Day Trading For Beginners: All-Inclusive Guide [2024]!

By J Maver

January 10, 2024 • Fact checked by Dumb Little Man

Recent market volatility makes it more attractive for day traders to enter the market. Everyone desires to make money as quickly as possible by purchasing and shorting stocks in the stock market during the day.

This sort of risky investing is profitable, though, isn't it?

Image from www.investopedia.com

This day trading for beginners guide covers basic information about day trading, includes mind-blowing figures, and discloses surprising day trading secrets. It details the essential principles of day trading and offers in-depth explanations. Consider how far you've come when making a choice on whether it's worthwhile to get into day trading now.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Day Trading For Beginners For Use

Trading one security on the open market on a specific trading day is referred to as “day trading.” Closing out a trade before the market closes for a day to secure gains is a common practice in day trading. Throughout a single trading session, day traders trade one or more positions.

Day traders disagree on occasion from brokers when it comes to what constitutes ‘active' trading. An increasing amount of trades that a client performs in a certain period of time shows that their views are accurate. Some firms may go so far as to call their traders ‘hyper-active traders,' which is beyond ‘active traders.'

Image from www.investopedia.com

Typically, day trading is done by taking advantage of tiny price swings in high-liquidity stocks or coins with trading strategies.

Many people misinterpret day trading. Before entering a business, ensure that there is a clear line of sight. In addition to learning the necessary trading skills, it is also important to learn how to avoid the main pitfalls that traders commonly face.

This lesson will help beginner traders to identify and understand the objects on the screen. Everyone will always make the same mistakes, therefore learn how to avoid them.

For beginner day traders, day trading may be a very profitable career, but you must approach it wisely and ideally, as you can lose money.

What is day trading?

This is buying and selling financial goods like stocks, options, cryptocurrencies, and futures throughout the same day. When traders use the phrase intraday trading, they mean day trades.

A day deal must be closed by the end of the day for it to be considered a day trade.

Long-term investors are often after returns that average out to around 7 to 8 percent each year, but day traders go for higher rates of return by utilizing the price momentum of an underlying asset.

Traditionally, the price of each share is multiplied by the number of shares exchanged, and the earnings per share are less.

Image from www.investorsunderground.com

The difference between day trading, swing trading, and investing is that day trading methodology quickly and efficiently produces larger returns by money trading stocks and high-volatile assets.

On the other hand, Swing trading emphasizes price swings regardless of a company's profitability and the primary objective of investing is to gain long-term benefits by investing in beneficial businesses and trading accounts.

Swing traders place their bets over a period of several days or even weeks, as opposed to day traders, which distinguishes them from day traders. It can still be a useful approach for traders who want to broaden their horizons.

How does day trading work?

A day trade is always comprised of two transactions: an opening transaction and a closing transaction, which is both executed simultaneously.

When a trader lasts long, he purchases initially and then sells later. An investor who uses the short-selling strategy sells first and then buys back the stock.

Before even opening the trade, the trader knows where he or she wants to exit the deal.

Aspiring traders require a well-defined trading plan and trading strategy, as well as clear guidelines, in order to become an experienced trader.

How you can start day trading?

Becoming a day trader is simple, as all you have to do is open an account. The greatest method to begin investing is to just start trading and place crazy buy and sell orders simply fun and exciting. Proper education is a must in any industry. It can take several months or even years to turn the day trading business into a profit.

How to become a day trader?

A trading course is a great place to get started if you want to gain an advantage over the market. Another option is to join a Discord server that caters to day traders. On the other hand, day trading demands a lot of time spent looking at a screen, so make sure you allow the time to study how the financial markets function.

Day trading penny stocks

As a beginning trader, day trading penny stocks is a great idea.For a newcomer, day trading can be nerve-wracking. Especially penny stocks have volatile price movements and can experience large swings in value.

Image from www.investorsunderground.com

Developing the skills and understanding trading volume as well as being a self-sufficient trader can help most traders feel empowered.

When it comes to day trading, one of the most important things for beginners to keep in mind is to proceed slowly. Success is not linear; it's a marathon, not a sprint. Study the principles of price action and how prices move before entering a transaction or like most day traders lose money, you can also lose your money.

In my opinion, most traders who are just starting out should only practice the basic day trading strategies and learn technical analysis.

Amount of money you need to start day trading

To actively day trade, you must have at least $25,000 in your day trading account. If you already have only about $25,000 in your account, you can execute a maximum of three-day transactions in five working days.

Up to three-day trades each week, each of which can be conducted with little than $25,000 of cash in your brokerage account, are allowed in the United States. With 1,000 dollars, you can day trade, but you're limited in terms of the number of trades you can conduct.

