JFD Brokers Review 2024 with Rankings By Dumb Little Man

By Wilbert S

March 17, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 124th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and private investors, employs a specialized algorithm for thorough evaluations of brokerage services. Their analysis focuses on key areas such as:

|

JFD Brokers Review

In the dynamic world of Forex trading, selecting the right broker is crucial for achieving financial success. Forex brokers act as intermediaries between traders and the global currency markets, providing a platform for buying and selling foreign currencies. JFD Brokers stands out in this competitive landscape, offering comprehensive brokerage services to both novice and experienced traders.

Our review of JFD Brokers aims to deliver a thorough evaluation of what the broker has to offer. We will delve into the specifics of account options, the efficiency of the deposit and withdrawal processes, commission structures, and other vital features. Combining expert analysis with feedback from actual traders, this review is designed to provide essential insights. Our goal is to empower you with comprehensive information, helping you decide whether JFD Brokers is the ideal choice for your brokerage needs.

What is JFD Brokers?

JFD Brokers represents a significant player in the online trading landscape, operating under the umbrella of JFD Group Ltd. This broker is recognized for its adherence to stringent regulations, overseen by reputable entities like the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). Such regulatory oversight assures traders of a secure and transparent trading environment, enhancing the broker’s credibility in the financial markets.

Offering a diverse range of financial instruments, JFD Brokers caters to the varied needs of traders. With over 1,500 trading instruments available, including currency pairs, stocks, precious metals, ETFs (Exchange-Traded Funds), and CFDs (Contracts for Difference), the broker provides ample opportunities for portfolio diversification. Furthermore, it includes innovative financial derivatives like CFDs on cryptocurrencies, stocks, indices, commodities, ETFs, and ETNs (Exchange-Traded Notes), making it a comprehensive platform for traders looking to explore different markets.

Safety and Security of JFD Brokers

JFD Brokers emphasizes safety and security in its operations, a crucial aspect for traders in the volatile world of online trading. This broker is rigorously regulated by the three largest regulatory bodies in the industry: the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This information, gathered from thorough research by Dumb Little Man, reassures traders of the broker’s compliance with stringent regulatory standards.

The validity of all licenses held by JFD Brokers serves as a solid testament to its reliability and commitment to upholding transparent working conditions. Traders can rest assured that the broker not only meets the declared conditions but also ensures the timely payout of traders’ profits. Such a level of regulatory oversight and operational transparency places JFD Brokers among the most trusted names in the forex and CFD trading space, making it a preferred choice for traders prioritizing safety and security in their investment endeavors.

Pros and Cons of JFD Brokers

Pros

- Intuitive interface for all users

- Universal account conditions with competitive spreads

- Variety of trading platforms and mobile options

- Unrestricted trading strategies including bots and scalping

- No fee for stock purchases, over 600 assets available

- Segregated client funds, emergency compensation fund access

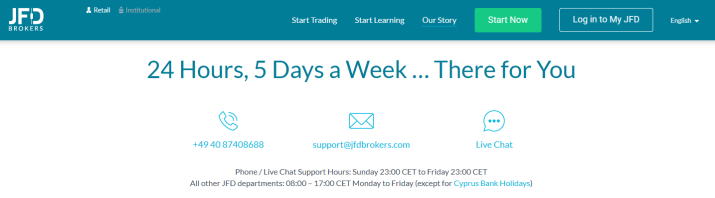

- 24/5 technical support via multiple channels

Cons

- Lack of fee transparency until active trading

- No passive investment solutions, such as copy trading

- Weekend support unavailable

Sign-Up Bonus of JFD Brokers

JFD Brokers currently does not offer a sign-up bonus for new clients. This policy aligns with the broker’s emphasis on transparency and straightforward trading conditions without the need for introductory incentives. Despite the absence of a sign-up bonus, JFD Brokers continues to attract traders through its competitive spreads, a wide range of trading instruments, and robust regulatory framework. Traders looking for value should consider these features and benefits when choosing JFD Brokers as their preferred trading platform.

Minimum Deposit of JFD Brokers

JFD Brokers sets a minimum deposit of $500, a figure that stands on the higher end when compared to many other brokers in the market. This deposit requirement reflects the broker’s target audience of serious traders who are committed to investing a significant amount upfront. Despite the relatively higher minimum deposit, JFD Brokers compensates by offering a wide array of trading instruments, advanced trading platforms, and a secure regulatory environment, making it a viable option for traders looking for a comprehensive and reliable trading experience.

