BlackBull Markets Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

BlackBull Markets Review

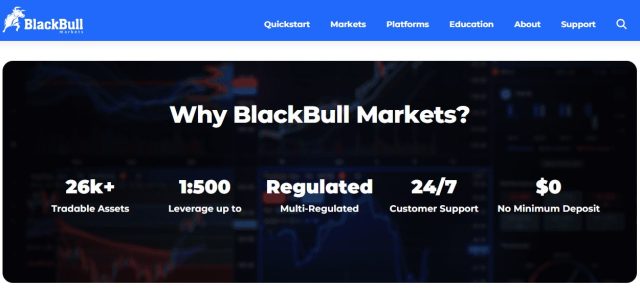

BlackBull Markets, established in 2014 in New Zealand, has swiftly risen to prominence in the forex landscape. Offering traders access to a multitude of financial markets, this firm operates under the rigorous regulation of the New Zealand Financial Markets Authority, thus cementing its reputation as a trustworthy and credible player in the trading industry.

Being celebrated for its ECN trading execution, straightforward pricing model, and robust MetaTrader platforms, BlackBull Markets facilitates a productive and flexible trading environment. While the broker could enhance its educational resources, its all-embracing features, diverse trading instruments, and steadfast commitment to customer satisfaction make it a preferred choice for traders worldwide.

Through this comprehensive review, we aim to provide an in-depth evaluation of BlackBull Markets, highlighting its key strengths and areas for improvement. Our analysis will arm you with valuable insights about the broker’s various account options, deposit and withdrawal processes, commission structures, and more. We offer a balanced perspective that merges expert analysis with real trader experiences, equipping you with all the information needed to make an informed decision about whether BlackBull Markets is the right brokerage service provider for you.

>> Also Read: Forex Trading Strategies – A Trader Beginners Guide

What is BlackBull Markets?

Founded in Auckland, New Zealand in 2014, BlackBull Markets is a leading online brokerage firm that provides a platform for trading various financial instruments. Although it primarily focuses on forex trading, the broker also facilitates trading in commodities, indices, and Contracts for Differences (CFDs).

The company was founded with the ambitious vision of creating a superior trading environment that caters to a diverse array of traders. The founders prioritized transparency, execution speed, and competitive pricing. To achieve these goals, BlackBull Markets employs the Electronic Communications Network (ECN) execution model, which ensures that trades are processed directly in the market without any dealer intervention, thereby guaranteeing traders fair and real-time market prices.

Traders can access BlackBull Markets’ services via MetaTrader 4 and MetaTrader 5, two of the industry’s most reputable and powerful trading platforms. These platforms provide a plethora of tools and features, such as automated trading capabilities and advanced charting, suitable for both novices and seasoned traders.

BlackBull Markets falls under the strict regulation of the New Zealand Financial Markets Authority, offering traders assurance regarding the security of their funds and the broker’s operational integrity. Consequently, traders can focus on their trading activities with confidence and peace of mind.

Safety and Security of BlackBull Markets

BlackBull Markets is regulated by the New Zealand Financial Markets Authority, which lends considerable credibility and security to its operations. To ensure client trust and financial protection, BlackBull Markets has put in place several safeguard measures. These measures serve to mitigate the normal risks associated with forex or CFD trading.

Clients’ funds are securely held in segregated accounts within the ANZ Bank in New Zealand, the largest and oldest financial services group in the country and one of the most trusted and sustainable banks globally. The segregation of client deposits from corporate funds is strictly maintained, and ANZ Bank acts as the custodian bank.

BlackBull Markets is also a member of the New Zealand Financial Services Complaints Limited (FSCL) dispute resolution scheme, providing an additional layer of security for its clients.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Sign-Up Bonus of BlackBull Markets

At the time of writing, BlackBull Markets does not offer a sign-up bonus to new clients. While some brokers may entice traders with promotional offers, such as deposit bonuses or welcome bonuses, BlackBull Markets has chosen not to provide such incentives. Instead, the broker focuses on delivering competitive trading conditions, reliable services, and exceptional customer support to attract and retain clients.

While sign-up bonuses can be appealing, it’s important to consider the overall quality and reliability of a broker rather than being solely swayed by promotional offers. BlackBull Markets prioritizes providing a transparent and fair trading environment, where traders can benefit from competitive spreads, efficient order execution, and access to a wide range of financial instruments. By prioritizing these aspects, the broker aims to foster long-term relationships with its clients based on trust and mutual success.

