Best Forex Head and Shoulders Strategy in 2025

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The Forex market is one of the largest financial markets in the world. To give you a brief idea of how big the Forex market really is, I have a general stat for you: The New York Stock Exchange is the largest stock exchange in the world with a daily market cap of nearly 25 billion US dollars! 25 billion dollars is a huge amount, and this amount is worth more than the GDP of several countries in the world. On the other hand, the Forex or Foreign Exchange market has a daily market cap of nearly 6 trillion dollars, which is nearly 8.25% of the entire world's economy.

The Forex market is without a doubt the largest, and one of the most important financial trading platforms in the world. Traders from all over the globe trade on this market, and it would be safe that the Forex market plays a vital role in maintaining the world's economy. All these reasons make the Forex exchange a highly lucrative option for novice traders who want to grow their money by investing in the Forex markets.

Now, Forex is also a kind of trading, and many people believe Forex trading to be similar to Stock Trading. However, this is not true, and both these markets differ from each other. While the forex market basically involves the exchange of currencies, the stock market involves the trading of equity securities of real companies.

Now regardless of the market, you are planning to invest your money in, it is vital to gain investment knowledge so that you can make sensible decisions. These decisions would decide whether you will be growing your money, or would you be losing it in the market. Because we are dealing with the Forex markets, we are going to talk only about the Foreign Exchange markets.

Now, there are a lot of different strategies, and analyzing techniques involved in the Foreign Exchange market that can help you analyze the Forex market better. Now there are several analyzing techniques involved in Forex trading like reading Forex charts, analyzing the performance of currency pairs, and more.

However, in this article, we are going to talk about a strategy that is extremely popular amongst seasoned Forex traders that goes by the name of the Head and Shoulders strategy. We are going to tell you everything you need to know about the Head and Shoulders strategy including what it is, how it works, how to use it, and the benefits that it offers.

However, before we have a look at the Head and Shoulders strategy, why don't we have a look at the Forex market, so that we can understand this article better.

Forex Head and Shoulders Strategy: What is Forex?

Before we get into a discussion of the head and shoulders pattern, it is important to gain basic knowledge about the market, so this article is a level playing field, even for those who are just interested in Forex trading. After all, you will be using the two shoulders pattern in your retail investor accounts in the forex market.

Well, to put it in plain & simple words, the foreign exchange or the Forex market is a global marketplace where people from all over the world exchange currencies. Now, trading on the Forex market usually takes place between two entities: traders can exchange currencies with other traders, or with a large financial institution like a bank.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Forex Market: Derivatives

What if I say that you do not need to exchange real currencies to be able to take advantage of this $6 trillion a day market. Yes, the Foreign Exchange market deals mainly with currencies from across the world, there are forex derivatives that give you exposure to the market from anywhere.

A derivative is basically a financial instrument whose value to determined by the value of an underlying asset. In this case, the underlying asset will be a currency pair. Derivatives are offered by many online brokers. But before you get in, please note that these are leveraged products that come with a significant risk of losing money rapidly. If you are new to all this, make sure you get advanced knowledge and info about forex trading for technical traders and so much more.

Investing in Forex Market: Technical Analysis

So you have made up your mind to be a Forex trader. You have got everything set up, and you are ready the enter the huge world of currency trading. It is worth noting that in today's time it is extremely easy to invest your money in the market, and all it takes is a few clicks. However, making sensible investments that would help you grow your money is difficult, especially in current times when more and more people are aspiring to establish themselves as the next big thing in the world of Forex traders.

If you want to make sure that you are sensible investment decisions, it is vital to gain knowledge of the market, and the currency pairs that are more likely to give higher RoI or Returns on Investment. Technical analysis is a skill set that is considered to be a must-have if you want to venture into the Forex trading world. Technical analysis is what helps good traders become great traders.

Now, there are multiple techniques used in the technical analysis. In this article, we are going to talk about the “Head and Shoulders pattern“, and tell you everything you need to know about these head and shoulders patterns. So let's have a look at what exactly do we mean by head and shoulders pattern.

What is the Forex Head and Shoulders Pattern Strategy?

The head and shoulders pattern strategy is very common, and one of the most popular trading approaches amongst Forex traders. One of the major reasons why these Head and Shoulders Patters are so popular amongst Forex traders is that they are highly effective, highly accurate, and they are not difficult to understand, even for beginners.

