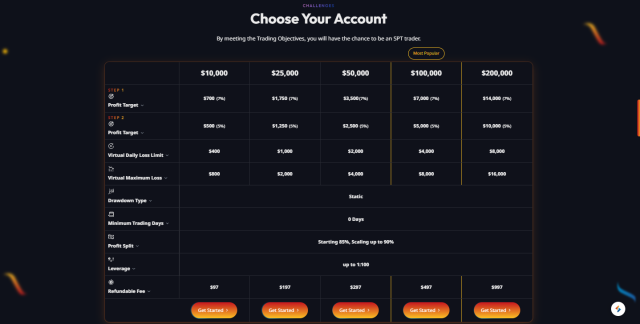

There is no minimum trading day requirements, a static drawdown type, and a profit share that starts at 85% and may go up to 90% on all SmartProp Trader accounts. Furthermore, traders have access to leverage of up to 1:100, which offers flexibility and the possibility of large returns on investment. Regardless of the account size they select, traders will always be aware of the terms and benefits thanks to this uniform foundation across accounts.

The available account types are listed below clearly and concisely:

$10,000 Account

- Profit Target: $700 (7%)

- Step 2 Profit Target: $500 (5%)

- Virtual Daily Loss Limit: $400

- Virtual Maximum Loss: $800

- Refundable Fee: $97

$25,000 Account

- Profit Target: $1,750 (7%)

- Step 2 Profit Target: $1,250 (5%)

- Virtual Daily Loss Limit: $1,000

- Virtual Maximum Loss: $2,000

- Refundable Fee: $197

$50,000 Account

- Profit Target: $3,500 (7%)

- Step 2 Profit Target: $2,500 (5%)

- Virtual Daily Loss Limit: $2,000

- Virtual Maximum Loss: $4,000

- Refundable Fee: $297

$100,000 Account

- Profit Target: $7,000 (7%)

- Step 2 Profit Target: $5,000 (5%)

- Virtual Daily Loss Limit: $4,000

- Virtual Maximum Loss: $8,000

- Refundable Fee: $497

$200,000 Account

- Profit Target: $14,000 (7%)

- Step 2 Profit Target: $10,000 (5%)

- Virtual Daily Loss Limit: $8,000

- Virtual Maximum Loss: $16,000

- Refundable Fee: $997

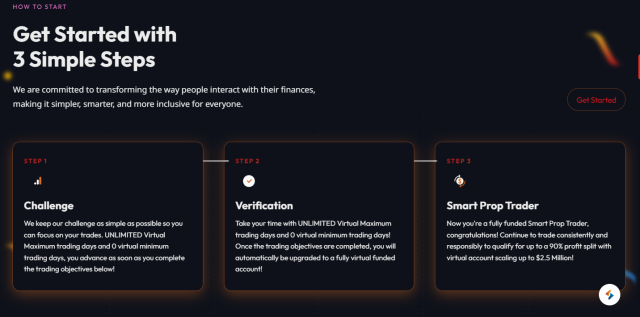

Opening a SmartProp Trader Account

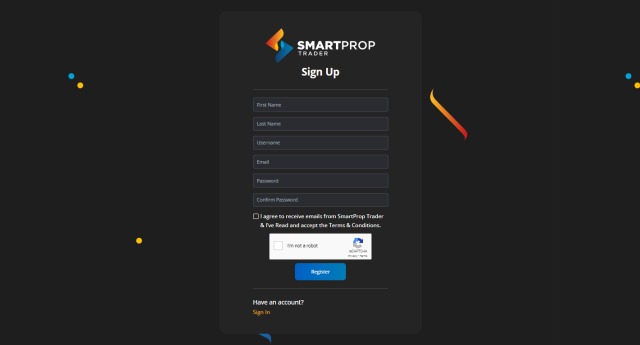

Opening a a prop firm account with SmartProp Trader account is a straightforward process designed for user convenience. By following a simple, 8-step procedure, traders can quickly gain access to a platform that offers a variety of trading opportunities.

- Select “Start now” on the SmartProp Trader website.

- Fill in your first name and last name under basic information.

- Choose a username for your account.

- Input your email address.

- Create a strong password and confirm it.

- Agree to the terms and conditions.

- Complete the CAPTCHA verification.

- Click “Register” to complete the signup process.

