OneRoyal Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

OneRoyal Review

Embarking on the journey of online trading, one encounters myriad Forex brokers offering diverse services and trading instruments. However, very few stand out as all-encompassing trading platforms. OneRoyal, a multifaceted online broker, is one such exception. Offering Contracts for Difference (CFDs) on a vast array of over 180 major, minor, and exotic Forex currency pairs, allows traders a wide spectrum of choices. But that's not all. OneRoyal extends its services to a variety of markets including Indices, Metals, Oil, Stocks, Cryptocurrencies, Exchange-Traded Funds (ETFs), and more, making it a versatile platform for traders of all types.

This comprehensive review is designed to evaluate OneRoyal exhaustively, focusing on its distinct advantages, potential downsides, account types, fee structure, and more. By combining expert analysis with real-life trading experiences, we aim to provide a well-rounded insight into this brokerage service, empowering you to make an informed decision about selecting OneRoyal as your go-to trading platform.

>> Also Read: Forex Trading Strategies – A Trader Beginners Guide

What is OneRoyal?

Emerging in 2006, OneRoyal carved its niche in the Forex trading landscape with an unyielding commitment to delivering excellent trading services. As a product of this steadfast dedication, OneRoyal quickly garnered acknowledgment and praise in the trading industry. This recognition paved the way for its successful expansion to the Middle East in 2008, and subsequently to Australia in 2016.

In the same year, OneRoyal reached a pivotal milestone by securing its license from the Cyprus Securities and Exchange Commission (CySEC). This licensing is a powerful endorsement of OneRoyal's stringent compliance with regulatory norms, transparency, and unwavering commitment to creating a secure trading environment for its clients.

OneRoyal's dedication to legal compliance is further highlighted by its prudent decision to withhold its services in certain countries like the USA, North Korea, Iran, and Japan due to regulatory constraints. This reinforces its image as a reliable and trustworthy trading broker in the industry.

Safety and Security of OneRoyal

With operations regulated by esteemed authorities such as the Australian ASIC and European CySEC, OneRoyal firmly establishes itself as a reliable brokerage firm. These regulatory bodies enforce stringent guidelines to ensure trustworthy and transparent operations.

OneRoyal ensures the safety of its clients' funds by keeping them segregated from the firm's own accounts and refrains from using them for operational purposes. Additionally, OneRoyal guarantees negative balance protection for its European clients.

Clients of Royal Financial Trading (CY) Ltd enjoy further protection from the Investor Compensation Fund for Customers of Cypriot Investment Firms (CIFs) and Australian fund for trading accounts under ASIC, adding an extra layer of security for traders' accounts. However, we recommend verifying protections since they may vary based on the broker entity.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Sign-Up Bonus of OneRoyal

In contrast to several other trading platforms that use sign-up bonuses to lure in new clients, OneRoyal follows a distinct approach. They do not offer a welcome bonus to traders who register for a real account with them. This strategy underscores OneRoyal's emphasis on long-term customer relationships nurtured through quality services, transparent pricing, and advanced trading infrastructure, rather than short-term promotions.

By prioritizing robust trading conditions over promotional perks, OneRoyal aims to attract serious traders who prioritize consistent performance and solid trading features. Although the absence of a sign-up bonus might seem off-putting to some, especially those accustomed to such perks, OneRoyal's approach manifests its commitment to delivering superior value in the form of efficient and trustworthy trading services.

Minimum Deposit of OneRoyal

Understanding that potential traders come from varied financial backgrounds, OneRoyal has set a highly accessible entry point. The minimum deposit required to open a OneRoyal classic trading account is just $50. This low threshold enables a broad spectrum of traders, including those with limited capital, to get started on their trading journey. It also reflects OneRoyal's commitment to democratizing trading by making it accessible to a large number of people.

However, the broker also caters to more seasoned and high-volume traders by offering a range of account types that can be opened with larger deposits, each with its unique set of benefits and features. The diversified account offerings ensure that OneRoyal can serve a diverse set of trader requirements, irrespective of their investment capacity and trading style.

