5 Best Brokers With Managed Forex Accounts in 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Investing in foreign currency sounds like a complicated and risky endeavor, but managed accounts are quite simple and can be a great way to invest your money. A managed forex account is an account where a professional trader manages your money for you and trades foreign currency on your behalf.

Beginners mostly use managed accounts, allowing them to trade without going through the learning curve. It is also a good option for those who don’t have the time to trade. However, before you sign up for a managed forex account, you need to learn what managed forex accounts are in detail.

To understand the concept of managed accounts, we have got Ezekiel Chew, the CEO, and founder of Asia Forex Mentor. He is one of the most credible forex educators in the industry with years of experience to share his take on managed accounts with us.

In this guide, we will discuss managed forex accounts, how it works, the top 5 best brokers with managed accounts in 2024, and more. So, without any further ado, let's get started.

What is Managed Forex Account

A managed forex account is an account where the trader cedes full trading authority to a professional money manager. The manager handles all aspects of the trading process, including making decisions on which trades to take, setting stop-loss and take-profit orders, and managing risk.

People with regular forex accounts make their own trading decisions and handle all the buy/sell processes themselves. However, if you open a managed forex account, somebody else will do all that work for you while you sit back and relax.

However, remember that with this type of account, you will be charged higher fees and costs than a standard forex trading account. In some cases, there is also a high minimum deposit. Your money manager will only trade for you. It means you will control your forex account while your manager will trade for you.

Managed accounts can be a good option for investors; however, choosing a reputable and experienced manager and broker account is important. Moreover, keep an eye on the fees charged as they can eat into your profits.

How does Managed Forex Account work

Your money manager will be in charge of your trading accounts. When you open your account, your manager traders your capital on your behalf. They will also help you buy and sell currencies involved in foreign exchange.

The good thing about managed forex trading accounts is that your manager can trade on your behalf even if you don’t know about forex trading. All you need to do is deposit your money in the account, and they will trade for you. The manager will take a percentage of the profits as their management fee, and the rest of the profit is yours to keep.

Accepting a managed forex account to obtain big money quickly is not the best idea because of the volatile nature of the forex market. In addition, most forex-managed accounts should have a warning that losses are inherent in the game because retail investor accounts lose money from time to time.

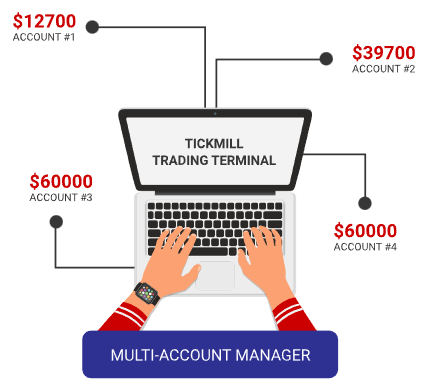

Fund managers have a long list of accounts to manage simultaneously, so they use specific systems to see all the accounts simultaneously. For example, they can access their investors' accounts from their dashboard. Using the dashboard, they can simultaneously fix the rate and buy or sell currencies on all accounts. Moreover, the profits and losses are also managed via this dashboard.

With time, you may suggest various trading ideas and trading signals you wish to see considered in your fund's account. Managed accounts help you avoid dealing with feelings of loss and gain. However, forex account brokers can vary according to their trade capabilities, so choose your broker immediately.

Important things to consider when getting Forex Managed Accounts

Account names and passwords mimic or copy other traders' accounts. But, that's not the case with the broker, as they display different accounts for investors from which they can choose. Investors these days choose bank accounts based on the ones that match their needs and specifications.

To choose the best managed forex account, there are certain things that you should keep in your mind. Below are a few of the short factors you should know:

Fees

One of the most important factors to consider while choosing managed accounts is the performance fee. Well, this fee can vary depending on the broker and the manager. So check the fee structure before investing in any forex managed account.

Credentials

When managing forex accounts, checking the manager's credentials is important. You can do this by checking their experience in the field and also by reading reviews about them.

Fund Performance

Another important factor you need to consider is your money manager trades performance and track record. You can check this by looking at the fund's return on investment (ROI).

Trading Activity

You'll need to get used to your manager's trading style and pattern. The number of times they trade daily is also crucial, so you can anticipate what to expect. The status of your forex account manager is also significant because it reveals whether they're intraday or scalper traders. It might even tell you if they trade less frequently than planned.

Maximum Drawdown

Things are not always smooth sailing in the forex market. There will be times when your account experiences a drawdown. When choosing a forex managed account, make sure that you check the maximum drawdown. You can do this by looking at the account's history to see how much loss it has incurred during its worst times.

Minimum Deposit & Volatility

Last but not least, you need to check the minimum deposit required by the manager. You should also find out about the account's drawdown and volatility.

Types of Forex Managed Accounts

The four major types of managed forex managed accounts are as follows:

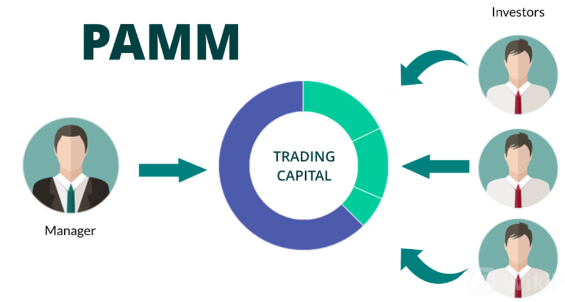

#1. Percent Allocation Management Module – PAMM Accounts

In a PAMM account, the fund manager manages all the money in one pool. All the investors' money is mixed together. The manager then trades with this money and makes a profit or loss. The profits and losses are then distributed among the investors based on their investment amount.

