Skilling Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

2.0 2/5 | 74th  |   |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of retail traders, financial consultants, and trading specialists, conducts thorough reviews of brokerage firms. They use a specialized algorithm to assess brokers based on uniform criteria like:

Customer opinions are also incorporated into the final evaluation. We combine expert viewpoints with user experiences to provide a well-rounded outlook, minimizing individual biases for an unbiased review of the broker. After this rigorous evaluation, Skilling emerged as a credible option for those looking for a reliable financial broker. While the platform performs well on many fronts, it's important to note that there are specific drawbacks. Potential users are advised to read the article carefully to understand these limitations fully. |

Skilling Review

Forex brokers play a crucial role in the foreign exchange market. They act as intermediaries between retail traders and the interbank forex market. Skilling is a brokerage firm built on STP (Straight Through Processing) technology. The company was born from the vision of making trading accessible to beginners and experts. Originating in Malta, Skilling has expanded its operations globally, thanks to its innovative and tech-savvy Scandinavian team.

In this comprehensive review, our focus is on providing a thorough evaluation of Skilling. We highlight both its unique selling propositions and potential drawbacks. The aim is to offer you crucial information on various aspects of the broker, like account options, deposit and withdrawal procedures, and commission structures. This review represents a balanced viewpoint, melding expert analysis from trading experts at Dumb Little Man, and genuine customer reviews. It equips you with the information you need to decide whether Skilling should be your go-to brokerage service.

>> Also Read: 8 Ways To Read Forex Charts: In Depth Guide For Beginner

What is Skilling?

Skilling is a broker originating from Scandinavia, founded in 2016. Initially focused on classic CFD trading services for the regional market, the broker has evolved into a notable European entity. It is now registered in Cyprus and holds licenses from the Cyprus Securities and Exchange Commission (CySEC) and the UK's Financial Conduct Authority (FCA).

Skilling identifies as a fintech platform, heavily investing in developing cutting-edge software and technology. This investment targets novice and seasoned traders, aiming to make trading more accessible and efficient.

In terms of trading options, Skilling offers a diverse range. Users can access over 800 instruments and utilize well-known trading software like MetaTrader 4 (MT4) and cTrader. Skilling has also rolled out its proprietary software, Skilling Trader. This platform provides transparent, high-quality technical solutions that let traders concentrate solely on performance.

Safety and Security of Skilling

Skilling takes stringent measures to ensure compliance with international financial standards regarding safety and security. The broker holds various licenses, making it a legally compliant entity that meets relevant trading requirements. This information is confirmed through meticulous research by Dumb Little Man.

Initially established in Malta, Skilling later moved its headquarters to Cyprus. Before commencing operations, the company secured a Forex trading license from CySEC (Cyprus Securities and Exchange Commission). This license ensures that Skilling aligns with the protective measures laid out by the European ESMA (European Securities and Markets Authority).

While Skilling also holds a license from offshore Seychelles, this is more of a registration than rigorous regulation. However, the additional licenses from reputable authorities make Skilling a reliable operation. These layers of licensure add credibility and instill confidence among traders considering Skilling for their trading needs.

Sign-Up Bonus of Skilling

The $30 Welcome Bonus is one of the benefits of beginning your trading career with Skilling. This bonus is applied to your account when you make your initial deposit. With this incentive, new users will have an advantage when it comes to investigating the trading platform and placing their first trades.

For novices, the $30 Welcome Bonus serves as a buffer. This bonus offer demonstrates Skilling's dedication to lowering the barrier to entry and increasing trading accessibility for newcomers.

Minimum Deposit of Skilling

The Minimum Deposit at Skilling varies based on your account type. For those opting for Standard Accounts, the minimum deposit requirement is $25. This low entry point makes it convenient for traders new to the platform or those who wish to start with a smaller investment.

Having a $25 minimum deposit for Standard Accounts aligns with Skilling's mission to be accessible. Regardless of their financial capacity, it allows a broad range of traders to engage in trading activities without a heavy initial commitment.

