Implied Volatility: Overview, How To Calculate, And Market Risks

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Like any investor, you need to understand the risks involved in an investment opportunity before putting your money in it. Trading in the options market is no different. With options, you are not precisely transacting over a property. You are acquiring a “right” to buy or sell a property. Before you begin trading options, you must understand the value of this underlying property. You should know the past value of the property, the current value, and perhaps, the potential value of the property in the future.

Implied volatility (IV) is the instrument you can use to predict the changes in the price of the underlying asset in options. Implied volatility is a broad metric. It is vital to understand it because options involve risk, and calculating implied volatility helps manage those risks better.

In this article, we’ve got Ezekiel Chew, a world-renowned forex mentor, to share his take on Implied Volatility. Read further if you want to learn implied volatility, how to calculate it, and how it works in the market.

What is Implied Volatility

Implied volatility (IV) is a metric used to grasp the market’s view of the likelihood of change in an options contract over its lifetime. It shows how much a security’s price will increase or decrease during a particular period. This period is often the entire duration of the options contract or up until the time when it expires.

Implied volatility is used to predict future moves of an option and future changes in its supply and demand. It is different from historical volatility, which, on the other hand, measures past stock price movements, current stock price movements, and the results of real changes. Historical volatility is also known as realized volatility or statistical volatility.

Implied volatility is also one of the six parameters used in determining options prices, especially where high implied volatility leads to options with higher premiums or low implied volatility leads to options with lower premiums. It is vital to know that implied volatility gauges future market volatility. Accordingly, if the price of an option is expected to rise in the future, then the IV will increase, and if it is expected to fall, the IV will fall. It also follows that when the market is bearish, IV increases, and when the market is bullish, IV reduces.

Implied Volatility Structure

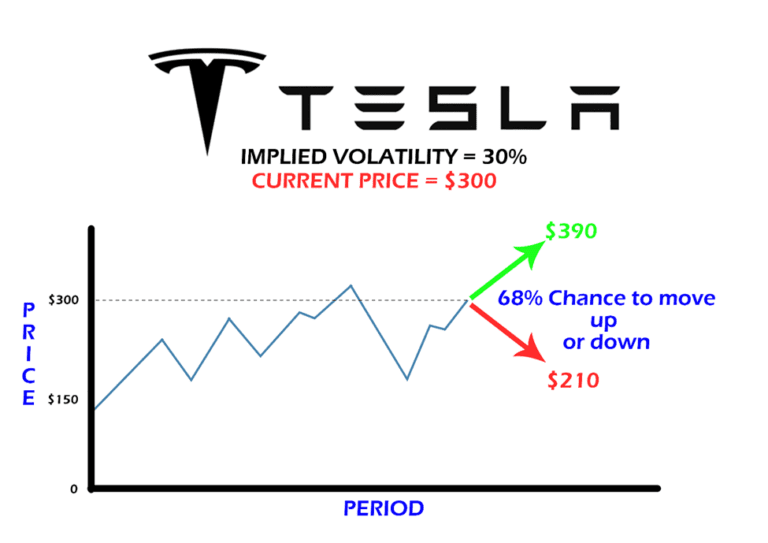

Implied volatility term structure is a curve depicting the different implied volatilities of options with the same strike price but different maturity dates. To understand the term structure, let us examine this graph for Tesla’s stock.

If an IV of 30% on the Tesla stock is priced at $300, this will represent 1 standard deviation range of $90 the following year. From basic statistics, we know that a single standard deviation equals 68% of results or outcomes.

Standard deviation is essential when determining implied volatility because it is the statistical metric used to measure the volatility of the market’s expectation regarding price. In the context of the implied volatility of tesla’s stock price, standard deviation means that there is a 68% chance that Tesla’s stock price will range between $390 and $210 in the following year.

