FXGT Review 2024 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

FXGT Review

FXGT, short for Forex Global Trading, is a formidable player in the global foreign exchange trading arena. Since its inception in 2019, the firm has carved a prominent position for itself in regions such as South East Asia, Africa, and Japan. As a multifaceted broker, FXGT offers an extensive range of trading instruments, from Contract for Difference (CFDs), Stocks, Foreign Exchange (FX), Commodities, and Cryptocurrencies to Energies, Indices, and beyond.

In this comprehensive review, our intention is to delve into the ins and outs of FXGT, pinpointing its unique value propositions and potential shortcomings. Our goal is to provide an exhaustive and objective examination, bringing to light crucial aspects such as the range of available account options, the processes of depositing and withdrawing, the structure of commissions, and other vital details. By amalgamating expert analysis with actual trader testimonials, we aim to equip you with the knowledge to make an informed decision regarding FXGT as your prospective broker of choice.

>> Also Read: Forex Trading Strategies – A Trader Beginners Guide

What is FXGT?

FXGT represents the epitome of the modern financial trading ecosystem, taking a progressive, crypto-friendly approach to its operations. The firm, which took root in 2019, has a significant presence in South East Asia, Africa, and Japan, offering a broad spectrum of trading instruments, spanning CFDs, Stocks, FX, Commodities, Cryptocurrencies, Energies, and Indices, among others.

FXGT prides itself as a ‘new generation forex broker,‘ harnessing the power of digital advancements in the currency markets and the widespread acceptance of cryptocurrencies. The firm's mission centers around empowering traders' success by availing cutting-edge digital tools, and a wide variety of trading pairs, while ceaselessly striving to provide the most favorable trading conditions in the market.

Although a relatively recent entrant, FXGT is committed to expanding its global reach, with a strong focus on growth markets such as South Africa. The latter is fast becoming a preferred destination for Forex brokers, attributed to its robust regulatory framework, the availability of high leverage, and promising potential for global growth.

Safety and Security of FXGT

When it comes to client fund safety, FXGT ensures that all client funds are entirely separate from the company's operational funds, held in numerous Tier 1 banking institutions. The firm's advanced encryption technology, secure servers, and fortified firewalls promise maximum data security. Clients enjoy the benefit of negative balance protection, providing peace of mind while trading.

As a testament to its financial health, FXGT maintains a capital adequacy ratio of 40%, fourfold the typical capital-to-risk weighted exposure ratio demanded by reputable regulators. The firm is fully regulated, with licenses from the Seychelles Financial Services Authority (SFSA) and the South African Financial Services Conduct Authority (FSCA). In addition, clients and third parties enjoy insurance coverage up to a total of €1,000,000 against errors, omissions, negligence, or other risks that might result in financial loss.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Sign-Up Bonus of FXGT

FXGT goes the extra mile to make newcomers feel appreciated and welcome, offering an attractive sign-up bonus of 50%. This means that when a new trader registers and deposits funds into their account, FXGT matches half of that amount in bonus funds. For example, if a trader deposits $1000, they will receive a bonus of $500, making their total trading balance $1500.

This bonus provides a significant boost for new traders, as it gives them a larger balance to start trading, thus allowing them to open more or larger positions. Additionally, FXGT doesn't stop at the sign-up bonus. Traders can also avail of a 30% bonus on any deposit they make, enhancing their trading experience and potentially increasing their trading profits.

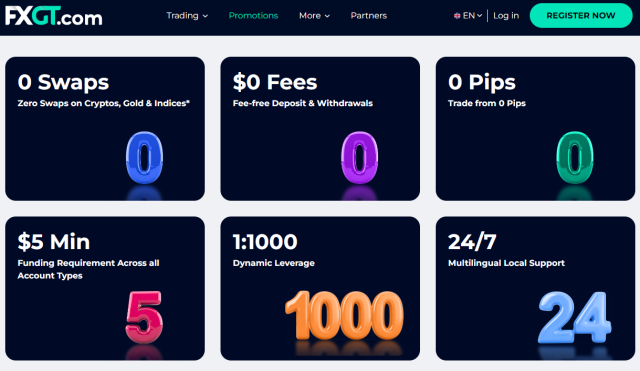

Minimum Deposit of FXGT

One of the appealing features of FXGT is the low entry barrier for prospective traders, made possible by the platform's incredibly low minimum deposit requirement. With just $5, anyone can open a live trading account on FXGT and gain access to the plethora of financial instruments available to trade on the MT4 and MT5 trading platforms.

This feature is particularly beneficial for novice traders or those with limited capital, as it allows them to test the waters of trading without requiring a significant financial commitment. It also demonstrates FXGT's commitment to inclusivity, striving to make the financial markets accessible to as many people as possible.