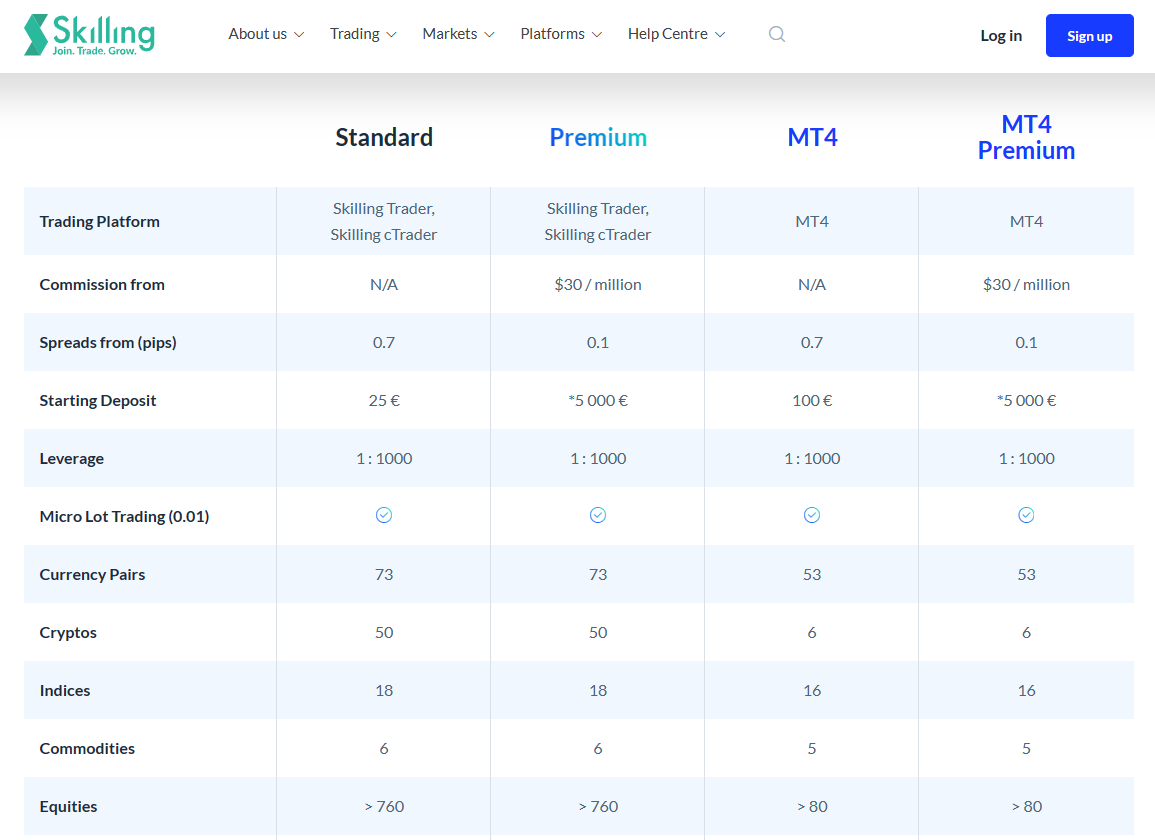

Skilling Account Types

Skilling caters to diverse trader needs by offering multiple account types. Our team at Dumb Little Man conducted exhaustive research and testing to provide you with accurate details about each type. Here's a straightforward list:

Standard Account

- Ideal for beginners

- Minimum deposit: $100

- No commissions

- Features: Spreads from 0.7 pips, leverage up to 1:30

- Tradeable assets: 73 currency pairs, 10 cryptocurrencies, 17 indices, five commodities, and over 700 equities

- Additional features: Scalping allowed, negative balance protection

Premium Account

- Tailored for experienced traders

- Minimum deposit: $5,000

- Commission: $30 per million for trade volumes over a million

- Features: Lower spreads starting at 0.1 pips

- Similar to Standard Account in other respects

MT4 Account

- For MetaTrader 4 (MT4) enthusiasts

- Minimum deposit: $100

- No commissions

- Features: Spreads from 0.7 pips, leverage up to 1:30

- Tradeable assets: 53 currency pairs, seven cryptocurrencies, 12 indices, five commodities, over 700 equities

MT4 Premium Account

- High-value MT4 traders

- Minimum deposit: $5,000

- No commissions

- Features and tradeable assets similar to MT4 Account

- Additional features: Scalping allowed, negative balance protection

Demo Account

- Risk-free learning environment

- Funded with $10,000 in virtual currency

- No expiry date

- Valid for new traders and strategy testing

Each account type has been crafted to cater to different trading styles and financial capacities. Whether you're a beginner or an experienced trader, Skilling has an account to suit your needs.

