Understanding Fibonacci Circle: In-Depth Beginners Guide

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Traders who trade in the financial market cannot rely on mere assumptions and presuppositions. Successful trading transactions greatly depend on technical analysis and mathematical calculations. In this regard, the classical Fibonacci circle based on numerical sequences is also widely used to forecast financial markets.

The significance of the Fibonacci circle is also thoroughly emphasized by financial experts. Among these experts, we've got Ezekiel Chew, the founder, and trainer of Asia Mentor Forex whose contributions to the forex market are acknowledged not just in Asian countries but across the globe.

According to Ezekiel, the Fibonacci circles are formed based on the mathematical sequences derived from the formulas presented by the Italian mathematician Leonardo Fibonacci. He further asset that the Fibonacci sequence is an integral calculation in the field of finance that can be applied while conducting the technical analysis.

This review aims to guide its readers regarding the application, methods, and techniques of the Fibonacci sequence. Moreover, it put forward the importance and advantages of this technique so that traders can use this method as a technical indicator during their trading transactions.

What is Fibonacci Circle

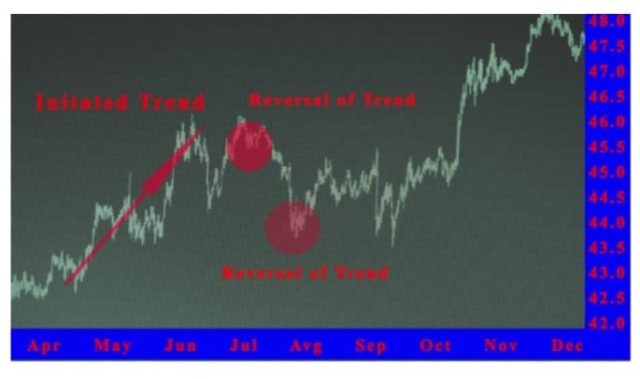

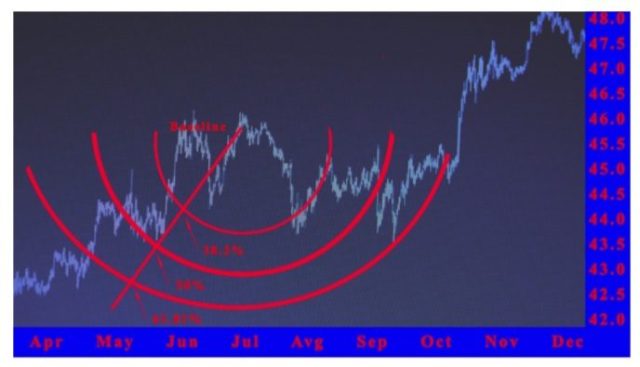

A Fibonacci arc is a circular dimensional indicator that appears during the technical analysis when financial trends are driven by the Fibonacci sequences. This method is applied by creating a trend line between two poles at opposite ends. As a result, a precise Fibonacci arc is formed when the line forms a circular dimension at 45 degrees based on the sequence of numbers that are steadily increasing.

A Fibonacci arc relies not on any other numerical formulas but on the Fibonacci sequences. Moreover, these circles can appear at 11 separate positions based on the ratios of 23.6%, 38.2%, 61.8%, and 100%.

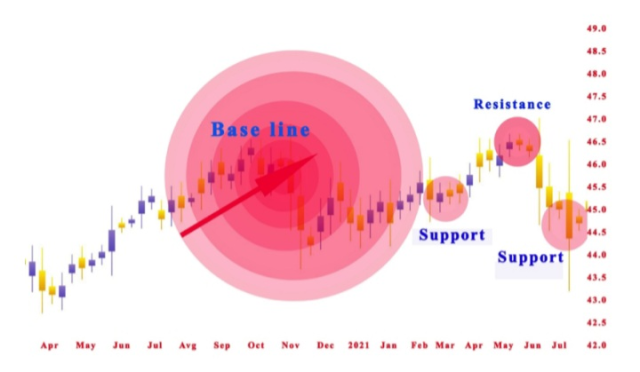

The purpose of using the Fibonacci Circles is to figure out the support and resistance levels in the market trends. The different positions of these circles indicate the rise and fall of the market prices. For instance, in the support level, the prices are positioned against the higher penetrated circles, it is usually an indication that the prices are going to fall soon moving towards the lower circles. The same is true for the resistance level however the movement of the price is in the opposite direction.

