FTMO Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Prior to forming any opinions about proprietary trading firms, the experienced panel at the Dumb Little Man platform conducts a thorough assessment of the firm. This panel is comprised of retail traders, financial advisors, and trading experts, all collaborating to ensure an impartial and accurate evaluation. Furthermore, an algorithm is employed in the evaluation process to differentiate each broker based on established criteria. These criteria encompass:

After applying the aforementioned criteria to assess FTMO, we deemed this firm to be a reputable proprietary trading establishment that satisfactorily meets numerous trading requisites in terms of cost-effectiveness and overall broker proficiency. It is worth noting, however, that the challenges presented by FTMO are notably rigorous, demanding traders to consistently employ effective strategies in order to successfully navigate the evaluation phase. All in all, FTMO was observed to be an authentic proprietary trading firm with a dedication to delivering exceptional trading services to its clientele. The firm boasts a proficient trading platform equipped with advanced features found in MT4, MT5, and cTrader. |

FTMO Review

Proprietary trading firms stand out as exceptional entities in the dynamic world of financial markets, where opportunities and risks converge. These businesses, often known as “prop trading firms,” operate at the intersection of creative ideas and financial resources. By combining creative techniques with knowledge and a dogged quest for profit, they have solidified their image as key actors in modern trade.

FTMO stands out as a forerunner in this dynamic environment after starting out as an innovative business and developing into a worldwide investment powerhouse via constant innovation. The trajectory of FTMO emphasizes how ambition and ingenuity can alter the financial industry.

Before working with this proprietary trading company, you should have a thorough understanding of the pros and cons, user feedback, benefits, security precautions, features, and more, which we will cover in-depth in this FTMO review. Additionally, traders and investors will obtain knowledge about the company’s limitations, enabling them to choose a prop trading partner with confidence. Our goal as we explore FTMO’s offerings is to arm you with the knowledge you need to successfully seek success in the prop trading industry.

What is FTMO?

FTMO, an abbreviation that represents its founders – Filip, Tomas, Marek, and Otakar – is a renowned proprietary trading firm that was established in the Czech Republic in 2014. The purpose of creating this organization was to provide financial resources to capable and aspiring traders who may be reluctant to step into the market due to a lack of funding, despite their potential to earn significant profits.

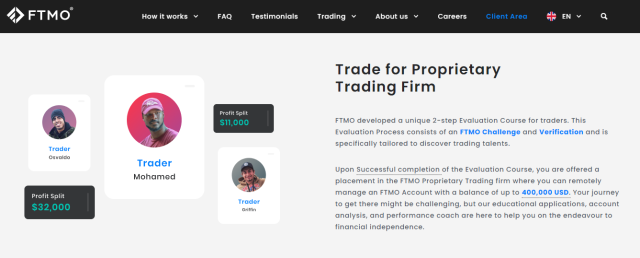

Therefore, FTMO proprietary trading firm operates by identifying and offering trading capital, as much as $1 million, to traders possessing the necessary skills. Nevertheless, before these funds are disbursed, traders must undergo a two-tier evaluation procedure, comprising trading challenges and account verification.

This evaluation process enforces a mandatory adherence to trading guidelines and ensures that FTMO traders generate profits for both themselves and the firm. The revenue is distributed in an 80:20 ratio, where the FTMO trader retains 80%. If a trader successfully navigates the FTMO challenge and verification stages, they are then deemed ready for live trading in the financial marketplace.

An aspiring trader must clear a two-step active trading examination. The initial step is the FTMO challenge, followed by the verification phase. The first step encompasses a minimum of 10 trading days and can extend up to a maximum of 30 trading days. Ultimately, to secure considerable funding of $1 million for actual trading, the trader must fulfill all the prescribed trading objectives.

>> Also Read: Forex Trading for Beginners • Step by Step

FTMO Pros and Cons

Pros:

- The cost of the testing is reasonably low.

- Traders are initially awarded an attractive 80% of profits.