Skilling Customer Reviews

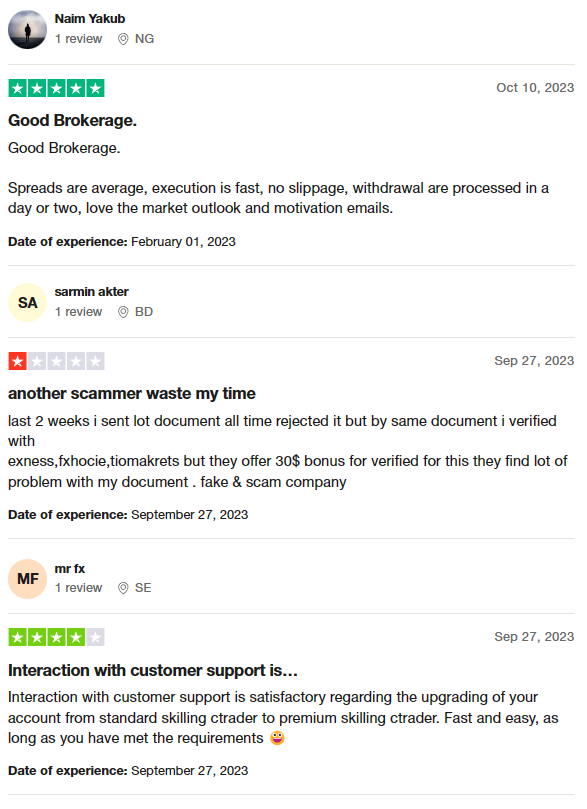

Customer feedback about Skilling presents a mixed bag of experiences. Many users appreciate the fast execution and quick withdrawals, finding the spreads average but acceptable. Some users also value the motivational emails and market outlooks provided.

However, there are criticisms concerning the verification process, with claims that Skilling is stringent compared to other brokers. Customer support generally receives positive reviews, especially for account upgrades, which are described as fast and easy if requirements are met. g points, there are also areas for improvement.

Skilling Fees, Spreads, and Commissions

Skilling adopts a competitive pricing model, especially in its standard accounts, where costs are integrated into spreads starting from 0.7 pips. For Forex and currency pairs like EUR/USD, the fees hover around 1 pip, aligning closely with industry standards. On the other hand, Premium Accounts feature interbank spreads as low as 0.1 pips and levy a $35 commission per million traded, making them quite competitive.

The fee structure mainly revolves around spread charges, which can differ based on the account type and trading platform. While CFD fees are slightly above average, the spreads on specific instruments are competitive. Therefore, the total trading cost is one of many factors to consider when evaluating Skilling as a potential broker.

Deposit and Withdrawal

Skilling offers a variety of payment methods to suit its diverse client base. Options include Visa/Mastercard, Neteller, and more, covering over 15 payment mechanisms. This extensive network aims to make financial transactions convenient for users.

A notable feature is the absence of fees on deposits or withdrawals from Skilling's side. However, users should be aware that some payment providers may charge their fees, which Skilling does not cover.

Not stated clearly on their website, Skilling occasionally charges a fee of up to 2.9% for purchases made using Neteller or Skrill. This is an important factor to take into account when choosing your chosen payment option.

Skilling has set a minimum withdrawal limit of 50 units, with the exact amount varying depending on the payment system used. For most systems, this typically stands at 50 euros.

Regarding transaction processing time, Skilling assures withdrawals to e-wallets within one business day. Bank transactions may take longer, usually between 2-7 days. This efficiency underscores Skilling's commitment to quick and reliable financial transactions.

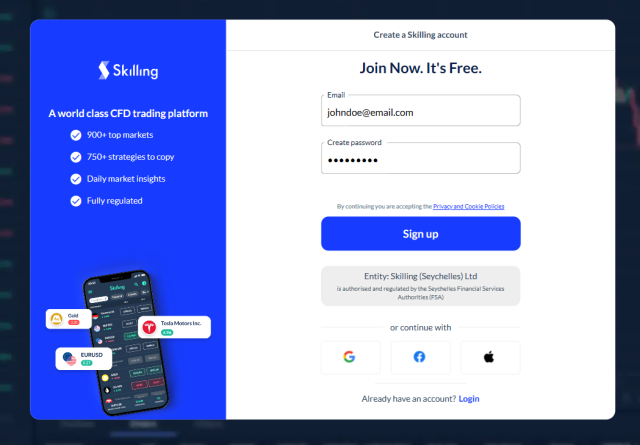

How to Open a Skilling Account

- Visit the Skilling website and click the ‘Login' button to start the registration process. Input your name, email, phone number, and country.