The main advantage of PAMM accounts is that starting one is very easy. You don't need a lot of money to get started. Moreover, you can withdraw your money at any time.

#2. Multi-Account Manager – MAM Accounts

MAM accounts are very similar to PAMM accounts. The only difference is that the fund manager can trade with multiple accounts in MAM accounts.

The main advantage of MAM accounts is that the fund manager can trade with more money and make more profits. However, the downside is that MAM accounts are riskier than PAMM accounts.

#3. Lot Allocation Management Module – LAMM Accounts

The account manager in charge of accounts under this module has the authority to utilize a wide range of leverage on all sub-accounts. This is, however, contingent on the demands of the clients and management.

This account type gives investors the flexibility to help them control and manage risks using LAMM accounts.

#4. Risk Asset Management Model -RAMM Accounts

RAMM seeks to mitigate risk from both the account manager and investor sides by implementing robust features similar to PAMM.

With a RAMM account, users can trade without the fund manager and decide how much of their balance they want to allocate for management.

Best Forex Brokers with Managed Accounts in Forex Market

Here are the top 5 forex brokers with managed accounts in the forex market:

#1. Avatrade

The MAM account from AvaTrade is perfect for money managers that want to trade on behalf of their clients. The MT4 MAM terminal provides functionality and excellent customer service, making it easy for the manager to handle block trades for client sub-accounts.

Account managers may employ EAs (Expert Advisors) to trade, establish sub-groups for various trading approaches, and pick from various commission plans. As a result, there is a lot of liquidity, dependable execution, and competitive spreads.

AvaTrade offers several account types: LAM, balance, PAMM, a trustworthy manager, and low regulatory restrictions.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

#2. Fidelity

Fidelity has been a top-tier forex broker in the business for years. In addition, the company provides its clients with an impressive array of products and services, including managed accounts.

Fidelity Investments provides various services, including wealth management, retirement planning, fund distribution and investment advice, and more.

Fidelity's managed forex account is a great way for investors to get exposure to the foreign exchange market. The account provides the manager with a great deal of flexibility and control, as well as access to competitive pricing and reliable trade execution.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Fidelity website |

#3. Interactive Brokers

Interactive Brokers is one of the world's largest and most respected online brokers. The company is a member of numerous exchanges, including the CME, ICE, and Nasdaq.

Interactive Brokers offers various products and services, including managed forex accounts. The company has a long history of providing excellent customer service and innovative technology.

Interactive Brokers is ideal for traders looking for a reliable and well-established online broker. The company is a great choice for beginner and experienced traders alike.

| Broker | Best For | More Details |

|---|---|---|

| securely through Interactive Brokers website |

#4. EToro

eToro is one of the most popular and offers one of the best FX-managed accounts. eToro is a fantastic trading platform with a large user base, and Copy Trader is one of eToro's most useful features.

A trader's eToro portfolio can be copied by other traders, and there is no charge to the investor for this service. With over 2 million people trading each day on eToro, investors have a large number of traders they can copy.

eToro is an excellent platform, providing users with detailed statistics and information on the traders’ track histories. eToro is regulated by CySEC (Cyprus) and Europe's FCA (Financial Conduct Authority).

#5. FXTM

FXTM is an international online broker offering trading CFDs, precious metals, and cryptocurrency financial services. They are regulated by CySEC in Europe and offer a user-friendly platform with tight spreads, fast execution, and a wide range of trading instruments.

FXTM is a legitimate broker since several international authorities have authorized and regulated each business and brand it deals with. CySEC of FSCA of South Africa, Cyprus, and an offshore authority in Mauritius named FSC.

Forex time is considered safe as FCA, a world-renowned regulator, regulates it. Additionally, the broker keeps the clients' funds in segregated accounts with top-tier banks.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through FXTM website |

Best Forex Trading Course

Ezekiel Chew is a professional forex trader and trainer. He is the founder of Asia Forex Mentor, one of the largest forex education companies in the world. He has 2 decades of experience in the forex market and is respected for his knowledge and expertise.

Ezekiel's core program, ‘AFM PROPRIETARY ONE CORE PROGRAM,' is the Complete Program, which covers everything from beginner to advanced. The program is designed to give you the best possible chance of success in the forex industry. It is backed by mathematical probability and has been used by banks and trading institutions for years.

Ezekiel is a highly credible figure in the forex industry. So, if you are trying to make money in forex trading, you should check out his program to start your forex career.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Managed Forex Accounts

A managed forex account is a great way for investors to get exposure to the foreign exchange market without having to trade themselves. However, remember that you could be charged up to 40% (or more) of your winnings and have a larger minimum deposit amount. In addition, depending on the account’s circumstances, brokerage and other manager fees could also apply.

Suppose you don't have enough money to trade in a managed account or would rather trade your own money. In that case, you could do better trading in a conventional forex trading account — especially if you already have a good trading plan. In addition, trading with a conventional forex account offers more flexibility and privacy and allows you to keep more profits.

Investing in a managed forex account is a big decision and one that should not be made lightly. Do your research and due diligence before choosing an account manager, and make sure that you understand the risks involved.

Managed Forex Accounts FAQs

How do I protect my forex account?

You need to pay close attention to the regulations outlined by the broker. Don't ever register with a broker who doesn't hold a license from a renowned regulatory body. Moreover, keep your password strong, use a firewall, and avoid all public networks when logging in to your account.

What is a managed forex account?

An experienced fund manager can trade on behalf of a client through a managed forex account. This is a good option for investors who want exposure to foreign currency without being experts in the field.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.