How To Use Price Discovery To Trade Better in 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex brokers for traders are Avatrade and FXCC

The #1 Forex Trading Course is Asia Forex Mentor

The entire process of buying and selling in the financial market depends upon the price of the asset or commodity. However, determining the accurate price of assets is in itself a complex procedure that involves the consensus of both buyer and seller. Hence, the activity of setting prices of the assets by the traders is simply known as price discovery.

Price discovery is best explained by Ezekiel Chew, a leading financial expert, and forex trainer for more than a decade. He has been one of the most sought-after financial experts whose opinions regarding various financial concepts are acknowledged worldwide.

According to Ezekiel, price discovery is simply a process through which the final price of an asset, commodity, currency, or security is approved by both parties that is the buyer and the seller. Moreover, this price discovery mechanism is based on multiple important factors such as supply and demand, personal finance, and other economical factors.

This review aims at defining the price discovery process for traders so that it is clearly understood by them. Moreover, the review will explicitly explain the multiple factors which affect the pricing mechanism so that it can guide traders in determining the correct market value of the assets.

What is Price Discovery

Price discovery is the process of finding out the fair and orderly market prices of assets in the financial market. For this reason, price discovery is considered to be an important concern of a marketplace. This process can be either direct or deduced from multiple factors to determine the spot price or any asset including stocks, security, commodity, or currency. In simple words, price discovery is a mechanism where a buyer and a seller make an agreement on a price and trade with each other.

The price discovery mechanism works keeping in mind several factors. These factors include supply and demand, investor risk tolerance, and the overall economic and geopolitical circumstances. These factors include the market system to cash flow to the circulation of information. By following this structure the traders interact with each other and look for methods to find out the proper price of a commodity.

Overall, with the help of the price discovery mechanism traders can trace out whether the market prices are flowing freely or are controlled by the buyers and sellers. Moreover, the fluctuations of the market prices are also monitored through this process. Hence, price discovery offers an accurate market price which helps the traders to set the transaction price without worrying about the risk of being scammed by the market players.

How Price Discovery Mechanism Works

The price discovery mechanism enables the first step towards active trading between buyers and sellers. Since finalizing the proper price of an asset is a complex task, it requires comprehensive interactions between the traders. These interactions are conducted keeping in mind the supply and demand of the asset.

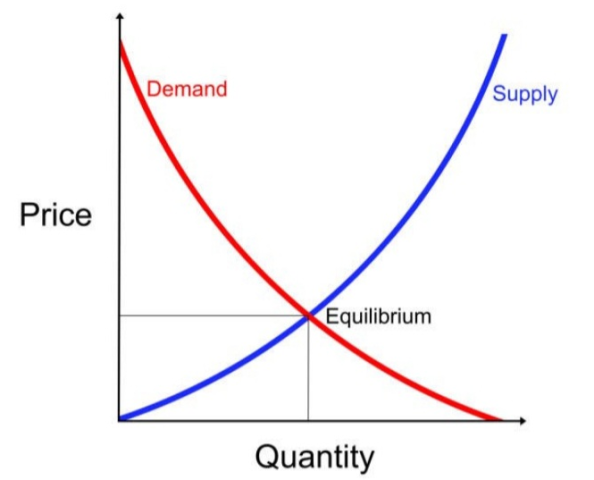

The equilibrium of buyers and sellers often points towards the overall situation of financial markets. This balance of supply and demand also dictates the market price of a commodity and indicates what price the buyers will be willing to pay for the assets. Moreover, the demand and supply of the traders also define the market price line and shape the design of the resistance and support rates.

Resistance rates are those where prices are low due to the declining demand for the asset. Whereas support rates are the opposites where the prices increase due to the high demand of the buyers. However, in both these rates, the supply of the assets remains the same without any change.

The crux of price discovery is to find out the point where demand and supply meet at the exact point. However, the identification of this point depends on many variables or factors. Moreover, these variables are not constant or fixed and are flexible. For this reason, it can be said that price discovery is sometimes almost impossible to figure out as it does not stay the same and keeps changing frequently.

Why Is Price Discovery Important To Trading

The supply and demand of any asset in the stock market do not stay stagnant. It is constantly changing by either rising or declining resulting in the price change. For this reason, for traders, it becomes very difficult to keep track of the demand and supply and determine the price for trading accordingly. Thus, during this time the price discovery process comes in handy for the traders to reach the maximum liquidity of an asset.

The driving force in any financial market is its dynamic nature. Investors and traders are encouraged to invest or sell in the market whenever the prices and values of the assets change. However, investors are also hesitant to make transactions for the fear of not overbuying or underselling the asset. Therefore, it is crucial for the investors to analyze the constant shift which is happening in stocks, securities, commodities, forex, and other assets, to gain maximum benefits.

Moreover, the price discovery mechanism enables traders to advance from opening prices to the actual spot price in the market. Any trade transaction initiates from an introductory price that can be higher or lower than the actual price of an asset. However, by implementing the price discovery process, traders can reach a consensus for an actual and adequate price for any transaction.

Factors That Determine The Market Price

Price discovery is the fundamental function of any marketplace. Without price discovery, it would be difficult to gain the confidence of the trades in the market. However, the price discovery mechanism is based on multiple factors, without which implementing this process would be detrimental.

