The Concept Trading Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The financial and trading experts at Dumb Little Man rigorously evaluate proprietary trading firms through a detailed algorithm and stringent standards. Their review highlights essential elements such as:

|

Unlike traditional investment businesses that manage client assets, “proprietary trading firms” trade financial instruments with their own money. The Concept Trading, founded in Australia in 2021 by Thomas Grayson, is unique in this sector.

This review of The Concept Trading is based on feedback from real customers and Dumb Little Man's trading experts. Our goal is to give readers a thorough grasp of the firm, including details on its attributes, efficiency, and participant satisfaction.

What is The Concept Trading?

The Concept Trading stands out from other prop firms. It is a revolutionary platform developed and founded in Australia in 2021 by Thomas Grayson, and Max Eason serves as its CTO. With over 20 years of combined industry experience, this leadership team has established a strong foundation for the company's operations and long-term objectives.

Their combined experience guarantees that the program can successfully negotiate the financial markets' intricacies, which is an essential feature.

What distinguishes the Concept Trading from other prop trading businesses is its membership in the ASIC licensing structure. The regulatory framework's stringent requirements guarantee accountability and openness in the business's activities.

Compared to many competitors, the Concept Trading offers traders and investors a higher degree of security and trust since it works with a heightened level of regulatory control. The software is accessible through the well-known trading platforms MT4 and MT5, which cater to different trading inclinations.

Additionally, there is an opportunity to trade up to $20 million with a significant 50–90% profit share. A great choice for traders seeking to maximize trading opportunities and benefit from robust regulatory safeguards, The Concept Trading stands out for its combination of regulatory compliance, platform accessibility, and alluring profit-sharing conditions.

Pros and Cons of The Concept Trading

Pros

- Scalable funding up to $20 million

- High-profit split of 50-90%

- Flexible withdrawals with no minimum amount

- Multiple payment methods including crypto

- ASIC licensed for high operational standards

- Responsive, region-specific customer support

Cons

- No bonus incentives

- Challenging evaluation process for beginners

- Lack of immediate support options like live chat

- Potential inconsistencies in customer service

- Static drawdown limits may not suit all trading style

Safety and Security of The Concept Trading

The Concept Trading's ASIC license is proof positive that security and safety are top priorities. The Australian Securities and Investment Commission's approval of the program shows that it can provide financial services with a focus on regulatory compliance and control.

The ASIC licensing process comprises a thorough assessment of the firm's financial resources, capacity to carry out the duties of an Australian Financial Services (AFS) licensee, and handling abilities for financial services, all of which are based on a substantial study conducted by Dumb Little Man.

The Concept Trading distinguishes itself in the market for proprietary trading businesses with its stringent regulatory structure. To get around the tight laws, a lot of companies in this field have their headquarters in places where there is less government scrutiny.

Concept Trading's commitment to safety, security, and compliance is demonstrated by its ASIC license, which offers traders and educators a dependable platform. The Concept Trading's dependability and client security are emphasized by this thorough investigation, which is unusual in the prop firm industry. This reassures participants that the company is capable and prepared to supply financial services.

The Concept Trading Bonuses and Contests

The Concept Trading does not provide bonuses to its traders, in contrast to other proprietary trading firms that could rely on these as their primary source of incentive. Traders should be alert to any changes or updates made to this policy.

Unlike other private trading organizations where bonuses could be the main source of incentive, the Concept Trading does not offer them to its traders. Any modifications or updates made to this policy should be noted by traders.

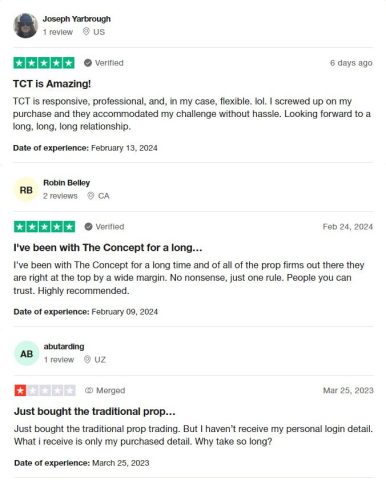

The Concept Trading Customer Reviews

The Concept Trading reviews show a 4.7-star rating on Trustpilot, which is considered low in the business based on a range of user reviews. Consumers value a business's professionalism, responsiveness, and adaptability to their needs. They are committed to forming enduring relationships and have demonstrated an ability to promptly address clients' problems.

Reputable clients consider TCT to be the greatest option when it comes to proprietary trading companies and appreciate its straightforward approach and reliable staff. However, some feedback calls attention to operational issues—such as the length of time it takes to acquire personal login credentials once a purchase is completed—and suggests areas in which the company's procedures should be reinforced.