- Check your email for a verification link from Skilling and click it to confirm your email address.

- Complete a detailed application form that asks about your financial status, trading experience, and knowledge to comply with regulations.

- Submit required identity and address verification documents, like a passport scan and a recent utility bill or bank statement.

- After account approval, fund your account using any available payment method, such as bank transfers or credit cards.

- Once the account is funded, you can start trading by selecting the financial instruments you want.

- Set your trading parameters according to your strategy and market outlook.

- Place your first trade; remember to start with small amounts if you are a beginner.

- Gradually increase your trade sizes as you gain more experience and confidence in trading.

Skilling Affiliate Program

Through its Affiliate Program, Skilling offers a range of rewards to different partner categories. A 50% Revenue Share is available to introducers such as merchants, teachers, and entrepreneurs. They benefit from a competitive fee structure and receive marketing support to grow their network.

Skilling pays affiliates—influencers, email marketers, and blog owners—up to $800 CPA. The program offers competitive flat fee pricing, a range of payment options, and 24-hour performance monitoring.

The PAMM/MAM section of the program is intended for money managers who oversee several client accounts. These managers offer an infinite number of trading accounts together with multiple fee levels. Additionally, they can profit from instantaneous sub-account allocation, real-time monitoring, and direct connectivity.

Lastly, the Strategy Provider program is for professional traders who want to share their trading strategies on Skilling's Award-Winning cCopy Platform. They become part of the Largest Worldwide Community of traders, can set up and broadcast their system immediately, and decide on the commissions they want to charge. Monthly, automatic commissions are a standard feature.

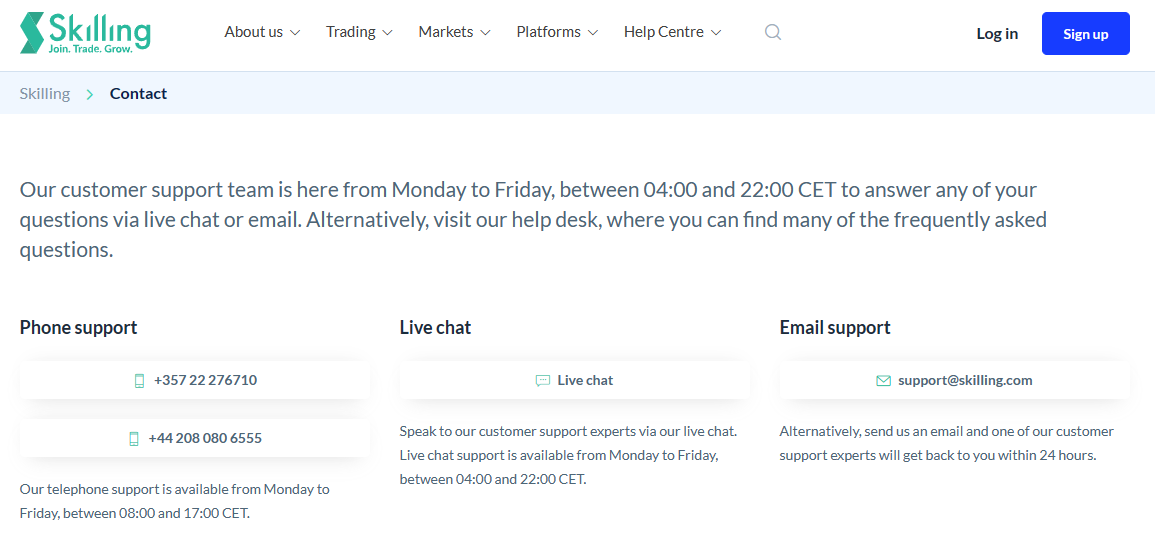

Skilling Customer Support

Based on the experience of Dumb Little Man, Skilling places a high emphasis on providing Quality Customer Support. They offer 24/5 Multilingual Customer Service, making it easy for a global audience to get the assistance they need.

To satisfy different user preferences, Skilling offers a variety of customer service channels. Their Live Chat feature is ideal for getting quick, in-the-moment assistance from a support agent.

Email support is also an option if you prefer to describe your problems in more depth. This choice is perfect for less urgent issues that need detailed explanations or step-by-step guidance.