JFD Brokers Account Types

Based on thorough research and testing by our team of experts at Dumb Little Man, JFD Brokers offers two main account types designed to cater to the diverse needs of traders. Here’s a concise overview:

Demo Account

- No minimum deposit required

- Utilizes real interbank market data

- Virtual funds for trading, no real profit earned

Standard Account

- Minimum deposit of $500, €500, £500, or ₣500

- Access to 4 types of markets, including CFDs

- Multiple withdrawal channels available

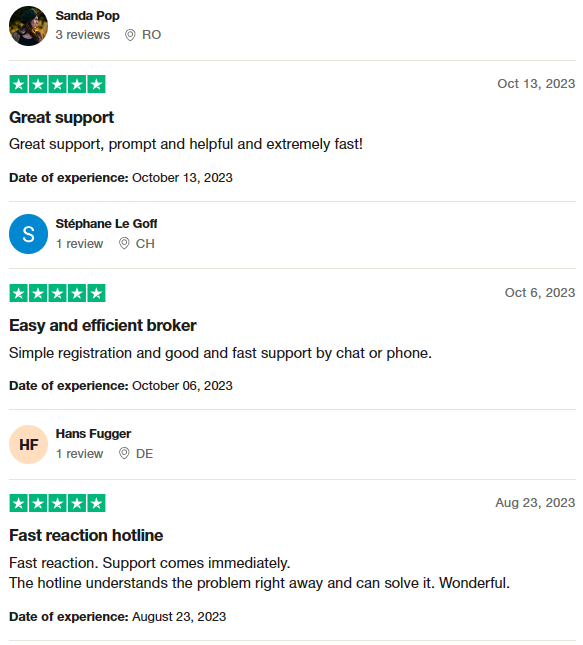

JFD Brokers Customer Reviews

JFD Brokers receives high praise from its clients, particularly for its excellent customer support. Reviews consistently highlight the speed and efficiency of the support team, whether through chat, phone, or the hotline. Customers appreciate the simple registration process and the fact that support is not only quick to respond but also effective in understanding and solving their problems immediately. This positive feedback underscores the broker’s commitment to providing prompt and helpful customer service, ensuring a satisfying and hassle-free trading experience for its users.

JFD Brokers Fees, Spreads, and Commissions

JFD Brokers operates on a fee structure common to the brokerage industry, where spreads and transaction fees are the primary charges traders encounter. These costs vary, often floating based on market conditions, yet JFD Brokers strives to keep them competitive, sometimes even below market average. This approach to pricing ensures traders can execute trades without the burden of excessive costs.

Withdrawal fees at JFD Brokers are variable, depending on several factors such as the asset being withdrawn and the chosen withdrawal channel. For instance, withdrawals in USD through JFD Group Ltd within the European Economic Area (EEA) are subject to a 0.15% fee, with a minimum of €2 and a maximum of €5. Outside the EU, a fixed fee of €17 is applied. Additionally, bank transfer fees are part of the cost structure, emphasizing the need for traders to consider these charges when planning their financial transactions with JFD Brokers.

Deposit and Withdrawal

JFD Brokers facilitates the earnings and accumulation of funds for traders using live accounts, offering real income potential from successful trading activities. According to a trading professional at Dumb Little Man who tested the process, all profits are securely stored within the traders’ user accounts, ensuring easy management and oversight of funds.

Traders have the flexibility to submit withdrawal requests at any time directly through their user accounts on the JFD Brokers website. Although these requests are often processed on the same working day, there are occasions when the process might extend beyond this timeframe. Once processed, the broker efficiently transfers the funds to the traders’ specified bank cards or e-wallets, demonstrating a commitment to timely and efficient financial transactions.

It’s important to note that withdrawal fees and minimum limits vary depending on the asset and the chosen withdrawal channel. These fees are transparently outlined in the “Withdrawal” section of the broker’s website, and traders are also informed of any applicable charges when they initiate their withdrawal requests. This clear and straightforward approach ensures traders are well-informed about any potential costs associated with accessing their earnings.

