Dark Cloud Cover: Overview, Examples, And Pros & Cons

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

You might be familiar with the saying “a rising tide lifts all boats.” The idea is that when the stock market is going up, everyone benefits. But what happens when the tide starts to go out? That's when you might see a dark cloud cover pattern on a candlestick chart. It is not a weather forecast but a technical indicator used in technical analysis to locate bearish reversal signals.

This pattern is mostly seen when the candle opens above the previous candle and then closes below the midpoint of the previous candle. This bearish candle suggests the market has reversed from an uptrend to a downtrend. While the dark cloud pattern is considered a bearish reversal pattern, it can also be used as a continuation signal in a downtrend.

The pattern's significance is that it signals a shift in momentum from the upside to the downside. A down candle follows an up candle, producing a dark cloud cover. On the following candle, traders note a decline in price as it moves lower. Understanding the dark cloud cover can reduce the significant risk you can experience when trading reversals.

To better understand the concept of dark cloud cover, we’ve got Ezekiel Chew, CEO, and founder of Asia Forex Mentor, a technical analysis education provider, to share his take on Dark Cloud Cover with us. In this article, we will discuss what dark clouds cover, its example, how to trade with this pattern, and much more. So, without any further ado, let's get into details.

What is Dark Cloud Cover

The dark cloud cover is a candlestick pattern that signals a bearish reversal in the market. The pattern consists of two candlesticks, the first being an up candle followed by a down candle. The down candle should open above the close of the up candle and then close below the midpoint of the up candle.

The dark cloud cover is a relatively simple pattern to identify, but it can be difficult to trade. The pattern is not always accurate, and false signals or patterns occur. It is important to use other technical indicators to confirm the signal.

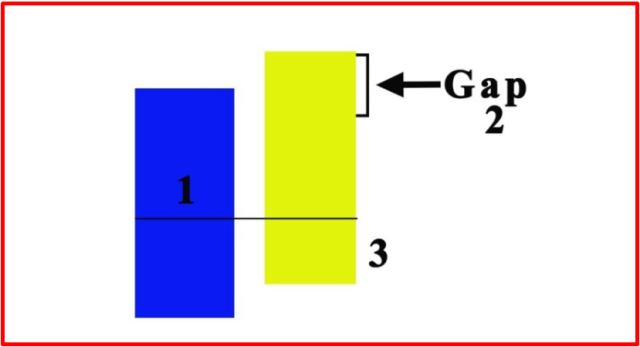

The following image shows an example of a dark cloud cover pattern:

Trading with Dark Cloud Cover Pattern

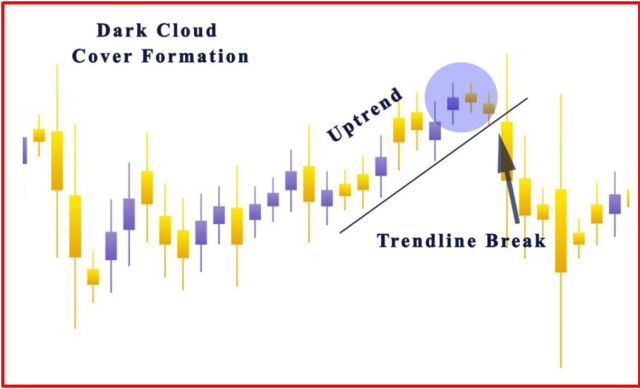

You may need to find different characteristics when using a dark cloud cover pattern as a trader. Because the pattern is a bearish reversal, it must be an uptrend. The size of the candlestick is critical in determining how strong the trend is. A small candlestick may not be as significant as a large candlestick.

The gap in the bullish trend and bearish candlesticks signals a possible trend reversal.

The bearish candlestick must be near the midpoint of the preceding bullish candle to signal a trend reversal. In conclusion, both bull and bear candlesticks need to have large figures.

Traders may employ the pattern in more conservative circumstances, such as the US Dollar/GBP or Yen/USD, yet it can also be used in range markets.

Recognizing a Dark Cloud Cover Pattern

The dark cloud cover is a candlestick pattern that forms after an uptrend. It consists of two candlesticks, the first being an up candle followed by a down candle. The down candle should open above the close of the up candle and then close below the midpoint of the up candle.

The pattern is considered a bearish reversal signal, and the formation of two candle patterns is quite ordinary. The initial candle is bullish with a higher price range than the medium candle. It is important to set up the pattern as it signals the huge purchasing of interest in the market.

The second candlestick will divide higher and fall, ending at the bottom of the first candlestick. This price movement suggests a wide advance because valuations are rapidly reversed downward.

Barring any unforeseen events, it appears likely that the Bearish candle will continue to unfold and adhere to the current price pattern. Investors with a long position might consider breaking even at the start of the next candle. This bearish candle formation suggests the potential of exiting only a portion of a large trade for investors with a bullish bias.

The bigger the upside difference, the more severe the potential reversal is.