It is obvious now that the implied volatility does not predict the direction in which the price change will occur. It helps quantify market sentiment and uncertainty, not the exact direction in which the market is leaning. IV measures the level of volatility in the market. High volatility means the price is swinging widely, either upward or downward. Conversely, low volatility means that the price is generally stable and unlikely to experience any fluctuations.

Implied Volatility on Stock Price

Most trading platforms give users the IV details for specific options or stocks. However, this information is usually accessible only to users with paid memberships or premium accounts. For investors who do not have a paid subscription, the trading platforms may provide other ways to obtain the IV calculations for options and stocks they are interested in. An example is by offering scripts from other traders to determine the implied volatility of a specific option price. These alternatives may not be as accurate as the IV details users get on premium accounts, but they can help traders make informed options trading decisions.

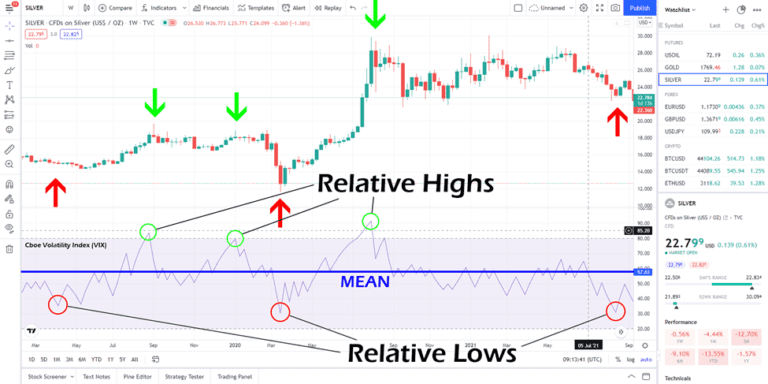

An indicator almost similar to the implied volatility is the Cboe Volatility Index. The Cboe Volatility Index for silver is illustrated in the following chart.

From the chart, we can see the relative highs and lows, which indicate the periods of volatility on the chart. The relative highs are periods when the pull price is ideal to sell options. The relative lows are periods when the call price is perfect for buying options. The IV is thus an excellent metric for measuring the standard deviation per annum, given that standard deviation is a measure of market volatility.

Why Implied Volatility Changes

The primary reason why implied volatility changes are that it is based on probability. It is an assessment of future prices and not an indication of which direction the prices will go. Therefore, it can swing either way – to the far left or the far right. It can also stay in between or not move at all. It depends on factors such as supply, demand, and time value. When these factors change, implied volatility also changes.

You can stay ahead of the changes in implied volatility by complementing it with other forecasting strategies to get more accurate trading decisions. One forecasting strategy you can adopt is a mean or average line of the relative highs and relative lows of the price volatility. By determining a mean, you can set boundaries within which you want to trade. This makes it easy to know what to do when the volatility is close to your lower or upper limits.

How Implied Volatility is Calculated with Strike Price

Implied volatility can be calculated using option pricing models. Rather than directly observable market factors, the option pricing model uses other factors to determine the IV and option's premium.

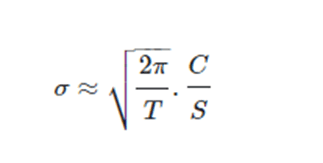

You can calculate IV using the upfront formula:

σ ≈ √{(2π/T)x(C/S)

Where:

