Valutrades Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

Valutrades Review

Valutrades, a prominent broker in the sphere of online trading, has garnered recognition globally for its expertise in Forex, Commodities, and Index CFDs trading. Having etched its footprint across six continents and over 120 nations, it continues to grow and diversify its suite of services.

Our comprehensive review offers an in-depth examination of Valutrades, illuminating both its distinctive strengths and potential limitations. From detailing its diverse account options to examining its deposit and withdrawal mechanics and commission structures, we aim to offer a complete picture of the broker’s operations.

This review melds expert scrutiny with the real-world experiences of traders to deliver a balanced perspective, arming potential clients with the knowledge needed to ascertain if Valutrades could be their go-to brokerage service provider.

What is Valutrades?

Rooted in the bustling financial hub of London, Valutrades is a Forex and CFD trading provider that caters to traders across the experience spectrum, from novices to seasoned professionals. It provides its clients with access to trade in excess of 80 major, minor, and exotic Forex currency pairs, as well as CFDs on Equity Index, Indices, and Commodities. Valutrades established a branch in Seychelles in 2019, which is regulated by the Financial Services Authority.

Valutrades leverages cutting-edge technology to enable ECN execution, offering competitive trading conditions that include free VPS and spreads starting from 0.0 pips. The assurance of negative balance protection adds an additional layer of security for Forex traders.

The firm also extends its offerings beyond individual retail clients, incorporating a diverse array of partnership programs tailored for affiliates. These programs include MAM for fund managers, which is designed with special attention to their unique needs and requirements.

>> Also Read: Forex Trading Strategies – A Trader Beginners Guide

Safety and Security of Valutrades

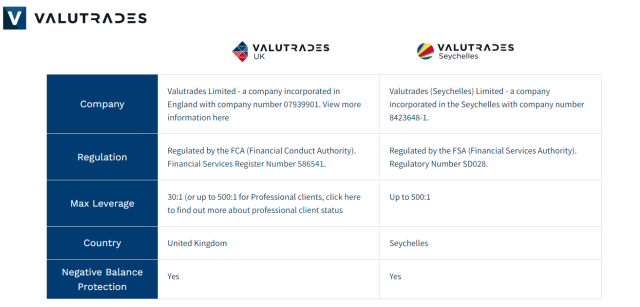

As a licensed financial services provider, Valutrades falls under the regulation of the UK’s Financial Conduct Authority (FCA) and Seychelles' Financial Services Authority (FSA), guaranteeing rigorous oversight and high standards of operation. Such a license reflects the broker's significant capitalization, a trait that sets it apart from many competitors.

Valutrades takes its clients' safety seriously, segregating their funds from the company’s operational accounts. This ensures client funds are not engaged in the firm's business transactions.

Additionally, all deposits receive protection up to a maximum of £85,000 under the Financial Services Compensation Scheme. Valutrades further ensures its clients' financial security through guaranteed negative balance protection, a provision that prevents traders from losing more than their account balance.

Sign-Up Bonus of Valutrades

During the period of this review, it is important to note that Valutrades has not instituted a sign-up bonus for its new clients. This indicates that the broker focuses more on delivering quality service and trading conditions rather than encouraging sign-ups through financial incentives. While some traders may find this disappointing, others may appreciate the transparency and lack of initial deposit-based restrictions.

Minimum Deposit of Valutrades

A key aspect of Valutrades‘ client-friendly approach is the absence of a minimum deposit requirement to initiate a live trading account. This feature underlines Valutrades' commitment to making the dynamic world of forex trading accessible to a broad spectrum of traders. From beginners to experienced traders, anyone can explore and leverage the potential of Valutrades' ECN Trading Account without the constraint of a minimum initial financial commitment.

Valutrades Account Types

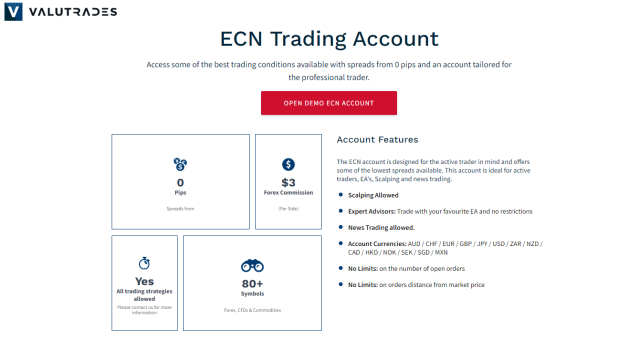

Valutrades primarily offers an ECN trading account, designed to deliver incredibly competitive spreads and commissions. This platform is particularly attractive to both novice traders testing the waters and experienced individuals wishing to assess Valutrades' platform without financial risks, courtesy of a free Demo ECN Account.