Some of these factors implicitly affect the price discovery process while others have a direct influence. Here are some of the evident factors influencing price recovery

#1. Demand and Supply

Price discovery is interlinked with the supply and demand of any tradable asset. As a result, an effective price discovery process can be completed only if the intersecting point of the supply and demand at a single price, is located.

For instance, if the demand is of an asset is high in the market, then it would inevitably increase its price. This would mean then the buyer would be on the verge of paying higher than the actual price of the asset.

In this scenario, the price discovery mechanism will not serve its true purpose as the sellers will get more benefits from high demand. It has been a consensus of both economists and financial experts that the best price of any asset is the equilibrium price. Price, where the supply and demand of an asset are equal, is the fair price for both buyers and sellers. Thus, demand and supply is the principal factor in the price discovery process.

#2. Volatility

The fluctuation in the market prices serves as its driving force. Buyers and sellers are motivated to participate in the trading activity when they observe volatility in the market. As a result, volatility indirectly also influences the market price due to the shift in the supply and demand of an asset.

Some traders prefer safe investment and wait till the market is stable. Contrary to this, some traders are waiting for the opportunity to invest in the volatility. Since there are more chances to earn significant capital gains from price fluctuations, risk-takers prefer this position in the market with their investments.

#3. Available Information

Any available information regarding the current value of an asset is also a factor that influences price discovery. After the variables of demand and supply, other available information regarding the price of a commodity can help in determining the spot price of a tradable asset.

This information may include, the position of the market, the economic situation, the support and resistance rates, and other related information that can help traders to predict the correct transaction price of an asset.

How Price Discovery Involves Finding Solutions to Day Trading

When a company is looking for an Initial Public Offering IPO, navigating and fixing the fair price for the stocks is the most crucial characteristic of the entire process. As a result, day trading during IPO days is mostly concerned with price discovery and it is the biggest apprehension of the day traders.

Usually, the price discovery process begins during the start of the day trading session while listing the IP shares for the first time in an open market. The process is also known as ‘call auction'. This session is crucial for any IPO day trading because there are no support or resistance rates present for the stocks. As a result, it becomes extremely difficult to get the fair price of the shares and this is where price discovery becomes inevitable.

This session usually ends an hour before the regular trading. Hence, the average transaction price of the stocks which are acquired from that session becomes the base for future trading. For this reason price discovery is valuable for day trading sessions.

Many financial experts suggest that to avoid the heated opening session it is important to wait for the early trades to settle down which would create more opportunities to acquire support and resistance rate. This strategy can also help to manage the risk that is involved in the early trading hours.

Best Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn't. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It's a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Price Discovery

The key takeaways: price discovery is an essential process that acts as a base for any market transactions or trading activities. Price discovery matters most to the market participants that is the buyers and sellers, as it assists them in finding out the current price of an asset. Hence, in any global marketplace, price discovery is of utmost importance to maintain fair markets and liquidity of the commodities.

Price discovery works best for buyers and sellers because due to the volatility of the market there is always a bullish and bearish flux in the stock prices. Moreover, buyers and sellers need to be sure that the price they agree to is the spot price of the asset. As a result, price discovery guides the traders to find the correct valuation of the asset and so they eventually avoid significant risk.

Since price discovery is considered to be a process, it is influenced by various factors such as demand and supply, market information, and volatility of the market. All these factors implicitly or explicitly affect the process of price discovery. Moreover, day-to-day trading in the stock market and even IPO trades are dependent upon the current price which is acquired only through an effective process of price discovery.

All in all, even though the term price discovery has been coined recently, however, as a process it has always been present even centuries ago during the street market trading between merchants. From the ancient Chinese silk trade to the European markets, fair and orderly markets were always a concern of the traders. And even so in modern times, it has preserved its importance in the financial markets. Hence, the importance of price discovery has always been there and will be there as long as there are any financial markets in the world.

Price Discovery FAQs

How does price discovery help the securities market?

Price discovery is the mechanism that helps in finding the spot price of the securities in the financial markets. The most essential purpose of a securities market is to handle orders and the execution of trade between buyers and sellers. These tasks combined make the process of price discovery. Thus, it will be not wrong to say that security markets would be non-functional without price discovery.

As buyers and sellers in the security market may get high or low prices of the securities than their market value. The price discovery mechanism assists traders to sell securities by scrutinizing the prices and then taking their final position. Hence, the sellers, as well as buyers, would be in a position to make their final call by finding out the spot price with the help of the price discovery mechanism.

What Investments are the most liquid for a company?

Liquidity means the efficiency of any asset, commodity, security, or stock to be able to be converted into money easily. If an asset can be sold with ease in the market without affecting its original price then that asset will be called liquid. Companies and businesses always require backup liquidity assets for managing the cash on their balance sheet to pay for the other required expenditures. For this reason, companies look for liquid assets which can be easily converted into cash at the time of need.

Moreover, these assets must have an established market in which enough buyers and sellers exist so that an asset can be exchanged for cash. In this regard, the most liquid asset for companies is the cash in the bank. However, there are other liquid assets as well such as security bonds, EFTs, mutual funds, or stocks.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.