To begin trading, you can only trade the money available in your account without having a pattern day trader account. The data on the settlement on closing positions is normally +2 in the United States, so you may have to wait two business days after you have closed a position before you may trade again.

In order to take advantage of daily price movements, it is crucial to have access to large amounts of capital. It is also important to have a margin account in case the market fluctuates suddenly and puts you into a position of having to quickly replenish your cash.

What can be traded in day trading?

The following are the most profitable and popular day trading marketplaces available today:

The foreign exchange currency market, sometimes known as the forex market, is the most popular and liquid market in the world. Day traders are drawn to forex trading because of the enormous volume of transactions. When trading against a surging currency pair, there are several short-term possibilities to profit, as well as an unprecedented amount of liquidity to ensure that opening and closing trades are swift and seamless. There are alternative methods of trading foreign exchange that is better suited to technical analysis. Furthermore, there is no central market for FX. This means that traders can execute trades seven days a week, twenty-four hours a day. They are an excellent beginning point for entry-level or prospective traders who are employed full-time in their current positions.

Image from www.investorsunderground.com

Equities include physical stocks in individual firms, normal and leveraged exchange-traded funds (ETFs), futures, and stock options. Futures are a type of futures contract in which a number of stocks or commodities are pooled together and traded like a single stock.

Trading stocks intraday provides a distinct set of options than a standard “buy and hold” investment strategy. Mean traders, who speculate on stock prices through CFDs or spread betting, for example, can profit from falling prices as well as rising prices. Margin and leverage both help to lower the amount of money needed to initiate a trade. To be able to take a position based on the most recent news release, product launch, financial report, or other financial data, as well as technical indications,

Cryptocurrencies – At the moment, Bitcoin and Ethereum are the two most popular cryptocurrencies.

At the moment, it's the hottest financial vehicle on the market.

When it comes to trading, binary options are the most straightforward and predictable way because the timing and return on a successful trade are both known in advance.

Image from www.investorsunderground.com

Regulations are being revised, and as the industry matures, these items are now being sold by large, well-established corporations. The only question you need to ask yourself is whether the asset will appreciate in value or not. Understanding binary options are not difficult due to the fact that the downside is limited to the size of the trade and the possible payoff is known in advance. They provide a different style of trading and may be incorporated into any day trader's daily portfolio in a variety of ways.

Commodities include oil and natural gas, food products, metals and minerals, and a variety of other items.

Best Day Trading Strategy for day traders – Day Trading Basics

Understanding the complexities can be achieved by using both educators and trade instruments. However, long-term profitability cannot be guaranteed. Finding your day trading strategy for stocks, ETFs, options, or the trade Forex market will first require you to find your preferred trading method. No matter what trading strategy you are looking for, you need to be sure it's the ideal one before implementing it.

Image from tradingstrategyguides.com

The tactics you employ depend on your personality, time, emotional control, and personal preferences. Of course, you must learn how to deal with losses, but you must also learn how to take advantage of profits.

Very often, your emotional well-being will be crucial if you hope to become financially successful in the long term.

Other tactics are best suited for activities before the market opens in the morning. Day traders would frequently check the percentage change in order to find equities that have yet to complete their price movement. In the course of the trading day, day traders frequently look at the most volatile stocks and search for stocks that have gained momentum due to price increases in a short time period.

In general, the pricing of the daily volume-weighted average price begins during the regularly scheduled trading hours. You'll need to know the basics of the market, like the bid-ask spread, if you intend to implement all-day trading methods.

Best time to buy stocks in the stock market

The morning news is often encouraging, and after hearing from experts in the area, it was discovered that getting engaged with stocks shortly after the open is perfect.

The two hours after the New York Stock Exchange (NYSE) opens witness the greatest percentage increase in the market.

Selling-based markets, on average, have the highest daily sales growth during the first two hours of trading on the trading day when the market opens. This takes place from 9:30 a.m. to 11:30 a.m. Eastern Standard Time.

Day Trading Charts and Patterns

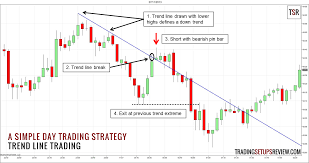

Trading stocks is usually done by day traders, who use the stock chart to see which stocks they intend to invest in actively. In addition, the trend and retracement lines could be drawn on the chart to show potential targets as well as areas of support or resistance.

Additionally, successful day traders pay attention to chart patterns because these patterns often contain practical forecasting features that become readily apparent once the market breaks out of the pattern. New-day traders rely heavily on charts as they also help understand the futures market and future price movements.