The ECN Account is a flexible offering, tailored to the needs of active traders. It offers some of the tightest spreads in the market, making it an ideal choice for advisors, those engaging in scalping, and news traders. Valutrades sets no restrictions on the number of orders or the distance of the order price from the market price, providing traders with complete flexibility. Active traders executing large volumes are offered free VPS, ensuring minimal trading latency. The maximum leverage for retail clients is 1:30, while professional traders are provided significant leverage of up to 1:500.

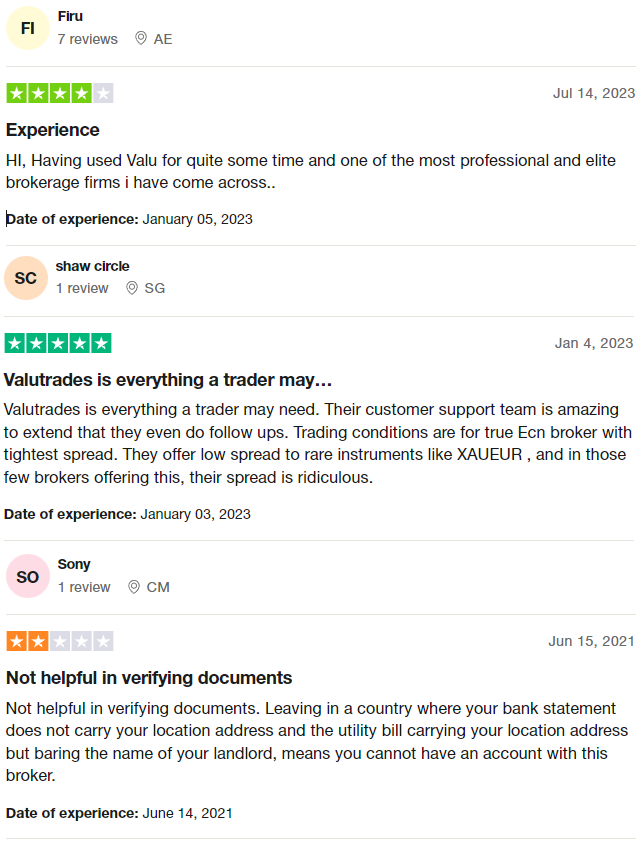

Valutrades Customer Reviews

Customers generally express satisfaction with Valutrades, frequently highlighting its professionalism, low spreads, and excellent customer support. They appreciate that the firm provides trading conditions befitting a true ECN broker, with tight spreads even for less commonly traded instruments like XAUEUR.

However, some customers have encountered difficulties with Valutrades' document verification process. For individuals residing in countries where utility bills and bank statements don't bear their names or addresses, establishing an account with Valutrades has proven challenging. This issue, however, seems to be more of an exception than a norm.

Valutrades Fees, Spreads, and Commissions

At Valutrades, fees are integrated into the spreads and commissions for the ECN account. Traders need to be aware of swap or rollover fees that apply when a position is open for more than a day. Valutrades prides itself on offering some of the tightest spreads in the industry, starting from as low as 0 pips, with the average spread for the major EUR-USD pair being a mere 0.1 pips.

Valutrades implements a commission per lot that starts from $3.0, subject to the asset traded. There are no charges associated with deposits, meaning that the entire deposit amount is credited directly to the client's trading account. Clients enjoy the perk of three fee-free withdrawals each month, while subsequent withdrawals carry a 5% fee. However, retail investor accounts must also factor in possible additional fees imposed by their chosen payment system.

Deposit and Withdrawal

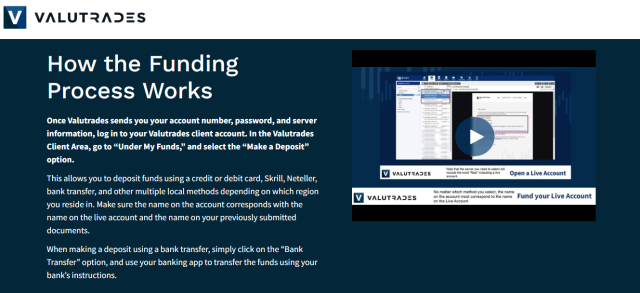

Valutrades makes it easy for traders to fund their trading accounts with various mainstream options, including bank transfers, card payments, and e-wallets like Skrill, Neteller, and UnionPay. This wide variety of funding methods ensures that traders can select an option that aligns with their preferences and convenience.

