How To Trade the Piercing Pattern – An Expert’s Take 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Successful traders have a common trait. And it’s their ability to read price chart directions using various indicators. One key indicator is the Piercing pattern – when traders anticipate price reversals from either a dominantly bullish or bearish trend.

The primary focus of this post is to share a guide to trading the Piercing pattern from an expert point of view. In that order, we’ll be liaising with Ezekiel Chew – a Forex Traders Trainer, distinguished market analyst, and founder/CEO of Asia Forex Mentor.

Ezekiel Chew has 20 years of experience trading financial markets. This post will set records clear on the importance of reading candle sticks on a chart. Also, we’ll help traders identify piercing patterns clearly.

Reading on, key takeaways focus on the two forms of piercing patterns: bullish or bearish. Plus, the correct way to analyze, verify, and make trade setups for the piercing patterns.

Finally, our expert will shed more light on two common questions that revolve around the piercing patterns.

What is Piercing Pattern?

A piercing pattern is a potential trend reversal indicator.

And, it has two clear points:

One, it comprises two candles – each represents a day of trading. Two, the second candlestick moves in an opposite direction to the first.

Since piercing patterns point towards potential short-term reversals of trends – the relative directions point to either a bearish or bullish reversal.

Finer Details of the Piercing Pattern

These are the key formational details on what to look out for in a piercing pattern formation:

Candle one or the first day opens near a high and closes near a low. It has either an average to a larger range of trading. More so, the first candle comprises a gap down – where day two prices pick on from it.

Candle two trading picks on – the opening is very near to the previous high. Plus, closes near to the previous high price. Most importantly, the second-day candle should cover half of the distance of the candle one.

Why are Candlestick Patterns Important within a Trading Day?

Candlesticks are an important tool for Technical analysts. They use the candle sticks and the patterns they form as principal tools for reading price action performance and getting insights from the markets.

Being graphical representations of price movements, technical analysts prefer them to other tools for price representation. Ideally, any timeframes fit into candle sticks. They give out simple visuals, yet are rich in key market information at any moment.

Some traders and analysts say that candle sticks offer practical impressions of the market. It can be in minutes, any time between to as long time frames like days, weeks, and months. So, it builds up the historical insights to any timeframes of preference.

Candlesticks show the opening prices and the closing prices. Plus, candlesticks show the highest as well as lowest prices for a trading timeframe.

From inference, market analysts are able to pick out key details of the market performance from the shapes of closed candle sticks. Hence, they are able to answer several questions per session: Was the volume of buying or selling high or low? Did prices close lower, higher, or the same as these at session opening?

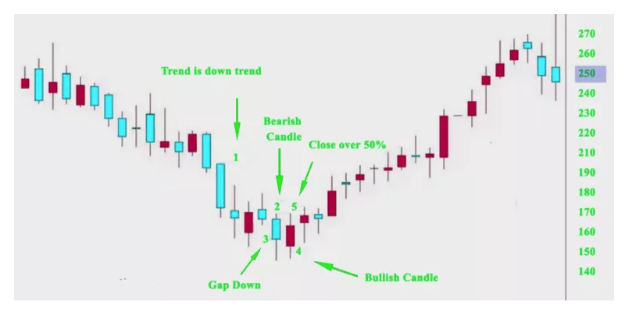

How to locate a Piercing Candlestick Pattern?

For market analysts and traders to distinguish a Piercing candlestick pattern, it has to narrow down to two candlesticks.

The identity depends on whether the last trend was bullish or bearish – since the piercing pattern indicates a reversal of a currently dominant trend.

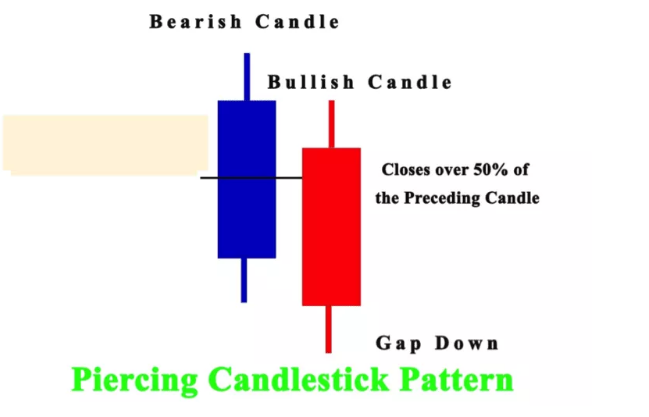

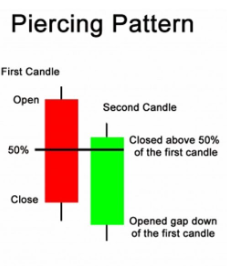

For a bullish candlestick reversal piercing candlestick pattern:

First, formation starts with a bearish candle. It has a long tail, and more specifically, the prices close above its midpoint.

Secondly is the bullish candle. It starts within the lower zones of candle one. However, its prices close higher than the midpoint of the bearish candle. This is a clear signal that buyers are stepping in with interest to push the prices higher.

As a matter of setting records more clearly, experts perceive a bullish reversal pattern with more weight. In other words, they consider it a serious signal

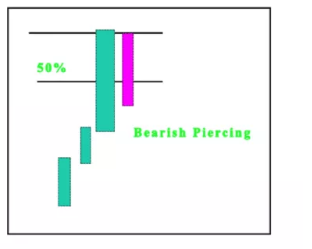

For a Bearish Candlestick Reversal Pattern:

In a bearish reversal, the initial candle stick remains bullish. It has a longer tail on the upper side.

