Short Crypto – A Complete Expert’s Guide 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best cryptocurrency brokers for traders are Coinbase and Gemini

The #1 Crypto and Forex Trading Course is Asia Forex Mentor

Cryptocurrencies are digital money that lacks the regulation of central banks or authorities. By lack of central authority adds to the risks. However, there are amazing investment opportunities for those who can take on it rightly.

In light of that, we want to expound deeper on the term – Short Crypto. This is a term that is synonymous with cryptocurrencies in the various marketplaces out there. As part of the efforts to give you the best of our knowledge regarding the term – Short Crypto, we'll connect with Ezekiel Chew, an expert trader, market analyst, and trainer from Asia Forex Mentor. Ezekiel shares market insights that help many traders across the board.

This post will expound on how shorting crypto works, plus the reasons for it. There’s a key section that will help create a distinction between Short crypto and margin trading, plus risks with cryptocurrencies.

What is Short Crypto?

Short Crypto arises from the original scenarios where traders in the forex market go short or simple open sell transactions. And, of course, it applies within the wider picture – where traders ride on many strategies to arrive at the same desired result.

Overall, shorting Crypto applies with many variations, including leveraging, which works for the trader in case their projection goes in the right direction. Shorting any cryptocurrency is a simple process.

The biggest risks come whenever an open contract experiences prices spiking higher instead of lower. In that case, a contract owner stands to lose huge investments – especially when leverage and margin come into the entire picture.

How does Short Crypto work?

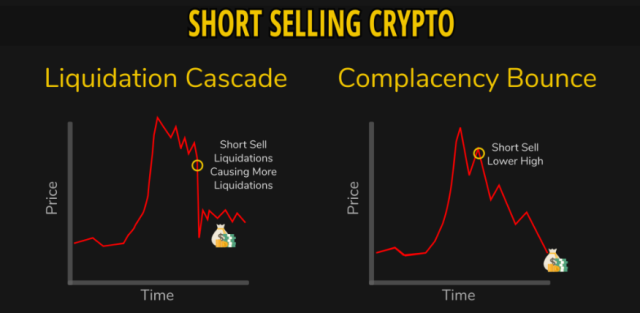

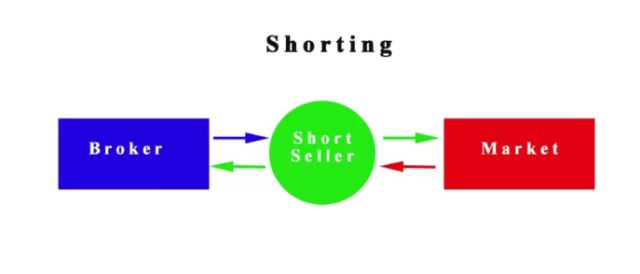

Shorting applies perfectly when a trader enters the markets at very high prices and plans to exit when prices shift to lower price zones. And the key point with Shorting Crypto is the ability to borrow it at present, with a clear plan to sell it later – of course, with coinciding falls in prices. While the above is the easiest part, the hardest task is being able to determine the fall in prices.

Therefore, shorting Crypto really depends on the strategy but more so on the foresight that prices will drop into the future timeframes. If the plan works in line with your predictions, you are in the money.

All you need to do is close the transaction. So you buy back your Bitcoin at a currently lower cost per unit and return them to the owner. The sweeter part is – you keep the difference as profit.

Here’s a Practical Way How to Short Bitcoin with a Lower price

- First, start by borrowing 25 BTC. We’ll assume the price of each BTC is running at $2000.

- Second, sell a small portion of the BTC. Let's take 100 Bitcoins, each selling for $2,000 per unit of Bitcoin.

- Third, hold on for some weeks, and if the prices fall, the transaction wins you a profit. In this case, our target was for the price to shift from $2,000 to $1,500 per unit of Bitcoin.