Last but not least, Skilling offers international phone lines for customer service for those who prefer a spoken connection. This makes it possible for questions to be answered immediately, guaranteeing prompt problem-solving and happy customers.

Skilling ensures that, across these various channels, clients receive fast and practical help according to their preferred communication style.

Advantages and Disadvantages of Skilling Customer Support

| Advantages | Disadvantages |

|---|---|

Skilling vs Other Brokers

#1. Skilling vs AvaTrade

Offering a variety of account types and competitive spreads in a streamlined trading environment is the essence of Skilling. AvaTrade, on the other hand, serves a wide range of customers and is available everywhere. Additionally, it offers a wider range of financial instruments. Furthermore, AvaTrade is bound by more stringent restrictions, hence augmenting security.

Verdict: AvaTrade is better for those looking for extensive regulation and a broad selection of trading options.

#2. Skilling vs RoboForex

RoboForex sets itself apart with a wide range of trading platforms and personalized trading conditions that support multiple trading strategies. Skilling is a simpler method that prioritizes spreads that are visually appealing and user-friendly platforms. RoboForex also has an edge in trading competitions to enhance the trading experience.

Verdict: RoboForex is better for traders who want a wide selection of platforms and personalized trading terms.

#3. Skilling vs FXChoice

FXChoice caters to experienced traders with its specialised ECN accounts and high trading volume requirements. Conversely, Skilling aims to appeal to a wider user base—including beginners—due to its inexpensive and straightforward platform. Penny and limited-validity sample accounts are among the few initial alternatives offered by FXChoice.

Verdict: Skilling is better for those who want an easy-to-navigate trading experience without focusing on high trading volumes.

Choose Asia Forex Mentor for Your Forex Trading Success

Recommended by trading experts at Dumb Little Man, Asia Forex Mentor is a top choice for anyone looking to succeed in forex, stock, and crypto trading. The platform's founder, Ezekiel Chew, is a proven expert in the field, consistently achieving seven-figure trades. His expertise elevates the educational content, making it exceptionally reliable and effective.

One strong point is the platform's Comprehensive Curriculum. It covers the essentials of stock, crypto, and forex trading, ensuring that learners get a well-rounded education. You're not just learning the basics; you're mastering the skills needed to excel in diverse financial markets.

Proven Track Record is another feather in its cap. Asia Forex Mentor has a history of transforming aspiring traders into professionals who make consistent profits. This highlights the effectiveness of their training methods and mentorship programs.

With Ezekiel as the Expert Mentor, students gain valuable insights into the trading world. His personalized guidance helps navigate the complex landscapes of forex, stock, and crypto markets. The experience is enriched by a Supportive Community of traders, offering peer learning and collaborative opportunities.

Emotional discipline is vital in trading, and this is where the platform's focus on Discipline and Psychology comes in. Asia Forex Mentor offers specialized training in these aspects, ensuring that you can manage stress and make rational trading decisions.

The platform keeps you updated with Constant Updates and Resources. This ongoing support keeps you ahead in the ever-changing financial markets. Numerous Success Stories underscore the effectiveness of the program. Students have achieved significant financial gains, some even attaining financial independence.

In summary, Asia Forex Mentor is the go-to platform for comprehensive, reliable, and effective trading education. With its multifaceted curriculum, mentorship by an industry expert, and a supportive community, it offers all the tools you need to become a successful trader in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Skilling Review

According to Dumb Little Man's team of trading professional analysts,Skilling is a good option for both novice and seasoned traders.It provides a user-friendly interface, competitive spreads, and various account options. Among its many payment alternatives, Skilling stands out for offering multiple options for both deposits and withdrawals, catering to the needs of a worldwide customer base.

Prospective traders should use caution in a few areas, however. Although Skilling provides customer service in multiple languages, it is not always accessible, which could lead to delays for traders based in different time zones. The increased CFD fees compared to other brokers may affect the profitability of your trades.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Skilling Review FAQs

Is Skilling suitable for beginners?

Skilling's competitive spreads and user-friendly interface make it a good option for novices. However, profitability can be impacted by the marginally increased CFD fees.

What types of customer support does Skilling offer?

Skilling provides multilingual customer service via email, international phone lines, and live chat. However, note that it isn't always accessible.

What are the payment methods available for deposit and withdrawal?

Skilling accepts a number of payment options, including as Trustly, Neteller, Visa/Mastercard, and more. Certain payment methods, however, can impose costs that aren't reimbursed by Skilling.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.