Penny Stocks vs. Forex: Which One Is For You

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The main difference between Penny Stocks and Forex is that Penny Stocks are usually much more volatile than Forex. Penny Stocks trading can make be a more risky investment, but it also means that they have the potential to generate higher returns. On the other hand, Forex is typically a more stable market, which can provide investors with consistent returns.

Penny stocks are also typically much less liquid than Forex, making it difficult to sell your investments quickly if you need to. This lack of liquidity can make penny stocks trading a more speculative investment, but it also means that there is the potential for greater rewards if the company you invest in does well.

Making money in the stock market is a dream for many people. For some, investing in penny stocks sounds like a great way to quickly create money. For others, trading Foreign currencies (Forex) seems like the best option.

In general, penny stocks are a more risky investment than Forex, but they also have the potential to generate higher returns. If you consider investing in either market, it is imperative to do your research and understand the risks involved. Investing in penny stocks can be a great way to make money, but you need to be aware of the risks ahead before you get started.

So, which is better: penny stocks or Forex? We will compare and contrast these two investment options and help you decide which one is right for you in this blog post!

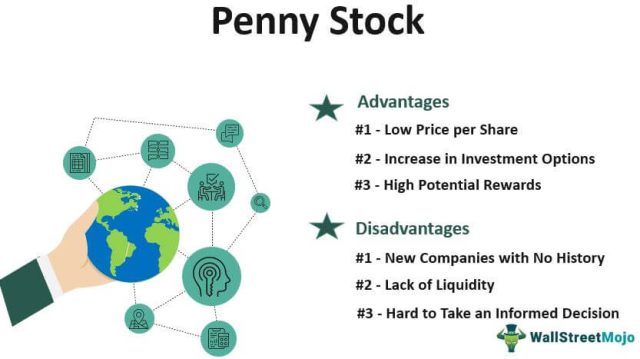

Penny Stocks vs. Forex: What is Penny Stocks

Penny stocks are a type of stock trading for a relatively low price. Usually, they are traded on OTCBB or Pink Sheets. They are traded for a low price because the companies that issue them are typically small or new companies with a bit of track record or history.

Penny stocks are considered high-risk investments, and they can be very volatile. They can fluctuate in value very quickly, and you can lose a lot of money if you don't know what you're doing.

If you're thinking about trading penny stocks, you should research and understand the risks before you invest any money. Penny stocks can be an excellent bet to make a lot of money, but you can also quickly lose everything you've invested.

What is Forex

The FX market, or Foreign Exchange market, is the world's largest financial market; With a daily volume of more than $ 7trillion, it is larger than all other financial markets combined. Transactions in the forex market take place 24 hours a day, five days a week.

Currencies are traded in pairs, investors and forex traders are able to speculate on the relative strength of one currency against another. For example, if forex traders believe that the Euro will appreciate against the US dollar, they will buy euros and sell dollars. If their prediction comes true, they will make a profit.

Conversely, if they believe the Euro will depreciate against the dollar, they will sell euros and buy dollars. If their prediction is correct, they will also make a profit. However, if their prediction is incorrect, they will incur a loss.

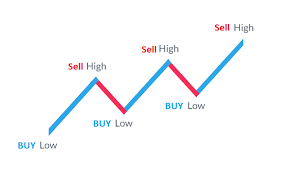

The fx market is a worldwide marketplace where currencies are traded. The prices of currencies fluctuate, and you can make money by buying low and selling high. The forex market is larger than the penny stock market, and it's more liquid. It means that there are always buyers and sellers, so you can quickly get in and out of trades. The forex market is also more regulated than the penny stock market, so there is less chance of fraud.

If you're about investing in the forex market, you should research and understand the risks before investing any money. The forex market is definitely a great way to make a lot of money, but you can also quickly lose everything you've invested.

Penny stocks and Forex are both risky investments, and you can lose a lot of money if you don't know what you're doing. It is imperative to do your own findings before you invest any money.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Similarities Between Penny Stocks and Forex

Penny stocks and Forex may seem like worlds apart, but there are quite a few similarities. Both penny stocks and Forex involve speculation on the future value of an asset, and both can be highly volatile. Forex or penny stocks are both extremely risky investments, and both can result in sizable losses.

They both offer the opportunity to make a lot of money. However, they also both carry a high degree of risk. So, if you're thinking about investing in either penny stocks or Forex, it's essential to do your research and understand the risks involved.

Ultimately, whether you invest in penny stocks or Forex (or both), it's important to remember that you can make a lot of money and lose a lot of money. So, invest wisely and always be cautious.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Differences Between Penny Stocks and Forex

Penny stocks and Forex are two of the most popular investment options available. However, some critical differences between the two are worth considering.

Penny stocks are much riskier than Forex, and they are also more volatile. This means that penny stock prices can change rapidly, and investors can lose a lot of money if they don't know what they're doing. Forex, on the other hand, is a much safer investment. Prices may fluctuate, but they tend to do so at a slower pace. This makes Forex a better choice for investors who don't want to take on too much risk.

