Everything You Need To Know About Mean Reversion

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

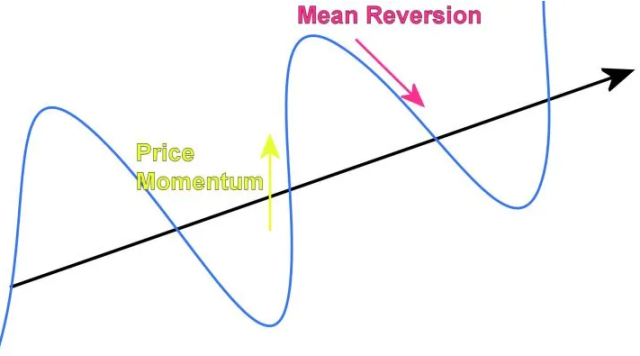

If you are a beginner in quantitative trading, you have probably heard the term “mean reversion” thrown around a lot. But what exactly does reversion mean? In its simplest form, mean is the idea that prices tend to return to the average price over time. Well, it is a natural law that everything that goes up must come down – and vice versa. So sooner or later, prices will revert to the mean.

Many stock market, commodity, or crypto traders know this concept. For example, mean reversion is the typical pattern in Forex and several other trading systems. And they use it to their advantage by buying assets when undervalued and selling them when they are overvalued. The reversion trading approach is based on the movements of stock prices; it bets on a rapid price reversal for specific asset prices.

When buying stock for long-term investments, investors typically use this approach. Mean reversion can be used with other technical indicators to create a short-term strategy based on mean reversion. Also, traders trading using mean reversion know how to get the maximum profits. To better understand the mean concept, we have got Ezekiel Chew to share his expert insights on the topic.

Ezekiel Chew is the founder and CEO of Asia Forex Mentor and a professional Forex trainer widely considered one of the most influential figures in the industry. Let's get into the interview and learn more about mean reversion trading from Ezekiel himself.

What is Mean Reversion

Mean reversion theory implies that prices and returns eventually move back towards the mean or average. It can be based on the industry, economy, or average return within the set. The theory is based on the belief that investors overreact to news, resulting in sharp price movements that are not sustainable in the long run. Therefore, over time, prices and returns should revert to their mean.

The dollar's value path is a function of its past performance. The length and degree to which the dollar deviates from its mean determine the probability that price movements will be closer to the standard in the future. In other words, an extreme occurrence that would boost or decrease stock momentum would likely be followed by a less severe event that would cause a minor deviation from the mean.

The concept of mean reversion is widely used by investors and traders alike to help make investment decisions. For instance, investors may believe it is undervalued and due for a rebound when a stock's price has fallen significantly below its long-term average. On the other hand, if a stock's price has risen considerably above its long-term average, investors may believe it is overvalued and due for a correction.

Formula of Mean Reversion in the Financial Markets

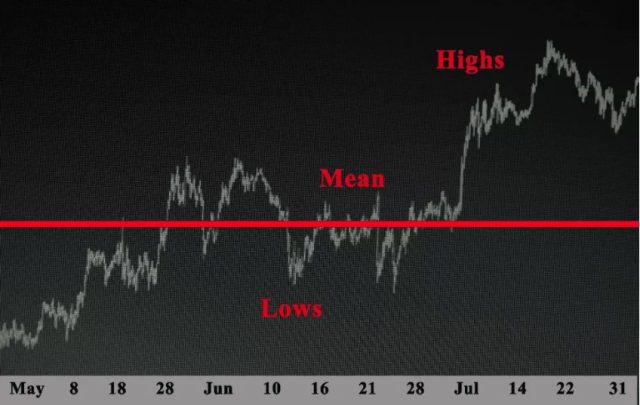

The formula for mean reversion in the financial markets is quite simple and created by calculating the average price. The mean is the price over a given number of data points, divided by the number of data points. In other words, if you want to calculate the mean reversion for the past ten days, you would add up the prices for each of those ten days and then divide by 10.

