Debit Spread: Explanation and Different Types (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

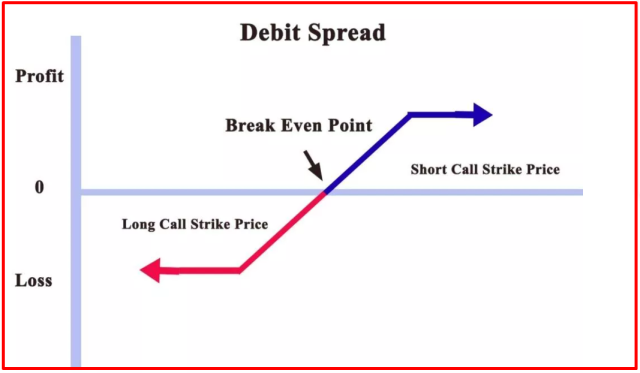

A debit spread is one of the most common options trading strategies used when an investor is bullish on the market. It consists of selling and buying options simultaneously with different strike prices with the same underlying assets.

It requires a net payment( debit) to enter the trade for the investor, and as the trader is paying the premium, they have to invest money upfront. This way, debit is created in their account, and that’s why it is referred to as a debit spread.

You may not know that, but debit spread can be created using two components: puts or calls. It depends on whether you are a bear or a bull on the market. Debit spreads are the best option for beginners as it is relatively easy to understand and execute. To understand this strategy in detail, we have got Ezekiel Chew to share his knowledge about the debit spread. He is the founder and head of Asia Forex Mentor.

What is Debit Spread

A debit spread is an options trading strategy involving simultaneous buying and selling of two options on the same underlying asset with a different strike price. The options must have the same expiration date. A debit spread involves selling options at a higher price than the cost of purchasing them, so the trader must put up money to start the trade. As a result, the trader receives a debit to their trading account.

There are several sorts of debit spreads, much like numerous spread trades in general. The most common type of debit spread is the bull put spread, which is used when the trader believes the underlying asset will rise in price. Conversely, a bear call spread is used when the trader believes the underlying asset will fall in price. In both cases, the trader uses options to bet on a price move in either direction.

Debit spread trading is a great way for traders to get involved in the markets without wasting capital. Debit spreads are less risky than other options trades, such as naked call or put positions. The most significant advantage of utilizing them is integrating more than one alternative transaction linked to the same underlying asset to establish a defined range for downside protection or profit potential.

Remember that debit spread is the opposite of credit spread, resulting in a trader having credit in their account. Also, they are types of vertical options spreads. This implies that traders should consider volatility when deciding whether to employ a bullish or bearish trading strategy while purchasing options.

How is Debit Spread Created

Debit spreads are created with the help of a broker who can make two option orders on the same underlying security, one for long and one for short. This way, you are taking quite a long position. Of course, to purchase contracts, you have to buy the options with a strike price lower than the one you sold, but that can be another expense.

You can always try to negotiate the price with your broker. The long order will have a higher strike price than the short one and cost more. The main idea is to have the overall trade result in a net debit, which will go into your account. This happens because you are paying more for the option that you are buying than what you are receiving for the one that you are selling.

The trader may offset some of the expenditure. You establish a sell-to-open order on the same asset by establishing a short position. This is based on the assumption that the contracts you buy are more expensive than those you sell. For long options trades, debit spreads can suffer time decay and lose value with time if the asset price remains the same.

Strike Price Stays Higher

When the underlying asset’s price is at or below the strike prices of the short option when expiration occurs, both options will expire worthlessly. The full premium of the long option is lost, offsetting most or all of the debit paid to enter the trade.

If the underlying asset’s price is above the strike price of the short option at expiration, both options will be in-the-money and have intrinsic value. The long option will be worth the difference between the underlying asset’s price and the strike price, while the short option will be worthless.

Let’s take an example; you establish a debit spread. You acquire calls for $50 on a stock that’s trading worth is $52 and write calls at a $55 strike price. Now, if the asset goes up to $45, you can use your contracts to purchase stock at $50 and sell it again at $50. The strike price you have specified is greater than the underlying stock as it expires, so you make a maximum profit.