Although the company may be more operationally effective, the majority of consumers have positive things to say about it despite these difficulties, indicating that it prioritizes professionalism and client trust.

The Concept Trading Commissions and Fees

The profit-sharing plan provided by The Concept Trading differs according to the trader's chosen account type and program level. The profit share for each model rises from 50% to 90% at the trader's program's greatest level. With the 90% Lock Rule, traders can safeguard 90% of their gains up to a certain amount.

No matter how long it takes, customers with Traditional and Premier accounts will be paid as soon as the goal is accomplished. Incentives are offered every week to individuals who reach the 90% lock criterion. After funding their account, traders can request weekly rewards with no minimum required.

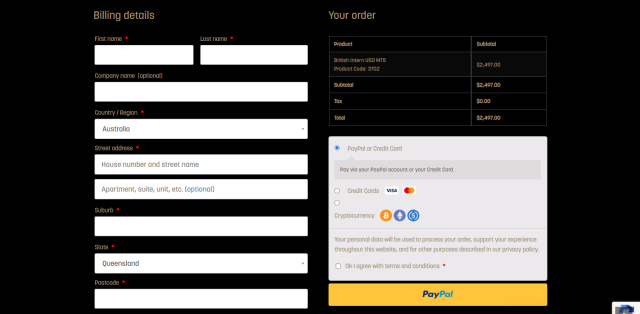

To accommodate a wide range of payment preferences, the Concept Trading offers a variety of payment choices, including bank transfer, Wise, PayPal, and cryptocurrency payments. The program offers options for traders with varying budgets and trading aspirations, with participation prices ranging from $97 to $997.

This configuration demonstrates the program's flexibility and commitment to rewarding traders for their profitable trading operations while simultaneously providing them with the necessary freedom and incentives.

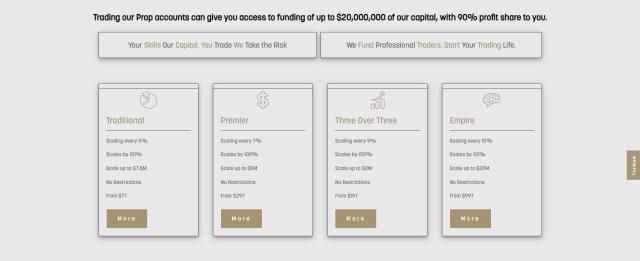

The Concept Trading Account Types

Dumb Little Man's team of professionals has undergone a rigorous inspection, and they have thoroughly investigated and tested the account types offered by The Concept Trading. With this scheme, traders can get a substantial 90% profit share in addition to funding up to $20,000,000 of the company's capital.

The accessible trading account kinds are listed below in a well-organized list that corresponds to different trading methods and goals:

Traditional Account

This option offers a structured account progression system, starting from an Intern Opening Account with a 0% profit share, escalating to a 50% profit share at Level 1, and eventually reaching a top-level account with a 90% profit share. Each level incorporates a 5% drawdown and 5% target, scaling by 50% up to a $7,500,000 balance. The program categorizes accounts into four types: Junior Associate, Floor Manager, Assistant Manager, and Manager, with initial balances ranging from $750 to $5,000, and purchase prices set between $77 and $497.

- Scaling: Every 5%

- Increase: Scales by 50%

- Maximum Funding: Up to $7.5M

- Restrictions: None

- Starting Fee: From $77

Premier Account

This account type shows a progression system is designed to elevate traders from an Intern 1 level with a 10% drawdown and a 7% target, starting with balances ranging from $3,000 to $25,000, to a Level 8 with a 90% profit to trader ratio, 5% drawdown, and targets eliminated at this stage, featuring substantial balance increases from $500,000 to $5,000,000.

The structure showcases a consistent 50% profit share from Level 1 through Level 7, maintaining a 5% drawdown and 7% target, while account balances dramatically scale at each level from $6,000 to $3,200,000 across four designations: Associate, Director, Executive, and CEO, with initial purchase prices spanning $297 to $2,497.

- Scaling: Every 7%

- Increase: Scales by 100%

- Maximum Funding: Up to $5M

- Restrictions: None

- Starting Fee: From $297

Three Over Three Account

It starts at an Intern level with a 5% drawdown and 3% target over 3 months, and escalates to Level 5 with an 80% profit-to-trader ratio, where the drawdown remains at 5% but the target becomes non-applicable. From starting balances of $10,000 to $40,000 at the Intern level, the program scales up significantly to $500,000 to $2,000,000 by Level 5, across four account types: 3 On The Tree, 4 On The Floor, Automatic, and Paddle.

Each level up to Level 4 adheres to a 50% profit share and a consistent target of achieving 3% over three months, with purchase prices for entry ranging from $197 to $1,597.