Before making a deposit, a trader is required to undergo a verification process. This is a necessary step taken by Valutrades to ensure a secure trading environment and to comply with anti-money laundering policies. While Valutrades does not impose a minimum deposit requirement, traders need to be aware that some payment providers might have their specific rules and limitations.

In terms of withdrawals, Valutrades processes withdrawal requests promptly, typically within 24 business hours. Clients can take advantage of three free withdrawals each month, after which a 5% withdrawal fee applies to subsequent withdrawals. Importantly, to further secure financial transactions, money can only be withdrawn using the same method that was used for depositing funds. In cases where a previously used deposit method becomes unavailable, the client will need to liaise with customer support for assistance.

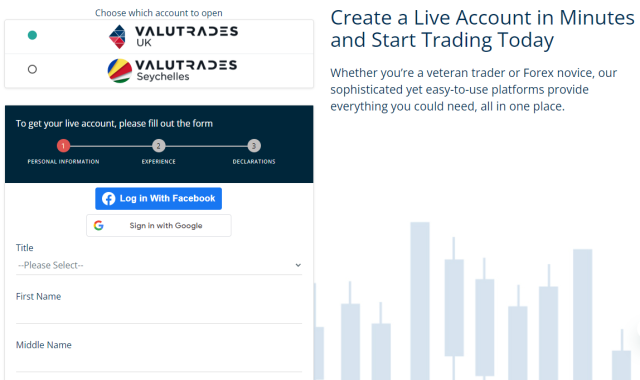

How to Open a Valutrades Account

Opening an account with Valutrades is a straightforward process. Begin by navigating to the account opening or sign-in page on the Valutrades website. Here are the steps to follow:

- Select and click on the “Open Live Account” page.

- Enter the required personal data such as your name, email, phone number, among other information.

- You'll then need to verify your personal data by uploading relevant documentation. This typically includes proof of residence (like a utility bill or bank statement) and a valid identification document (like a passport or a national ID card).

- Once your account has been activated and your identity verified, you can proceed to deposit funds into your account. This completes the setup process, and you can now start trading.

>> Also Read: How To Trade Forex For Beginners – An Important Know How For Traders

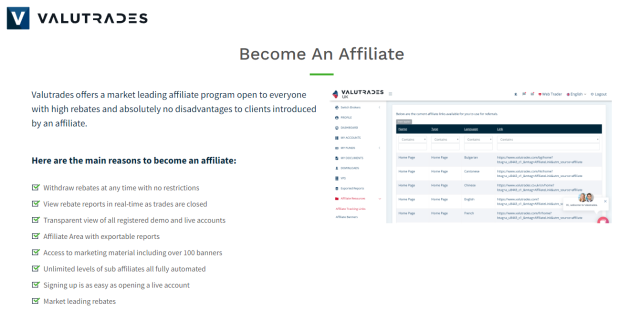

Valutrades Affiliate Program

Valutrades facilitates a high-yielding affiliate program, distinguished by the absence of limitations on referral levels. This program empowers participants to earn rebates with each referral they make, the accumulated amount of which can be withdrawn anytime without any restrictions.

In addition to its simple registration process and fully automated operations, the affiliate program also provides easy access to a suite of marketing materials. This includes over 100 customizable banners designed to assist affiliates in effectively promoting Valutrades. The real-time statistics on referrals are readily available for viewing in the affiliate account, enabling participants to track their performance and strategize their promotional efforts accordingly.

To become a part of this rewarding affiliate program, individuals need to send a request from their registered Personal Account on the Valutrades platform.

Valutrades Customer Support

Valutrades is dedicated to providing comprehensive customer support services, available five days a week, 24 hours a day. Through various communication channels like Live Chat and WhatsApp, Valutrades ensures that clients can reach their customer service representatives promptly and conveniently.

Beyond these, the broker offers additional avenues to get in touch: via phone, email, and an online chat facility accessible both on the website and within the Personal Account. There is also a feedback form for clients to share their experiences, suggestions, or any issues encountered.