Dark Cloud Trading Example

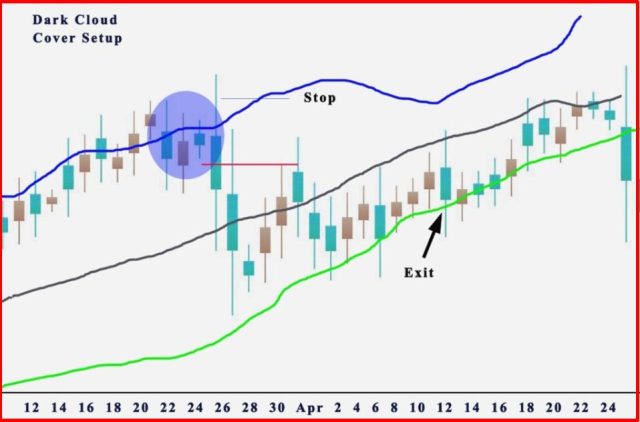

Let's look at an example of this approach, as seen in the price graph above. The pattern formed above is a result of the market movement.

The first candle is straightforward: it's a bullish one with a visible body, and the second gapes higher and then approaches the midpoint of the body of the first candle, verifying dark cloud cover development.

When you double-check the two most essential elements of the trading approach, we can be certain that the Bollinger band condition is satisfied. According to the strategy's guidelines, the second bar in the dark cloud must exceed the upper Bollinger line.

This shows that the market is overbought, making a price drop more likely. You can see from the chart that the second bar begins above the top band, which confirms this condition.

With everything in its place, traders may prepare for a brief trading opportunity. Traders who use this pattern can make a market order to sell when the price falls below and closes beneath the second candle.

You must remember that the trade must break and close under the indicator line after three bars following the dark cloud cover formation. You can see from the price chart that the third candle was successful. It broke, suggesting a potential buying opportunity.

The initial trade order will then be used to create a sell entry order at the market. You can concentrate on the trade management procedure after filling the sell entry order. You should establish a stop-loss order in the market to protect your trade. The stop loss can be set above the high of the second candle in the dark cloud cover formation's second bar.

Trades will move lower more rapidly after a trade entry is created, and the stop loss won't be in danger of being hit.

Investors must remember where their exit signal may be as the price falls. It can exit the position when the price reaches the lower Bollinger band.

Dark Cloud and Crypto

You must notice the pattern when you apply the dark cloud cover candle design in crypto charts by looking for the breaks in the candlestick charts.

The reason for this is that crypto has a 24-hour trading window. There are no open or close market prices in cryptocurrency, and the cause of chart price fluctuations.

Pros and Cons of the Dark Cloud Cover

The dark cloud cover's effectiveness is dependent on a variety of other candlestick formations, price action surrounding it, where it appears in the trend, and critical resistance levels. Here are some of the advantages and disadvantages of this pattern.

Pros

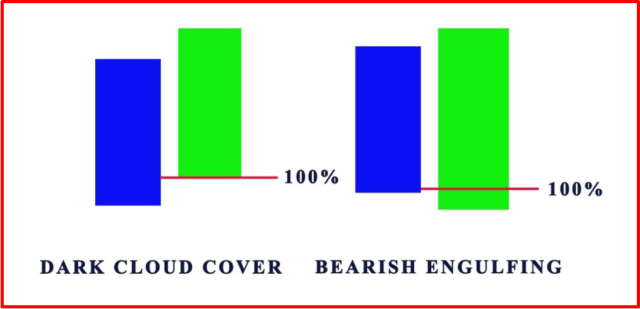

- The dark cloud cover is a highly useful bearish candlestick reversal pattern. It can be applied in almost all markets to get an attractive risk-to-reward ratio only if related to the bearish engulfing pattern

- This pattern is relatively easy to identify, even for beginner traders

- There are interesting entry levels as this pattern shows the downtrend beginning

Cons

- The pattern is not so common, which makes it harder to find trading opportunities

- It is necessary to have a good knowledge of candlestick patterns to trade it

- The pattern is less reliable when it appears in a ranging market

Best Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn't. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It's a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Dark Cloud Cover

The dark cloud cover is a significant bearish reversal pattern that can be utilized in almost all markets and timeframes. The pattern is not so common, which makes it harder to find trading opportunities. It is necessary to have a good knowledge of candlestick patterns as a technical analysis tool.

Some traders believe they may use candlestick formations in isolation, but it is not advised. The dark cloud cover candlestick was created to assist investors in gaining better comprehension of this pattern. It confirms a downward trend that investors may use to help them make investment judgments.

The dark cloud cover chart pattern is frequently seen in stock prices and futures trading.

In the foreign exchange market, this structure is more likely to happen at the start of the trading week since weekend gaps are generally observed during that time.

Dark Cloud Cover FAQs

Is Dark Cloud Cover Reliable?

The reliability of the dark cloud cover pattern depends on a few factors, such as the location of the pattern in the trend, the price action surrounding the pattern, and critical resistance levels. However, it is not as reliable as the other indicators available.

Is Dark Cloud Cover Bullish?

No, the dark cloud cover is not a bullish pattern. It is a bearish reversal candlestick pattern that can be found in an uptrend.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.