Another notable difference is that penny stocks are often traded on smaller exchanges. Typically much less expensive than Forex, making them a more accessible option for many penny stock investors. They also tend to be more volatile, which can make them a more risky investment.

It could be challenging to find buyers or sellers when you want to exit a position. On the other hand, Forex is traded on major exchanges all over the world. This makes it easy to buy or sell currency pairs whenever you want.

Pros and Cons of Penny Stocks

Pros

- Can offer high returns

- They are often easier to trade than other types of stocks

- Can be traded online

- The minimum investment is low at a few dollars, you can buy a large share

Cons

- It can be illiquid; quickly converting back to cash is not easy

- Highly speculative

Pros and Cons of Forex

Pros

- It is the global largest market

- The market opens 24 hours daily, from Sunday evening to Friday night

- You can trade with leverage

- You can trade Forex online

Cons

- The Fx market is very complex, and it can be challenging to understand

- The government regulates the fx market, and there are rules and regulations that you need to follow

Best Forex Brokers for Trading

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Trading Course

Asia Forex mentor is the best forex trading course in Asia. The course is designed to let you earn while you learn. You will be able to trade forex with a professional trader's help and make a profit.

They've trained thousands of people in Singapore and different places around the globe from USA, Uk, Hong Kong, India, Indonesia, Japan, Malaysia, Vietnam, and other countries around the world.

They've mentored not just individual students but corporate bodies and financial institutions on foreign exchange, including the DBP, which is the second-largest state-owned bank in the Philippines with assets of over $13B

The course is affordable, and it comes with a money-back guarantee. You can get started with the course by signing up for a free trial. After the free trial course, you can decide whether you want to continue with the course or not.

Are you looking for the right mentorship and also serious about being a successful trader? Then this is your course. With their undefeated trading strategies, you will become an expert at the trade. You can check out their website for more information on how to register and get started https://www.asiaforexmentor.com/

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Penny Stocks vs Forex

Penny stocks and forex trading are both viable options for those looking to make a profit. However, it tends to be more volatile and unpredictable, while forex trading is more stable and predictable. It is paramount to understand these differences before deciding which option is right for you.

If you are looking for stability and predictability, forex trading may be better. However, if you are willing to take on more risk for the chance of higher rewards, penny stocks may be the better choice. Whichever option you choose, do your research and understand the risks before investing.

There is no distinct preference when it comes to penny stocks and Forex. Both have their specific pros and cons and peculiarities, and it depends on your individual goals and preferences as to which is better for you. If you're looking to make quick, easy profits, then penny stocks may be the way to go.

Forex trading may be better if you're more interested in long-term little gains and stability. So, your investment goals and risk tolerance would be the ultimate determinant of your option.

Penny Stocks vs Forex FAQs

Can you get rich off penny stocks?

This question comes often, and it's not an easy one to answer. It depends on several factors, including the company you invest in, the amount of money you invest, and how well you manage your investments.

You should be aware of a few critical differences between penny stocks and Forex before making any investment decisions. Penny stock involves companies with a stock price of $5 or less per share, while Forex is the marketplace where currencies are traded with high volume as you may decide.

Penny stock is generally much riskier than Forex, but it can also offer a higher potential return. This is because they are often more volatile and less liquid than Forex.

Is Forex riskier than stocks?

Penny stock has a higher risk-return ratio, with more volatility and less liquidity than Forex. But there are some exceptions. For example, your risks will be higher if you're investing in a currency on Forex that's not very stable or using leverage.

It's important to remember that both have their risks and rewards. It's up to you to decide which one is right for you.

If you're thinking about investing in penny stock or Forex, do your research and understand the risks. It is also noteworthy to always remember never to invest more than you can afford to lose.

Can you make more money in Forex than stocks?

When it comes to making money in the financial markets, there are a lot of different avenues that you can take. The same question that comes to the mind of many people is whether they can make more money in Forex than stocks. The simple answer is yes. Forex trading has a higher tendency to make you more money than stock trading, but it comes with risks and rewards. Let's look at Forex and stocks closer to see their comparison in terms of money-making.

Which is More Profitable?

There are different factors that you need to consider when you are trying to determine which market is more profitable. Forex trading involves currency pairs, and you make money by speculating on the movement of those currencies. For example, if you think that the US dollar will strengthen against the Euro, you would buy USD/EUR. If the US dollar does strengthen, then your trade will be profitable.

Stock trading involves buying and selling publicly traded shares. You make money in the stock market by buying shares at a low price and selling them at a higher price. Like forex trading, there is a lot of speculation involved, and you need to understand the market before you can make money.

So, which is more profitable? Forex trading can be better than stock trading; With forex trading, you can make a lot of money in a short period.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.