- A wide variety of scripts, advisors, and indicators are available for established platforms like MT4, MT5, and cTrader.

- There’s an array of tariff plans offering diversification.

- The profit targets set are realistic and achievable.

- The withdrawal process is straightforward and uncomplicated.

Cons:

- The funding details of the company remain undisclosed.

- The origin of the capital is unclear.

- Trading goals set can be quite demanding and challenging.

Safety and Security of FTMO

The trader’s financial risk is constrained to the test fee under the FTMO framework. To put it another way, a trader’s financial responsibility is limited to the fee they pay to take part in the proprietary firm’s qualification procedure.

The trader starts trading with the firm’s capital rather than their own money after passing this test. This concept helps traders with limited financial resources since it enables them to use their trading expertise without putting their cash in danger.

However, there are problems with the company’s operation being transparent. Even though it is well known that FTMO does not fall under the legal definition of an investment or pension company, detailed information regarding its operations and regulatory oversight is still lacking.

Some traders or potential traders may be alarmed by this lack of transparency, especially if they are trying to figure out where the firm gets its money from and how it complies with financial standards. Due to the lack of specific information, some people may be hesitant to work with the company due to doubts about the reliability and security of their trading model and operations.

FTMO Bonuses and Contests

The way that FTMO does business is distinct from conventional brokerage methods. Contrary to many trading companies or platforms, FTMO does not employ bonuses, competitions, or promotional offers as means of luring new customers or motivating current ones. By its strategy, the proprietary trading firm does not provide bonuses to its traders or hold trading competitions, two standard strategies employed by many brokers to promote trading activity and boost client engagement.

FTMO Customer Reviews

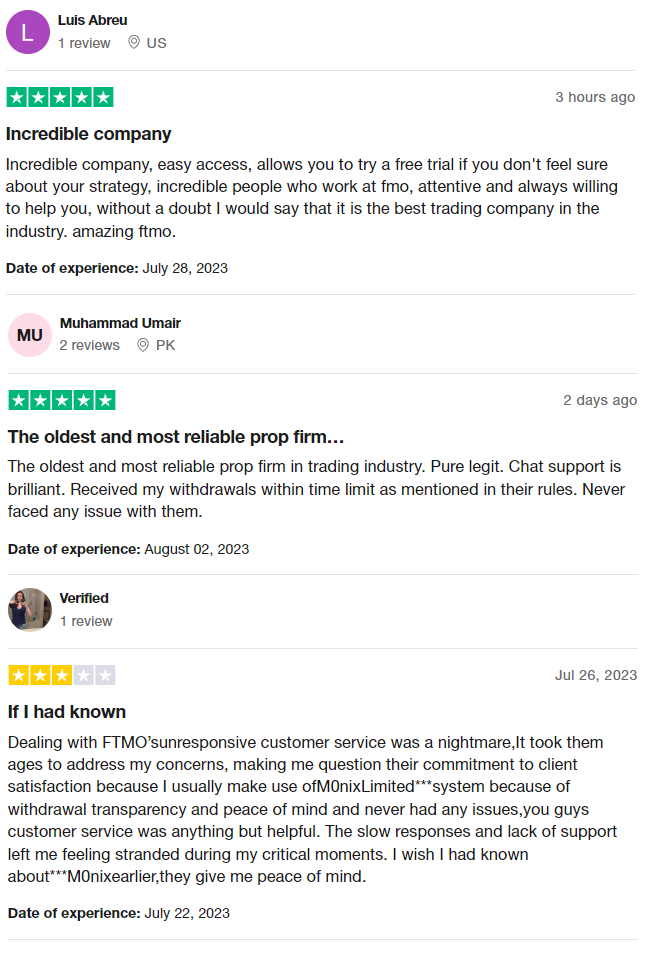

The customer reviews about FTMO are mixed.