The Head and Shoulders pattern tries to identify a trend reversal pattern for a given currency pair. So what exactly is trend reversal? So, in most cases, currency trading pairs will have upward and downward price movements. When the price has gone up or down consistently over a period of time, that pair is said to be on a trend. But trend reversals in price charts are very common. This simply referred to a stage in the trend line where the pair will reverse the general movement and retreat.

The Head and Shoulder strategy is designed to help traders identify this reversal and pick good entry points to short trade or long trade. So in essence, a head and shoulders pattern will appear if the market is about to reverse trends. As long as you pick the right entry point over the blue horizontal line and middle peak, you are likely to make decent returns with it. It is also possible to use several trading solutions or software to identify and execute a shoulder pattern with the right breakout price.

Trend reversal is an extremely common phenomenon in the Forex market primarily because the Forex market remains open for 24 hours a day, and there is always someone in the world who has his eyes set on any currency pair. It goes without saying that you cannot keep a watch on the Forex market 24 hours a day, and it is possible that the price of a currency pair might change drastically during the time you were off the market. Thus trend reversal is one of the major factors involved in the Forex market.

Head and Shoulders Pattern: How does it look like?

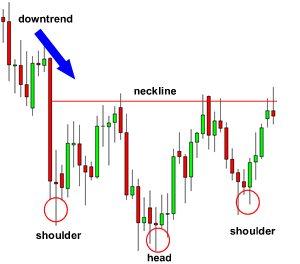

Before we can start discussing how to use the Head and Shoulders pattern, it is vital to know how do these shoulder patterns look like. Following is an image that depicts a common Head and Shoulders Pattern graph used by Forex traders.

There are three main components of any Head and Shoulders patterns graph:

- Left Shoulder: The Left shoulder on a head and shoulders graph indicates the rise in the price of a currency pair. The currency pair price then reaches a peak, after which the currency pair witnesses a drop in the price.

- Head: The head portion of a head and shoulders graph indicates that the price of a particular currency pair is increasing again.

- Right Shoulder: The Right shoulder of a head and shoulders graph indicates that the price of a currency pair is declining again. However, the price of the currency pair shoots as well, although the peak rise is less than the head of the graph.

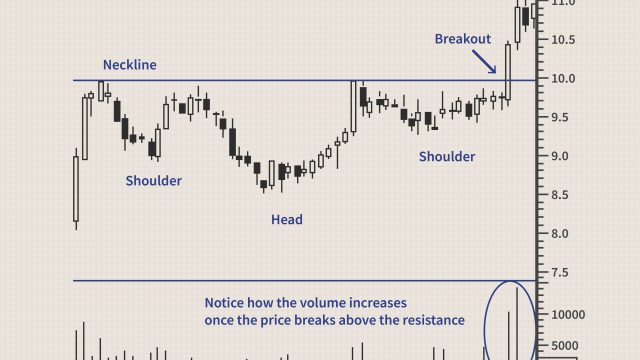

Inverse Head and Shoulders Pattern Graph

Just like the regular head and shoulders graphs, there also exists an inverse head and shoulders graph. An Inverse Head and Shoulders graph plays the same role as a regular head and shoulders graph, with the only difference being the pattern & appearance of both these charts. It would be safe to say that the Inverse Head and Shoulders graph is just an inverted head and shoulders graph.

There are three main components of any Inverse Head and Shoulders patterns graph:

- Left Shoulder: The Left shoulder on an inverse head and shoulders graph indicates that the decline in the price of a currency pair. The currency pair price then reaches a bottom, after which the currency pair witnesses a surge in the price.

- Head: The head portion of an inverse shoulders graph indicates that the price of a particular currency pair is forming a lower bottom.

- Right Shoulder: The Right shoulder of a reverse head and shoulders graph indicates that the price of a currency pair is increasing again. However, the price of the currency pair declines as well, although the peak fall is less than the head of the graph.

Head and Shoulders Patterns: Neckline

Neckline is a crucial part of any head and shoulders graph for a number of reasons. The neckline of a head and shoulders graph provides resistance or support to a trader thanks to which they can figure out several strategic areas where they can place their orders.

If you want to master the head and shoulders strategy, it is important that you know how to place these Necklines. The first step you need to follow is to locate the left shoulder, right shoulder, and head on the graph/chart.

Once you have located these three attributes, connect the low created just after the left shoulder, and connect it with the low generated just next to the head. This line would then be your “Neckline“.