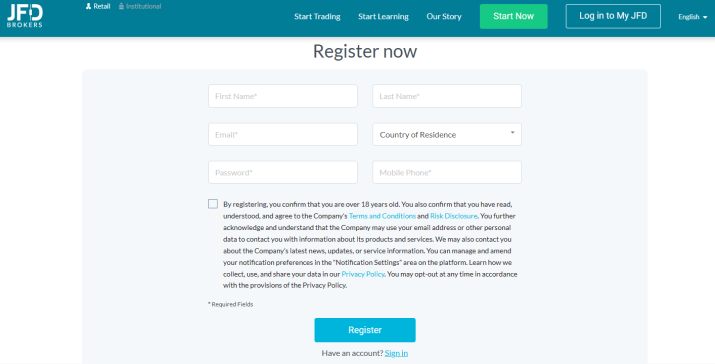

How to Open a JFD Brokers Account

- Visit JFD Brokers’ website and choose your language at the top right.

- Click “Start Now” to begin registration.

- Choose between personal, demo, or corporate account types and your trading platform.

- Fill in personal details, including name, nationality, birth date, contact information, residence, and tax details.

- Answer yes/no questions about trading and click “Next”.

- Provide employment and income information, select deposit methods, and proceed.

- Select account currency, financial instruments, and detail your trading experience.

- Read and agree to the terms of service, then proceed.

- Check your email for a confirmation link and follow it.

- Log in on the website with your credentials.

- Upload identity verification documents and enter banking details for transactions.

- After verification (1-3 days), access the “Trading Accounts” menu to start trading.

JFD Brokers Affiliate Program

The JFD Brokers Affiliate Program offers a lucrative opportunity for individuals to earn income by referring new clients to their platform. Through a variety of deals, affiliates can start earning with a minimum payout of $250 per account under the standard CPA (Cost Per Acquisition) deal. This program features a tiered structure, which means the more clients you refer, the higher your rewards, enhancing your earning potential with each successful referral.

Moreover, the program includes rebate deals that can reach up to $10 per lot, providing an additional avenue for affiliates to boost their income. This comprehensive affiliate program is designed to reward affiliates generously, making it an attractive option for those looking to profit from promoting a reputable broker like JFD Brokers.

JFD Brokers Customer Support

Based on the experience detailed by Dumb Little Man, JFD Brokers provides a comprehensive customer support system designed to assist clients through various channels. In the event of encountering any issues or needing guidance, clients are encouraged to reach out to JFD Brokers’ support via global and regional call centers, where contact numbers are readily available in the “Contact Us” section of their website. Additionally, support can be accessed through email and a live chat feature, both on the website and within the user account, ensuring a responsive and helpful service.

Furthermore, JFD Brokers maintains an active presence on multiple social media platforms, including Facebook, Instagram, Twitter, YouTube, and LinkedIn. Following these official profiles is highly recommended for clients who wish to stay updated on the latest analytics, essential announcements, and information about periods when technical support might be unavailable, such as holidays. This multifaceted approach to customer support underscores JFD Brokers’ commitment to providing timely and effective assistance to its clients, enhancing the overall trading experience.

Advantages and Disadvantages of JFD Brokers Customer Support

| Advantages | Disadvantages |

|---|---|

JFD Brokers vs Other Brokers

#1. JFD Brokers vs AvaTrade

JFD Brokers is known for its rigorous adherence to regulatory standards and its provision of a broad spectrum of trading instruments and platforms. It offers a transparent trading environment with competitive fees and spreads. AvaTrade, on the other hand, stands out with its extensive global reach and diverse client base, offering a wide variety of financial instruments across multiple jurisdictions. It is well-regulated and provides robust educational resources and trading platforms.

Verdict: For traders valuing a wide international presence and a plethora of trading instruments, AvaTrade may be the better choice. However, for those prioritizing a highly regulated trading environment with competitive conditions and transparency, JFD Brokers emerges as the superior option.

#2. JFD Brokers vs RoboForex

JFD Brokers offers a straightforward, transparent trading experience with a focus on security and regulatory compliance. Its trading conditions are suitable for traders looking for competitive fees and a wide range of trading platforms. RoboForex differentiates itself with a vast array of trading options, cutting-edge technology, and customized trading conditions suitable for various trading styles and volumes. It also provides numerous platforms and a unique contest project for demo accounts.

Verdict: RoboForex could be more appealing to traders seeking technological innovation and customization in trading conditions. However, for individuals who prioritize a transparent fee structure and a robust regulatory framework, JFD Brokers stands out as the preferable choice.

