Fixed Exchange Rate: Overview, How It Works, and Benefits

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex brokers for traders are Avatrade and FXCC

The #1 Forex Trading Course is Asia Forex Mentor

A fixed exchange rate (also known as a pegged exchange rate) is a system where the government or central bank sets the country's official currency value against another country's currency or an alternative measure of value such as gold. The fixed regime aims to keep a currency's value within a specific range. It is used chiefly by countries with weak currencies or a high inflation rate.

The fixed exchange rate regime has several strengths, including the fact that it can make a country's currency exchange rate more stable and predictable. It helps the government manage inflation by providing greater certainty for importers and exporters. However, several weaknesses can be attributed to the fixed regime. One of them is that it limits the currency's flexibility, so the central bank may find it challenging to adjust interest rates to facilitate the growth of the domestic economy.

To help us understand the topic better, we've got Ezekiel Chew, a world-renowned forex mentor, to share his take on Fixed Exchange rates with us. Read further to find out the fixed exchange rate, how it works, its strengths, and its weaknesses.

What is Fixed Exchange Rate

The fixed exchange rate sets the country's currency against the gold standard or pegs it with a stronger, more stable currency. The fixed regime links one country's currency to another country or a commonly traded commodity such as gold or oil, which facilitates free and smooth trading between countries. Unlike other international monetary fund options like the floating exchange rate, this is not influenced by the stock market fluctuations. In floating exchange rate systems, the current price on the forex market determines the nation's currency.

Fixed exchange rates work by allowing the reference value to control the value of the pegged currency. When there is a fall in the reference value, a corresponding fall in the currency's value is expected. The same goes for when there is a rise in the reference value. Ultimately, the reference value determines the value of the pegged currency.

The government buys and sells its currency fixedly to maintain its pegged ratio. Depending on the appreciation or depreciation of the coin, the government either buys other currencies to put the domestic currency out in the market or sells other currencies to boost the local currency.

In the modern world, a currency peg is typically associated with the currency of countries that have weaker or underdeveloped economies. Developed countries with major currencies do not usually have pegged exchange rates. A unique situation where a large economy adopted the fixed exchange rate system was in 2005 when the People's Republic of China adopted the managed exchange rate, a slightly more flexible one.

Open Market Fixed Exchange Rates

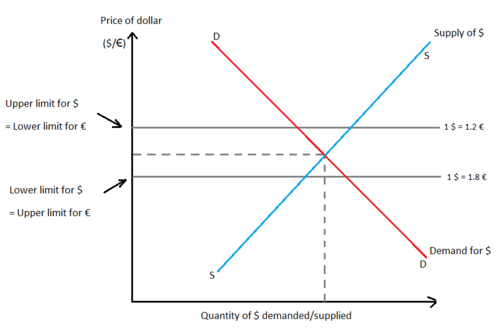

An open market system has a concept known as the market equilibrium exchange rate. The market equilibrium exchange rate is the rate at which the supply and demand of the reference value (e.g., gold, US dollars) are equal.

The government or central bank announces a fixed exchange rate for the country's currency. This pre-announced rate is not always the same as the market equilibrium exchange rate in a fixed exchange regime. The open market mechanism comes to play here. Central banks keep other currencies and commodities of value that they can sell to compensate for the deficit or surplus on the forex market.

Demand for forex occurs when there is a local demand for foreign goods, services, and financial assets. Similarly, the forex supply occurs when there is foreign demand for a country's local goods, services, and financial assets. Fixed exchange regimes do not have the flexibility to respond freely to fluctuations in the demand and supply of forex. The government has already set the exchange value of the currency. The upper and lower limits the currency can operate have already been determined.

If the exchange rate moves too close to the upper limit, the currency is more robust than is required, and the government sells the country's currency to buy foreign currencies. This action increases the supply of foreign currency. Conversely, if the exchange rate moves too close to the lower limit, the domestic currency is weak. The government buys the country's currency in the market by selling its reserves of foreign currencies and commodities of value.

Some countries maintain their fixed exchange rate by making it illegal to trade the currency at an unapproved rate. The problem with this fiat method is that it can be challenging to regulate and often leads to a black market in foreign currency. However, countries, where the government has a monopoly over all money conversion may be able to use this method successfully.

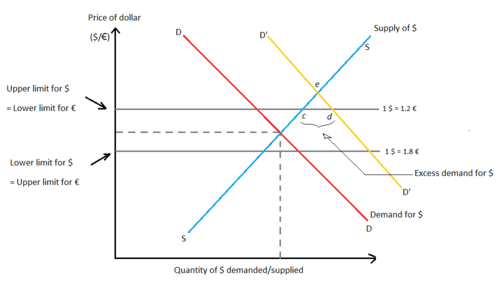

Excess Demand for US Dollars

When domestic demand for foreign assets, goods, services, and financial assets exceeds the foreign demand for local goods, services, and financial assets, there is an excess demand for the US dollar. What results is a deficit of the US dollar. The exchange rate is not at a market equilibrium in this condition.

To rectify this, the government may adopt a strategy called sterilized forex market intervention. This strategy is aimed at preventing the domestic money supply from shrinking. The government may also sell the country's currency and buy more US dollars, bridging the gap between the fixed rates and the market equilibrium exchange rate.

