Slippage Trading: Overview, What It Is, And How It Occurs

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Traders make efforts to capture pips. Therefore, it's essential to know about every fact that can reduce the pips a trader wins. And one such term is – Slippage Trading.

Slippage in the long term has a huge drawback. And if a trader sums up the pips they've lost, they can amount to large amounts of capital. Knowing the inner details regarding slippage Trading helps. A trader will be able to trade in the right market conditions to ensure they reduce the number of pips lost.

To help us in breaking down the concept around Slippage trading, we'll seek the input of Ezekiel Chew. He is a distinguished trader and mentor under the Asia Forex Mentor brand. He sits in trading panels of high reputation to share his views on market analysis. Retail traders follow his views closely to help them make better insights into their trading careers.

Reading along, traders will understand the different types of slippage trading there is in the markets. Better still, we'll see to get crystal clear guidance on how best to trade and reduce slippage trading.

What is Slippage Trading

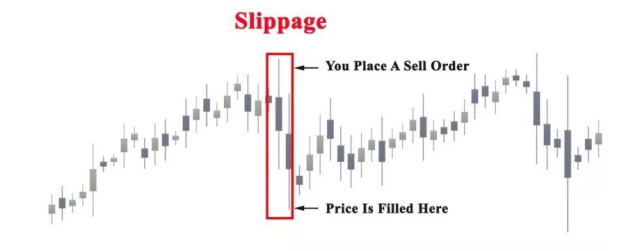

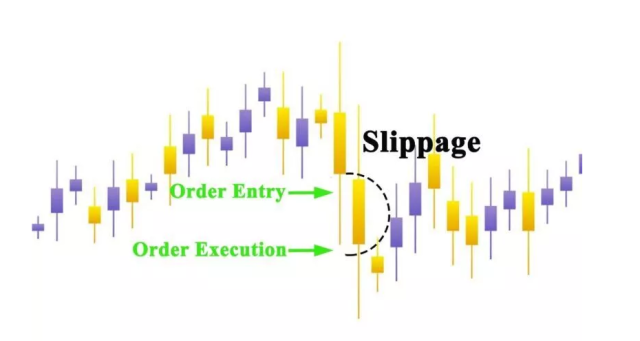

Slippage in trading refers to a difference in the target price of entry and the actual price a trade picks at.

Also, if a trader targets to exit the market at a specific price point – a slight miss at that also brings in Slippage.

Slippage ends up in minute losses for traders. And it happens in all markets: forex, stocks, and futures.

A Practical scenario of Slippage in Trading

Let's assume a trader wants to pick 500 shares of stock. And a broker offers a bid-ask spread per share at $49.36 by $49.37.

Once the order is sent to the broker, it delays by fractions of seconds. Meanwhile, at the point of fractional delays, the prices change slightly. Therefore, while the target price was $49.37, the trade picks at an actual price of $49.40.

Notice the difference between the target and actual price is $0.03 (deference between $49.37 and $49.40). The difference is the “Slippage.”

Types of Market Orders with Respect to Slippage

Slippage in trading happens specifically with market orders. Of course, traders are free to execute trades with the types of orders they feel work best for their trading scenarios.

Conversely, traders opening trades with limit orders (desired price) have a default way to reduce or totally eliminate Slippage.

One other specific way that also contributes to why Slippage occurs in trading is the exit or closure of trades via the market orders. So Slippage takes a two-fold scenario – you lose a few pips at the target price and also at the closing price.

Limit orders only fill in at a specific price point. So, brokers have no choice but to alter that. And they are a smart way for a trader to ensure that they reduce Slippage. Limit orders, unlike the market orders, will only start trades if prices hit the expected zones.

Trade Slippage at Entry Positions

Traders use a limit order to open a position. Some traders also refer to it as the stop-limit order. And for caution, traders should not confuse it with a stop loss or SL position.

Limit orders end up in two scenarios. One, if the prices do not hit the set price, you have no trade at all. While traders may feel they've lost lucrative opportunities, by extension, it means Slippage in trading is avoided.

On the other way, market orders ensure you dive right into the market. There's instant execution of a trade. At the tail end, it may end up in Slippage or, at the worst, a huge loss.

Ideally, a trading plan should approach markets with limit or stop-limit orders to eliminate Slippage in trading. And the limits should also apply to trade exits.

Conversely, during instances of fast price action, market orders are the only way to execute trades – both entry and exit. So with market orders, a trader should be ready to encounter Slippage.