- Fourth, with a lower price of $1,500, all you do is repurchase your 100 Bitcoins and refund them to the broker who lent them to you.

- Lastly, here’s a mathematical representation of the estimated profits you can make: $50,000-$37,500 = $13,000.

Short Crypto, in other words, is a strategy for making profits whenever a crypto-asset declines in market value. Smart investors make plans early enough whenever the climates of politics or economics show warning signs of recessions. While shorting Crypto is a risky affair, there’s one more aspect that makes it more dangerous – the unpredictability plus lack of regulation in cryptocurrencies.

Reasons for Short Selling Crypto

Investors and traders have a host of reasons why they get the motivation to short sell any cryptocurrency. But for valid reasons, it should build on the information they have after adequate market analysis from the data they have.

Additionally, how confident they are as regards their ability to make correct projections with the potential profits in the picture. It should also factor in the risky nature – given how much they stand to lose with every risky move.

Assets Valuation

Technical analysts attempt to continuously scan charts to capture the accurate price of an asset. In reality, market prices keep changing, which brings in the aspect of either overvaluations or undervaluations. With the right information at hand, the investors have a clear opportunity to take the opportunities and profit from asset overvaluations.

The aspect of short selling applies when over-valued assets make price corrections. And to be specific for Short sells in Crypto, targeting a retracement works best – when prices shift from a higher high towards a lower high.

One critical point of awareness is that short-selling Crypto isn’t a transaction to take on from the point of hope. So to be on the safe side, build on valuable information about asset valuations. Next, bring in an in-depth analysis with price cycles over reasonable long timeframes to spot a probable opportunity.

Hedging Risks

Hedging risks is one way to protect portfolios against huge price moves. Therefore, short selling helps reduce the losses one may incur with long positions. While prices move in the opposite direction of a long position, reducing the high margin requirements.

If all odds point to a significant shift in prices lower, a short sell is a good opportunity to earn you some return on the Bitcoin you own. Hedging, therefore, works with a strategy to help lower the levels of riskiness whenever bear markets dominate the economy.

Difference between Shorting from Margin Trading

Shorting Crypto and margin trading of Crypto are almost similar. Yet, when it comes to the differences, they become wider apart. Firstly, shorting a cryptocurrency refers to the selling of a cryptocurrency of which you have no ownership.

Secondly, margin trading refers to the arrangement where traders borrow some funds from brokers to buy assets. So, as you can see, the big difference arises with interest on funds you borrow for margin trading. With shorting, you incur fees that you pay to the broker.

Crypto Margin Trading

Markets have several exchanges which allow short selling of cryptocurrencies. Among them are those which allow trading on margin accounts with and with no leverage. For those missing the leverage portion, they allow borrowing Crypto at the spot rate and selling it at a later timeframe.

At later stages, the borrower may repurchase the Crypto at lower prices, riding on the original fees to borrow the Crypto.

The above option is a reality with the Kraken Exchange, to which a user must adhere via certain advanced account settings. Traders use the sell and settle features. One other exchange with similar features is Poloniex.

Advice On How to Short Bitcoin – Including Bitcoin futures trading

Shorting crypto works within the ingredients of successful trading strategies. Next, we’ll go over the major factor to include in a strategy to successfully short-sell cryptocurrency.

#1. Keep in Touch with Current Market and Economic News

Cryptocurrencies, by lack of regulation by many state authorities globally, contribute to high risks The social, political, and economic events are key triggers for the price of BTC.

Any regulations to regulate the market are the potential to crash the entire cryptocurrency market. While it’s a great benefit to short Crypto while bear markets rally, the impeding regulation poses huge consequences with time.