Minimum Deposit of BlackBull Markets

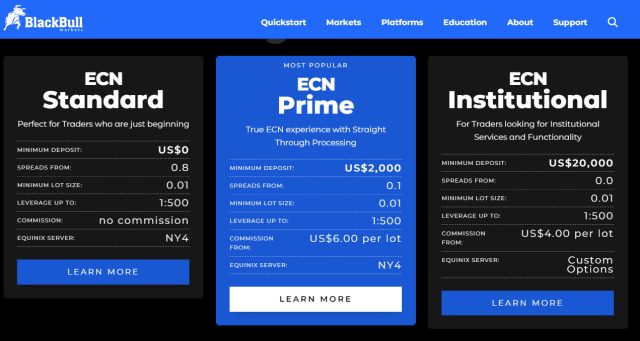

The minimum deposit amount required to open a live trading account with BlackBull Markets can vary depending on the chosen account type. At the time of writing, the minimum deposit for BlackBull Markets ranges from $0 USD to $20,000 USD, depending on the account type selected.

The different account types cater to traders with varying levels of experience, capital, and trading needs. The ECN Standard Account typically requires a lower minimum deposit and is well-suited for beginner traders or those with a smaller initial investment. On the other hand, the ECN Prime Account and ECN Institutional Account may have higher minimum deposit requirements, making them more suitable for experienced traders or institutional clients.

It’s important to note that the minimum deposit requirement may be subject to change and can depend on various factors. Traders should refer to BlackBull Markets’ official website or contact their customer support to obtain the most accurate and up-to-date information regarding the minimum deposit requirements for each account type.

BlackBull Markets Account Types

BlackBull Markets caters to different types of traders based on their trading needs, experience, and capital by offering three main types of trading accounts. Note that specific details might have changed over time, so it’s recommended to check BlackBull Markets’ official website for the most accurate, up-to-date information. Here’s an overview:

- ECN Standard Account: Ideal for novice traders or those with a lower initial deposit. The ECN Standard Account generally requires a lower minimum deposit and includes costs within the spread instead of charging commissions on trades. Both MetaTrader 4 and MetaTrader 5 platforms are accessible with this account.

- ECN Prime Account: Catering to experienced traders who trade in larger volumes, the ECN Prime Account usually requires a higher minimum deposit than the ECN Standard Account. It offers tighter spreads and charges a commission per lot traded. Both MetaTrader platforms are accessible with this account.

- ECN Institutional Account: Tailored for professional traders and institutional clients, this account type offers the tightest spreads and necessitates the highest minimum deposit. Commission rates are negotiable and depend on the trading volume. Both MetaTrader platforms are available, and dedicated account management services are included.

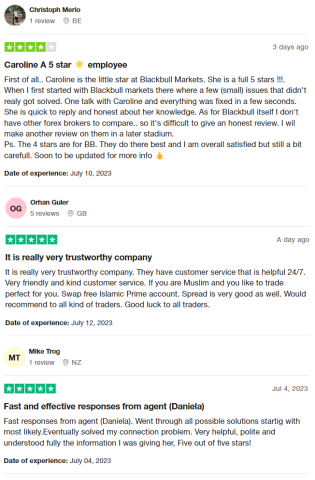

BlackBull Markets Customer Reviews

From the reviews, it is evident that BlackBull Markets is well-regarded by its customers for its exceptional customer service, with particular mention of the swift and helpful responses provided by its representatives. Notably, one reviewer commends the broker’s offering of a Swap-free Islamic Prime account, demonstrating BlackBull’s commitment to catering to a diverse range of trading needs.

While one client highlighted some initial small issues, they noted these were promptly resolved, enhancing their overall satisfaction with the broker. There’s also positive feedback on the company’s trustworthiness, friendliness, and competitive spreads. Collectively, these reviews paint BlackBull Markets as a customer-focused and reliable broker, though one client suggests exercising caution initially, highlighting the importance of continuous performance evaluation.

BlackBull Markets Fees, Spreads, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in optimizing your trading profits. It’s not just about the capabilities of the trading platform or the variety of markets available to trade. Costs associated with each trade can quickly accumulate and impact your bottom line, especially for active traders. In this section, we’ll examine BlackBull Markets‘ fee structure and how it may affect your trading experience.

As an ECN broker, BlackBull Markets offers variable spreads that can adjust based on market conditions. For major forex pairs, spreads can be very low, sometimes starting from 0.1 pips for ECN Prime and ECN Institutional accounts.

For the ECN Standard account, the spreads start slightly higher. Remember that spreads can widen during periods of high volatility or low liquidity.

BlackBull Markets does not typically charge additional fees such as deposit or withdrawal fees, which is a significant advantage for traders. However, certain payment methods may involve fees, so it’s crucial to check this before proceeding with transactions.

BlackBull Markets applies different commission structures depending on the account type. For their ECN Standard account, costs are included in the spread, hence no commission is charged. For ECN Prime and ECN Institutional accounts, a commission per lot is charged on each trade. The specific rate may vary, so check their website for the most accurate information.