On the other hand, if the stock price keeps going over $55, you’ll witness the profit rise on calls, and at the same time, it will bring you losses. So, if you plan to establish a debit spread, you should be aware of the risks and study them before taking action.

Large Strike Prices

The best illustration of the technique is to use calls at or in the money. Then produce higher-priced puts with a smaller strike price.

If you buy 200 in the money calls for $4 each, your investment would be $800. However, if you write 200 out of the money calls with a lower strike price and are trading at $200, you will recoup $200. You may thus construct a debit spread by incurring a total cost of $200.

You may create debit spreads by selling puts with lower strike prices than those you buy. It is a debit spread when you sell or purchase different options contracts on the same assets. The goal is to lower the overall cost of the position by offsetting some of the premium paid for the option purchased by the premium received for the option sold.

Types of Net Debit Spreads

As a trader, you can use different debit spreads depending on the market situation. Below are the types of net debit spreads:

#1. Bear Call

It is an advanced-level strategy that is not recommended for beginners. The bear call is best for returning a maximum profit when the market goes downward. The strategy should only be used by people comfortable with higher risk.

The bear call spread is a good option when predicting an asset’s price will fall. This is designed to generate money. It is the best alternative against the short call to minimize maximum loss if the market unexpectedly rallies.

#2. Reverse Iron Butterfly Spread

This creative strategy can be used to take advantage of different market conditions. For example, the reverse iron butterfly is the mirror image of the traditional iron butterfly. It is a strategy used when the trader thinks that the underlying asset price will not significantly change in the near future.

It is a good strategy when you expect low market volatility and are less risk-averse.

#3. Bear Put Spread

This strategy is used when the trader believes that the underlying asset’s price will fall soon. You can choose the bear put spread option if you are stepping into options trading.

This is a good strategy when the market is bearish and you want to take advantage of it.

#4. Butterfly Spread

This neutral strategy is created by using different transactions. First, it is constructed using a long and short call position in 2 other options with the same underlying asset and expiration date.

The butterfly spread is used when the trader believes that the underlying asset’s price will not make significant changes in the near future.

Best Forex Trading Course

If you are a trader looking to fast-track your journey into earning six-figure trades is a mathematically proven model with a very low risk-free profit approach, your best forex course is the One Core Program.

The One Core Program is a course with a cumulative 20 years of trading markets by Ezekiel Chew from the Asia Forex Mentor brand. It’s the main course for retail traders, institutional traders, and other market participants is taken from the introduction to the advanced analytical trading strategy to approach the financial markets.

Lastly, the One Core Program builds on a holistic approach to trading – it’s the main reason many traders end their search for credible skills by taking the One Core Program. In a nutshell, it tackles the psychological approach to trading, beating the market through the thorough analysis of price action as part of a trading strategy. It also lays emphasis on picking a few expected trades with high odds of winning.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Debit Spread

As an options trader, you can enjoy several perks from debit spreads to generate maximum profit. Using the debit spread, you can easily downside risks and make the most out of bearish market conditions.

Make sure to use a call debit spread. Also, keep an eye on the underlying stock price and the options’ strike price. That way, you can make a sound decision and enter into a profitable trade without using margin trading.

Investors who cannot use margin trade can also use debit spreads, offering a more significant profit than other vertical spreads. You should consider using a debit spread the next time you want to make some quick and easy money in the options market. However, keep in mind that the profits you make are always limited with debit spread.

Debit Spread FAQs

How do you profit from debit spread?

You can profit from a debit spread by purchasing one call option and then selling it at a higher price. Doing this can offset the premium paid for the option purchased. When the stock price goes up, so is the profit ratio.

What is a debit call spread?

A debit call spread is an options strategy used when the investor believes that the underlying asset price will rise. The strategy allows traders to buy and sell options with different strike prices but with the same expiration date. The exact amount, therefore, reduces the trader’s trading account. Also, the number of options sold is less than the total number of purchased options. As a result, the trader’s risks are limited to the difference in strike price between the options.

What is a debit time spread?

A debit time spread is an options strategy of buying and selling options of the same class and different strike prices simultaneously.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.