Price Action Trading: An Expert Breakdown in 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Anyone who knows anything about trading the financial markets has heard of price action trading.

What many novice traders don’t know is how the price action on the price charts can be used to hit consistent profit targets.

As with any skill, one requires to dedicate a decent amount of time to learn a profitable price action strategy and things like the inside bar pattern, pin bar identifying a reversal signal, etc.

These lessons will help turn him or her into a successful price action trader.

In this review, you will learn all about price movements, price action patterns, and how you can use price action patterns such as swing highs and swing lows together with technical analysis.

Price Action Trading: What is Price Action?

Did you know that all price action strategies, including trading strategies such as swing trading, and technical indicators such as moving averages have price action as the basis of their analysis tools?

If you were to take out all the technical indicators and clear all the clutter from your price chart, all you would see is price action such as pin bar and inside bar, etc.

This is what price action trading is all about. It is about making trading decisions based on what you are seeing on your price charts to achieve profitable trading.

Now you might be thinking that trade price action is simple. However, as any professional trader will tell you, less can be more!

The idea behind the price action trading strategy is that the price action trader can spot a potential trade by just looking at the price action patterns on the price chart such as pin bar and inside bar pattern.

let’s delve a bit deeper and learn more about price movements and how you can use price action trading strategies in your day trading.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Supply And Demand Price Action Trading

Whether you are looking at currencies, crude oil, or stock price, the moving force behind the price action is supply and demand. This in turn is caused by the actions of traders.

When there is more demand than supply for certain instruments, there are more buyers in the market than there are sellers. As a result, the price of the financial instrument rises.

On the other hand, if the instrument has more suppliers than buyers, there are more sellers than there are buyers. Thus there is an oversupply of the trading instrument, and the price of the instrument drops.

If there is an equal number of sellers and buyers then there will be consolidation of price action i.e price doesn’t move up or down and stays in a horizontal range.

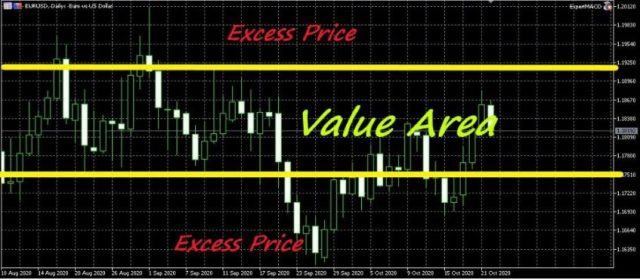

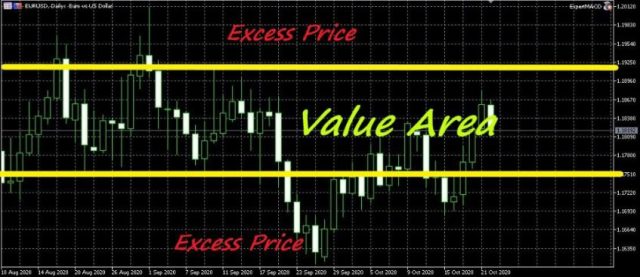

The Fair Value Area

let’s recap what we learned about demand and supply. When the supply and demand are equal, price action is consolidated around an area. There will not be any significant price movement up and down.

This area is called the fair value area.

Even while the price may go beyond an upper limit or lower limit, it will quickly revert into the trading ranges.

When price action goes beyond the fair value area, these are called excess prices.

When looking for the fair value area, there are a couple of things to always keep in mind:

- You should never try and identify the fair value area using a mathematical approach.

- All you need to do is to find an area where most of the trading took place

This value area is where most trading will occur and is viewed as a fair area by both sellers and buyers.

There will not be much price action trading outside the value area. Most price action traders will be unwilling to push the price outside of the value area.

Other traders would call these areas support and resistance which is a true representation of the price action in the area.

Useful price action trading tips:

- when the price rises above the value area, there is an opportunity to sell

- when the process goes below the value area, its an opportunity to buy

Price Isn’t Static

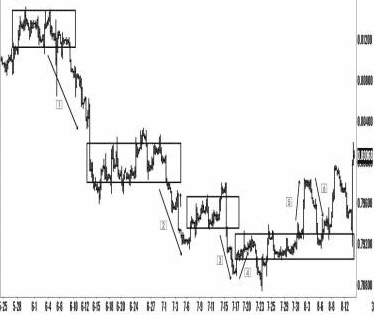

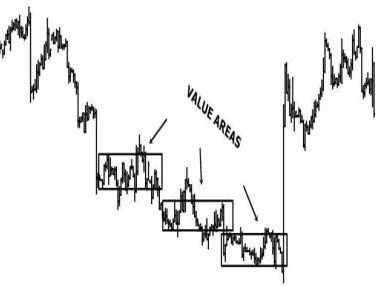

If there is one thing about the markets is that they are dynamic never static. Price movement shifts from one value area to the next. The reason for this is that markets are always trying to reach an equilibrium between buyers and sellers.

Therefore when the supply is larger than the demand the price will fall in search of a new equilibrium between buyers and sellers. On the other hand, when demand is greater than the supply, the price will rise to search for a new equilibrium between buyers and sellers.

If you are wondering how to perfect price action trading then the best way is to practice.

Simply pause reading, open your price chart and try to see if you can identify value areas and excess zones.

These price action signals will be visible in any time frame.

Volume Precedes Price Action

Volume changes and price movement in the markets are a reflection of what buyers and sellers are doing.

When the volume is low, there are few buyers and sellers on the instruments. As a result, price action will not move significantly and will often consolidate.

When there is an influx of buyers and sellers on a trading instrument, the volume increases and the price starts to move.