Like many brokers, BlackBull Markets might charge an inactivity fee if an account remains dormant for a certain period. Be sure to review the broker’s terms and conditions to understand any additional charges that might apply.

Deposit and Withdrawal

BlackBull Markets provides a range of options for depositing and withdrawing funds. It’s important to note that specific details regarding these options and associated fees may have changed, so it’s recommended to refer to BlackBull Markets’ official website or contact their customer support for the most up-to-date information.

When it comes to withdrawals, BlackBull Markets typically supports various methods, including bank transfers, credit/debit cards, and popular online payment processors like Skrill or Neteller. The specific options available may vary, so traders should review the options provided on the platform or consult with customer support for further details.

Regarding deposit and withdrawal fees, BlackBull Markets generally does not charge additional fees for these transactions. However, it’s important to consider that some payment processors or banks may impose fees on their end, which are beyond the control of BlackBull Markets. These fees can vary based on the chosen payment method and the recipient’s location. Traders should be aware of any potential fees associated with their selected payment method and consider this when planning their deposits and withdrawals.

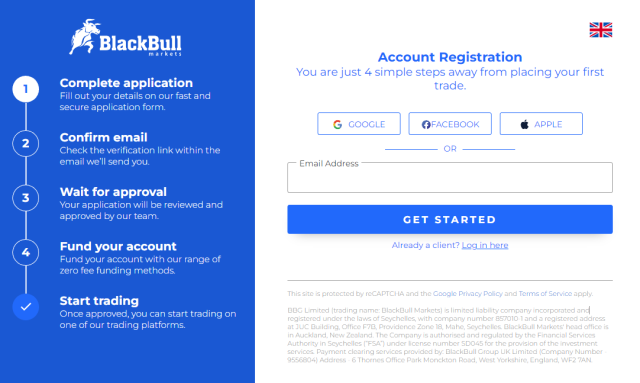

How to Open a BlackBull Markets Account

Opening an account with BlackBull Markets is a simple process.

To start trading with BlackBull Markets, you can follow these straightforward steps to open an account. It’s important to note that the process may have slight variations, so it’s advisable to refer to BlackBull Markets’ official website for the most accurate and up-to-date instructions:

- Visit the official BlackBull Markets website.

- Look for the “Register” or “Open Live Account” button, typically located at the top right of the website.

- Fill out the registration form with your personal details, such as name, email address, phone number, and country of residence.

- Select the account type that suits your trading needs and deposit requirements, such as ECN Standard, ECN Prime, or ECN Institutional.

- Verify your identity by providing the required documents, such as a scanned copy of a valid passport or ID for proof of identity and a utility bill or bank statement for proof of residence.

- Deposit funds into your account once it has been verified. BlackBull Markets offers various funding options, including bank transfers, credit/debit cards, and online wallets. Choose the method that is most convenient for you and follow the instructions to complete the deposit.

- Once your deposit is processed, you can start trading. Download the trading platform, log in using your account details, and begin your trading journey.

BlackBull Markets Partnership Programs

BlackBull Partners is a revolutionary partner program that prioritizes partners’ needs. As one of the fastest-growing brokers globally, BlackBull Markets has designed every aspect of its partner program to meet the requirements of innovative online marketers in the evolving financial referral landscape. By becoming a BlackBull Markets partner, you can grow your business with a trusted broker. BlackBull Markets offers the following partnership programs:

- Marketing Affiliates: This program is designed for online marketers who generate paid or organic traffic using their industry-related website, blog, forum, or advertising portfolio on a performance basis.

- Social Influencers: Content creators, streamers, community managers, and influencers who produce engaging media about the industry with their followers can join this program.

- Introducing Brokers: Industry professionals with a good understanding of the foreign exchange market can promote BlackBull Markets to their network and generate new business.

BlackBull Markets Customer Support

BlackBull Markets is committed to delivering reliable and efficient customer support to address traders’ inquiries and concerns. The broker offers multiple channels for customer support, ensuring assistance is readily available when needed.

For real-time communication, BlackBull Markets provides a live chat feature on its website. This allows traders to engage in direct conversations with customer support representatives and receive immediate assistance. Live chat can be a convenient option for quick inquiries or issues that require immediate attention.

Additionally, traders can reach out to BlackBull Markets’ customer support team via email. This method allows for more detailed or complex inquiries and provides a written record of communication. Email support is suitable for inquiries that may require attaching documents or require a more thorough response.

For urgent matters or situations that require immediate assistance, BlackBull Markets offers phone support. By directly speaking with customer support representatives, retail traders can receive timely help to address their concerns.

The customer support team at BlackBull Markets aims to provide prompt and helpful assistance in addressing any issues or questions raised by traders. They are dedicated to ensuring a positive customer experience and assisting traders in navigating the platform, resolving technical difficulties, or providing general support and guidance.

