How To Make Profit With Crypto Scalping (2024)

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best cryptocurrency brokers for traders are Coinbase and Gemini

The #1 Crypto and Forex Trading Course is Asia Forex Mentor

It is no longer news today that digital currency is gradually taking over the financial markets, despite records of cryptocurrency’s high volatility. However, crypto traders can use one popular trading strategy to make small gains due to tiny price movements, provided they have the right tools and knowledge; this trading strategy is called scalping crypto.

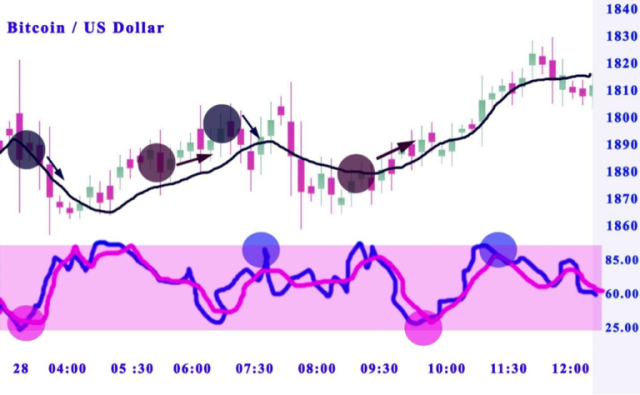

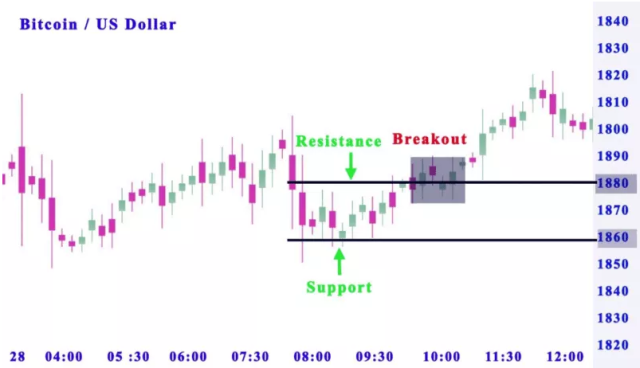

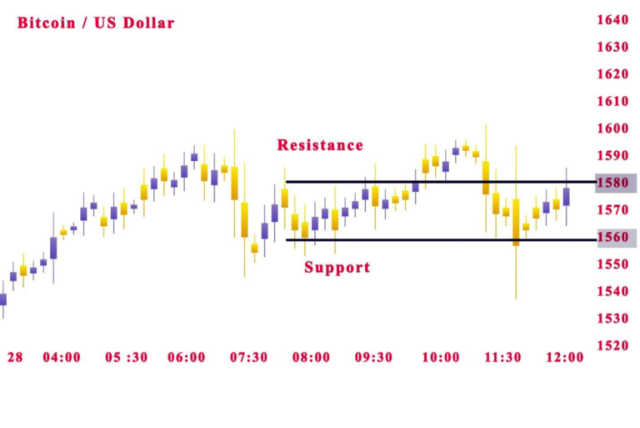

Crypto scalping is a trading style to make small but frequent profits from price movements that might generate significant gains at the end of the trade for the day. Crypto scalping strategies can be low-risk and very beneficial because crypto traders depend on the candlestick chart patterns, support and resistance levels, and other crypto scalping indicators such as the Bollinger band and the Relative Strength Index (RSI).

For this article, we have Ezekiel Chew, a renowned and seasoned forex mentor, to further expand the crypto scalping trading strategy. Read through the article below to understand how to execute scalp trade crypto and how to apply them in your cryptocurrency trade.

What is Crypto Scalping

Crypto scalping is a short-term trading strategy that crypto traders use to make profits from relatively small price movements that accumulate over a limited period into a significant profit. Crypto scalping is also small and consistent profits that accumulate substantial gains overtime at the end of the trading day.

Crypto scalping is a very efficient means of making profits since cryptocurrency is a volatility-based market; constant price movements create windows of opportunities for scalping. Crypto scalp traders rely on technical analysis and use chart patterns within a minute or five minutes timeframe.

As an intraday trade, it doesn’t usually last long as it exists from a couple of minutes to a few hours, which means that crypto traders must always pay attention and focus; otherwise, they’re going to make losses instead of profits. Most crypto scalp traders do crypto scalp trading with Bitcoin due to its constant and persistent price action; nevertheless, it requires discipline and patience.