OneRoyal Account Types

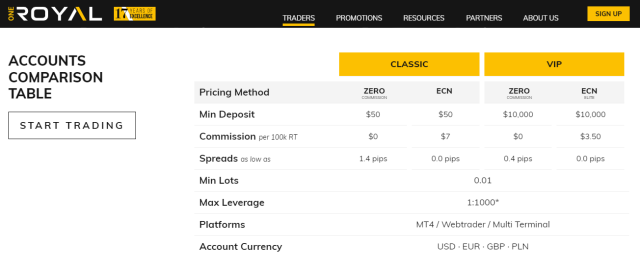

OneRoyal provides its clients with a range of account types designed to cater to different trading preferences and investment capacities. There are two primary categories of accounts: the ECN account and the Zero Commission account. Each of these primary types is further broken down into three distinct account types based on the investment level and the associated features.

Zero Classic Account

Designed with beginners and low-volume traders in mind, the Zero Classic Account requires a minimum deposit of just $50, going up to $19,999. It offers the advantage of commission-free trading with spreads beginning at 1.4 pips. Account holders can access platforms like MetaTrader 4, WebTrader, and Multi-Terminal, and have the option to open an account in multiple currencies. Other features include access to live market news and social competitions.

Zero Premium Account

For more experienced traders with a larger investment capacity, the Zero Premium Account can be opened with a deposit ranging from $20,000 to $99,999. Besides commission-free trading and spreads from 1.0 pips, holders of this account type enjoy all the features of the Zero Classic Account. Moreover, they gain access to an Account Manager and Trading Central, as well as MetaTrader 4 Tools and Plugins.

Zero VIP Account

Reserved for high-net-worth individuals and high-volume traders, the Zero VIP Account demands a minimum deposit exceeding $100,000. This account type offers all the features of the Zero Premium Account and further grants access to the Dow Jones Newswire. Spreads start from as low as 0.6 pips.

Core Classic Account

For traders preferring the ECN model, the Core Classic Account is an ideal choice. It requires a deposit ranging from $50 to $19,999 and offers tight spreads starting from 0.0 pips. However, a commission of $7 is charged.

Core Premium Account

With a minimum deposit between $20,000 and $99,999, the Core Premium Account operates on an ECN model, providing trading with spreads starting from 0.0 pips. Commissions are reduced to $5 for this account type.

Core VIP Account

Catering to VIP traders preferring the ECN model, the Core VIP Account requires a deposit over $100,000 and offers the most competitive conditions with spreads from 0.0 pips and commission charges as low as $3.5.

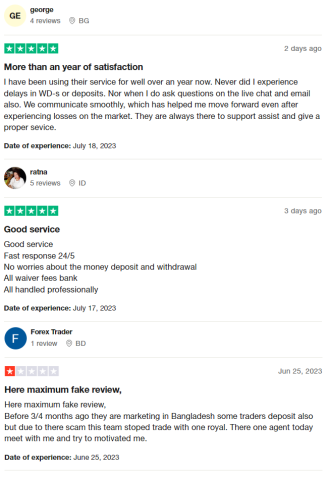

OneRoyal Customer Reviews

OneRoyal has received mixed reviews from its users. Some clients appreciate the platform's efficiency, especially in terms of fund deposits and withdrawals, and have enjoyed a hassle-free experience with waived bank fees. They commend the customer service team for their quick, round-the-clock responses, as well as their professional handling of inquiries and concerns. They have expressed that this level of support has helped them overcome setbacks and losses in the market.

However, on the downside, there have been concerns raised regarding the broker's marketing practices, with accusations of deceptive tactics used in certain regions, like Bangladesh. Some users have labeled such activities as scams, causing them to halt their trading activities with OneRoyal. It's clear that while many find the platform reliable and customer-oriented, others have had less positive experiences, warranting a careful evaluation before deciding to trade with OneRoyal.

OneRoyal Fees, Spreads, and Commissions

OneRoyal prides itself on its competitive and transparent pricing structure. For Forex trading, the broker offers tight, floating spreads with an average spread of just 0.2 pips for the popular EUR/USD currency pair. This stands out in the industry, as the average spread is typically around 1.2 pips. Furthermore, the firm offers attractive spreads across all major currency pairs and other popular trading instruments.

One Royal Forex broker distinguishes itself by ensuring there are no hidden costs. No fees are levied for account opening, closure, or inactivity. However, charges may apply to deposits and withdrawals depending on the chosen funding method and the trader's country of registration. Therefore, traders are advised to conduct thorough research to understand any additional charges they may incur while trading with OneRoyal. This transparency and competitive pricing form part of OneRoyal's commitment to providing an honest, affordable, and straightforward trading experience.