Fibonacci Sequence

The formation of Fibonacci circles is based entirely on the Fibonacci numerical sequence. These sequential numbers are calculated by adding the two numbers before them. There is no hard and fast formula however there is a specific pattern to these numbers where each of them is connected with one another in the sequence. This pattern is quite commonly used in mathematical riddles where the sequence of numbers is completed after adding the preceding two numbers. For example, 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377.

Similarly, this classical Fibonacci sequence is also used in the financial markets. Financial experts and traders read the market trends by applying this sequence through four techniques. These include the retracement levels, arcs, fans, and time zones. Moreover, the key to this sequence also relies on the specific golden ratio of 1.618. This ratio is the same which is used in many other professional fields for deriving accurate calculations. In the same way, the numbers in the Fibonacci sequence are a result of 1.618 obtained by dividing one quantity by another.

The Fibonacci sequence can help traders to identify the numerical patterns in the trends chart during the technical analysis. There is no proof of any inter-related relationship between these patterns and the market trends, however, it does support the traders in predicting the future market trends which may tend to set a certain atmosphere among the traders. As a result, based on the Fibonacci sequence, when traders buy and sell assets it eventually affects the situation of the overall market.

How to Calculate Fibonacci Arcs

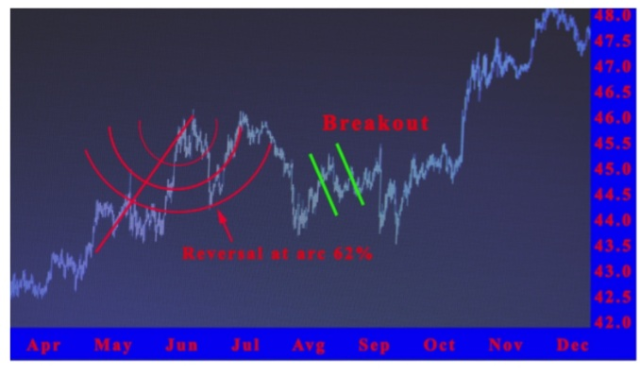

Fibonacci Arcs or half circles are also a type of method which is used in technical analysis. The method of creating Fibonacci arcs is different from retracements, fans, and time zones. These arcs represent the potential positions of support or resistance levels. This enables the traders to figure out the prices and their movement in the future by using Fibonacci sequences. Hence, these arcs aim to anticipate the price movements so that traders can make their financial decisions more confidently.

One cannot draw Fibonacci arcs by applying any specific formula. There are no constant percentages and it has been observed that different charts use varying calculations to draw Fibonacci arcs. However, Fibonacci arcs represent areas that indicate the rise and decline of market prices in the future.

Fibonacci arcs are half circles that move beyond the line which connects point A to point B. Here the line from point A (high price) and point B (low price) represents the baseline. These arcs converge at various intervals of 23.6%, 38.2%, 50%, 61.8%, and 78.6% in the baseline. Consequently, these arcs merge two points at swing high and swing low. Thus, these arcs between the baseline intersection point inform the traders about where the price moves on the trending charts.

Trading with Fibonacci Circles

In financial trading, the Fibonacci arcs are most commonly used for tracing the price projections in the market. Where the Fibonacci sequence may help to create retracement levels to find out the support and resistance levels, the Fibonacci arcs can take this process one step ahead. Consequently, with the Fibonacci arcs, traders can not only trace the price swing lowest and swing highest numbers approximate but can also predict when exactly will these levels can be reached.

With the Fibonacci arc, traders can make accurate price estimations and can also anticipate clearly when the price will react to the different retracement levels. With such insight into the future, the traders can reach a safe position to make future trading plans and take informed investment and financial decisions.

Traders should use price projection tools such as the Fibonacci arcs also known as Fibonacci circles to accurately predict the price action in the financial market. However, relying completely on this information is not a good idea for any investor as there may be instances when these methods are not accurate. In such cases, the traders be would left at the mercy of such methods which may turn out disastrous.

Fibonacci Arc vs Fibonacci Retracements

A Fibonacci retracement tool is the same as the Fibonacci sequence which is used as a tool during financial technical analysis. This tool enables the traders to pinpoint the technical positions for transactions, avoid losses or locate prices that can turn out to be a profitable venture for themselves.

The prices which are identified through the Fibonacci retracement are fixed and do not change constantly. For this reason, the traders find this tool useful to trace the accurate prices at a static position so that traders can take maximum advantage in their trading transactions. Additionally, since these retracement levels indicate the signs of the derivative change in the price action, traders usually expect either a pause or a rejection.

