All You Need to Know About Current Dynamics in the HSI Price and Its Impact

By Dumb Little Man

January 10, 2024

The Hang Seng Index is a China’ Financial Engine and is considered as one of the biggest Indices of Asia. The largest indicator of overall market performance in the country, HSI came into being on 24th November 1969. The idea of creating it by given by Ho Sin Hang. Its base that was developed equivalent to the stocks’ total value was 100 points. 58.61 points were the all-time low that this index has ever experienced on 31 of August 1967. On 18 of October 2007, this crossed the milestone of 10,000 points and reached its high value after a few years, and that was 31,958.41 points.

Four Sub indexes

- Industry

- Finance

- Energy and Utilities

- Properties

Factors That Influence the Overall Index Price of Hang Seng Index – HSI

While we talk about the factors that influence the overall price of HSI, many macro and micro-economic factors are involved. The HSI has close interlink with the Chinese economical current; any ups and downs in the Chinese market have a huge impact on the Hang Seng Index. One example is the devaluation of Yaun, as it entirely shook the market. Not just the devaluation of the Yuan, but also the removal of the CNY/USD peg impact the economy, and make it better. These things have also an influence on the HSI. You might be aware that they are not directly impacting the Hang Seng Index, but the price dynamics are being influenced by any changes. With the announcement of Brexit, the index faced 1000 points drop.

The Best Week in the Life of Hang Seng Index Since February

Last Friday, the Hang Seng Index has seen its best week, as the value increased. It gained 0.2% after Friday afternoon, and in the entire month of October the price went up, and for the straight four weeks, the weekly gain was 2.9%. However, the top gainers on the index were Longfor Group and China Resources Land.

How Tech Stocks Contributed to these Scenarios

Hang Seng benchmark Index has seen the rise, and the major factor that contributed was Tech stocks in Hong Kong. As the investor picked up, it gained nearly 6%. Alibaba Group, the E-commerce giant, saw a weekly gain of 7.9% after April. Tencent Holdings also saw a good week.

The Rise in Japan Inflation

While HSI saw again, there are many other things that have happened during the last weekdays. The Japanese benchmark index saw a rise of 0.3% and on Friday the points were 28,804.85. Consumer inflation rose as well according to the data and that happened the first time during the 18 months.

What Makes CFDs Better as Compared to Stocks

Here are some of the things that you need to know about CFDs, as you can do trading HSI via CFDs.

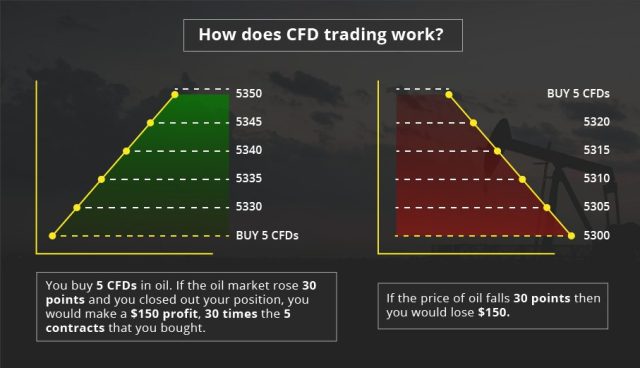

There are two types of trading; stocks and CFD. Contract for difference (CFD) trading is quite different from stocks, and in it, you do not possess the underlying stock or the asset. The core difference likes in the leverage and the ownership. Both of these have pros and cons, and you can choose the one according to your preferences. In stock, you buy a stock or take a small share of the company you are interested in and pay the full price. While in CFD, you do not need to own the entire assets or stock that you decide to trade. You can get the benefits from the Markets' ups and downs. CFD provides the leverage while stock trading does not, and you can take ownership in stock trading. Multiple markets are involved in CFD, while in-stock trading; only equities and ETFs are involved. You have the voting right in stock trading, not in a contract for difference.

CFDs are quite suitable for short-term trading and you can trade 24/7, while stocks are preferred for long-term holdings and trading is done during the stock exchange hours.

Advantages of CFDs

There are many advantages of CFDs, and here are some of them;

- Provides the Leverage

- Go Long and Short

- Access to loads of Markets

- You can trade 24/7

They say, risk comes when money is involved, so we know that CFD provides leverage, and the risk that is involved is also higher. There are many platforms where you can do the trading, and while some online brokers provide the chances of stock trading, some are experts in forex and CFD.

FAQs

HIS Trading is quite popular, and while there might be some frequently asked questions that need to be answered, we are answering them for you.

What does HSI exactly Mean?

HSI stands for Hang Seng Index. About 30 largest multinational companies that are trading on the Hong Kong exchange, it is the capitalization-weighted index of them and they cover approximately 65% of the total market capitalization. Many Chinese firms are part of the Hong Seng Index (HSI) as there is a close relationship between Hong Kong and China.

What Are the Sub-Indexes of HSI?

There are about four sub-indexes of HSI – Industry, finance, energy and utilities, and properties.

When Can You Trade The Hang Seng Index?

The HSI is one of the most popular Asian Indices, and the trade is mostly from 9:30 AM to 4:00 PM Hong Kong time. It gets most of the investors that are living in Europe and America to trade during such hours. Providing you with great exposure to Chinese companies can be a big deal for you.

If you can be available during these hours, you can trade efficiently and get the exposure of working in Hong Kong and the Chinese Market.

What Factors Move the Hang Seng Index?

There are many factors that influence the HSI, and as it is an amalgam of stocks, some macro and microeconomic factors and trends can influence it. Technical levels can also influence the Hang Seng Index. As we all are aware of close relationships between Hong Kong and China, and many Chinese companies are part of HSI, thus economic developments in China also impact Hang Seng. Not just that, recently some trade disputes between America and China have also affected the Hang Seng Index.

Conclusion:

The Hang Seng Index is considered one of the biggest Indices of Asia. There are many macro and microeconomic and technical factors that influence it and we have listed some of them for you in this write-up. It is a capitalization-weighted index of the 30 largest Chinese companies, and any ups and downs between the two countries strongly impact the HIS. During the last week and generally in the first half of October, the price rose, and now it has dropped as compared to last week's stats. While the market keeps fluctuating, currently the Hang Seng Index is at 25,377.24 points, with many lows and highs. As compared to last week's rise in the value, the Hang Seng slips.

Dumb Little Man

At Dumb Little Man, we strive to provide quality content with accuracy for our readers. We bring you the most up-to-date news and our articles are fact-checked before publishing.