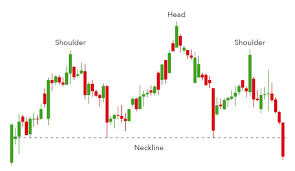

Image from hotforexblog.com

For day traders, popular chart patterns include a head and shoulders pattern ready to break out on the downside, a head and shoulders pattern poised at the neckline ready to break out on the upside. These theoretical patterns show their theoretical shapes and behaviors by using schematic diagrams, as shown in the graphic to the right. A conceptual sketch of human heads.

Basic Day Trading Strategies for Beginners (Also includes short term trading strategies)

Scalping

One of the most popular day trading strategies is scalping, which tries to make a number of tiny profits on short-term trading positions with little exposure. To make money as a scalper, you need quick reactions, and the ability to trade quickly and frequently. Also, their entry points must be timed effectively, they must enter trades with high-probability trades in liquid and volatile assets, and they must cut losses fast.

Image from www.tradingsetupsreview.com

In the field of cryptocurrency, scalpers (those who buy and sell crypto assets to make a profit) work best with tight trading spreads, swift order executions, and low order slippage. Watching very short-term tick charts for anticipated price patterns like the one below is a common practice among traders.

For beginners, day trading frequently begins with an exercise that focuses on scalping, in which a demo account is used, and then goes on to include practice trading with real money.

News Trading

To those with vast pockets and a strong desire for risk, someday traders will utilize tactics aimed at profiting from highly volatile markets that follow news announcements.

A news trader will usually be keeping an eye on several calendars as well as news feeds in order to monitor for major data releases or noteworthy news occurrences.

Fundamental analysis, often known as fundamental news trading, involves buying or selling shares on the basis of news.

Additionally, it's not uncommon for these strategies to necessitate the trader to monitor the market in advance of a risk event in order to identify important support and resistance levels that allow them to make quick decisions once the news is released.

Trading Reversals from Oversold and Overbought Levels

Momentum indicators for day traders include the Relative Strength Index and the Stochastic Oscillator, which indicate when overbought and oversold markets are ready for a reversal. While day traders usually trade in a market that is overbought, they buy when a market is oversold. Typically, this trading strategy is more of an active approach and requires a faster reaction time to carry out trades in the proper time and level.

Pivot Points

A pivot point is a technical analysis indicator calculated by averaging the high, low, and closing prices from the previous day. When trading, traders will typically look to buy ahead of pivot points on the downside (i.e. when the price is falling) and sell ahead of those on the upside (i.e. when the price is rising).

Pattern Breakouts

Patterns that have diagnostic accuracy can be spotted by watching price charts. The market will typically take its initial impulse and follow it to a breakout, allowing investors to use a prior objective to anticipate the movement's distance in the direction of the breakout.

Day traders are most likely to place a trade in the direction of a breakout and then attempt to close it near the price objective computed based on the breakout's price.

Don’t Use Leverage

Use leverage to expand your position size by borrowing shares from your broker. When you take a bigger position, you increase your potential profits significantly.

That's what's the problem. It's possible to dig yourself into a deep hole with this method. To trade successfully, you need to understand how to take advantage of leverage. Leverage is unnecessary. It's not a good idea.

If you lose, your broker will likely call you asking you to deposit more money.

When your losses can't be covered, the game is over. No good will come of it.

Follow Stock Chart Patterns

When you take the time to scrutinize penny stocks, you'll notice patterns emerge. When these patterns are used, they can open up new trading opportunities.

How? Patterns are repetitive over time. Studying things thoroughly makes it possible to discern patterns, learn how to identify them, and discern when to strike. After you've learned a few patterns, you should become proficient at spotting them.

Trade Volatile Stocks

One thing you should never be intimidated by is a term you come across that says ‘stock portfolio.' The position of the metaphor refers to the stocks you trade and the various positions you have.

It is critical to use your own discretion when selecting securities in a portfolio. Of course, gathering information from a variety of sources is perfectly acceptable. However, ultimately, you're the one who bears responsibility for the transaction. Know what you're talking about.

Be sure to also have a diverse portfolio of work that you curate. You should not put all your money in one investment, as things can change very quickly in the stock market.

Advantages and drawbacks of day trading

To help traders to profit from opportunities that the market offers, various features are available, with both advantages and disadvantages.

PROS

The thing about trading that makes it particularly interesting is that it is open 24 hours a day, seven days a week. Even in a market that never closes, you're lucky to have access to all of the perks that come with it. Second, the cryptocurrency market is very volatile, and it's important to keep that in mind.

