FXTrading.com Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved.

|

FXTrading.com Review

Established in 2009, FXTrading.com is an Australian-based FOREX brokerage firm headquartered in Sydney, Australia. It operates under the supervision of two reputable regulatory bodies, the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

This detailed review is designed to provide an exhaustive assessment of the company, including its strengths and weaknesses. By combining expert analysis and the experiences of real traders, this review aims to furnish readers with an extensive understanding of FXTrading.com, enabling them to make well-informed decisions.

What is FXTrading.com?

FXTrading.com is a seasoned Australian FOREX and CFD brokerage, providing traders with swift and simplified access to the global financial markets through advanced yet user-friendly trading platforms, including MetaTrader and IRESS. The brokerage offers an array of trading instruments spanning multiple asset classes, such as forex, commodities, indices, and cryptocurrencies. Traders can leverage competitive trading conditions, including tight spreads, low fees, quick trade execution speeds, top-tier liquidity, leverage up to 1:500, multiple account funding options, dedicated customer support available 24/5, and more.

>> Also Read: Forex Trading Strategies – A Trader Beginners Guide

Safety and Security of FXTrading.com

FXTrading.com‘s financial services and products are provided by Gleneagle Securities (Aust) Pty Limited. The company is duly authorized and regulated by the Australian Securities and Investments Commission (ASIC) to operate a financial services business in Australia under its Australian Financial Service License.

FXTrading.com ensures that all client funds are held in segregated trust accounts with National Australia Bank, an AA-rated Australian bank regulated by APRA and ASIC.

Moreover, it undergoes regular independent external audits of its financial and compliance arrangements to meet all regulatory requirements. FXTrading.com places great emphasis on the privacy and protection of both the financial and personal information of its clients. Furthermore, the firm is subject to anti-money laundering and counter-terrorism financing laws.

Sign-Up Bonus of FXTrading.com

While FXTrading.com does not provide a sign-up bonus, it does offer a 10% deposit bonus as a welcome gesture to traders who register a real account with them. Traders who deposit amounts between $1,000/R16 000ZAR and $50,000 can avail a 10% bonus up to a maximum of $5,000/R80 000ZAR. It's important to note that this bonus is paid into the trading account as trading credit and cannot be withdrawn.

Minimum Deposit of FXTrading.com

FXTrading.com has set an entry threshold that is easily accessible to a wide range of traders. With a minimum deposit amount of $200, FXTrading.com provides an opportunity for both novice and experienced traders to venture into the foreign exchange market without needing a hefty initial capital outlay.

This amount is low enough to encourage beginner traders who may not be willing or able to invest larger sums of money at the onset of their trading journey. On the other hand, it is also sufficient for more experienced traders to test the platform's capabilities, trading conditions, and services before committing a larger portion of their trading capital.

FXTrading.com Account Types

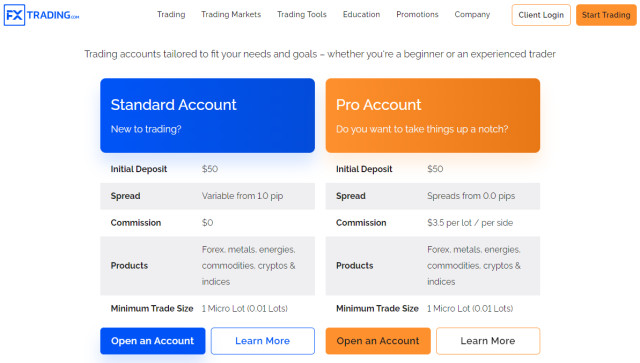

FXTrading.com acknowledges the diverse trading requirements of its global clientele and caters to this diversity through the provision of various account types: the Standard Account and the Pro Account.

Standard Account

The Standard Account serves as an entry-level account suitable for most traders. This account type addresses the needs of beginners who are starting their forex trading journey and experienced traders who are not yet categorized as professionals. With the Standard Account, traders get to enjoy a host of features, including competitive spreads, commission-free trading, and a user-friendly trading environment, among others.

Pro Account

The Pro Account is tailored for professional traders who seek to elevate their trading experiences. With this account type, FXTrading.com provides some of the most competitive trading conditions in the market, along with a transparent and comprehensive fee schedule. Although the Pro Account comes with a commission of $2 per side, the extremely tight spreads and other professional-grade features justify this.

Demo Account

Additionally, FXTrading.com provides a Demo Account option. This option allows beginner traders to practice and develop their trading skills in a risk-free environment. The Demo Account is also handy for experienced traders who want to test their strategies before implementing them in the live market. Lastly, it gives potential clients a chance to explore the platform's offerings and understand how FXTrading.com operates before they register a live trading account.