On a positive note, numerous clients commended FTMO for being an excellent proprietary trading company in the sector. They enjoy how simple it is to use the platform and how the free trial option enables prospective traders to experiment with different trading approaches. The FTMO support team is praised for their attention to detail and readiness to help, while the business is praised for its dependability, experience, and credibility in the trading sector. Numerous customers praise the company’s prompt withdrawal method and claim to have had no problems using the platform.

Contrarily, several unfavorable reviews complain that FTMO’s customer service is poor. Customers have said that the company’s support staff is a pain to work with since they respond slowly and provide insufficient help when it counts. These clients picked other systems because of their withdrawal transparency and greater customer service since they believed that the company’s dedication to client pleasure was in doubt.

FTMO Commissions and Fees

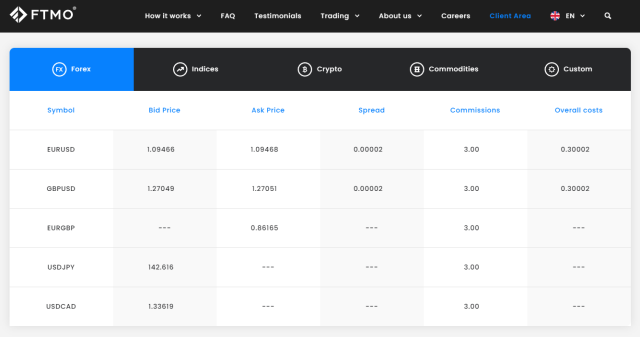

Traders are required to pay a nominal, refundable fee to create an account on FTMO before they can go through the review procedure. This fee is expressed as a percentage of the account balance. For example, there is a $170 cost for maintaining a balance of $10,000, $270 for $25,000, $370 for $50,000, $580 for $100,000, and $1100 for a balance of $200,000.

Furthermore, FTMO’s commission structure varies for each asset class. The company does not charge a fee for dealing in indices or cryptocurrencies. Forex trading, on the other hand, has a standard commission rate of 3% per traded lot. Commodities commissions are asset-specific but typically offer better value than those offered by other proprietary trading firms.

In addition to the various commission rates and the refundable account fee that is returned at the initial profit split, FTMO does not charge any further costs for using the platform. Traders will not incur any fees when receiving their payouts, barring any transfer or third-party fees levied by a bank.

FTMO Account Types

To determine whether traders are worthy of accessing FTMO‘s large investment, the company has developed an evaluation process. First, a trader must sign up for an account on the FTMO platform; there, they can pick between two distinct account types known as the Standard Account and the Aggressive Account.

FTMO Standard Account

The Standard Account offers traders a range of account balances from $10,000 to $200,000 to choose from. Although the fundamental trading requirements remain the same regardless of account balance, there are variations in details like profit loss, profit target, and refundable fees. As part of the preliminary assessment for this account type, a daily loss cap of 5% of the opening amount and a cumulative loss cap of 10% for the trading term are imposed. Ten percent of the starting capital is chosen as the profit goal.

To advance to the verification phase, traders are given 60 days to achieve the aforementioned trading targets. The profit goal is reduced to 5% and the trading duration is increased by 60 days compared to the first stage. During this verification phase, traders are not charged any fees.

FTMO Aggressive Account

The Aggressive Account is designed to encourage more intense trading than the Standard Account. While this account type shares the same structure as the Standard Account, its profit goals and loss protections are more liberal. There is a daily loss cap of 10% and a cumulative loss cap of 20%. The profit goal is significantly higher than in the Standard Account, at 20%. Therefore, the Aggressive Account is best for seasoned traders who have the knowledge and competence to confidently meet FTMO’s tough criteria.

>> Also Read: 8 Ways to Become a Successful Day Trader

Opening an FTMO Account

Opening an account on the FTMO platform is a simple process that includes the following steps:

- Begin by going to the official FTMO website and starting the signup process for a free account.

- Continue to the next stage, where you will finish the registration by providing information on the registration form. Confirm your human identity by completing the “I’m not a robot” reCaptcha, and then complete the process by clicking the “Signup” button to enter all required information.