Candle two is a bearish candle, whose starting point is above the closing prices of the previous bullish candle. But, more specifically, the second candle stick has prices closing below the midpoint of the candle one.

As much as it points to a bearish reversal, analysts do not hold the pattern as a really serious reversal signal. Therefore, it requires more analysis, probably with another indicator to verify in indeed it is a real turnaround of the trend.

Bullish Candle Piercing Pattern

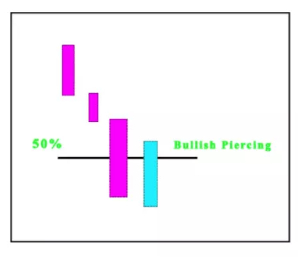

A bullish candle sticks piercing pattern forms while prices are on a downtrend.

Specifically, the appearance comprises two candlesticks. Candlestick one remains bearish – however, it may have a longer lower tail, which indicates buyers pushing prices higher.

Candlestick two is bullish and forms a morning star. It maintains the lower long tail – indicating sellers are still strong. However, the closing price settles at not less than the middle point of the candlestick one.

The notion about piercing arises from the fact that prices are able to show reversal evidence when buyer pressure (morning star) seemingly overwhelms that of the dominant sellers in the market.

Bearish Candle Piercing Pattern

As usual, a bearish candlestick piercing pattern shows up as a reversal sign consisting of two candlesticks – within dominant bullish trends.

Candle one remains bullish, while candle two is bearish. However, it’s worth noting that candle two starts within the upper bullish limits or zones, yet closes past halfway the extent of the bullish candle (day one).

As we’ve spelled out earlier, analysts do not pick it as a clear show of trend reversals. Therefore, while the logic holds true, it requires more carefulness to verify if it’s a real reversal or just a false break.

How to Trade a Piercing Candlestick Pattern?

The best way to trade the piercing candlestick pattern is to first check the clarity of its formation. Once the prices form a clear candle two – with clear 50% retracement for candle one, wait for another day.

Meanwhile, use the analysis of other indicators to see if the reversal is a valid one. Among three good ways to compliment the piercing pattern includes confirming with the RSI, MACD, and the Parabolic Sar. The list includes many more technical indicators.

Having verified the reversal or otherwise, traders can take on placing positions more confidently. If in case the markets show clear signals of bullish reversals, traders can then take advantage of the bullish trend with other factors on board.

Therefore, the core point here calls for market analysts to pull in more effort. Why? It’s not adequate to jump into the markets with one indicator – piercing pattern alone. It’s the confidence and analysis based on several more indicators.

Pulling in several indicators at a go complement each other and minimize the chances of picking a false break with complex instruments.

Best Trading Setup for Piercing Pattern

The best trading setup for trading the piercing patterns relies on several factors – all of which must fall in place concurrently.

One is clarity and confidence in spotting the formation of the piercing pattern. So, this eliminates the chances of jumping to the wrong conclusions regarding trend reversals.

And primarily, it’s the masterly and taking time to analyze markets with two or three more indicators at the same time.

Second, is the ability to analyze markets from other angles and fit into the reversal trading strategy. Practically, the piercing pattern allows traders to wait at bay and only jump in once the bullish momentums offer clear signaling.

Best Forex Trading Course

Ezekiel Chew is a renowned forex trader, trainer, and industry expert. He has trained professional and retail forex traders as well as corporate finance players like bank traders, money managers, and asset investors. From his trading experience drawn from over 20 years of trading the forex markets, he has created a comprehensive forex trading course known as “the one core program”.

Ezekiel asserts that the one core program is designed for the ‘committed learner', so previous trading knowledge or experience is not required before you can enroll in the program. The program comprises over 60 video lessons that teach proprietary trading strategies that are backed by mathematical probability and technical analysis principles.

The one core program has been proved to be highly efficient as it has generated millions of US dollars for Ezekiel Chew and his students. There are numerous testimonials from students that have graduated from the program and are now making six-digit figures per trade just by applying the techniques learned from the program. The one core program is available on the Asia Forex Mentor website; which is a forex trading blog that has been existing for over a decade.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Piercing Pattern

The piercing pattern works when two candles show potential for trend reversal. The second candle moves in the opposite direction to the prior candle, but it must retrace to past 50% of the candle one.

Traders and analysts should expand the analysis to clear false signals in line with impending trend reversal and trading strategies. Or, not relying on the pattern alone.

Agreeably, all other prudent trading concepts must also be in place including the balance expectations. A set of balanced expectations builds on trading with reasonable risk-to-reward ratios, and correct money management.

Plus, when the worst comes against the setup, traders should jump out of the markets with a well-set stop loss position.

With a well-set SL position, the trader ensures they preserve large portions of capital for trading CFDs and other numerous future opportunities.

Piercing Pattern FAQs

Is Piercing Pattern Reliable?

Yes. However, the level of reliability depends on verifying price direction using other complimenting indicators at the same time for profitable traders.

Is the Piercing line bullish or bearish?

A piercing line pattern is primarily reliable as a bullish reversal pattern.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.