Interestingly, the broker's customer support extends its help to all traders, regardless of whether they have an active Personal Account. This allows even prospective clients to ask questions and get the necessary information to facilitate their decision-making process about opening an account with the broker. This approach to customer support underscores Valutrades' commitment to transparency, accessibility, and customer satisfaction.

Advantages and Disadvantages of Valutrades Customer Support

| Advantages | Disadvantages |

|---|---|

Valutrades vs Other Brokers

#1. Valutrades vs AvaTrade

Valutrades and AvaTrade are both well-established Forex brokers, but they cater to different types of traders. Valutrades, with its no minimum deposit policy and ECN account, offers low spreads starting from 0 pips and is an excellent option for both new traders and veterans. Its focus is on providing a cost-effective and accessible platform, with a maximum leverage of 1:500 for professional traders.

AvaTrade, on the other hand, boasts a much larger customer base and offers a vast selection of financial instruments. Their focus is on providing a comprehensive trading experience with a strong emphasis on regulation and licensing. However, AvaTrade does not cater to US traders, which might be a limiting factor for some.

Verdict: If you're a beginner or a professional trader looking for low spreads and an accessible platform, Valutrades would be a better option. However, for those seeking a broader selection of trading instruments and a broker with strong regulatory measures, AvaTrade is the superior choice.

#2. Valutrades vs RoboForex

RoboForex offers an extensive range of trading options with more than 12,000 to choose from, catering to traders of all levels of experience and investment size. Their impressive selection of trading platforms, including MetaTrader, cTrader, and RTrader, coupled with their unique trading contests, sets them apart from many competitors.

Valutrades, while offering fewer trading options, excels in providing highly competitive spreads, no minimum deposit requirements, and unrestricted access to ECN trading. The maximum leverage for professional traders stands at a striking 1:500, allowing for significant trading flexibility.

Verdict: For traders prioritizing a vast array of trading options and platform choices, RoboForex is the superior option. However, if low spreads, ECN trading, and high leverage are your primary concerns, Valutrades emerges as the preferred broker.

#3. Valutrades vs FXChoice

FXChoice, with its adherence to strict regulatory rules by the FSC, offers quality brokerage services primarily suitable for experienced traders. They provide classic and professional ECN accounts with tight market spreads. However, their trading services, including the demo account option and loyalty program, appear more geared toward professional traders with high trading volumes.

Valutrades, while also offering an ECN account with low spreads, caters to a broader range of traders with no minimum deposit requirement. Their maximum leverage is higher (1:500 for professional traders), and they offer free VPS for clients with large volumes, making it more versatile for different trading styles and volumes.

Verdict: If you're an experienced trader seeking a broker that offers high trading volumes, FXChoice is the better fit. However, for traders valuing flexibility, low spreads, and accessibility, regardless of trading volume or experience level, Valutrades comes out on top.

Conclusion: Valutrades Review

In conclusion, Valutrades represents a commendable choice for individuals seeking an authentic ECN broker experience. especially those who want to establish good and professional algorithmic trading strategies. Its exceptional customer service, coupled with some of the industry's lowest spreads, makes it an attractive platform for both novice and experienced traders. Its diverse and user-friendly funding options, alongside the provision for zero minimum deposit, serve to widen its accessibility to traders across different financial capabilities.

The broker's commitment to transparency and efficiency is reflected in its simple account opening process and efficient handling of withdrawals. While some users have voiced concerns over the document verification process, this issue seems to be more the exception than the norm. It's crucial, however, for potential traders to understand the documentation requirements prior to signing up.

Overall, Valutrades offers a trading experience that balances affordability with a robust suite of features. Its highly competitive ECN account, dedicated customer support, and flexible funding options make it a worthy consideration for any trader.

> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

Valutrades Review FAQs

Does Valutrades offer any sign-up bonus?

As of the time of this review, Valutrades does not provide any sign-up bonus for new clients.

What is the minimum deposit requirement for a Valutrades account?

Valutrades does not impose a minimum deposit requirement to open a live trading account, making it easily accessible to a wider range of individuals.

What are the fees and commissions with Valutrades?

Valutrades' fee structure is integrated into the spreads and commissions for its ECN account, with industry-low spreads starting from 0 pips. The broker charges a commission per lot of $3.0, which can vary based on the asset traded. Swap or rollover fees also apply if a position remains open for more than a day. While the broker does not charge a deposit fee, withdrawal fees apply after the third withdrawal within a month. Additional charges may apply based on the client's chosen payment system.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.