- Navigate to the proper sign-up tab after confirming accurate input of information, including your name, email address, phone number, and nationality.

- Verify your password by clicking on the verification link provided in your email. Follow this link to choose and set your new password.

- After signing up, you’ll have access to the FTMO portal where you can start the preliminary stages of the review process. Choosing an account type and the accompanying fee is necessary for this.

- When opening an assessment account with the proprietary firm, the first step is to specify what kind of account you want.

- After you’ve selected the appropriate account type and specified the initial account balance, click on the “Open Account” tab. This action redirects to the billing information page.

- Confirm your choices by clicking the “Confirm and Proceed to Payment” button. Following that, select your desired payment option, allowing the payment to be processed. You are now ready to begin your trip through the site, using the login information provided to you.

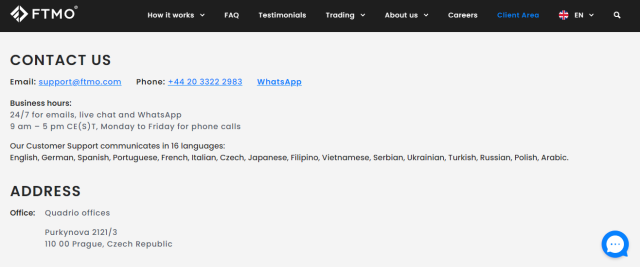

FTMO Customer Support

FTMO has an effective customer support team that includes not only experienced customer care representatives but also financial specialists, allowing them to give high-quality, personalized support. This multilingual crew speaks 19 languages, enabling excellent communication with a wide range of clients.

Every team member is given a comprehensive arsenal, which includes plenty of workspaces, trade indicators, and cutting-edge technology. This structure ensures that they are well-prepared to assist traders in achieving good trading outcomes. The crew is highly driven and determined, and they stand ready to answer questions, provide direction, and facilitate future contract conversations.

FTMO provides a variety of avenues for client touch and communication. Traditional communication channels include phone, email, and live chat on the company’s website. Furthermore, the organization embraces the digital age by offering customer assistance via numerous social media sites. Clients can contact FTMO representatives via platforms such as WhatsApp, Facebook, Twitter, Instagram, and others, allowing them to communicate with FTMO most conveniently and comfortably for them.

Advantages and Disadvantages of FTMO Customer Support

| Advantages | Disadvantages |

|---|---|

FTMO Withdrawal Options

With a minimum investment of under $200, FTMO provides a very accessible platform for traders on a tighter budget. Traders can pay for the FTMO Challenge in a variety of ways, including bank wire transfers, debit/credit cards, cryptocurrencies, and Skrill.

Profit division on an FTMO account is performed on a monthly basis by default. However, a trader has the opportunity to request a payout once 14 days have passed since the initial trade on the account.

Payouts are executed within 1-2 business days once an invoice is validated. Profits can be received via wire transfer, Skrill, or cryptocurrency. Withdrawals are not subject to any commissions at FTMO.

FTMO does not need traders to make a minimum profit in order to qualify for a Profit Split of up to 90%. Any profit made is shared 80/20 (or 90/10 on the Scale-up plan) and distributed to the trader.

If a trader meets the terms of FTMO’s Scaling Plan, their account balance will be increased by 25%, and their payout ratio will immediately shift to an astounding 90/10.

Traders can keep their Profit Split in their account to increase their balance and drawdown buffer. It is important to note, however, that FTMO will always withdraw its share of the Profit Split.

FTMO Challenge Difficulties

Navigating the FTMO challenge offers traders a tough array of challenges, emphasizing the complexities of this evaluation process.

Getting Around the 5% Daily Drawdown Barrier

The difficult trip through the FTMO challenge is distinguished by the strict constraint of a 5% daily drawdown. Drawdown, a word that describes the difficulties that traders face when market prices fall, becomes a critical issue of contention. Drawdowns, defined as the drop from the peak of profitable trading to the depths of loss, can be a significant difficulty.