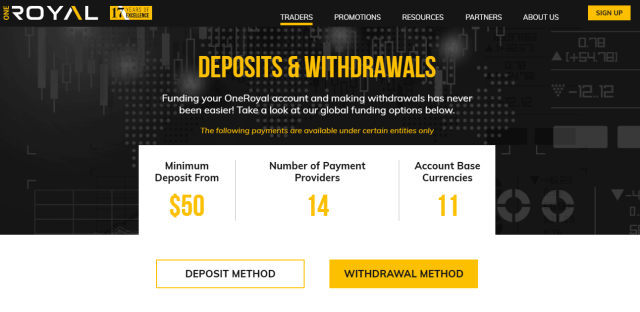

Deposit and Withdrawal

Depositing funds into a OneRoyal trading account is a straightforward process that allows for a variety of funding options. OneRoyal strives to cater to its global clientele by offering multiple deposit methods, including bank wire transfers, credit/debit cards, and popular online payment systems such as Skrill and Neteller. The aim is to ensure seamless, quick, and convenient transactions for clients irrespective of their geographical location.

Other payment methods accepted by OneRoyal include FasaPay and POLi, further broadening the options for traders across the world. It is, however, crucial to understand that specific requirements and limitations may apply to each funding method. These may depend on the regulations of the financial institution handling the transaction or the trader's country of residence.

Withdrawals are handled with equal efficiency and transparency at OneRoyal. The platform aims to provide a smooth and prompt withdrawal process, enabling traders to access their funds as and when needed. Keep in mind that while OneRoyal processes withdrawals quickly, the time it takes for the funds to reflect in your account may vary depending on the payment provider. For instance, withdrawing funds through online payment systems like Skrill or Neteller could take up to 7 business days.

How to Open a OneRoyal Account

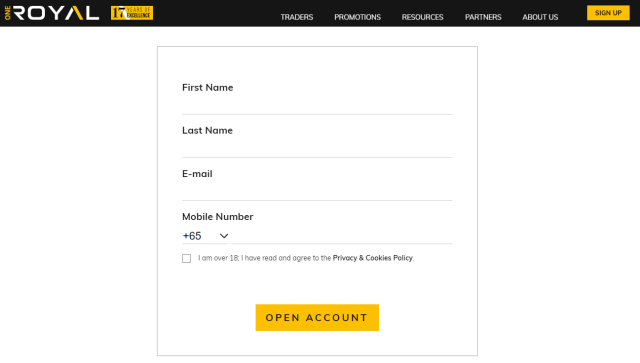

Embarking on your trading journey with OneRoyal is a straightforward and efficient process. Here is a detailed step-by-step guide on how to open a trading account with OneRoyal:

- Go to Their Website: Start by visiting the official OneRoyal website. The “Sign Up” button is located in the upper right corner of the home page. Clicking this button will kick-start the account creation process.

- Fill out the Information: You will be asked to complete a form requiring your personal details. This includes your name, contact information, and some regulatory information. It is important to ensure that all the information you provide is accurate and up-to-date, as this will be essential for the subsequent account verification process.

- Verify Your Account: After successful registration, OneRoyal will send an account verification email to your registered email address. The email will contain instructions on how to verify your account. This process is important to confirm your identity and secure your account. After verification, you will be able to log in to your new OneRoyal account and start your trading journey.

OneRoyal Affiliate Program

OneRoyal boasts an appealing Introducing Broker (IB) program that is designed to incentivize those who bring new traders to the platform. By participating in this program, affiliates stand to earn up to 60% on all spread and commission-based accounts, a highly competitive rate in the industry.

The key benefits for affiliates participating in the OneRoyal IB program include:

- $150 Cash Bonus: The program incentivizes introductions with monetary rewards. For every 10 clients that an affiliate introduces to OneRoyal, they will receive a cash bonus of $150. This is a substantial bonus that enhances the earning potential of the affiliate.

- 5% Client Discount: Not only does the affiliate benefit but the clients they bring in also receive perks. All clients introduced by the affiliate will receive a 5% cashback discount on spreads and commissions at the end of each month. This provides a win-win scenario for both the affiliate and the introduced client.