- Scaling: Every 9%

- Increase: Scales by 100%

- Maximum Funding: Up to $2M

- Restrictions: None

- Starting Fee: From $197

Empire Account

This account type offers a multi-tiered account system, starting with an Intern Opening Account featuring a 10% drawdown and target, and account balances ranging from $10,000 to $500,000 across various historical-themed account types: Spanish, British, Mongol, Incan, Aztec, and Roman.

As traders progress through levels, the program maintains a 50% profit to trader ratio up to Level 16, with incremental increases in account balances reflecting each advancement. By Level 15 and 16, the balances expand significantly, with the Top Level offering a 90% profit share and no set target, allowing for balances from $5,000,000 to $20,000,000. The initial purchase prices range from $997 to $49,997, catering to a diverse array of investment capacities and ambitions.

- Scaling: Every 10%

- Increase: Scales by 50%

- Maximum Funding: Up to $20M

- Restrictions: None

- Starting Fee: From $997

Opening The Concept Trading Account

For traders of any degree of experience, creating an account with The Concept Trading is an easy process. These are eight easy steps that will provide you access to a variety of models and trading platforms that are tailored to your needs as you start your trading career.

- Select a trading plan that fits both your trading goals and interests.

- Select a trading model that works with your approach, your preferred currency, and a trading platform.

- Click the “checkout” button to move your application along.

- Kindly supply your name, company (if applicable), country, address, phone number, email address, and other personal and billing information.

- Verify the order summary to make sure all the information is accurate.

- To finish the transaction, select your preferred payment option and provide your card details.

- To proceed, please accept the Concept Trading's terms and conditions.

- Make sure your transaction is finished by completing the payment procedure.

The Concept Trading Customer Support

The Concept Trading prioritizes customer service and offers several avenues via which traders can get in touch. Dumb Little Man's experience has shown that The Concept Trading crew is committed to offering prompt, helpful assistance when answering inquiries on FX trading and private trading accounts.

Direct phone lines, email addresses tailored to different areas, and a dedicated contact form make it simple to get in touch with The Concept Trading. The organization pledges to reply to questions promptly and efficiently, whether they are directed to regional contacts in Indonesia and the United Kingdom or the corporate office at [email protected].

Their consistent support for traders' success is demonstrated by their commitment to immediately attending to all requests, which demonstrates their dedication to providing excellent customer service.

Advantages and Disadvantages of The Concept Trading Customer Support

| Advantages | Disadvantages |

|---|---|

|

The Concept Trading Withdrawal Options

A trading expert at Dumb Little Man claims that The Concept Trading offers a range of withdrawal options to accommodate traders' preferences. Profits are distributed to both Traditional and Premier accounts when certain milestones are reached.

Timeframes for completing targets vary from four days to four weeks. Weekly payment requests are accepted from traders that use the 90% lock rule or have Challenge accounts, thus they are not subject to a minimum withdrawal limit.

Numerous payment options are available through the Concept Trading , such as bank transfers, PayPal, Wise, and cryptocurrency payments. This version shows how committed the program is to providing simple and effective withdrawal processes by guaranteeing that traders from all over the world may quickly collect their profits utilizing the ways of their choice.

The Concept Trading Challenges and Difficulties

To progress, traders who use The Concept Trading must meet specific profit targets. Premier accounts require a profit of 7%, while traditional accounts require a gain of 5% to advance. The Three Over Three challenge requires participants to make a profit of 3% every month for three consecutive months. Higher achievers or those who follow the 90% Lock Rule are not bound by these goals and are instead awarded a 90% profit share.

If a trader's account hits the maximum drawdown limit, it will be closed. This rule underlines the program's focus on risk management and the need to have a strategic approach to trading. The drawdown limits stay stable across all account types, giving traders with the full drawdown buffer whenever needed, ensuring a steady risk management framework throughout the trading journey.

How to Pass The Concept Trading Evaluation Process

Mastering The Concept Trading's evaluation method extends beyond fundamental trading expertise because of its rigorous criteria. To increase your chances of success, it's vital to equip yourself with the required knowledge and strategic tactics.

Signing up for a comprehensive training program is vital for your preparation, arming you with the required tools and information to achieve and exceed the evaluation requirements. This method guarantees that you are not only approaching the evaluation confidently but also with a strategic edge to obtain success.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is the #1 alternative for traders wishing to succeed in The Concept Trading's evaluation process, as supported by trading gurus at Dumb Little Man. Committed individuals can increase their trading skills with The Concept Trading given by Asia Forex Mentor.

Established by Ezekiel Chew, a forex trading specialist who consistently earns six figures every trade and has more than twenty years of trading expertise, Asia Forex Mentor has successfully helped thousands of traders through their prop company review programs.

Ezekiel Chew's knowledge goes beyond his personal trading exploits. He developed the Golden Eye Group and the unique One Core Program to educate forex traders on how to benefit from the forex market.