This constraint is enforced as a hard test for even the most talented traders in the context of FTMO challenges, requiring a careful balance between risk-taking and strategic accuracy to stay within the confines of the stipulated drawdown.

Ambitious Profit Targets

During the first part of the FTMO challenge, traders face a lofty profit target of 10% of the initial payment. This aim falls to 5% as the evaluation continues to the verification phase. This enormous aim looms as a substantial challenge, heightened by the tight time limits of 30 days in the first stage and a more expansive 60 calendar days in the following stage.

Meeting these lofty profit targets necessitates a combination of keen market insights, strategic acumen, and steadfast discipline within a constrained time frame, increasing the hurdles faced by aspiring traders.

The Persistence of Minimum Trading Days

Among the many requirements inherent in the FTMO problem, the need for a minimum of 30 trading days emerges as a critical issue. However, a nuanced limitation exists within this criterion: only days designated by the commencement of trading positions are taken into account.

The confluence of daily loss limit maintenance, profit target attainment, and the requirement of maintaining trading positions for a ten-day stretch emerges as a multidimensional difficulty. This condition intertwines various aspects of successful trading inside a tight web of demands, providing a web of complications for traders to negotiate skillfully.

How to Pass FTMO’s Evaluation Process

Navigating the complexities of the FTMO review process can be a difficult task, especially for traders who are just starting out in the trading arena. It puts your knowledge, strategy, and resilience to the test in real-world market situations.

However, if you empower yourself with the necessary knowledge and abilities, the road to success is substantially smoother, making enrollment in a thorough training program mandatory. A program like this can provide you with the tools and knowledge you need to overcome the hurdles of the evaluation process, paving the path for a successful trading career with FTMO.

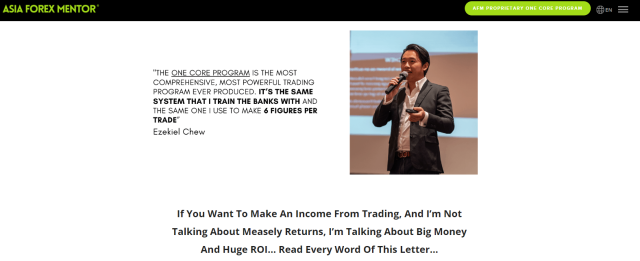

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Despite its geographical implication in the name, Asia Forex Mentor serves budding traders from all around the world. This platform has earned the distinction of being the world’s leading forex education provider, having trained thousands of people from all over the world.

Ezekiel Chew, a renowned forex trading guru who frequently earns six figures per trade, is the mastermind behind Asia Forex Mentor. Chew, who has over twenty years of trading experience, also controls the Golden Eye Group and developed the exclusive One Core Program. This project seeks to provide forex traders with the knowledge and skills necessary to benefit from forex trading.

Chew’s trading success is undeniable, and Asia Forex Mentor was created as a platform for him to share his wealth of knowledge, skill set, and broad experience with others. Surprisingly, this educational path began with Chew’s friends’ demands for trading lessons.

He moved these lectures online as demand expanded, and his platform has been thriving and increasing ever since. Enrolling in Asia Forex Mentor can thus give you the critical training and insights required to successfully navigate and pass the FTMO’s evaluation procedure.

How Could Asia Forex Mentor Help You Pass FTMO’s Challenge?

For various reasons, Asia Forex Mentor is well-positioned to assist individuals in effectively navigating and passing FTMO’s review procedure.

- Firstly, Ezekiel Chew, a seasoned trader, established the program’s comprehensive curriculum, which provides in-depth insight into the methods and abilities required for profitable forex trading. This expertise is essential for navigating the FTMO’s rigorous examination procedure, which examines an applicant’s trading aptitude.

- Second, Asia Forex Mentor’s practical approach ensures that students receive hands-on experience in a variety of market settings. This real-world exposure and experience can be quite beneficial in handling the trading circumstances and criteria of FTMO.

