Mitrade Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved.

|

Mitrade Review

Mitrade, an established Forex and Contracts for Difference (CFD) trading company, provides its clients with a diverse suite of more than 400 financial products. The array of tradable assets includes Forex, Indices, Commodities, Shares, and much more.

Founded in Melbourne, Australia, Mitrade is a licensed entity, overseen by the Australian Securities and Investments Commission (ASIC), Cayman Islands Monetary Authority (CIMA), and Mauritius Financial Services Commission (FSC). The company has expanded its footprint by establishing supporting offices across seven countries globally.

This comprehensive Mitrade review aims to delve deep into the features and functionalities of this broker, highlighting its strong and weak points. We aim to offer a panoramic view of the trading experience with Mitrade, covering account types, deposit and withdrawal processes, fee structures, and other salient aspects.

What is Mitrade?

Founded under the mantle of Mitrade Global Pty Ltd, Mitrade is an online forex and CFD trading broker stationed in Melbourne, Australia. The firm holds licenses from multiple regulatory bodies – Australian Securities and Investments Commission (ASIC), Cayman Islands Monetary Authority (CIMA), and Mauritius Financial Services Commission (FSC), giving it credibility in the global financial market.

The online brokerage firm extends a vast catalog of tradable instruments to its users. This list includes Forex pairs, commodities such as gold and oil, major stock indices from global economies, and trending cryptocurrencies. In total, Mitrade provides traders with access to over 300 different financial instruments, helping them diversify their portfolios and hedge risks.

The Mitrade trading platform stands out due to its simplicity and usability. The platform is the result of continuous innovation and meticulous work by a team of experienced developers from across the globe. The user interface is intuitive and has been designed to provide a seamless trading experience to users, regardless of their trading expertise. Be it a trading enthusiast just stepping into the world of financial markets or a seasoned trader with years of experience, Mitrade's platform is built to cater to all.

>> Also Read: 5 Best Forex Trading Software in 2025

Safety and Security of Mitrade

The safety and security of funds and personal information are paramount when choosing a trading broker. Mitrade goes to great lengths to ensure these aspects. It is operated by Mitrade Global Pty Ltd, a company officially registered and regulated in Australia. As evidence of its legitimacy, Mitrade transparently displays its license number (AFSL 398528) and registration number (ABN 90 149 011 361) on its website. These credentials can be cross-verified on the ASIC’s website.

Mitrade's compliance policy is solid, ensuring it adheres to the rules and regulations stipulated by ASIC. This rigorous oversight adds an extra layer of security to the client's funds. Deposits and funds of clients are held in separate accounts, and Mitrade does not use client money for any operational activities, a practice consistent with standard financial regulations. However, while Mitrade provides trading services to a worldwide audience, it does exclude certain regions like the United States, Canada, and Japan.

Sign-Up Bonus of Mitrade

Contrary to some brokerage houses, Mitrade does not offer Sign-Up Bonus, Welcome Bonus, or No-Deposit Bonus upon account registration. However, the broker does host periodic competitions and profitable events, providing traders with opportunities to increase their capital and trading prowess.

Minimum Deposit of Mitrade

Mitrade has set the minimum deposit amount for opening a Mitrade Professional live trading account at $50 USD. This means that in order to start trading with Mitrade, users are required to deposit at least $50 USD into their trading account.

The purpose of setting a minimum deposit requirement is to ensure that traders have sufficient funds in their accounts to engage in meaningful trading activities. By setting a minimum deposit, Mitrade aims to attract traders of varying experience levels, including beginners who may have limited initial capital to invest.

Mitrade Account Types

Standard Account

Mitrade aims to provide an equal opportunity platform to all its traders, as reflected in its one-size-fits-all Standard Account. To open a Standard Account, a user needs to make a modest deposit of USD 50. Mitrade also offers an option to sign in using one's Facebook or Google account, making the registration process even more accessible.

Risk-Free Demo Account

Recognizing the importance of practical learning in trading, Mitrade provides users with an option to open a Risk-Free Demo Account. This account allows traders to practice trading strategies, understand market dynamics, and get comfortable with the platform without risking real money.