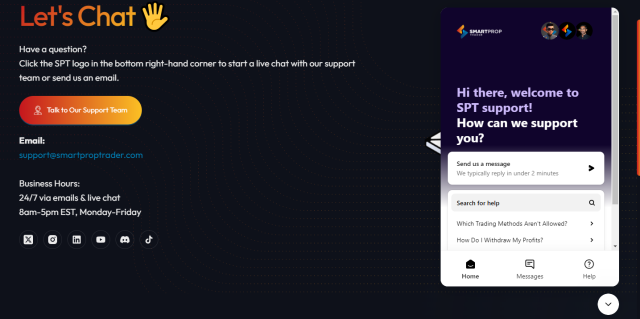

SmartProp Trader Customer Support

The customer service team at SmartProp Trader ensures availability and prompt assistance by offering traders multiple channels of communication. According to Dumb Little Man's experiences, all it takes to initiate a live chat is clicking the SPT logo, which can be found on the website in the lower right corner. With this option plus the ability to email [email protected], getting help is quick and easy.

The support team is available via email and live chat around the clock, catering to traders from across numerous time zones. More direct communication is made possible by their live, interactive business hours, which are 8 a.m. to 5 p.m. EST, Monday through Friday. This kind of accessibility shows how committed SmartProp Trader is to provide traders outstanding customer support by making sure they can obtain help anytime they need it.

Advantages and Disadvantages of SmartProp Trader Customer Support

| Advantages | Disadvantages |

|---|---|

|

SmartProp Trader Withdrawal Options

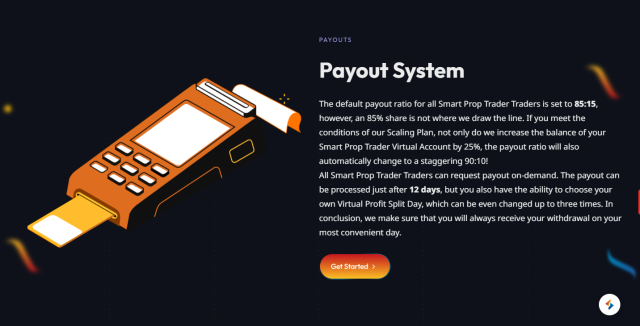

SmartProp Trader's payout ratio by default is 85:15, but traders who fulfill the requirements of the Scaling Plan may be eligible for an increase to 90:10. This plan increases the trader's Virtual Account balance by 25% in addition to improving the payout ratio.

Traders can request payouts whenever they choose, and the processing time can be as short as 12 days after the request. Moreover, traders can choose their own Virtual Profit Split Day using SmartProp Trader, and they can change this selection up to three times, so withdrawals can be planned for the most convenient day. The company promises prompt and dependable rewards, mostly via cryptocurrency or the Rise payment system. Traders have already received payouts totaling an amazing $4.3 million.

SmartProp Trader Challenges and Difficulties

SmartProp Trader allows Expert Advisors (EAs) and other trading tools, but it sets limits by prohibiting some risky methods. These comprise the following: martingale (doubling down after losses), demo environments, account sharing, high frequency trading (rapid trades using algorithms), reverse trading (executing trades in opposition between different firms), grid trading (placing opposing orders), latency arbitrage (taking advantage of data delays), and reverse trading. These strategies contradict SmartProp Trader's emphasis on risk management and sustainable trading, and violators' accounts may be terminated as a result.

Strict adherence to drawdown guidelines promotes targeted trading. In addition to a daily loss cap of 4%, accounts using SmartProp Trader are subject to an overall loss cap of 8%. It is important to follow risk management recommendations as violating these restrictions will result in the trading account being terminated.

Last but not least, SmartProp Trader's administrative team closely monitors each trading activity. If any illegal trading activity is found, the relevant traders' accounts will be closed and they will not be allowed to use the platform again. This meticulous attention to detail maintains the trading environment fair for all users and ensures that the platform's trading policies are adhered to.

How to Pass SmartProp Trader Evaluation Process

SmartProp Trader evaluation criteria are strict to identify experienced traders, navigating the process might be difficult. In order to increase your chances of passing this difficult test, you must participate in an extensive training program.

These courses give you the essential information and trading techniques needed to both achieve and surpass the standards in the Smart Prop Trader evaluation, so you'll be ready to take on the assessment with ease.

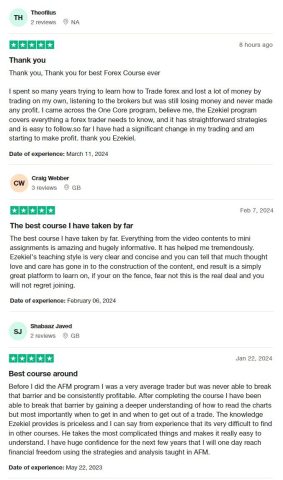

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is often considered the best resource for anyone hoping to get through the SmartProp Trader assessment procedure. Trading professionals at Dumb Little Man highly recommend this platform to anyone who are serious about passing prop company evaluation procedures.

Asia Forex Mentor was established by Ezekiel Chew, a well-known forex trading expert with more than 20 years of expertise, and has helped thousands of traders reach their objectives.