For example, if a basketball team scores 80 points in a season and two or three matches score 100, it will most likely revert to its normal performance in the next games. Therefore, extreme events are sought for using this method, and the further the current price is from the mean, the more likely it is to revert.

On the other hand, financial markets have a significant problem: they are not equally distributed. Long tails and extraordinary occurrences may be aggregated together. The stock can drop by 5% on a day and might even fall more on the following day. Mean is an essential concept that traders use to find the advantage and develop trading strategies.

The SMA is a simple moving average representing the trading chart's mean. Prices tend to fluctuate near the SMA. When traders want to know when a price will return to the mean, they employ various criteria such as that away from the SMA. In addition, technical indicators use proprietary formulas that signal traders when the price is reverting. However, as a trader, you can encounter false signals that make it hard to get precise indications of price reversal.

Relationship vs Directional Mean Reversion

Mean reversion is used to explain the relationship between two variables, such as the price of a stock and its earnings. It is also used to predict the direction of costs, such as when a stock's price has fallen below its moving average and is due for a rebound.

Directional mean reversion predicts the direction of price movements in a specific security. For example, if Microsoft stock falls outside the regression, we may anticipate net returns in those cases to be more favorable. There are different ways to create a mean reversion system, like buying when a stock is at its lowest and selling when it is at its peak.

However, many pro traders don't trade directionally. Instead, they prefer relationships between securities as both shares are the same in value. Traders buy the lower-valued share and sell the higher-priced one to reduce the delta.

Correlation vs Cointegration

Well, many people may think that correlation and cointegration are the same. However, that's not the case.

Correlation is the statistical analysis that shows the relationship between two securities when the two price series move in the same or opposite direction. When two prices move in the same direction, it's considered a bullish or bearish relationship. A negative correlation exists when one price rises or falls, and the other goes in the reverse order.

On the other hand, when a pair of stocks are cointegrated, it indicates that the series is linearly linked and thus stationary. If a linear combination of two asset prices is stationary, both stocks are cointegrated.

News Influence Mean Reversion

News can impact the prices and cause them to revert. Good news, such as a new product launch by Apple, can drive up the stock price. However, if there is bad news about a company, the prices may fall sharply and cause investors to lose money.

Some traders take advantage of the mean reversion trading by shorting the stock when there is terrible news and repurchasing it when the price falls. This is called contrarian trading. Conversely, when there is positive news, it can significantly impact the costs and cause them to move away from the mean. This is known as momentum trading.

It's important to remember that the market may go against your investment strategy, especially if you're trading on a short-term basis. A stock can revert to its mean in rare circumstances. The news may influence how markets react to assets.

Intraday Mean Reversion Trading Strategy

Intraday trading strategies are based on buying and selling multiple items daily. The open positions were not retained overnight. Traders opted to trade around a moving average because they believed it would provide them with an edge. The price may go above the average level in an uptrend and back down again. And, when they are returned to the mean, trades get purchasing options.

The opposite happens in a downtrend, where the price moves below the moving average and returns to it. The short positions are opened when the price comes to the average.

Case Against Mean Reversion

Some investors think that it is impossible to surpass the market because all information is accessible to investors. If insiders are trading, though, they have a competitive advantage since they have information that isn't available to the public.

A positive momentum exists when a stock rises by 15%. The stock may rise before anticipated. Unreleased information might be the cause when you notice significant price changes, exercise caution.

Traders believe that until the announcement was made, there were no optionable price movements unless there was an actual reason. As a result, mean reversion trading indicators are ineffective against the market.

How to select Stock Pairs

There are tons of opportunities in stock trading. When you begin trading, you must categorize stocks by sector, volume, and market capitalization. This will help you find stocks that have a higher probability of moving in tandem.

The match allows you to limit the matches to a more controllable group. You can discover links between securities and select cointegrated pairs when you create small groups.