Live Trading Account

The live trading account at Mitrade comes with attractive trading conditions. There is no minimum deposit requirement, allowing traders of all sizes to participate. The spreads start at as low as 0.8 pips, offering cost-effective trading opportunities. Additionally, the platform allows leverage of up to 1:200, enabling traders to take larger positions and potentially increase their profits. However, it's essential to understand that while leverage can amplify profits, it can also magnify losses.

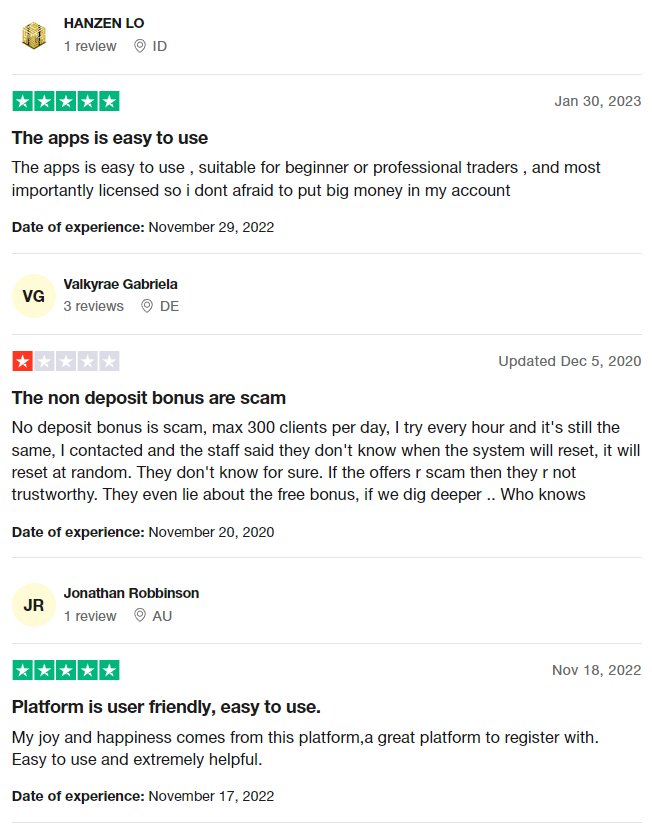

Mitrade Customer Reviews

The customer reviews for Mitrade highlight several aspects of their service. Firstly, the app is praised for being easy to use and suitable for both beginner and professional traders. Customers appreciate the user-friendly interface of the platform.

However, there are complaints regarding the no-deposit bonus. Some customers consider it to be a scam, as they were unable to receive the bonus despite the advertised offer. They mention that there is a limit of 300 clients per day for the bonus, and even after multiple attempts, they were unsuccessful. The staff members were unable to provide a clear explanation or timeframe for when the system would reset, causing doubts about the credibility of the company.

Despite this issue, other customers express their satisfaction with the platform, finding it easy to use and helpful. They enjoy using the platform and consider it a great platform to register with.

In summary, the customer reviews for Mitrade highlight the ease of use and suitability for traders of all levels. However, there are concerns about the no-deposit bonus being potentially misleading or unavailable, leading to doubts about the trustworthiness of the company. Nonetheless, many customers still find the platform user-friendly and beneficial for their trading needs.

Mitrade Fees, Spreads, and Commissions

When considering an online broker, one of the critical deciding factors is its fee structure. Mitrade presents a trader-friendly fee system, marked by low floating spreads and zero commission charges. For Forex trading, the average EUR/USD spread stands at a competitive 0.12 pips, showcasing Mitrade's commitment to affordability.

One of the key developments in Mitrade's operations has been its move towards a commission-free trading model. It means traders only have to focus on the spread costs, irrespective of the volume of their trades. This aspect, combined with the absence of deposit and withdrawal fees, reflects Mitrade's dedication to a client-centered approach.

Despite the limitation of offering only a single trading account, Mitrade has managed to craft an attractive package with its competitive trading fees and no hidden charges. However, traders should be aware of certain auxiliary charges. Positions that remain open for more than a day are subject to overnight fees. Also, accounts that have been inactive for 180 days are charged an inactivity fee of $10.