#2. Get Insights from Technical Analysis

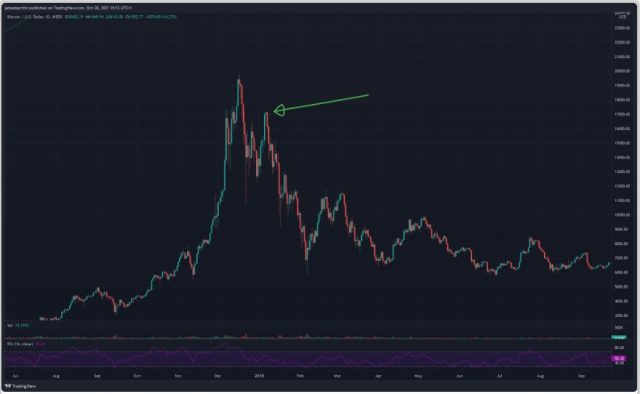

Technical analysts rely on past data to help forecast future probable price action. Key variables like volume and price in the cryptocurrency markets are not by chance. They rely on trends, and therefore, based on the insights, traders take advantage of it – whether trending or in reversal.

A good instance is how Bitcoin trading volumes work. Make a comparison of at present and a few months ago. Clearly, volumes in technical analysis plus the aspects of price histories have notable cycles. One best way to approach analysis is from the historical perspective and building on research around looming regulations, market interest as well as the present demands for a crypto-asset.

Here is a List of Indicators that are Helpful with Technical Analysis in light of spotting market retracements:

- Average Directional Index for analysis of trends and their strengths

- RSI or Relative Strength Index for picking signals on market momentum, magnitudes as well as price changes

- The standard deviation for elaborating the Annual ROI or Rates of Return for an asset

- Bollinger Bands to show the zones of lower price and higher price

The above indicators are helpful and it's best to master how they work in combination with moving averages within given trading time frames.

Risks of Short Sell Bitcoin

Short selling of Bitcoin is a very profitable opportunity. On the flip side, it comes with two key drawbacks.

The first and the worst is the likelihood that an investor can lose money due to high market volatility. Price forecasts may never fall into 100% of what investors predict for price drops for any underlying asset.

The second drawback with short-selling crypto-assets arises from the little or no existence of regulations. This is not the case with many other futures trading arrangements for crypto-assets. And it adds to the uncertainties facing traders in case their market predictions go against the courses they expect.

Best Crypto and Forex Trading Course

Ezekiel Chew is considered one of the most credible forex trainers in Asia. He is the CEO and founder of Asia Forex Mentor, a company that provides forex education and training to individuals worldwide.

Ezekiel's focus on mathematical probability sets his course apart from other forex trading courses. Moreover, his methods are backed by statistical evidence and proven to work in the real world.

So if you are a beginner looking forward to starting your forex trading journey, then you should opt for AFM PROPRIETARY ONE CORE PROGRAM, a complete program covering from beginner to advanced.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Crypto Brokers

| Broker | Best For | More Details |

|---|---|---|

| Earning Rewards Read Review | securely through Coinbase website |

| Altcoin Trading Read Review | securely through Binance website |

| Sign Up Bonuses | securely through Crypto.com website |

| New Investors Read Review | securely through Gemini website |

Conclusion: Short Crypto

Short Crypto is a term that points to the selling of a crypto-asset whenever bear markets show signals of rallying. Ideally, traders take several forms – including working with a platform with leveraged trading or none.

The aim is to exit markets when prices dive lower as per expectations. Short selling has risks as any forex or bitcoin futures trading market. However, the low regulations amplify the riskiness of bitcoin prices and all cryptocurrencies.

Investors have at their disposal, many indicators for analysis. Also, fundamental analysis plays a significant role in spotting the valuation of markets to help figure out when markets are ripe for bear rallies. Typically, overbought markets are followed by bear market rallies – but traders need to verify before joining in with futures and options contracts.

Short Crypto FAQs

Where can you short Crypto?

One exchange to short Crypto on is Coinbase. Else, investors can trade futures contracts without leverage.

Can you short Crypto?

Yes, traders are open to short crypto transactions. However, investors require awareness of the risks it involves.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.