σ – Initial Implied Volatility

T – Time of contract

C – Call price

S – Strike price

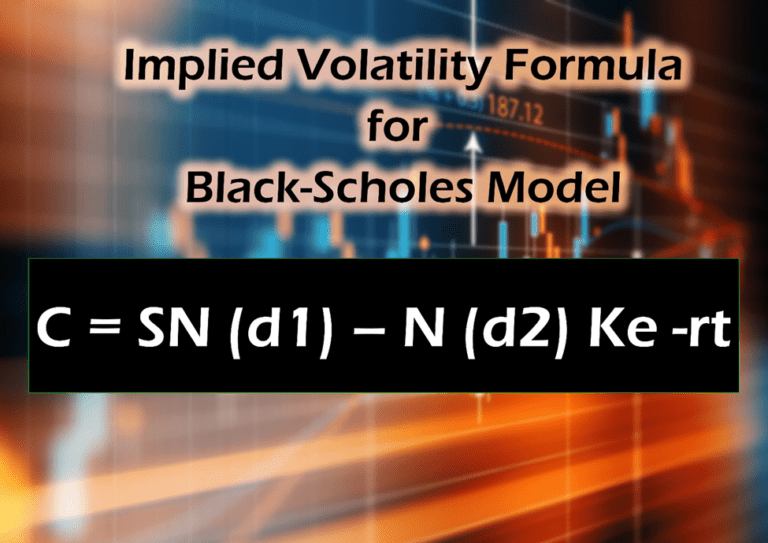

Implied Volatility Formula for Black-Scholes Model

The Black-Scholes Model is a popular option pricing model that factors in current stock price, options strike price, time until expiration (denoted as a percent of a year), and risk-free interest rates.

The Black-Scholes model formula is as follows;

C = SN (d1) – N (d2) Ke -rt

Where:

C – Option Premium

S – Stock Price

K – Strike Price

r – Risk-free Rate

t – Maturity time of the stock

e – Exponential Term of the stock

Factors that can affect Implied Volatility

Implied volatility operates within the constraints of demand and supply. They are significant factors to be considered in calculating implied volatility. Where an option has a high demand, the option’s price is likely to rise along with the implied volatility. On the other hand, when there is a higher supply than demand, the option’s price and implied volatility can drop.

Time value is another important factor that can affect volatility. Options are generally made up of two parts: the intrinsic value, the difference between the market value of the underlying assets and the strike prices, and the time value, which is the expiration date of stocks or options. Options with a relatively short period usually have low IV, while options with longer lifespans are more likely to have high IV. The primary consideration regarding time value is the time left before an options contract expires. If there is enough time available before the expiration, the option’s price can move to better levels.

Market Risk when Implied Volatility Decreases or Increases

Implied volatility helps set options prices and allows investors to map a trading strategy. When implied volatility increases, the market is highly volatile and risky. It could be because the price has increased or because the price has reduced. Implied volatility does not prescribe the direction in which the market is leaning. It only helps to quantify market uncertainties.

When IV decreases, the market is not experiencing any changes. The price is stable at this point. It could be stable at a high or a low point. The important thing is that the price is not moving.

Best Forex Trading Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Implied Volatility

Implied volatility is essential in options trading. As discussed earlier, IV does not tell investors the price movement direction. It helps estimate the quantity of movement that an asset may experience, either in the negative or in the positive. It also helps quantify market sentiment and set option prices—investors who consider IV when trading is likely to make informed decisions and maximize their investments. For example, they may invest in relatively safe sectors or companies when the market is experiencing high volatility.

Factors that affect IV include supply, demand, and time value. Other factors such as wars or natural disasters which affects people’s spending habits may also affect IV. There are several disadvantages to using the IV. It is based solely on prices and not the market assets' fundamentals. It is also susceptible to change when there are unexpected events or news. Lastly, it only predicts movement and not the direction in which the movement will occur, which may make it difficult for investors to be sure of their next investment moves.

Implied Volatility FAQs

Why do you need Implied Volatility?

A statistic called implied volatility (IV) is used to predict what the market believes will happen to the price of the underlying stock of an option in the future. IV is helpful because it gives investors a basic idea of the price range an investment is likely to fluctuate within and helps identify suitable entry and exit locations.

Which is better high or low implied volatility?

The reply is “both” Both IV options can be utilized depending on the trading strategy or kindly used, whether a long or short trade. The market anticipates that the price will experience a substantial fluctuation in either direction as implied volatility rises. Low IV indicates that option pricing is moving slowly in this situation.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.