>> Also Read: 8 Ways To Read Forex Charts: In Depth Guide For Beginners

Deposit and Withdrawal

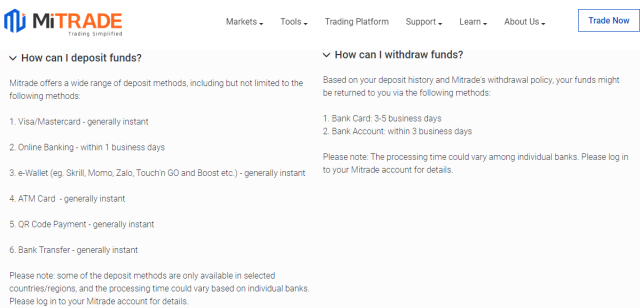

Navigating deposit and withdrawal methods should be straightforward for traders. Mitrade offers various funding methods for deposits and withdrawals. These include Skrill, Moneybookers, Poli, Visa, Mastercard, and Wire Transfer. Such a diversity of options caters to different payment preferences among traders, providing flexibility.

A unique aspect of Mitrade's financial policies is that there are no minimum deposit requirements. It removes an entry barrier for traders, especially beginners or those with limited capital. However, when it comes to withdrawals, a minimum amount of 100 USD applies.

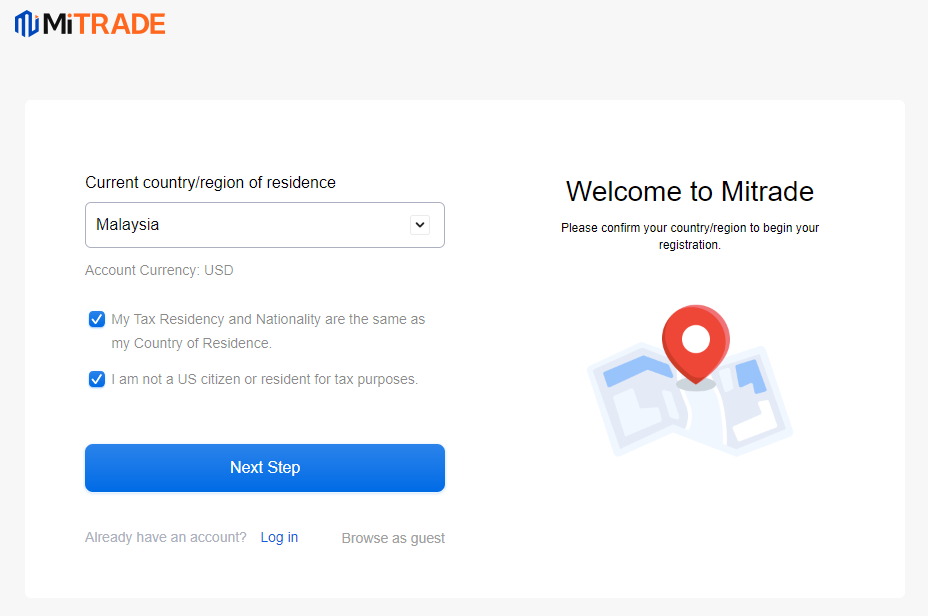

How to Open a Mitrade Account

Go to Mitrade Website

Opening a Mitrade account is an uncomplicated process that caters to both novice and experienced traders. The first step is to navigate to the Mitrade website and select the “Open Live Account” option.

Fill Out Their Registration Form

The next step involves completing the registration process. This step requires you to provide personal information, such as your name, email address, phone number, and other necessary details. After providing all the required information, you need to click on “Sign Up.”

Verify Your Account

The final step is account verification. Mitrade will send a verification email to the provided email address. You need to verify your account by clicking on the link sent in the email. After your account is verified, you can log in, deposit funds, and start trading. It's important to remember that, as with any broker, you should familiarize yourself with Mitrade's trading terms and conditions before commencing trading.

Mitrade Affiliate Program

The Mitrade affiliate program is designed to foster long-term collaboration between the broker and its affiliates, promoting the company's award-winning CFD trading platform. The program offers two attractive schemes: cost-per-acquisition (CPA) and a revenue share program. These schemes allow affiliate partners to earn continuous income for every new user they invite to join the platform. To join the Mitrade affiliate program, register at www.mitradeaffiliates.com.

Mitrade Customer Support

While Mitrade does not offer a contact number on its website, there are multiple ways to get in touch with them. Customer support can be reached via LinkedIn, an inquiry form, or by email.