The One Core Program was created with the specific goal of teaching forex traders how to make winning trades, according to Ezekiel Chew, who also serves as the leader of the Golden Eye Group. Chew's educational path in forex trading started when his close friends asked him for trading guidance, which prompted him to move his lessons online.

Asia Forex Mentor is now the go-to training resource for budding traders hoping to effectively negotiate the difficulties of prop trading assessments because of his track record of success and attitude to trading.

How Could Asia Forex Mentor Help You Pass the SmartProp Trader Challenge?

Asia Forex Mentor is in a unique position to help people pass the Smart Prop Trader challenge because of its exceptional reputation and awards in the forex education field.

First off, Investopedia, a reliable resource for financial education, has determined that the Asia Forex Mentor One Core Program is the Most Comprehensive Course currently offered. This suggestion lays the foundation for a successful outcome in the SmartProp Trader challenge by showcasing the breadth and depth of knowledge that traders can obtain.

Furthermore, Benzinga—a trustworthy source of stock, financial, and business information—ranked the One Core Program as the Best School for Beginners in forex trading. This distinction emphasizes how well the program prepares new traders for advanced forex trading and how easily accessible it is to them.

To add to its credibility, Asia Forex Mentor was recognized as the Best Forex Mentor of 2021 by BestOnlineForexBroker, a website that showcases the significant gains that traders can get by employing its strategies. Furthermore, Asia Forex Mentor was rated #1 in a comprehensive analysis of the top forex trading courses by experienced traders and platforms due to its successful trading strategies and systems.

These accolades demonstrate Asia Forex Mentor's unparalleled ability to surpass the expectations of both new and seasoned traders. By participating in Asia Forex Mentor's One Core Program, traders can gain the skills, strategies, and knowledge required to effectively navigate and pass the SmartProp Trader evaluation process.

Asia Forex Mentor Members' Testimonials

Participants in Ezekiel Chew's One Core Program for Asia Forex Mentor have expressed gratitude to the program for being a vital part of their trading success. For individuals who had previously struggled with forex trading for years, often suffering significant losses, the program was a game-changer. They appreciate the program's straightforward strategies, simple comprehension, and comprehensive coverage of all pertinent facets of forex trading knowledge.

Testimonials highlight the significant improvements in their trading performance, going from consistent losses to profits. Members emphasize how concise and straightforward Ezekiel is as a teacher and how insightful, well-thought-out, and genuinely transformative the program is. Apart from being an acknowledged educational initiative, the One Core Program is perceived as a way to surmount profitability barriers, cultivate a comprehensive understanding of market research, and boldly progress in the direction of financial autonomy.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: SmartProp Trader Review

Trading professionals at Dumb Little Man agree that SmartProp Trader is a promising platform for traders looking to get access to large amounts of capital and use their trading expertise to generate large profits. As an advantageous partner for aspirational traders, SmartProp Trader prides itself on its dedication to openness, adaptability in trading tactics, and competitive profit splits. Its attractiveness is increased by offering quick payout procedures and instructive materials.

Potential users should be aware of the platform's tight drawdown restrictions and banned trading techniques, though, since these could provide difficulties for some trading philosophies. Careful planning and strategy are also necessary for the review process that must be completed in order to obtain funding. Enrolling in top-notch courses like Asia Forex Mentor greatly increases the likelihood of passing the evaluation process for traders who are serious about succeeding with SmartProp Trader.

>> Also Read: The Concept Trading Review with Rankings 2024 By Dumb Little Man

SmartProp Trader Review FAQs

How long does it take for SmartProp Trader to pay?

Fast payout procedures are a hallmark of SmartProp Trader, according to this Smart Prop Trader review, guaranteeing traders can access their profits without needless delays. Payouts are normally completed in 12 days after a trader submits a request, demonstrating the platform's dedication to speedy financial exchanges. For traders who want to swiftly reinvest their profits or use them for other objectives, this speedy payment mechanism is a big plus.

Is prop trading legit?

Prop trading is, in fact, a recognized and legal practice in the financial sector. Skilled traders have the opportunity to trade with the firm's capital under well-stated terms and circumstances through SmartProp Trader and other respectable firms. These businesses are governed by laws that are intended to safeguard both traders and businesses, guaranteeing openness and justice in all trading journey and deals.

Do prop firms give you real money to trade?

It is true that prop firms, such as Smart Prop Trader, give traders real money to use for financial market trading. Traders must successfully complete an assessment procedure and demonstrate their potential to produce steady earnings while abiding by risk management guidelines in order to be eligible for this cash. After being approved, traders have access to the firm's funds, which increases their potential for profit by enabling them to trade in bigger volumes than they could with their own money.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.