Trade Slippage at Exiting of Positions

The best way a trader can avoid trade slippage is at the trade planning stages. Else, when the trade is already running, there's little or no chance to alter it with respect to Slippage.

With already running trade, market execution can help you exit a trade instantly. Also, limit orders can help with trade exit if a trader is in some favorable positions.

Let's consider a trading instance. A buys shares going at the price of $49.40 each. And at the same time, places a limit order, targeting to sell the shares if prices hit $49.80.

The shares will only sell if there's a trader willing to pick them for $49.80 each. In this arrangement, there's no room for Slippage. The value the seller will get is simply $49.80 per share. And if there's more demand, the seller may earn more.

If the trader sets a stop loss, it may get them out of the market with a guaranteed price. And it helps avoid losses in cases where the prices move against the trading plan.

Also, if the trader works with a stop-loss limit order, the order will only execute if market prices move in the trader's favor – and not unfavorably. It's the main reason why stop-loss market orders are essential. While they may not entirely eliminate Slippage – they help avert bigger losses.

At What Instances Does the Biggest Slippage Occur?

In the markets, the biggest slippages arise around the release of major news and events.

It is a wise idea for any day trader to stay away from the markets during such days. These include:

- Major news events with a high rating

- FOMC or Federal Open Market Committee announcements

- Schedules of company announcements on earnings

Of course, the big moves are enticing to traders. However, the challenge arises with getting into and out of the market at the prices a trader desires.

If it happens, you already have active trade positions upon the release of huge impact news – you stand to face significant Slippage before prices hit the stop loss positions. And you may end up with more risks than your expectations.

The best way to plan trades is by analyzing the future plans of market events. These are primarily the economic earnings and the central banks' calendars. It's best to avoid trading at reasonable intervals before and after the release of the news items (major news events).

Change in Spread and Expected Price

Brokers change the spreads for various reasons.

Let's explore how it works. Using the example below – a broker quoting the Bid or sell price and the Ask or the Buy price. For the EUR/USD currency pair.

Varying with broker's spreads per currency pair or stock can be narrow or wide. It depends on the currency pair or underlying stock. Others limit narrower spreads to certain trader account categories.

In the example above, it's very wide, though for exemplification purposes. The difference is 50 pips. In usual cases, it's less than five pips.

The focal point here is why brokers keep varying the spreads. And the adjustments, if any, happen within short notice.

Investors and traders have a duty to shop around for good brokers – those offering narrower spreads. Further, they have to keep monitoring the spread amounts – especially with live trades.

To take target profits, traders need to close trades with huge amounts of profits to cover the spreads plus any other fees. On the other hand, brokers earn more per trade whenever they increase the spreads.

In reality, wide bid and ask spreads amount to one thing – traders get higher charges when buying. Conversely, traders receive less while selling. And either way, brokers benefit. Every time a trade is open, brokers use spreads to earn small commissions – regardless of whether traders make losses or profits.

How External Factors Tigger Changes in Forex Spreads

Other than the minimums set by brokers, other factors beyond their control dictate spreads. So, the following are the factors that see you experience narrow or wide spreads in forex markets:

Trading Sessions of the Day

The time a trader opens a position matters most. And within it is the particular currency pair in the backdrop of the session the trade is opened. Of course, the sessions overlap in a cyclical fashion.

In practical terms, traders in European sessions have to be aware that their counterparts in the United States are trading at very early morning hours. At the same time, APAC or Asia Pacific trade session opens at actual late-night timelines for the US markets.

To be more realistic, any trade currency pair comprising the Euro during Asia-Pacific sessions will encounter wider spreads than one opening during European actual trading sessions.

To clarify, if you open trades outside the normal trading sessions, there's likely less demand for it – actually, fewer traders interested in it. What transpires behind the scenes is – there's less liquidity. Or there were not many sellers or buyers at the time.

So, it's the lack of liquidity that triggers the brokers to call for wider spreads. The wider spreads are to account for the risks of loss in case they fail to get enough buyers or sellers to close the positions.

Market Events and Their Volatility Effects

One other category that drives forex spreads wider is the economic data releases and geopolitical events.

Let's take, for instance, data showing that unemployment rates in the US are higher than expectations – the USD will come out as weak in comparison to other currencies.

The markets are usually in high volatility; every time such news hits the markets. And concurrently, brokers make adjustments to the spreads as the markets switch to abrupt swings – high and low in a very unpredictable fashion.