The Fibonacci retracements and the Fibonacci arcs are very much similar. Both of these methods are used by positioning at the baseline with two opposite points. Consequently, if both the Fibonacci arc and Fibonacci retracements are measured from the same baseline both will intersect at the same location. For instance, if both methods are started from 38.2% both will land at the same price in the chart.

Conversely, there is a key difference between the Fibonacci retracements and Fibonacci arcs which make them apart from each other. The Fibonacci retracements show constant price actions which remain fixed with many variations. For this reason, they are also positioned horizontally on the chart. Whereas Fibonacci arcs are always in a moving position. The arcs keep on rearranging their location according to their radius and only stay at one position once during their constant movement.

Disadvantages of Fibonacci Arcs

Fibonacci arcs account for useful information to the traders regarding the price movement and market trends by indicating the support and resistance levels. However, this information can not be taken for granted and so traders cannot solely rely on the Fibonacci arcs for investment decisions. There is always a possibility of price fluctuations or reversals even at these levels.

Moreover, the time duration of prices is also not evident from the Fibonacci arcs. As a result, one cannot anticipate for how long the prices are going to stay at these levels and whether or not they are going to move in the predicted direction or will revert its position.

Additionally, since there are around 11 arcs in a chart, there are often chances of misinterpretations. With so many arcs it is sometimes not clear which one will be considered for support and resistance levels before making any trading transactions. For this reason, it is often advised to wait until the investor is confident that the price has finally paused and has started moving in the trending direction.

Best Forex Trading Course

Have you ever thought of how professional traders earn consistent profits with all the risks and leverage out there? The living truth is that while you lose one trade after another, there're speculators out there smiling in profits. And the difference between you and them is only a course away.

The best course to take and trade forex is the One Core Program from Asia Forex Mentor. Ezekiel confesses that he’s been in similar frustrations – making losses and blowing accounts. What comprises the building blocks of the Once Core Program is the system he built with over a decade of trading in the same markets.

No doubt, no formal school out there will teach you practical trading like the training cum mentorship via Ezekiel Chew courtesy of the One Core Program. This is a course that turns the tables for traders from losing to banking profits with up to six-figure trades.

One Core Program is a holistic set that targets any individuals and corporate staff willing to learn the ropes and scale the heights of their speculating journeys. Ezekiel approaches the course by tackling many factors that contribute to being a risk-free and profitable trader.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Fibonacci Circle

Fibonacci circles or Fibonacci arcs are most commonly used in technical analysis to forecast the financial markets. These are circles that are drawn on charts during the technical analysis using the classical Fibonacci numerical sequence. The main purpose of creating these arcs is to assess the market price fluctuations and predict the timings of potential support and resistance levels.

The Fibonacci arcs are constructed by making a baseline connecting two opposite points. These points represent the two extremes of high and low prices in the market. The arc created after using the Fibonacci sequence precisely shows where the price may find support and resistance in future trends. When the arcs intersect a price rise, it usually leads to where the price will pause before rising again. In contrast, when the arc reaches the price fall it is usually the sign of where the price would possibly rebound before declining more.

For achieving any kind of success in the financial market it is important to take reassurance from multiple resources at the same time. Traders cannot depend solely on one technique to predict the market price and make investment decisions. Similarly, Fibonacci arcs are one tool among many to analyze the price movements in the market and traders should not make investments only relying on information derived from them. The final investment decision should be well informed after going through multiple resources.

Fibonacci Circle FAQs

How does Fibonacci Spiral work?

The Fibonacci spirals are created with the help of the Fibonacci sequence. This numerical sequence is based on the golden ratio which is not only used in the financial world but are also applied to measure many things around us in architecture, statistics, mathematics, nature, science, etc.

In the world of finance, the Fibonacci spiral works as a useful tool to estimate price projection and the duration of the potential support and resistance levels. Moreover, these spirals are also known to be dynamic in nature as the Fibonacci arcs indicate different price actions by their movement and so they do not possess a static position.

How are Fibonacci Spiral created?

The Fibonacci spirals are often created and imagined on a chart or graph in the form of spiral galaxies. Each of the squares illustrates the area of the next number in the sequence. The Fibonacci spiral can be drawn by first creating a square that has the width and length of the next number in the Fibonacci sequence. This square fits accurately into another as the number in the Fibonacci sequence is the same as the golden ratio i.e. 1.6180.

From this square being the center point, spirals begin to emerge connecting the corners of the squares. The Fibonacci spirals are hence created by drawing arcs based on the Fibonacci integers and come together in the shape of spirals.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.