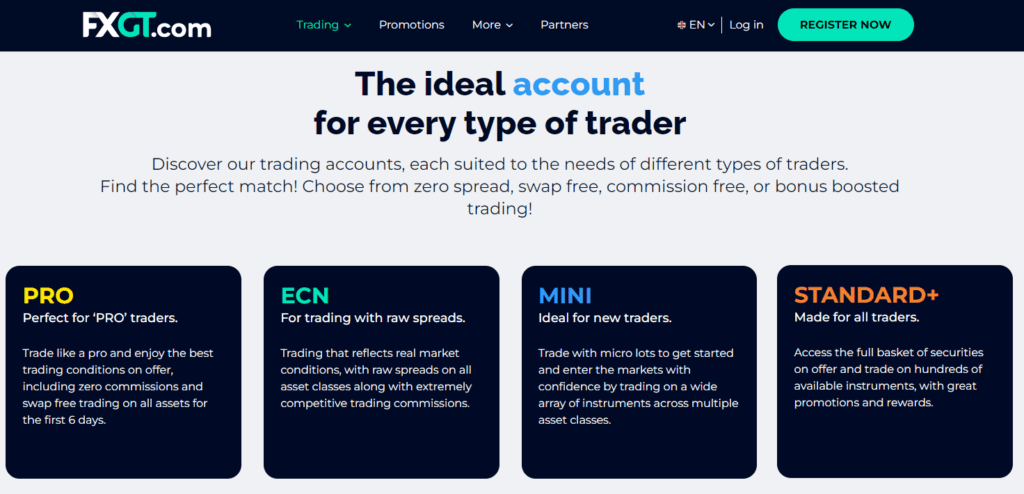

FXGT Account Types

FXGT understands that traders come from diverse backgrounds and have different trading needs and preferences. To cater to this broad spectrum, the firm offers several account types, each with its unique features and benefits.

Mini Account

This account is designed for those who prefer trading fractional CFD instruments. It comes with a low deposit requirement and basic trading features, making it ideal for beginners or low-volume traders.

Standard FX Account

Targeting Forex traders specifically, this account type provides access to a wide array of currency pairs along with some advanced trading features.

Standard+ Account

This account type offers high leverage and access to all trading instruments, suitable for traders looking for diversity and flexibility in their trading.

Pro Account

This is designed for high-volume or professional traders who desire premium trading conditions, such as low spreads and high leverage.

ECN Account

The ECN account is for traders comfortable with trading larger volumes and looking for raw spreads and a direct market access trading environment.

Demo Account

The Demo account is a practice account where traders can experiment with virtual funds, a great tool for beginners or for testing new trading strategies without any risk.

Islamic Account

Available upon request, the Islamic account complies with Sharia law, meaning it incurs no swap or interest charges on overnight positions.

FXGT Customer Reviews

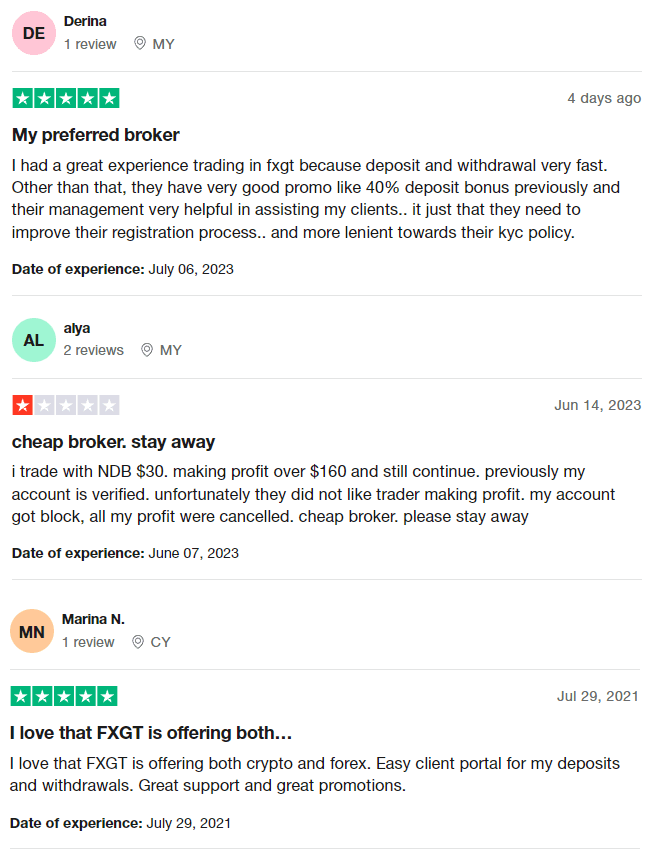

Trader testimonials reveal a spectrum of experiences with FXGT. Some traders commend the broker's quick deposit and withdrawal procedures, abundant promotional offers, and comprehensive selection of trading options, which includes both forex and cryptocurrency trading. Conversely, there are accounts of suspended trading and annulled profits, with these traders suspecting that FXGT may not favor significantly successful trading.