How to select Forex Pairs

The forex pair concept is the same as stocks like you participate in the foreign exchange trading market. You will be looking to pair two foreign currencies against each other. The pricing is done in real-time and is located in countries with comparable economic growth fundamentals. Selecting economic zones is the best method to go.

Pair trading in forex can be a great way to take advantage of mean reversion. The liquidity in currencies is greater and lowers the overall cost of transactions.

Mean Reversion in Pairs Trading

One of the best options for reversion traders is pairs trading, as it's a market-neutral strategy. By being hedged, you're not exposed to the directional risk of the market.

Finding two comparable assets might be a risky move. When two markets are closely linked, and the resemblance vanishes, you may take a position on the price's return. Pairs trading involves looking for pairs of similar assets. These assets' prices attract each other and create an opportunity to execute a mean reversion trade if prices deviate.

These pairs will follow suit if EUR/GBP and EUR/USD move in the same direction. However, while the EUR/USD is declining, the EUR/GBP is rising. Therefore, if history indicates, these pairs will move in the same direction.

As a trader, you should short the better pair and buy the failing pair to gain more profit. However, keep in mind that trading pairs demand selling and purchasing at the same time as traders don't know how long it would take for the mean to be reverted.

Traders are placing their bets on the two prices crossing and reconnecting in the future. Because the assets may not move in tandem, putting a stop-loss in place is a good idea. In addition, traders can protect themselves against potential losses by limiting profit if the price trend fails to continue.

Using different pairings implies that you may not combine two assets and make a profit. Because you buy one asset and sell another in a pairs trade, the hedge ratio may be used. This is estimated by comparing the relative change in one asset to the other. When an asset rises 2% each day while another falls 3%,

The 3% asset is split into two equal pieces. The percentage in the middle (i.e., 50 percent) is half of the 2% asset. Compared to an asset that is moving less, you don't need as much of this position to generate a profit because it moves more frequently.

Mean Reversion Indicators

Many traders are familiar with mean reversion indicators. However, they don't know about sentiment and fundamental indicators. Using a mean trading strategy with technical indicators can be difficult. It's best to use a contrarian indicator or an oscillator that will allow you to understand when the market is oversold or overbought.

The most popular way to detect means is through a fundamental indicator Bollinger Bands. This technical indicator uses a moving average and volatility to create upper and lower limits. If the price action of security violates one of these limits, it is said to have undergone a mean reversion. The other technical indicators include the Relative Strength Index, Williams Percent R, and Stochastics which provide overbought and oversold signals.

Sentiment indicators come in many shapes and forms, but their function is generally the same. Mean reversion traders check for extreme readings in a sentiment index to determine the market's dominant mood. The sentiments are either bullish or bearish. This is because if a bullish mentality rules, no one is propelling prices up, leading to a price drop. Conversely, if everyone is pessimistic, the value will be immune from falling pressure and will therefore rise.

Best Forex Training Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Mean Reversion

Mean reversion is betting that the lousy market situation will improve. That's why traders buy the stock at a discounted price and wait for the market to rebound. So when the market starts to improve, they can sell their assets at a higher price and make a profit.

This strategy is not without its risks. The main risk is that the market may not rebound, and the trader will be stuck in a losing position. However, mean reversion strategies can be very profitable if used correctly. By using sentiment and fundamental indicators, traders can better understand when the market is due for a rebound.

Mean Reversion FAQs

What is Mean Reversion Strategy?

A mean reversion strategy is an investment or trading strategy based on the belief that prices and returns eventually move back towards the mean or average. The goal of a mean strategy is to take advantage of market conditions when prices have moved away from their average, hoping they will soon return.

Does Mean Reversion work?

There is no guaranteed way to make money in the financial markets, and mean reversion is no exception. However, many investors believe that mean reversion is a natural phenomenon and that prices tend to return to the average over time. A mean reversion may not work in all markets. However, you can get the best results in stocks, but still, it is not guaranteed. Prices are expected to move away from the mean longer than usual in the case of a structural change.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.