However, professional traders will not even flinch. Volatility is a very profitable trading instrument if you desire to day trade, but is challenging for new investors because the profit opportunities are numerous.

CONS

Trading a position on a day-to-day basis can be difficult due to the difficulty of exiting a trade at the price and time you want.

In financial markets, slippage is a much larger problem than it is in other asset classes. Because no one will aid you if an exchange closes, is hacked, or simply disappears with everyone's money, unregulated day trading has the double-edged sword of delivering massive losses and a lack of dependable assistance in getting them back.

As a day trader, you will make frequent orders that are high in volume, so always bear this in mind.

Best Day Trading platforms and day trading tools

The existence of free tools permits getting a better grasp of stock market techniques. One of the greatest assets you can have in trading is a stock scanner. One-minute feedback A new brokerage called Webull launched in 2017, offers commission-free stock and Exchange-traded fund. Financial services firms such as the Securities and exchange commission and Financial Industry Regulatory Authority are responsible for regulation. Securities and exchange commission and Financial Industry Regulatory Authority are also there to help new traders.

Image from www.ig.com

Trade-Ideas

Trade-Ideas is a very strong intra-day stock scanner that has pre-formatted scans built-in for numerous possible trades.

The platform is customizable, configurable, and extensible. It is one of the best trading tools.

In the beginning, the platform may seem overwhelming for new users, but over time, it becomes an indispensable asset that is just like a physical exoskeleton once a person has adjusted to it.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

TradingView

Tradingview.com is one of the best and most affordable online trading platforms. With free and basic charting functionality, there's little to no competition. Although the market leader Trade Ideas has more stock screening capabilities, it is limited in comparison to the competition.

You must define what is most important to you for that reason. The best of both worlds: if it's technical analysis and charting, then TradingView is your choice.

Even if you're interested in taking your trading to the next level, you must use Trade-Ideas. Trades with the greatest potential are identified on an artificial intelligence-powered stock screener each and every day. Every week, the company offers free trading rooms and free webinars. It has some of the best trading tools.

CLICK HERE TO READ MORE ABOUT TRADINGVIEW

Finviz

Finvinz provides the following:

- Market cartography

- Stock screening tools for seasoned investors

- Analysis/ investigation/ investigation tools

Finviz's objective is to provide the latest and most powerful financial research, analysis, and visualization for investors.

The website summarises a large amount of information with easy-to-understand charts and maps.

Each of these tools is provided in an easy-to-use format that is highly visual.

The Finviz stock screen is widely used by investors today. The finviz tool is a stock screener and trading tool which is used for creating financial charts.

Because Finviz offers the ability to quickly find stocks based on customizable criteria, professional traders utilize the service frequently.

Additionally, the firm supplies gadgets that make it possible for users to receive an overall idea of what is happening in the marketplace.

CLICK HERE TO READ MORE ABOUT FINVIZ

Picking a broker- day trading for beginners

You employ one of the online brokers or a physical broker to execute a deal in the market when you wish to trade. It is vital to find the broker that is best for your investing needs. Before making a choice, here are a few things to keep in mind:

When trading, you will make a lot of deals each day, thus it is essential to make trades quickly. However, receiving the price you want, when you need it, is also vital.

Because fees and commission rates are minimal, day trading is more viable. Active traders are likely to trade frequently, as such minimizing trading costs is critical.

Avoid unnecessary regulations – ensure your broker is properly regulated. Your financial interests will be legally required to be protected.

Find online brokers with rapid response times and solid customer support. Competitive spreads, leverage, and margins are important considerations while day trading.

Would you be interested in a trading platform? The trading platform must provide the tools and features you want, even if you make the order a stop loss and even if you use advanced charting.

The strategies used by most new traders differ greatly from those used by stock traders. Stocks and currencies are traded in distinct markets. You have to understand that you can correctly trade stocks and currencies.

Risk Management

This is a tendency that many beginners fall into, where they have numerous tiny victories but then have one big setback that wipes out all their progress. Experiencing this is discouraging. Learn to Be a Defensive Player.

As a beginner trader, your primary concern should be how to limit your losses and focus on technical indicators. Once you've figured out how to lose less, you may concentrate on increasing the size of your winners.

Soon after leaving a position, place a stop-loss order and then leave the position alone. The worst habit you can develop is the practice of continuously changing orders around in response to what you believe is occurring during the trading session.

Before you enter into a deal, you should be aware of your risk and the amount of money that you could lose. Having this understanding before you enter a transaction is not only important for trade management, but it is also important for your overall mindset.

Technical Analysis – Day Trading for beginners

Day traders rely largely on Technical Research, which they combine with order flow analysis and news catalysts to make decisions on the market.