Advantages and Disadvantages of BlackBull Markets Customer Support

| Advantages | Disadvantages |

|---|---|

BlackBull Markets vs Other Brokers

#1. BlackBull Markets vs AvaTrade

Both BlackBull Markets and AvaTrade are renowned Forex brokers in the forex industry. However, they offer distinct advantages and disadvantages that can influence a trader’s choice.

BlackBull Markets is known for its transparent pricing model, ECN execution, and robust MetaTrader platforms. As a New Zealand-based broker, it operates under the strict regulatory oversight of the New Zealand Financial Markets Authority, which adds credibility and reassures traders about the safety of their funds.

AvaTrade, headquartered in Dublin, Ireland, has been in the industry longer than BlackBull Markets. Established in 2006, AvaTrade operates under the regulation of several top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Central Bank of Ireland. AvaTrade offers a broader range of trading platforms, including their proprietary AvaTradeGO and AvaOptions, in addition to MetaTrader 4 and 5.

Verdict: Considering the comprehensive regulatory oversight, wide platform offerings, and extensive experience in the industry, AvaTrade seems to be a more attractive choice for traders seeking a mature and diversified brokerage service.

#2. BlackBull Markets vs RoboForex

BlackBull Markets and RoboForex both provide excellent brokerage services, but they target somewhat different audiences.

RoboForex, established in 2009, is well-known for its automated trading solutions and offers a broad range of trading instruments, including forex, stocks, indices, ETFs, commodities, and cryptocurrencies. Regulated by the International Financial Services Commission (IFSC) of Belize, RoboForex offers multiple account types and trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and R Trader.

On the other hand, BlackBull Markets, while offering a lesser range of tradable assets compared to RoboForex, emphasizes its ECN execution, transparent pricing, and excellent customer service. Their focus is primarily on forex trading, making them a go-to option for forex-focused traders.

Verdict: If a trader is primarily focused on forex trading and values efficient execution and transparency, BlackBull Markets would be the better choice. For traders seeking a wider range of trading instruments and automated trading solutions, RoboForex stands out.

#3. BlackBull Markets vs FXChoice

When comparing BlackBull Markets with FXChoice, both brokers have their unique strengths.

BlackBull Markets, as mentioned, excels in providing ECN execution, transparent pricing, and MetaTrader platforms. Their commitment to customer service is also commendable.

FXChoice, on the other hand, is a Belize-based broker founded in 2010. Regulated by the International Financial Services Commission (IFSC) of Belize, FXChoice offers tight spreads, fast execution, and deep liquidity. FXChoice also stands out for its support for MetaTrader 4 and 5, as well as its proprietary platform – ‘FXChoice Web Terminal’. Moreover, FXChoice offers a broader range of trading instruments compared to BlackBull Markets.

Verdict: If a trader values diverse trading instruments and unique trading platform offerings, FXChoice is a better choice. However, for traders prioritizing transparent pricing and excellent customer service, BlackBull Markets would be the preferred choice.

> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: BlackBull Markets Review

In summary, BlackBull Markets presents a compelling offer for traders, particularly those with a strong focus on the Forex market. The broker’s commitment to transparency, efficient execution, and robust MetaTrader platforms make it an attractive choice for both beginner and experienced traders.

One of BlackBull Markets’ key strengths lies in its ECN execution model, which allows for fast, efficient order execution, reducing the likelihood of slippage and ensuring traders get the best available market prices. The broker’s regulatory oversight by the New Zealand Financial Markets Authority is another point in its favor, providing a layer of trust and security.

However, BlackBull Markets could do more to diversify its trading instruments portfolio, as it falls behind some of its competitors in this area. Additionally, while its commitment to customer service is commendable, localized support services could further enhance its client satisfaction levels.

Overall, BlackBull Markets stands out as a reputable, reliable, and customer-focused broker, particularly suited to those traders who prioritize transparent pricing and efficient execution in the forex market.

BlackBull Markets Review FAQs

Does BlackBull Markets offer a demo account?

Yes, BlackBull Markets offers a free demo account. This is a great feature for beginner traders, as it allows them to practice their trading strategies in a risk-free environment before they start trading with real money.

Is BlackBull Markets regulated?

Yes, BlackBull Markets is regulated by the New Zealand Financial Markets Authority (FMA). This regulatory oversight ensures the broker adheres to strict operational standards designed to protect traders and their funds.

What trading platforms does BlackBull Markets support?

BlackBull Markets primarily supports MetaTrader 4 and MetaTrader 5 trading platforms. These platforms are widely recognized for their advanced technical analysis tools, automated trading capabilities, and user-friendly interfaces. Whether you’re a novice trader or an experienced one, these platforms offer the tools and functionalities that can cater to your trading needs.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.