FXTrading.com Customer Reviews

Overall, customers have expressed high levels of satisfaction with FXTrading.com‘s service and platform. They praise the brokerage's exceptional customer service, responsive staff, and helpful analytical tools. The platform is also lauded for its ease of use and professional demeanor, despite minor suggestions for improvement like the inclusion of timestamps in communication. Many users have seen significant earnings from their investments, leading them to highly recommend FXTrading.com to other traders, especially beginners. There is a consistent sentiment of trust and loyalty towards FXTrading.com, with clients planning to continue using their services.

FXTrading.com Fees, Spreads, and Commissions

At FXTrading.com, the pricing structure is designed to accommodate traders from different regions and various trading preferences. The brokerage firm prides itself on its transparent and competitive pricing policies.

Fees

Traders should note that while the fees and costs are generally competitive, they can vary depending on the country or region of residence of the trader. Hence, it is always recommended to review the specific terms and conditions relating to fees and costs for your location.

Spreads

Foremost, traders should note that the costs associated with trading here revolve around spreads and margins. Spreads are essentially the difference between the bid price and the ask price of a particular currency pair or other financial instrument. FXTrading.com offers impressively tight spreads, starting from as low as 0.0 pips for both Standard and Pro accounts. This implies that traders can enter the market at prices very close to those they see in the market, potentially boosting their trading efficiency.

Commissions

Commissions, another critical aspect of the trading cost, are also competitively structured at FXTrading.com. For the Standard account, the broker charges no commission, enabling traders to conduct their activities without worrying about any commission-based expenses. On the other hand, traders using the Pro account are subject to a commission of $3.5 per side. This is in line with the industry standard and reflects the more sophisticated trading conditions offered by the Pro account.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Deposit and Withdrawal

FXTrading.com provides traders with various convenient methods to fund their accounts and withdraw their earnings. Recognizing the importance of offering user-friendly and secure financial transactions, FXTrading.com has implemented a range of popular funding options.

Deposit

The minimum initial deposit requirement at FXTrading.com is $200. This amount, while serving as a threshold for commencing trading activities, is relatively low compared to many other brokers. It allows for accessibility for those starting their trading journey while also providing sufficient funds for meaningful trading.

Clients can choose to fund their accounts through several methods, including credit/debit cards, which are commonly preferred for their instantaneous transaction processing times. Digital wallets like Neteller, Skrill, and PayPal are also available for those seeking quicker, more convenient options. For clients who prefer traditional methods, Wire Transfer is an available option.

Withdrawal

Similar methods can be used for withdrawals. However, traders should be aware that while deposits are typically processed instantly, withdrawals may take a few business days, depending on the method used and the respective processing times.

FXTrading.com takes the security of financial transactions very seriously. Hence, it employs rigorous measures to safeguard the deposit and withdrawal processes, ensuring clients' funds are protected at all times.

FXTrading.com Partnership Program

FXTrading.com recognizes the value of collaborative efforts in enhancing business growth and hence, offers a robust partnership program. The program is categorized into three: Introducing Broker (IB), MAM/PAMM, and Liquidity Solutions.

Introducing Broker (IB) Program

The Introducing Broker (IB) program allows partners to earn uncapped commissions for every trade executed by the traders they refer. The setup is hassle-free, and the program includes advanced real-time tracking and payout features. The IB program is perfect for those with a wide network of potential traders.

MAM/PAMM Program

FXTrading.com's MAM/PAMM program is tailored for Money Managers. This program offers the flexibility to manage multiple client accounts from a single master account. Traders have the option of manually conducting trades or utilizing Expert Advisors for automated trading. This is an excellent solution for experienced traders or firms that manage funds on behalf of their clients.

Liquidity Solutions Program

Lastly, the Liquidity Solutions program is designed for institutional partners seeking direct market access to liquidity pools. The program provides prices derived from a wide range of Tier-1 institutions, access to an ecosystem of partners and third-party API integrations, and complimentary reports for regulatory checks, performance analysis, and risk auditing. This program is ideal for those seeking optimized liquidity in their trading environment.

FXTrading.com Customer Support

FXTrading.com offers excellent customer support through live chat, phone, and email. The live chat is quick, efficient, and always provides relevant responses. The phone support is helpful, providing satisfactory answers, and the email support is prompt and helpful.