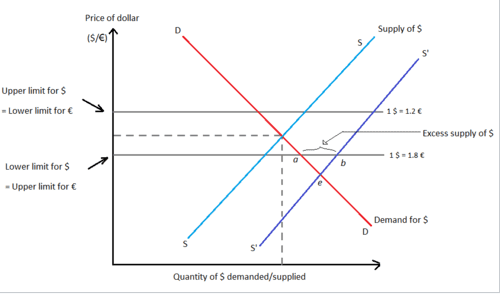

Excess Supply of the US Dollars

Excess supply of the US dollars occurs when foreign demand for domestic goods, services, and financial assets exceeds the local demand for foreign goods, services, and financial assets. In this case, the government sells its dollar reserves in exchange for its local currency. By doing this, the government neutralizes the dollar surplus and bridges the exchange rate and equilibrium gap.

Alternatively, the government may adopt an automatic adjustment system. This system corrects any disequilibrium by describing a price specie flow plan under the gold standard that adjusts to changes or shocks to the market exchange rate equilibrium.

Fixed Exchange Rate Benefits

Avoid Currency Fluctuations

A fixed exchange rate provides currency certainty because the exchange rate is not subject to the temperament of the stock exchange or forex markets. This makes it easy for the economy to thrive and businesses to carry out imports and exports without fear of the currency rising or falling.

Manage Inflation

Because the currency is stable, the economy is less likely to experience inflation. Without a fixed exchange rate, the currency is subject to devaluation, which discourages foreign investors. Devaluation can lead to inflation since it subjects investors to an increased demand for export, increased import prices, and fewer incentive costs cut out. The government can manage devaluation and inflation better with a fixed exchange regime, which will, in turn, attract foreign investment.

Strengthen the Economy

A stable currency means that manufacturing companies can do business freely without worrying about the increasing cost of production. With devaluation and inflation out of the way, the country can increase local production of goods and services, which will boost the economy.

Fixed Exchange Rate Disadvantages

Macroeconomic Objective Conflicts

The country's monetary authority may conflict with other national economic objectives in maintaining the fixed exchange rate. If the value of the currency falls or is under extreme pressure, the government response might be to increase interest rates with other currencies. This move is a double-edged sword. On the one hand, it may reduce the inflationary pressures on the economy. On the other hand, it may slow down the economy's growth and reduce aggregate demand, likely resulting in unemployment and recession.

Less Flexibility

Under a fixed-rate regime, the central bank has limited freedom to adjust interest rates as necessary for economic growth. It also limits market adjustments when the country's currency becomes undervalued or overvalued.

The multiplicity of Systems

Where the exchange rate is unrealistic, the economy may develop parallel, unofficial or dual exchange rates. Significant disparities between the official and unofficial exchange rates could potentially divert hard currency away from the central bank. The result is forex shortages and periodic devaluations of the currency. This may pose a more significant threat to an economy than the periodic adjustment of a floating exchange rate regime.

Best Forex Trading Course

Thousands of people from the United States, the United Kingdom, Hong Kong, India, Indonesia, Japan, Malaysia, Vietnam, and other nations have been trained in Singapore, and other locations across the world have been trained and mentored by The Asia Forex Mentor.

They have the greatest forex trading education in Asia. Their course is designed to allow you to make money while learning. With the assistance of a skilled trader, you will be able to trade forex profitably.

They've advised not only individual students but also corporations and financial institutions on foreign exchange, including the DBP, the Philippines' second-largest state-owned bank with assets of more than $13 billion.

The course is reasonably priced, and it is backed by a money-back guarantee. You can begin the course by registering for a free trial. You can decide whether or not to continue with the course after the free trial period.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Fixed Exchange Rate

The fixed exchange rate is common among developing or small economies. The country's currency is pegged to that of a more robust economy or an alternative measure of value, known as the reference value. When the reference value drops, the pegged currency drops and vice versa. Countries often adopt different strategies to maintain the fixed exchange rate. However, most developed or strong economies usually adopt the floating exchange rate.

The fixed regime has many strengths and weaknesses. It helps stabilize the currency and allows the government to manage devaluation and inflation, which could strengthen the economy. The catch is that the fixed-rate system affords the central bank less flexibility in making economic growth decisions and, in some cases, may do more harm than good to the economy.

Fixed Exchange Rate FAQs

Which Type of exchange rate is better?

Exchange rates subject to supply and demand on the foreign exchange (currency) markets are known as floating exchange rates. This implies that floating exchange rates constantly fluctuate, just like stock prices on the stock exchange.

Exchange rates that fluctuate provide advantages. For instance, floating exchange rates more accurately represent a currency's genuine worth based on supply and demand. On the other hand, when the market and other conditions change unexpectedly, currencies become more volatile (unstable in value).

The floating exchange rate system may be the best choice for a nation that feels its central bank can regulate and uphold a stable monetary policy. However, the fixed exchange rate system may be the best choice for developing nations without a sound fiscal or financial framework. In other words, the country's economic and political system will determine the ideal exchange rate system.

How do you maintain a fixed exchange rate?

A central bank keeps the exchange rate stable by purchasing or selling its currency. If the domestic currency increases in value, the central bank will step in and sell its domestic currency reserves, increasing the amount of the domestic currency available on the foreign exchange market and lowering the value of the domestic currency. Similarly, if the domestic currency falls in value, the central bank will purchase it on the foreign exchange market to raise its value.

When the central bank intervenes, it alters the trading curve and changes the local currency supply to help bring the exchange rate back to equilibrium.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.