Asia Forex Mentor was formed when Chew's friends sought for trading lessons, which ultimately expanded into an online platform. Since then, Chew has committed himself to sharing his enormous knowledge, abilities, and experience, supporting numerous traders in accomplishing their trading objectives. This experience makes Asia Forex Mentor a fantastic option for individuals who are devoted to thriving in The Concept Trading's examination.

How Could Asia Forex Mentor Help You Pass The Concept Trading Challenge?

Asia Forex Mentor is in a strong position to assist traders in overcoming the challenge presented by The Concept Trading because of its outstanding reputation in the forex education sector.

Investopedia has awarded the One Core Program the Best Comprehensive Course Offering Award in recognition of its wide and varied material. This distinction highlights the breadth of the program's material and solid reputation as the most complete forex education accessible, which makes it an invaluable tool for traders who want to pass the exam for The Concept Trading.

Furthermore, Asia Forex Mentor was named the Best Forex Trading Course for Novices by Benzinga, underscoring its appeal to traders of all experience levels who want to improve their forex trading skills. This recommendation from an additional reliable source of financial data demonstrates that the One Core Program is effective in giving traders the tools they need to be successful.

BestOnlineForexBroker has named Asia Forex Mentor the Best Forex Mentor, noting the program's ability to help users realize significant currency profits. In addition, a comprehensive evaluation carried out by eminent forex traders and platforms identified Asia Forex Mentor as the greatest Forex Trading Course, crediting its accomplishments to the outstanding trading tactics and approaches it imparts.

The recognition that Asia Forex Mentor has received from reputable trading and finance websites demonstrates the authority and effectiveness of the company as a forex teacher.

This curriculum has a proven track record of exceeding expectations for both new and experienced traders, making it an excellent tool for anybody aspiring to tackle the challenge of The Concept Trading. It provides strategic insights and tactical know-how for efficient FX market management.

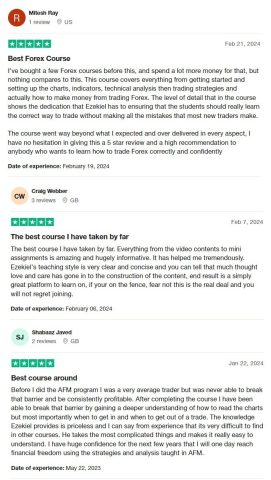

Asia Forex Mentor Members' Testimonials

Participants in Asia Forex Mentor's One Core Program have expressed great appreciation for the thorough education, attributing their success in boosting business ratings to it. Pupils enjoy Ezekiel Chew's easy-to-understand instruction that focuses on the general theme of the curriculum and the real-world application of trading skills, from basic setups to advanced technical analysis.

Members have transformed from mediocre traders to regularly profitable ones, proving how well the curriculum clarifies complex concepts and builds confidence. The importance of Asia Forex Mentor in enabling traders to succeed in the foreign exchange market is demonstrated by this evaluation.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: The Concept Trading Review

The Concept Trading stands out in the proprietary trading business industry by delivering unique features, including funding up to $20 million and a profit split ranging from 50-90%. It maintains strong operating standards by holding ASIC licensing to guarantee a secure trading environment. With a variety of withdrawal alternatives and acceptance of other payment methods, such as crypto, it serves the needs of a wide range of traders.

Although The Concept Trading offers enormous prospects for traders, people interested in joining should thoroughly evaluate its restrictions. By enrolling in well-known trading courses such as Asia Forex Mentor, individuals can considerably boost their likelihood of effectively traversing the program's examination. This form of training not only enhances trading skills but also gives a strategic edge in completing the program's requirements, maximizing the prospects for success in the competitive proprietary trading field.

>> Also Read: Bespoke Funding Program Review with Rankings 2024 By Dumb Little Man

The Concept Trading Review FAQs

Based on this The Concept Trading review, what sets it apart from other prop trading firms?

The Concept Trading offers special advantages such up to $20 million in investments, 50–90% profit split, and flexible exit alternatives. Because of its ASIC certification, it provides a secure and regulated trading environment, making it a great option for traders searching for a trustworthy platform.

How can The Concept Trading enhance my trading skills, especially in foreign exchange contracts?

By joining The Concept Trading, traders can dramatically enhance their trading skills, especially in relation to foreign currency contract tactics. A realistic environment for practicing trading in real-world situations is provided by the program, which offers a range of account options and a rigorous evaluation process.

Is The Concept Trading suitable for beginners in forex trading?

The Concept Trading presents chances that seem attractive, but new members could find the evaluation process difficult. For individuals who wish to begin trading, enrolling in comprehensive courses such as Asia Forex Mentor can prove advantageous as it will equip them with a strong foundation and skill set prior to taking on the program's challenges.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.