How to Trade Using a Head and Shoulders Strategy?

One of the most important rules you always have to remember when trading using the Head and Shoulders charts is that you have to be patient. The Head and Shoulders charts take some time to develop completely, and you should ideally place your bets once the chart has developed completely, and you have analyzed it properly.

Now it goes without saying that you should analyze the graph while it is under development, but the final decision needs to be made only after the chart has been developed completely.

Once the chart has been developed completely, you need to create a neckline, using the steps we discussed in the earlier section. Once done, you can start placing your bets on the Forex market using the head and shoulders patterns. However, before you begin, there are two fundamentals that you need to memorize with your heart.

- When observing a regular head and shoulder graph, we are looking for the price to move lower than the neckline break, right after the peak obtained in the right shoulder.

- When observing an inverse head and shoulder graph, we are looking for the price to move higher than the neckline break, right after the bottom obtained in the right shoulder.

For a lot of traders, the common entry point is the instant when the breakout occurs. A breakout simply means a situation when the price of an asset(here the currency pair) moves above the resistance area, or it drops below the support area. This is when the neckline is broken, and you make the trade.

Another popular method amongst forex traders is to wait for the “Pullback” to the neckline after the breakout situation has already taken place. This method is a more conservative approach, as it requires a lot of patience, and if the currency pair resumes it original breakout direction instead of the pullback direction, then you might miss the trade opportunity.

Placing your Stops

Knowing where and when to place your stops is another crucial factor of the head and shoulders chart patterns graphs. Most of the Forex traders usually place their stops just above the right shoulder of the graph which is the point where the neckline is just penetrated. However, it is not a rule, and you can also place your stops at the head of the shoulders pattern graph.

However, placing your stops at the head is considered to be an extremely risky affair, and the risk to reward ratio when you are placing your stops at the head is increased significantly.