It should be remembered, however, that technical analysis is merely a tool for interpretation and not for prediction. The future cannot be predicted from a graph or a chart.

Predicting the weather based on historical data is more controllable than projecting the direction of the stock market. Technical analysis, on the other hand, aids in making the best selections possible. When you use visuals, you can always see where you are in relation to the rest of the market.

Trading Software

For the majority of day traders, trading software is a pricey necessity. It is the application rather than the news that people who rely on technical indicators or swing trades turn to.

5 tips to help you succeed with day trading

Risk Capital

When trading, risk capital should never be risked above an allotted amount. There is a very high likelihood of this leading to financial difficulties. 1% of the trader's capital should be risked on a single deal. A benefit of this system is that funds are spread across multiple trades, making a single trade unlikely to fail.

Educate Yourself

Being a professional in this field involves having an extensive amount of knowledge and extensive training. Seize every opportunity to learn. The best way to learn is to read and do other educational things.

Patience

The most important attribute a trader should possess is patience, even if they believe they are ready to day trade. While the potential of this new asset class is exciting, it may also be volatile and unpredictable. Sometimes it is possible that you might lose money.

Beginners should treat online trading cautiously, and make only small transactions until they have a full understanding of the market. Traders with greater confidence may go for trading currencies more frequently and explore more advanced techniques.

Stay calm

During volatile times in the stock market, don't get too worked up. You need to learn to control your emotions, especially greed, hope, and fear, as a day trader. Should decisions be based on rational thinking rather than on feelings?

Start small

When starting out, focus only on one or two stocks trading each session. Keeping track of and spotting possibilities is simple with a small collection of securities. Fractional shares have been more prevalent in recent years, and this means you can invest in smaller cash amounts.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion

To become a successful day trader, you should be adequately prepared and practice online trading from the very beginning. You have to learn how in order to be like these other successful traders. You should know that any trade or investment is at your own risk.

A profession and a vocation are combined in day trading. For those who can be patient, the wait can be worthwhile. Patience is a virtue and is often rewarded with many different benefits. The biggest reward is that you're able to save your money and don't gamble it away before you learn the right skills.

In the beginning, new day traders should learn the basics like market research, evaluate their past performance, and estimate how much capital they have. Active traders should then start by stock trading on paper before attempting day trading on a live exchange. It's a good idea to open a real brokerage account if you use the profits from your print trading account or trading simulator to begin trading with a broker.

In any kind of short-term trading or any kind of trading where you use borrowed money (like margin trading), you must always be very careful. The net profit can go up, but there is also a greater risk. Since market makers know where retail traders' stop-loss orders are, you may encounter stop-running issues when trading in the live market. Level II data feeds allow a more comprehensive visualization of stock price and price volatility, but it comes at an additional cost.

If you're a new day trader and looking for helpful tips and ideas for day traders, you will be spoilt for choice. However, it is important to have a lot of on-screen experience in order to get good at day trading, and I hope that this little guide helps those interested in getting into day trading.

Trading with own capital or joining a funded trader program gives a day trader the opportunity to trade other people's real money.

Swing trading is a better choice in some cases because large financial institutions do not compete with swing traders, and price movements cannot completely wipe out a portfolio as quickly.

FAQs

Is Day Trading Illegal?

Day trading based on patterns is not prohibited. The US government wants investors to believe it is unsafe, so the PDT rule was created to safeguard investors' capital. However, to the extent possible, they try to regulate margin accounts and trading in those accounts as much as possible.

How much money do you need for day trading?

How much money you need depends on whether you want to create a full-time living from day trading or just supplement your income with day trading as a secondary source of income.

What you undoubtedly know is that in only two short years, there are people who started with just $500 in their cash account and grew their investment and are now day trading millionaires.

That's an extreme scenario, and even experienced traders will have a hard time generating the type of return that was exhibited in that example. I am making the case that in order to start day trading, you don't need a significant quantity of money.

While you do need over $25,000 in your cash account to bypass the Pattern Day Trader rule, you do not need $25,000 to trade.

Is pattern day trading illegal?

There is no regulation against pattern day trading. This description by the U.S. government is one that emphasizes the riskiness of investing in U.S. government bonds, and thus the PDT rule was implemented to protect investors' capital. However, the minimum capital requirement for trading is $25,000 and margin trading is prohibited.

Which trading platform should I use?

Choosing the right free trading platform for your needs is a difficult task. eToro is an amazing trading platform for day trading beginners and new traders.

J Maver

Passionate in tech, software and gadgets. I enjoy reviewing and comparing products & services, uncovering new trends and digging up little known products that deserve an audience.