When the market volume is high, this is a sure sign that it is also highly liquid. At this time it is simple to trade the instrument i.e buying and selling as there are plenty of buyers and sellers including price action traders on the instrument.

By using a combination of volume analysis, technical analysis, and price action signals, price action traders can see the overall sentiment in the market.

For instance, if there was a spike in trading volume and a hike in prices, this would indicate that buyers who are controlling the market

On the other end of the spectrum, when the volume increases while prices shoot down, this shows that sellers are in control of the market.

Here’s a great piece of investment advice for trading smart:

You can include volume analysis as part of your technical analysis and as confirmation of your price action strategy.

This is how to use volume in conjunction with price action analysis…

- You can use an increasing volume to confirm that the prices are rising. You can also use a decreasing volume with lowering of prices.

- Moreover, you can confirm downward trending markets with increasing volume and prices making new lows.

- You can also tell that the downward trending markets are slowing down with a decrease in volume and a rise in prices.

- You can tell that a price is weakening when the prices are at extremes and there is no increase in volume to confirm the new price levels.

- If the price is in a protracted area and moves out of this area with a corresponding increase in volume, a breakout may be expected.

A few things to take note of:

- Since the forex market is decentralized, there may be differences in the volume profiling between different brokers.

- That said, using volume can be a highly useful piece of information to help you with your trading system.

- Institution market participants such as hedge funds, and banks have the most significant impact on the price action and therefore volume.

- You cannot predict price movement with volume alone.

- It is the institution’s money that will generally move during those low-volume days. Retail price action traders therefore often react to institutional, money movement and try to ride the trend direction.

At this point, you may want to pause further reading. Open your charts and see if you can see how the volume will relate to price moves.

You can do this by first plotting a volume indicator.

Excess Price – Tails And Spikes

When you look at the price history and identify a fair value area, you will also notice that excess prices stay out of the fair value area for a short time and then reverts back into the opposite direction into the fair value area.

New buyers and sellers entering the market are responsible for the excess value prices. They view these zones as being advantageous to them. However, the prices are then quickly rejected and move back to the fair value area.

One of the most significant bits of information to use with your trading system is that this pin bar pattern can form future support or resistance levels.

They are therefore important to include in your day trading price action trading strategies.

Check previous price history and see if you can identify areas where spikes and trails formed support and resistance levels.

Control Price

We saw that in the markets, prices will usually respect the fair value area and trade around or within these prices. When prices go beyond the fair value area, they quickly revert in the opposite direction.

That said, even with an established fair value area, take a closer look at the market’s price chart and you will notice that there is a price consolidating around a specific price area within the fair value area.

This price area is called the control area.

You can think of the control price as the area where traders spend most of their time. This is a point where the price moves and oscillates back and forth.

By identifying the control price, you can use it as a support and resistance level and a price action signal with your price action trading strategy.

Now it’s time for you to pause further reading and head off to your charts. Try and see if you can identify fair value prices. This price action reflects across multiple time frames.

In these fair value prices, see if you find a price where price action gravitated most around. This is the control price.

You will likely notice that the control price is usually in the middle section of the fair value prices.

Moving Value

Up until this point, we have assumed that demand will always meet supply in the markets. The truth is that this is not always the case.

No price action signal or market structure is perfect and often there is an imbalance that affects how price moves. Past performance is also not necessarily indicative of future results.

This is a highly important piece of information to include with your price action strategies. If the demand is slightly higher than the supply, the buyers would gradually push up prices.

The same is true if there was a slight oversupply, then sellers would slowly push down prices.

Best Forex Trading Course

If you are searching for the best forex trading course to learn the best price action strategies and help turn you into a successful and profitable trader, then you need the Asia Forex Mentor Program. It was developed by the world-renowned trading guru Ezekiel Chew.

Ezekiel has trained many successful price action traders from all backgrounds including banks, fund management companies, and prompt trading firms to retail traders. Ezekiel has also trained DBP bank which is the 2nd largest state-owned bank in the Philippines.

It is not all the time that you get the privilege of being trained by someone who makes up to 6 figures on a single trade. You know that you will get value for your money.

The Asia Forex Mentor One Core program is divided into 5 sections and covers everything you need to learn to achieve profits and avoid losing money rapidly. It is suitable for any experience level from beginners to advanced traders.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion

When creating a price action trading strategy, you need to consider the actions of the other participants in the market, especially institutions such as banks. These are responsible for the market’s price movement.

By understanding a few fundamental factors about price action, traders can develop profitable price action trading strategies.

Understand the concepts of demand and supply and how these affect the price movements. Also, consider the fair value price and the control price.

Including these in your trading systems will bring you closer to becoming a successful forex trader.

Price Action Trading FAQs

What does price action mean in trading?

Price action means the movement of and changes in prices of a security or trading instrument over a duration of time.

You can think of price action simply as the up and down movement of price over a duration of time.

While many traders will not view the price action as a trading tool, it is often used as a source of data from which all trading tools are formed.

Does price action trading really work?

Price action trading really works but only if the trader is using the correct analysis and is also using other information to support price action.

For instance, using a candlestick chart, the trader would find price action signals such as inside bar, pin bar, swing lows and swing highs, etc.

For price action trading to be profitable, the trader needs to have a clearly defined strategy that clearly states the entry and exit rules as well as having proper money management in place

Is price action good for day trading?

If carefully and strategically employed, price action trading can be a profitable strategy for day trading.

For instance, one way to us price action is to find the excess prices. These can develop above or below the fair value areas.

That said, in your price action trading you will need to identify things like inside bar pattern and decide if you will use this for a long position or as a reversal signals.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.