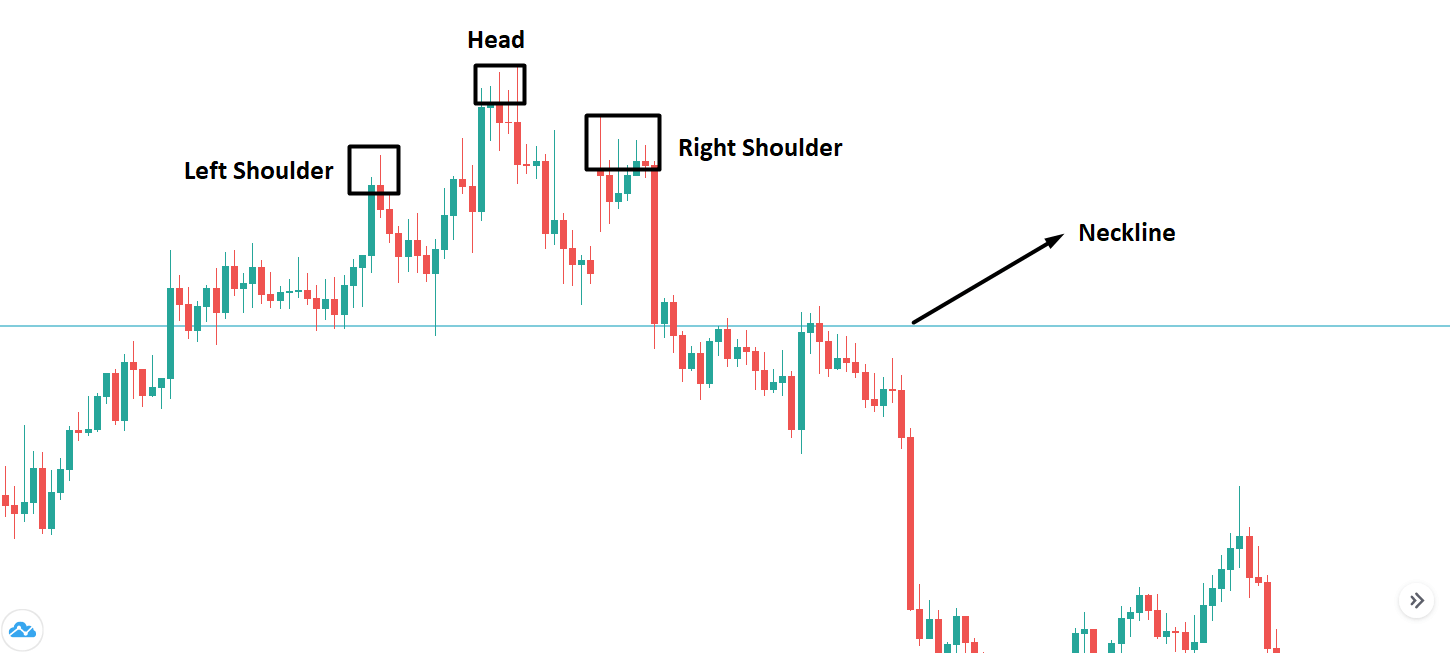

Head and Shoulder Graph: Identifying Trend Reversals

The chart patterns on the right shoulder or left shoulder are simple tools that allow you to identify a trend reversal. So, they can not tell you the exact way the market will move. There are two main trends in the forex market that can be predicted by the head and shoulder patterns. This includes the bullish trend and the bearish trend.

So, what does a bullish chart pattern look like? Well, this pattern has three main troughs. Here, the central low point which is the head will be the lowest. The other 2 shoulders will be roughly equal. Think of it as a human head with shoulders on both sides. However, instead of standing upright, the head will be inverted. When this happens, it suggests that the market is going to have a bullish trend.

The bearish head and shoulder pattern is the exact opposite. Again, think of it as a human head with the shoulder on both sides. But instead of the head being inverted as it is in the bullish chart patterns, the head will be upright in a bearish trend. In essence, the head will represent the highest price of the currency pair at that given moment.

Does Forex Head and Shoulders Chart Pattern Work?

The short answer is yes, the head and shoulders chart pattern works. But it's not as simple as you would assume. Technical analysis is a good way to understand the direction of the market. But even with advanced technical analysis pattern tools for helping you with the head and shoulders pattern, forex markets are very volatile and as such, there may be some occasions where the strategy will not hit the profit target.

The good news is that the head and shoulders pattern strategy is a classic analysis tool that has been used by so many traders over the years. It is an effective way of identifying trends in the market and making the most out of them. There are however some limitations when it comes to head and shoulders patterns.

First, this is a highly sophisticated trading approach that may not be ideal for beginners. Also, it is important to note that the head and shoulders bottom analysis is simply a tool to identify a trend. It does not constitute investment advice and you must decide how much capital you are willing to risk at any given time.

How to Make Money with Forex Head and Shoulders Pattern Strategy?

Different people have different profit targets when they use this strategy in trading forex. There are however three crucial things to keep in mind if you want to make money using this trading strategy. The first thing is to know what your profit target is. You don't want to be too greedy. However, it is also important to ride out a trend for as long as possible.

In most cases, if you can lock in at least 20% of profits, you are good. Secondly, always include a stop loss. Sometimes the price falls even if the head and shoulders pattern showed a bullish run. It could be because of underlying fundamental factors like geopolitics or shocks in the economy.

With a stop loss in place, you will easily protect your capital in case the trade goes against you. Finally, it is also important to understand basic capital management.

For example, one big rule for traders is to never risk more than 10% of their accounts in one trade. This means that even if the price target is not hit and you end up losing trades, there will still be enough money in your trading account to make a comeback.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Forex Head and Shoulders Pattern Pros and Cons

As you would expect from any trading strategy, the head and shoulders pattern has several pros and cons that you should know about. Here is the full list starting with the pros:

Pros

- The head and shoulders pattern is one of the most reliable trading strategies in forex.

- Can be used to determine a continuation pattern or trend in a market.

- Does not require a lot of indicators to understand or analyze.

- You also get a huge variety of tools to analyze these patterns.

Cons

- The method can be very challenging for beginners.

- The inverse pattern is not always accurate.

Best Forex Trading Course

Investing in the Forex market might seem to be a daunting task especially if you are a beginner, and have just started exploring the Forex market. Although experience is said to be the best teacher when dealing in the Forex market, it is good to learn about the Forex market briefly before making your first investment.

There are several ways in which you can start expanding your knowledge of the stock market. You can either start reading books or ask for tips from your friends or family members who have prior experience of trading on the Forex platform. However, the former is a time-consuming method while the latter is not always a credible learning source.

If you want to learn about investing in the Forex market that would help you gain knowledge, and tell you all you need to know about the market, then you can opt for some professional courses available on the internet. These courses are developed by Forex markets experts who have years of training Forex traders.