The Crypto scalping strategy is a highly profitable trade that generates many profits over a limited time, but its transaction costs can discourage the faint-hearted. This means that only professional scalp traders with great mental strength can put up with the pressure of the crypto scalping routine and stick to their trading strategies despite the high trading fees.

How Crypto Scalping generates profits

Crypto scalp traders build their trading system to make maximum profits daily, and the scalping trading strategy is one of the means to achieve that. Crypto scalping is derived from real-time technical analysis such that every trader develops a personal system and trades frequently.

The average position starts every five to ten minutes, which is when traders take a move; this implies that the trade must be closely monitored. To generate profits from scalping in crypto, traders must react to the crucial points of market movements as they take a move and know how to benefit from fluctuations.

Scalp traders also have to be smart because sometimes they rely on their instincts to generate trade ideas and make wise decisions. After all, every trader has a personal system to monitor the trading platform and assume positions at the right time.

There are two ways to scalp crypto: the manual and automated trading system. For the automated trading system, crypto traders develop an original software program to back up their trading strategies. The manual crypto trading system requires traders to carefully monitor the market movements and the trades using charting tools like TradingView to know the market’s volatility.

Why Focus on Crypto

The financial market today is stocked with many possibilities for transactions such that there are many available options to invest in, but for those who want to get quick cash, although it is not always quick, it is at least quicker than company stocks is the crypto trade.

Crypto trading scalping is a profitable trade for many traders because of the cryptocurrency’s persistent and constant price action, especially Bitcoin. However, only patient and disciplined traders can profit from it because it requires knowledge and a build-up of experience; greedy traders should not bother to try scalping in crypto.

Also, the fact that cryptocurrencies are volatility-based markets has made scalping a popular type of crypto trading. The constant price movements have also opened more opportunities for scalping. The more reason many scalp traders tend towards scalping Bitcoin is that it provides a middle ground for both reliability and volatility, on the other hand.

With crypto scalping, scalp traders who use quality trading platforms can make small profits frequently with relatively small price movements. Also, traders must have a good exit strategy and a well-laid-out plan to accumulate profitable trades and generate profits; however, some risks come with scalping, and traders must keep that in mind.

Similarities of Crypto Scalping with Forex Trading Strategy

The whole concept of crypto scalping and forex trading are very much alike in so many ways.

Crypto scalping and forex scalping strategies operate based on market demand and supply. The rate of demand and supply in trades determines how much profit you make and the prices of the forex currency and cryptocurrency.

Crypto scalping strategy and forex trading strategy make use of the candlestick chart patterns. The bearish and bullish candlestick patterns are indicators of the trend of the market and the price action as well.

However, the major bone of contention between both is that you can only trade the forex market on workdays while you can trade the crypto market anytime and any day, and also, cryptocurrency is more volatile than forex.

Difference between Scalping and Day Trading

Some traders often mix crypto scalping and day trading because both are intraday trades, but there are differences.

Scalping focuses more on technical analysis than fundamental techniques, while day trading focuses more on fundamental techniques than technical analysis. This, in turn, affects the indicators used by both trades; crypto scalping indicators are quite different from that day trading.

The time frame for crypto scalping( five-minute) is very different from day trading, affecting the rate at which both intraday trades maximize the small price movements.

For crypto scalping, an average scalp trader makes many trades per day and closely monitors the market, while for day trading, the traders check in less frequently and make fewer trades.

Day trading has more risk than crypto scalping even though they generate profits more than crypto scalping with lesser risks.

Pros and Cons of Scalping Crypto

Whatever has advantages must also have disadvantages, and crypto scalping is not exempted from the fact that there are many benefits attached to it also means that there are limitations to it.

Pros

- Low level of risk– since crypto scalping involves taking small position sizes, it comparatively has a reduced level of risk compared to long-term day trading.

- Profitability– serious and disciplined forex traders can accumulate small profits frequently, which eventually adds up to something significant at the end of the day trading or the trading season.

- Easy automation– trading bots or signals easily automate scalping crypto trading strategies. It also eliminates the whole stress of intraday trading and avoids trading emotions.