Advantages and Disadvantages of Mitrade Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

Mitrade vs Other Brokers

#1. Mitrade vs AvaTrade

Mitrade and AvaTrade are both renowned brokers with unique features to offer. AvaTrade, headquartered in Ireland, is regulated by five regulatory authorities, including ASIC, providing an extra layer of security for traders. AvaTrade offers a broad array of financial instruments, including Forex pairs, commodities, indices, equities, and cryptocurrencies.

On the other hand, Mitrade, based in Australia and regulated by ASIC, CIMA, and FSC, provides a simpler, more streamlined trading experience with a one-size-fits-all account type. Mitrade's standout feature is its commission-free model and its user-friendly platform designed for both beginner and advanced traders.

Although both brokers have their strengths, the choice depends on individual trader needs. If you prioritize a wider range of trading instruments and multiple regulatory protections, AvaTrade might be the better choice. However, if simplicity, affordability, and user experience are your main concerns, Mitrade might be more suitable.

#2. Mitrade vs RoboForex

RoboForex, founded in 2009 and regulated by IFSC Belize, offers a variety of trading instruments and multiple account types with diverse features, catering to different trading styles. They also provide a range of trading platforms, including MetaTrader 4, MetaTrader 5, and their proprietary R Trader.

Contrarily, Mitrade simplifies the trading process with a single account type, reducing the learning curve for new traders. Mitrade offers a lower minimum deposit requirement, which, combined with the commission-free trading model, could be more attractive to small-scale and beginner traders.

Deciding between these two brokers depends on your trading needs and preferences. If you are looking for diverse account types and a variety of platform options, RoboForex could be a better fit. If you prefer simplicity, lower costs, and a user-friendly platform, Mitrade would be the preferable choice.

#3. Mitrade vs FXChoice

FXChoice, founded in 2010 and regulated by IFSC Belize, offers an impressive selection of trading platforms including MetaTrader 4 and MetaTrader 5. They also offer two types of accounts: Classic and Pro. FXChoice offers competitive spreads, and depending on the account type, they either charge a commission or incorporate the cost into the spread.

On the other hand, Mitrade‘s main draw is its simplicity with a single standard account, an intuitive proprietary trading platform, and commission-free trading. Mitrade also has a more diverse regulatory oversight compared to FXChoice, which adds an extra layer of security.

If you are seeking versatility in trading platforms and account types, FXChoice might be the right broker for you. However, if you prefer a simpler, more streamlined, and cost-effective trading experience, Mitrade could be a better option.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Mitrade Review

In conclusion, Mitrade offers a commendable trading platform with a diverse range of financial products, streamlined trading interfaces, and competitive fee structures. The company's transparent approach towards licensing and regulation, coupled with stringent safety measures, contributes to its credibility.

Although the absence of multiple account types may seem a limitation, Mitrade's Standard Account is designed to cater to a broad spectrum of traders, from beginners to experienced ones.

Mitrade is a worthy choice for traders looking for a comprehensive, easy-to-use, and regulated trading platform. As with any financial decision, prospective clients should consider their individual trading needs, risk tolerance, and investment objectives before choosing a broker.

Mitrade Review FAQs

What makes Mitrade different from other online brokers?

Mitrade distinguishes itself with a simplified trading structure. It offers a single account type, removing the confusion of multiple account options, and boasts a user-friendly proprietary platform designed to cater to both beginners and advanced traders. Furthermore, Mitrade operates on a commission-free model and does not impose any deposit or withdrawal fees, making it a cost-effective choice for traders.

Is it safe to trade with Mitrade?

Yes, Mitrade is regulated by three well-respected authorities – the Australian Securities and Investments Commission (ASIC), the Cayman Islands Monetary Authority (CIMA), and the Mauritius Financial Services Commission (FSC). This means the broker is held to high standards of practice and client fund safety. Mitrade keeps client funds in segregated accounts, separate from the company's operational funds, providing an additional layer of security.

What kind of support can I expect from Mitrade?

Mitrade offers dedicated customer support through various channels. While they do not provide a direct contact number on their website, traders can reach out to them via LinkedIn, an online inquiry form, or by emailing [email protected]. Mitrade aims to provide prompt, comprehensive assistance to its traders, addressing their queries and resolving any potential issues promptly.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.