Now, there are thousands of courses on the internet that claim to teach you about Forex investment. However, not all of these courses are reliable and give accurate information. So which is the best Forex course for learning the ins and out's of the Forex market?

Asia forex mentor course by Ezekiel is by far one of the best Forex learning courses on the internet, and they are one of the best learning sources if you want to expand your Forex trading knowledge.

They have been featured on multiple different leading forex platforms and Forex events happening around the world. Ezekiel's platform is the perfect solution for you to learn because their clients include multiple trainees and bank traders from private trading institutions around the globe.

It is the number one course available on the internet because it also reaches new bank traders and has fun managing if you want to make money from trading forex stocks and other commodities.

You can get a great return on investment by indulging yourself in this systematic course. Even if you are a beginner in the field and do not have enough experience and knowledge about Forex trading, you still join this program with zero knowledge. Everything will be taught to you from scratch, and you can enroll yourself in this program right now to get started.

Check out the testimonials on the website and start your Forex trading journey right away. The good thing about this course is that you will be crystal clear about what you need to do from day one.

They are using a return on investment approach to teaching their students. It is a scientific method of beating the market, and you will not be taught this somewhere else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

So it's time for us to conclude this article now.

Conclusion: Why Use Forex Head and Shoulders Patterns Strategy?

The Head and Shoulders strategy is one of the most popular technical analysis methods followed by Forex traders, and there are several advantages of using these graphs with shoulder patterns.

In this article, we have told you everything you need to know about the Head and Shoulders pattern graphs. We first introduced these graphs to you, and we discussed why are they called so.

Then we told you how to read these graphs and some of the rules that you must follow when using the Head and Shoulders strategy for trading on the Foreign currency market.

Then we discussed how to trade on the Forex market using the Head and Shoulders patterns graphs. TO finish things off, we discussed the Pros and Cons of these graph patterns.

The Head and shoulders formation is one of the must-have skills for any Forex trader, especially if you want to make a name for yourself in the Forex market.

Forex Head and Shoulders Patterns Strategy FAQs

Does the head and shoulders pattern work?

To be honest, Yes, the head and shoulders chart pattern works. However, it is worth noting that it is not a magical graph that would make accurate predictions for you. The Shoulders trading pattern graphs can only help you analyze the trends displayed by a particular currency pair, and only you can make the decisions based on the findings of these graphs.

Although the Head and Shoulders pattern is easy to understand, using it is not as simple as you would assume. Technical analysis is a good way to understand the direction of the market.

But even with advanced technical analysis pattern tools for helping you with the head and shoulders pattern, forex markets are very volatile and as such, there may be some occasions where the strategy will not hit the profit target.

The good news is that the head and shoulders pattern strategy is a classic analysis tool that has been used by so many traders over the years. It is an effective way of identifying trends in the market and making the most out of them. There are however some limitations when it comes to head and shoulders patterns.

What is head and shoulders pattern in forex?

The head and shoulders pattern strategy are very common, and one of the most popular tradings approaches amongst Forex traders. The Head and Shoulders pattern tries to identify a trend reversal pattern for a given currency pair.

So, in most cases, currency trading pairs will have upward and downward price movements. When the price has gone up or down consistently over a period of time, that pair is said to be on a trend. But trend reversals in price charts are very common. This simply referred to a stage in the trend line where the pair will reverse the general movement and retreat.

The Head and Shoulder strategy is designed to help traders identify this reversal and pick good entry points to short trade or long trade. So in essence, a head and shoulders pattern will appear if the market is about to reverse trends. The price bars are not fixed, the trading head can show volatile patterns at times, and it would be hard to deny that there are substantial risks involved when trading with valid head & shoulders graphs.

How often does head and shoulders pattern work?

The Head and Shoulders strategy is said to be one of the most dependable technical analysis strategies that you can learn, and it would help you make better decisions most of the time.

However, it is worth noting that it is not a magical graph that would make accurate predictions for you. The Shoulders trading pattern graphs can only help you analyze the trends displayed by a particular currency pair, and only you can make the decisions based on the findings of these graphs.

Even if you think that you learned everything about the Head and Shoulders graph, you might mess up the first few investments because learning and experience are different aspects. However, as you gain experience, and continue using the Head and Shoulders graphs, you would make better decisions with each passing day, and its success rate would shoot up significantly for you.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.