- No time limit– Crypto scalping is not limited to a particular time of the day or week; making small profits at your convenience is possible.

Cons

- Leverage– For those involved in margin trading, scalping needs lots of leverage which can be risky, especially for inexperienced crypto scalp traders. Generally, new scalp traders are not advised to go into crypto scalping because only experienced people can make fast moves.

- Patience, speed, and discipline – are essential skills crypto scalp traders must have; the more reason inexperienced scalp traders are not advised to dabble in it. Scalp trading involves quick actions and executions as much as it requires patience because, on the other hand, it is a high-risk strategy that only experienced scalp traders can properly handle.

Time Frame to Scalp Crypto

The best time frame chosen by scalp traders is the five-minute chart. However, the general time frame for scalping is usually between 5 – 30 minutes. The desired time frames to the scalp in crypto regulate the number of trading signals, buy and sell that are produced at any time.

The smaller the set timeframe, the more the possible trade setups available. However, this depends on the crypto scalping strategy that the trader uses.

Since crypto scalping relies on technical analysis, scalp traders use cryptocurrency indicators such as support and resistance, moving average, etc., and the candlestick chart patterns.

Trading Tools for Scalping Crypto

Crypto scalping can be achieved through varieties of tools such as;

Trading Bot

Automated trading is one of the most popularly used tools for scalp traders because it lessens the workload, and makes it easier to execute high-intensity tasks and the high-frequency nature of scalping. Crypto trading bots operate based on the support and resistance, Relative Strength Index (RSI), and moving averages.

Technical Indicators

Scalping crypto is a technical analysis that requires certain indicators because of their sustainability with small timeframes and fast moves.

Scalping crypto strategies will give better outcomes if executed with the right type of indicators that suits its purpose, making profits from small market movements.

Best Crypto and Forex Trading Course

Ezekiel Chew is considered one of the most credible forex trainers in Asia. He is the CEO and founder of Asia Forex Mentor, a company that provides forex education and training to individuals worldwide.

Ezekiel’s focus on mathematical probability sets his course apart from other forex trading courses. Moreover, his methods are backed by statistical evidence and proven to work in the real world.

So if you are a beginner looking forward to starting your forex trading journey, then you should opt for AFM PROPRIETARY ONE CORE PROGRAM, a complete program covering from beginner to advanced.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Crypto Brokers

| Broker | Best For | More Details |

|---|---|---|

| Earning Rewards Read Review | securely through Coinbase website |

| Altcoin Trading Read Review | securely through Binance website |

| Sign Up Bonuses | securely through Crypto.com website |

| New Investors Read Review | securely through Gemini website |

Conclusion: Crypto Scalping

Cryptocurrencies provide various opportunities to make money while being extremely unpredictable investments. This article covered the definition of scalp trading and scalping and thoroughly examined the top scalping tactics, ways to profit from them, timeframes for scalping cryptocurrency, and their benefits and drawbacks.

You can use trading robots or human traders for scalping. We contrasted the two while outlining the rise in popularity of bots. New traders should exercise caution and research the hazards associated with scalping cryptocurrencies.

Be careful to become familiar with trading bots and charting indicators. Profitable trades are feasible with relatively few price changes for modest gains when using a top-notch trading platform. The secret to becoming a good crypto scalper is to develop your ability to comprehend charts and understand various crypto trading tactics.

Most traders will halt their trading while prices are moving sideways or downward. Crypto signals help forecast when to purchase or sell by interpreting market conditions. If you’re interested in using a cryptocurrency scalping strategy as a day trader, you should get financial counsel on the best trading methods to maximize profits.

Crypto Scalping FAQs

Is Crypto Scalping Profitable?

One of the trading strategies that can be the most profitable is scalping. Trading in a favorable trend or market conditions can considerably raise one’s winning percentage. As a result, it might be advantageous to include a trend-following indicator on a larger timeframe.

Is Scalping good for beginners?

Scalping in cryptocurrencies is not for everyone. Attempting a less hazardous trading approach is advised if you are new to crypto and are just starting. Additionally, investing in the bitcoin market over the long run may be preferable.

When scalp trading, you must be mentally prepared for all possible outcomes and have ample money to acquire many positions. Additionally, very few rookie traders possess the emotional control necessary for scalp trading. However, if you believe you possess all of these factors and the required trading skills, then, by all means, get going.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.