While customer service agents are available only during working hours (9 a.m. to 6 p.m. AEST), FXTrading.com also provides an AI-driven customer service representative named FXT Bot. Available 24/7, the bot can answer over 100 FAQs in natural language, streamlining the user's online experience.

Advantages and Disadvantages of FXTrading.com Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

FXTrading.com vs Other Brokers

#1. FXTrading.com vs AvaTrade

When comparing FXTrading.com and AvaTrade, several factors need to be considered. Both brokers are regulated, with FXTrading.com being regulated by ASIC and VFSC, while AvaTrade is regulated by ASIC, the South African Financial Sector Conduct Authority (FSCA), the Central Bank of Ireland, and the Japan Financial Services Agency (JFSA).

FXTrading.com excels in terms of providing a choice of trading platforms, offering both MetaTrader and IRESS, whereas AvaTrade is primarily focused on the MetaTrader platform. When it comes to spreads, FXTrading.com offers spreads as low as 0.0 pips on both its Standard and Pro accounts, which is better than AvaTrade's offering. AvaTrade, however, stands out with its extensive educational resources that are especially helpful for beginners.

Verdict: While both brokers are competitive, FXTrading.com takes the lead with its ultra-low spreads, diversity in trading platforms, and flexible account types, catering to both beginner and professional traders.

#2. FXTrading.com vs RoboForex

FXTrading.com and RoboForex both offer a wide range of assets for trading, including forex, commodities, indices, and cryptocurrencies. FXTrading.com is regulated by ASIC and VFSC, while RoboForex is regulated by IFSC and CySEC.

Regarding trading platforms, FXTrading.com offers MetaTrader and IRESS, whereas RoboForex offers MetaTrader, cTrader, and its proprietary platform, R Trader. RoboForex offers a slightly wider range of account types, including accounts that cater to copy trading and Islamic traders. FXTrading.com offers more competitive spreads, starting at 0.0 pips, compared to RoboForex's starting spread of 0.1 pips.

Verdict: If trading costs are your priority, FXTrading.com is the preferred choice due to its lower spreads. However, if platform diversity and a wider range of account types are important to you, RoboForex might be a better fit.

#3. FXTrading.com vs FXChoice

FXTrading.com and FXChoice both provide traders with access to a range of financial markets. FXTrading.com is regulated by ASIC and VFSC, while FXChoice is regulated by IFSC.

In terms of trading platforms, both brokers offer MetaTrader, though FXTrading.com also provides the IRESS platform. FXChoice offers a tighter spread starting from 0.1 pips, slightly better than FXTrading.com's 0.0 pips. However, FXTrading.com offers more competitive trading conditions with its commission-free trading for the standard account and $3.5 per side for the Pro account, while FXChoice charges higher commission rates.

Verdict: Despite FXChoice's slightly tighter spread, FXTrading.com outperforms with its lower commission structure, making it a more cost-effective broker for both new and experienced traders. The addition of the IRESS platform is also a significant plus for FXTrading.com.

>> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FXTrading.com Review

In conclusion, FXTrading.com, with its stringent regulations, advanced trading platforms, and a wide array of trading instruments, stands as a trustworthy broker in the world of forex trading. Its dedication to maintaining high-security standards ensures client safety. While it does not offer a traditional sign-up bonus, its welcome deposit bonus does provide an attractive perk to new users.

The company also offers a variety of account types to cater to different trading needs and a demo account for practice. With competitive fees and spreads, and flexible deposit and withdrawal options, it creates a conducive trading environment. Its efficient customer support and partnership program further enhance its appeal. Despite some limitations in customer service availability, FXTrading.com demonstrates a commitment to providing a reliable, secure, and efficient trading platform for its clients.

FXTrading.com Review FAQs

Is FXTrading.com a legit broker?

Yes, FXTrading.com is a legitimate broker. It is an Australian company founded in 2009 and is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). The broker is also compliant with strict regulatory standards including regular independent external audits and anti-money laundering and counter-terrorism financing laws.

What kind of trading platform does FXTrading.com offer?

FXTrading.com offers the industry-standard MetaTrader platform and the IRESS platform. These platforms are known for their user-friendly interfaces, powerful trading tools, and features that enhance the trading experience. They are accessible from various devices including desktop, tablet, and mobile, and support both manual and automated trading strategies.

Does FXTrading.com offer a demo account for practice trading?

Yes, FXTrading.com offers a demo account for its clients. The demo account is designed to help beginner traders practice and build their trading skills without risking their capital. More experienced traders can also use the demo account to test their trading strategies in a risk-free environment before trading in the live market.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.