- $500 Cash Bonus: The bonuses don't stop at introductions. Affiliates can earn an additional cash bonus of $500 for every 2000 round lots traded on the platform. This offers an ongoing opportunity to increase earnings based on the trading activity of the clients they bring to the platform.

OneRoyal Customer Support

Delivering top-notch customer support is a critical component of OneRoyal‘s service offering. They offer a comprehensive 24/5 support system, meaning that assistance is available almost every day of the week. The platform ensures that clients can reach them through multiple channels, including Live Chat, Social Media, Email, and Phone, catering to the communication preferences of a wide range of clients.

The customer support team at OneRoyal consists of experienced trading professionals who are equipped to address a variety of issues and queries. They can handle everything from technical difficulties with the trading platform to inquiries about market analysis. They are also available to answer general inquiries and address operational concerns.

OneRoyal takes pride in delivering a customer service experience that is as professional and efficient as possible. The goal is to provide a seamless trading experience for all users, and the knowledgeable support team plays a pivotal role in achieving this. Regardless of the issue or question at hand, OneRoyal's support team stands ready to assist, ensuring that every trader can focus more on trading and less on troubleshooting.

Advantages and Disadvantages of OneRoyal Customer Support

| Advantages | Disadvantages |

|---|---|

OneRoyal vs Other Brokers

#1. OneRoyal vs AvaTrade

OneRoyal and AvaTrade are both prominent forex trading platforms in the market. OneRoyal, known for its low minimum deposit of $50 and various account types, provides a flexible and affordable entry point for many traders. It also offers an impressive range of trading instruments and an attractive affiliate program.

On the other hand, AvaTrade stands out with its comprehensive educational resources and highly regulated operations. AvaTrade also offers a wider range of trading platforms, including MetaTrader 4, MetaTrader 5, and their proprietary AvaTradeGO and AvaOptions.

Verdict: AvaTrade is a better option for beginners due to its extensive educational resources and variety of trading platforms, providing users with more trading tools and knowledge to start their trading journey. However, for more experienced traders looking for lower entry barriers and lucrative affiliate programs, OneRoyal would be the preferred choice.

#2. OneRoyal vs RoboForex

RoboForex is another competitor in the trading space. While OneRoyal offers a wide range of trading instruments and an appealing affiliate program, RoboForex shines with its various account types, each tailored to different trading strategies and styles. RoboForex also has the advantage of offering a demo account, allowing beginners to practice without financial risk.

Verdict: If you're a beginner looking for a safe environment to learn and practice, or an advanced trader wanting a specific account type to suit your trading style, RoboForex would be more suitable. However, for traders looking to take advantage of a lucrative affiliate program, OneRoyal takes the lead.

#3. OneRoyal vs FXChoice

FXChoice, compared to OneRoyal, has been in the industry longer, and its experience shows in its service. It's recognized for its excellent customer service, competitive spreads, and robust MetaTrader 4 and 5 platforms. However, FXChoice has a higher minimum deposit of $100.

Verdict: For traders who value exceptional customer service, competitive spreads, and a robust trading platform, FXChoice would be the better choice. Nevertheless, if you're looking for a lower initial deposit and an attractive affiliate program, OneRoyal would be the better option.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: OneRoyal Review

OneRoyal emerges as a strong contender in the Forex trading market with its range of offerings. Its low minimum deposit threshold, comprehensive trading instruments, and appealing affiliate program are standout features. While it may not offer a welcome bonus or a demo account, it compensates with an easy and flexible account setup, a variety of payment methods, and top-tier customer service. For traders looking to step into the world of Forex trading with minimal initial investment or those looking for opportunities beyond just trading, OneRoyal provides an accessible and promising platform.

> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

OneRoyal Review FAQs

What is the minimum deposit for OneRoyal?

The minimum deposit to open a OneRoyal classic trading account is $50.

Does OneRoyal offer a welcome bonus?

No, currently, OneRoyal does not provide a welcome bonus for new traders.

What types of customer support does OneRoyal offer?

OneRoyal offers 24/5 customer support via several channels, including live chat, social media, email, and phone. The customer service team is well-equipped to handle a range of issues, from technical difficulties to market analysis advice.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.