FXGT Fees, Spreads, and Commissions

FXGT operates primarily on a commission-free basis, with all charges included in the spreads. However, ECN Account holders are charged a $6 commission fee for trading transactions. The broker employs a floating or variable spread mechanism, where the spread fluctuates based on market conditions.

FXGT imposes an inactivity fee of $10 per month on dormant accounts. On the bright side, deposit and withdrawal fees are generally waived, although this could vary depending on the trader's region. For traders holding overnight positions, swap fees apply and vary per instrument. However, these fees are waived for those trading through a Swap-Free account.

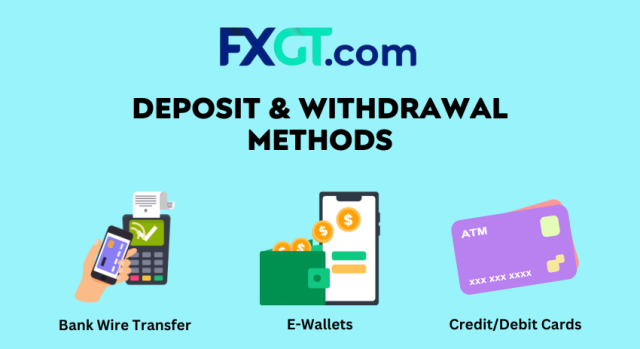

Deposit and Withdrawal

FXGT provides several deposit and withdrawal methods, offering traders the flexibility to choose the most convenient method. These methods include credit/debit cards, bank wire transfers, and several e-wallets such as Skrill, and Neteller, among others. The processing times for withdrawals depend on the method used, with e-wallet withdrawals typically processed within 24 hours.

While FXGT does not impose fees on most withdrawal methods, certain methods like bank transfers may incur fees levied by the bank. Traders are advised to review the FXGT website details or contact customer support for the most accurate information.

How to Open an FXGT Account

To initiate your trading journey with FXGT, the account opening process is quick and uncomplicated, designed with customer convenience in mind. Here's a step-by-step guide on how to go about it:

- Visit the FXGT official website and navigate to the “Open Account” button usually located at the top right corner of the homepage. Clicking on it starts your registration process.

- You'll be prompted to fill in a form with your personal information. This includes details like your full name, email address, contact number, and country of residence. It is essential to provide accurate information as it will be verified later for account authentication.

- After providing your personal information, you'll be directed to choose your preferred trading account type. FXGT provides a variety of accounts catering to different trading needs and preferences. The options range from Mini, Standard FX, Standard+ to Pro and ECN accounts. There's also a Demo account for beginners to practice, and a Swap-Free Islamic account.

- After selecting your account type, the next step is funding your account. FXGT offers multiple payment methods, including bank transfers, credit/debit cards, and various e-wallet options like Skrill and Neteller. The minimum deposit required to open a live account is just $5, a feature that makes FXGT accessible to various types of traders.

- Once your account is set up and funded, you are now ready to commence trading. You can choose to trade using either the MT4 or MT5 trading platforms, which offer various features to suit different trading strategies.

FXGT Partnership Programs

The FXGT partnership program is an excellent opportunity for those looking to capitalize on their networks in the Forex industry. FXGT offers five different reward plans based on the number of clients a partner invites and the volume of trades those clients complete.

Under the Bronze plan, a partner can earn up to $4 per lot, under the Silver plan up to $6, Gold offers up to $8, Platinum provides up to $10, and the Elite plan can earn a partner up to $12 per lot. Importantly, partners are only rewarded for trades that have been open for more than five minutes.

The partnership program is structured into three levels, with the primary partner, known as the master, earning 100% of the profits. Level-1 sub-partners pay the master 10% of their earnings, while level-2 sub-partners pay 5% to the master. Rewards are paid weekly in the currency of the referral's trading account. However, trades involving bonus funds are not included in the fee calculation.

FXGT Customer Support

A strong customer support system is essential in the online trading industry, and FXGT places a high emphasis on this aspect. The broker provides around-the-clock support, ensuring help is available to traders any time they need it.

The support team can be reached via different channels including live chat, email, or phone. Traders who prefer instant answers can use the live chat option available on the website. Email support is ideal for less urgent queries, while phone support provides a direct line to the customer service team.

FXGT also hosts an extensive FAQ section on its website. Here, traders can access a wealth of information on common queries related to trading conditions, account management, deposits and withdrawals, and more. The aim is to empower traders by giving them easy access to information.