- Third, Asia Forex Mentor’s patented One Core Program is designed to teach traders how to consistently make lucrative trading selections. This corresponds to one of FTMO’s major evaluation criteria: consistent profitability.

- Finally, AFM was named the “Most Comprehensive Course” by Investopedia, a leading finance and investment website. Furthermore, AFM’s One Core Program was named the “Best Forex Trading Course” for novices by the premier financial news site, Benzinga.

These prestigious honors and recognitions are only the tip of the iceberg. Asia Forex Mentor’s One Core Program continues to outperform expectations, catering to both new and experienced traders, solidifying its legitimacy and prestige in the forex trading education field.

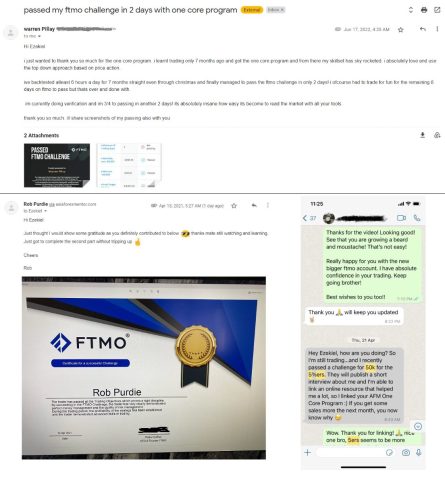

Asia Forex Mentor Members’ Testimonials

As evidenced by the immense praise received from its customers, Asia Forex Mentor‘s One Core Program, led by Ezekiel, has been vital in assisting traders to successfully complete the FTMO challenge.

- After only seven months of participating in the One Core Program, one user was able to drastically improve their trading skills. The top-down, price-action-based approach of the program was highly praised. The user passed the FTMO challenge in two days with constant practice and backtesting for hours per day and is making steady progress toward passing the verification stage.

- Another trader who was previously successful in the trading sphere completed a 50k challenge set by the 5%ers. They intend to credit their success in a forthcoming interview to the great instruction they received through the One Core Program.

- Another student also expressed genuine gratitude to Ezekiel for his substantial impact on their success. They have cleared the first level and are now confidently working towards finishing the remainder of the challenge.

These testimonials demonstrate Asia Forex Mentor’s One Core Program’s potential and efficacy in assisting traders to overcome challenges and evaluation processes such as FTMO, transforming them into confident and proficient traders.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: FTMO Review

FTMO provides an amazing chance for traders to gain access to large amounts of capital and achieve their trading potential without putting their personal finances in danger. FTMO provides a comprehensive platform for prospective prop traders, with its rigorous evaluation procedure, clear rules, transparent profit-sharing arrangements, and strong client support.

Traders should be wary of a few things, including the need for self-funding at the preliminary review, and the absence of regulatory oversight. FTMO comes out as a credible prop trading organization giving a unique opportunity for traders, despite several aspects that may be improved, such as more clarity regarding the company’s funding and regulation.

FTMO Review FAQs

What exactly is the FTMO evaluation procedure?

The FTMO evaluation procedure is a two-step procedure meant to test a trader’s capacity to manage large sums of money while adhering to trading laws. To begin, the trader must successfully complete a challenge in which they must achieve a profit target while staying under the maximum loss limits. If the deal is successful, the trader advances to the verification phase, which has a more relaxed profit target.

In FTMO, how does the profit share work?

Profit splitting in FTMO is a monthly process by default, although on-demand payouts can be requested after 14 calendar days after the account’s first trade. The profit is shared 80/20 by the trader and FTMO. If the trader satisfies the FTMO Scaling Plan parameters, the account balance is enhanced by 25% and the payment ratio is changed to a more attractive 90/10 split.

Is training provided by FTMO in order to pass the evaluation process?

Yes, FTMO does offer training to help you pass the evaluation procedure. However, to boost their chances of success, traders should engage in rigorous training and practice, such as the curriculum given by Asia Forex Mentor.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.