Behind the scenes, during the sprees of high market volatility, brokers actually face a challenge. What is the best rate they can pinpoint as the actual exchange rate? So, in the end, they charge wider spreads to cater to the up-spike in the risks of losses in the forex market.

Types of Slippage and their Context of Occurrence

At this point, traders are aware of how Slippage takes place. But, we'll cover two contexts next to see how beneficial or unfavorable slippages get to. And, we'll cover two – positive and negative Slippage.

In reality, slippage risk happens whenever a trade executes a price other than what the traders set or rather anticipated. Also, the context appears across all markets – inclusive of stocks and foreign currencies.

Positive Slippage or Positive Price Improvements

A positive slippage takes effect when an order triggers at a more favorable price point. The favorable point here gives a trader more pips than they'd have to pick in actual terms.

Let's take, for example, a trader taking on the GBP/USD forex currency pair for a long or buy position, targeting a buy limit order set at an expected price or requested price of 1.1965. Yet, the actual point of position execution takes effect at a favorable price of 1.1962 (executed price).

All things held constant; you get into the trade with 3 pips (better price) to your advantage.

Negative Slippage

A negative slippage occurs or takes place when an order takes effect at a price lower than the initial plan of a trader. For exemplification, let's take a practical scenario for a market order.

A trader is going long or buying the USA EUR currency pair. The target is to have the position executed at a specified price point of 1.2060. However, following price movements, the trade executes at a more favorable price point of 1.2056 (different price).

In this case, the target is short with 4 pips. The main occurrence here arises due to the volatility and dynamic nature of prices. And the Slippage actually happens due to delays in execution. A trade takes fractional moments to execute. Meanwhile, news events push changes to a new price or ask price.

It takes the form of lagging – between the moment of trigger as compared to the actual execution.

Reducing Slippage using Market Order(s)

There's no way a trader can escape from the spreads. However, they can explore ways to minimize Slippage. One of the best ways to reduce Slippage is trading in markets with two clear conditions:

- One is highly liquid markets (high liquidity)

- Second is trading only in low volatility markets

Also, interacting with several brokers can give traders an edge. Aside from the multiple chances, the overlap of trading sessions also adds to the market liquidity.

Other approaches include abstaining from trading at low liquidity markets: inclusive of overnights and weekends for the requested price.

Of course, Slippage is akin to market orders – for both trade entry and exit. Therefore, reducing the number of orders as well as working with limit orders also adds up to reducing Slippage. Limit orders help lower Slippage as trades start at the prices set by a trader.

As this post elicits, Slippage is high within volatile markets. In that order, it's the duty of traders to follow market news with any inclination to the assets they trade on.

While market turbulence causes huge moves, traders have to look at it from an angle of highly risky moves. It's, therefore, best to work with reasonable stop loss positions. At the apex of a trading strategy is capital protection, and taking profit comes next.

Best Forex Trading Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Slippage Trading

Slippage in trading occurs when trades trigger at a price target other than the target by the trader. And it can be in favor of a trader, which is positive Slippage or negative Slippage – costing a trader a few pips.

Also, Slippage spikes up when markets are highly volatile markets. In that order, traders looking to reduce on it can best avoid trading at highly volatile sessions. The best way is to counter the high volatility by trading on limit orders and not market orders.

Also worth noting here is that brokers cushion their risks with high volatility by charging more spread than usual – wider spreads. It's a mind-wrangling task trying to figure out the exact costs of Slippage. And only an expert chattered markets technician can help evaluate that.

Lastly, instead of paying too heavy attention to Slippage, it's best to work with stop loss positions to help with capital protection – to avoid losing money rapidly. Trading CFDs require in-depth investment research and investment advice to minimize slippage and the trader's own risk.

Slippage Trading FAQs

How can we stop slippage trading?

Stopping Slippage in trading is best done by using limit orders (at expected trade price) other than market orders. The reason is that prices with limit orders activate at the set price.

A market order increases Slippage, especially at times of very high market volatility. It combines with brokers widening the spreads to cover the high market risks.

How is slippage trading calculated?

The calculation of Slippage in trading is typically done by taking the difference between two price points. One is the target price, and the next is the actual price a trade picks at retail investor accounts.

At times, traders may want to express Slippage in terms of a percentage. And it's usually the dollar at the target price, divided by a dollar at the actual price of trade execution. Next, multiply the result by 100 – to transform it into a percentage.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.