The FXGT customer support team is not just efficient, but also multilingual, catering to the diverse needs of its international client base. This global approach ensures that language is never a barrier to receiving high-quality support.

Advantages and Disadvantages of FXGT Customer Support

| Advantages | Disadvantages |

|---|---|

| ㅤㅤ ㅤㅤ ㅤㅤ | ㅤㅤ |

FXGT vs Other Brokers

#1. FXGT vs AvaTrade

FXGT and AvaTrade are both reputable brokers with distinctive offerings. FXGT stands out with its low minimum deposit of $5, appealing particularly to novice traders or those with limited funds. AvaTrade, on the other hand, requires a minimum deposit of $100, which may be a barrier for some investors.

In terms of trading platforms, both brokers offer MetaTrader 4 and 5. However, AvaTrade provides its proprietary AvaTradeGo and AvaOptions platforms, which offer a tailored trading experience. FXGT, while lacking proprietary platforms, compensates by providing a wide array of trading instruments including FX, CFDs, Metals, Indices, Energies, Stocks, Cryptos, Synthetic pairs, Defi Tokens, NFTs, and the exclusive GTi12 Index.

Considering the sign-up bonus, FXGT offers a 50% sign-up bonus and a 30% deposit bonus. AvaTrade's bonus structure is different and depends on the deposit amount, which may be less advantageous for small-scale traders.

Verdict: For novice traders and those preferring a low initial deposit and attractive bonus, FXGT is the better choice. For those looking for proprietary trading platforms and a more established brand, AvaTrade would be the preferred broker.

#2. FXGT vs RoboForex

FXGT and RoboForex are two different brokers with varied characteristics. RoboForex has been in the market since 2009, offering more years of experience compared to FXGT. This might be attractive for traders looking for a more established and proven broker.

However, FXGT's minimum deposit stands out again, being significantly lower than RoboForex‘s $10. FXGT also offers a more attractive bonus structure, with a 50% sign-up bonus and a 30% deposit bonus, which RoboForex does not match.

In terms of trading platforms, both brokers offer MT4 and MT5, with RoboForex also offering a proprietary platform, the R Trader. In contrast, FXGT provides a broader range of trading instruments.

Verdict: For those looking for an experienced broker with a proprietary platform, RoboForex could be a better choice. However, for traders preferring a lower initial deposit, larger bonus structure, and broader instrument availability, FXGT is the better option.

#3. FXGT vs FXChoice

FXChoice and FXGT provide unique trading experiences and have their strengths. FXChoice, established in 2010, provides a sense of reliability with its more extended market presence.

FXGT's minimum deposit of $5 provides an advantage over FXChoice's $100, making it more accessible for traders with limited funds. FXGT also surpasses FXChoice with its attractive bonus structure.

Both brokers provide access to the MT4 and MT5 platforms, and while FXChoice does offer a narrower selection of trading instruments, it is recognized for its excellent customer service and faster execution speeds.

Verdict: If excellent customer service and faster execution speeds are the priority, FXChoice could be the better choice. However, for those seeking a lower initial deposit, an attractive bonus scheme, and a wide variety of trading instruments, FXGT would be the preferred broker.

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FXGT Review

In conclusion, FXGT, despite being a relative newcomer, has managed to make a substantial impact on the global forex trading landscape. Offering a wide array of trading instruments, lucrative bonus schemes, a variety of account types to cater to diverse trader needs, and a robust safety framework, FXGT makes a compelling case for itself as a preferred broker.

Their emphasis on harnessing digital advancements and cryptocurrencies' potential reflects their commitment to staying at the forefront of the industry. The low minimum deposit and the array of user-friendly features make FXGT an attractive choice for both novice and seasoned traders.

While it's always essential for each trader to do thorough research and choose a broker that best fits their trading style and goals, FXGT seems to cater to a wide spectrum of trader profiles. Their growth in markets like South Africa speaks volumes about their global aspirations, and it will be interesting to see how they continue to evolve in the ever-changing forex landscape.

FXGT Review FAQs

What is the minimum deposit required to open an account with FXGT?

The minimum deposit to open a live account with FXGT is just $5. This makes it accessible to a wide range of traders, from beginners to more experienced individuals.

Does FXGT offer a demo account for practice?

Yes, FXGT provides a demo account option. This is a risk-free environment where beginner traders can practice their trading skills and experienced traders can test new strategies, all using virtual funds.

How does FXGT ensure the safety and security of my funds?

FXGT employs several measures to safeguard your funds. It segregates client funds from operational funds, storing them in various Tier 1 banking institutions. Furthermore, advanced encryption technology, secure servers, and robust firewalls are used to ensure data security. FXGT also offers negative balance protection and maintains a high capital adequacy ratio, giving traders additional peace of mind.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.