#3. JFD Brokers vs FXChoice

JFD Brokers is characterized by its strict regulatory compliance and transparent trading conditions, catering to traders who favor a wide variety of platforms and instruments. FXChoice, with its focus on providing quality brokerage services, targets experienced traders through its ECN accounts and services tailored for automated trading. It is well-regarded for its commitment to customer focus and business integrity.

Verdict: For traders looking for a broker that supports automated trading and offers specialized ECN accounts with tight spreads, FXChoice presents a compelling option. Conversely, JFD Brokers is more suitable for those who value transparency, a broad selection of trading instruments, and a strong regulatory stance.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a successful path in forex trading and aiming for significant financial rewards, Asia Forex Mentor is the premier selection for top-tier forex, stock, and crypto trading education. Ezekiel Chew stands out as the influential figure at the helm, known for his role in educating trading institutions and banks. Notably, Ezekiel’s ability to consistently secure seven-figure trades distinguishes him from other trainers in the sector. The key factors supporting our endorsement include:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational framework that spans across forex, stock, and crypto trading. This structured program is designed to arm budding traders with the essential expertise to thrive in varied financial markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its successful history of cultivating traders who consistently profit in different market areas. This success underscores the efficiency of their teaching approaches and mentorship.

Expert Mentor: At Asia Forex Mentor, learners gain insights from an adept mentor with a proven track record in forex, stock, and crypto trading. Ezekiel’s personalized support empowers students to confidently tackle the complexities of these markets.

Supportive Community: Enrollment in Asia Forex Mentor grants access to a community of fellow traders focused on achieving success in forex, stock, and crypto trading. This network promotes cooperation, the exchange of ideas, and mutual learning, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastering trading requires not only skill but also a disciplined mindset. Asia Forex Mentor emphasizes psychological training to aid traders in controlling their emotions, managing stress, and making informed decisions while trading.

Constant Updates and Resources: Keeping abreast of the ever-evolving financial markets is crucial. Asia Forex Mentor ensures students stay informed with the latest trends, techniques, and market analyses, providing ongoing access to valuable tools and information.

Success Stories: Asia Forex Mentor is celebrated for its numerous success narratives, where students have dramatically changed their trading careers and attained financial autonomy through its detailed forex, stock, and crypto trading education.

Asia Forex Mentor stands as the definitive choice for aspiring traders seeking an exceptional forex, stock, and crypto trading course to secure a lucrative career and financial success. With its exhaustive curriculum, seasoned mentors, practical approach, and supportive network, Asia Forex Mentor equips aspiring traders with the necessary resources and guidance to evolve into successful professionals in various financial domains.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: JFD Brokers Review

In conclusion, the team of trading experts at Dumb Little Man has conducted an extensive review of JFD Brokers, highlighting its significant strengths along with areas where traders should exercise caution. The broker stands out for its robust regulatory compliance, diverse trading instruments, and competitive spreads, positioning it as a reliable choice for both novice and experienced traders. The comprehensive customer support, including multilingual assistance and various communication channels, further enhances the trading experience, ensuring users receive the help they need when they need it.

However, potential clients should be aware of the higher minimum deposit requirement and limited passive investment options, which may not suit all trading preferences and strategies. Additionally, the absence of weekend customer support could be a drawback for some traders.

>> Also Read: Valutrades Review 2024 with Rankings By Dumb Little Man

JFD Brokers Review FAQs

What regulatory bodies oversee JFD Brokers?

JFD Brokers is rigorously regulated by several respected authorities, including the Cyprus Securities and Exchange Commission (CySEC), the National Securities Market Commission (CNMV), and the Vanuatu Financial Services Commission (VFSC). This multi-jurisdictional oversight ensures a high level of security and transparency for traders’ investments.

Can I try JFD Brokers before I commit to a live account?

Yes, JFD Brokers offers a demo account that allows traders to practice trading with virtual funds. This account uses real data from the interbank market, providing an authentic trading experience without the risk of losing real money. It’s an excellent way for new traders to get acquainted with the platform and for experienced traders to test their strategies.

How does JFD Brokers handle deposits and withdrawals?

JFD Brokers facilitates deposits and withdrawals through a variety of channels, ensuring a smooth process for traders. Funds earned are accumulated in the user’s account and can be withdrawn at any time through the broker’s website. Although applications are often processed the same working day, it may sometimes take longer. The broker then transfers funds to the trader’s specified bank card or e-wallet. Note that different assets and channels have their own minimum limits and fees, detailed in the “Withdrawal” section of the website.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.