What Is Channel Trading – Explained By An Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Channel trading is also known as price channels. It is a trading strategy that can produce incredible results for traders if they use it appropriately. To explain channel trading comprehensively we've got Ezekiel Chew, who is known across the globe for his financial expertise and has trained not just retail traders but investors from reputable financial institutions.

According to Ezekiel, trading channels are a strategy through which experts can visually draw an upper trend line or lower trend line to join an asset's resistance and support levels. Moreover, it is considered to be an important strategy that is used in technical analysis. This enables investors to predict the financial situation of an asset and make investment decisions accordingly.

This review is written specifically to explain the benefits and usefulness of the channel trading strategy. Furthermore, it put forwards the analysis regarding the advantages and limitations of trend channel trading so that investors can use this strategy effectively to gain maximum profits.

What is Channel Trading

Channel trading is a strategy that is used in technical analysis to assess the price of an asset. This strategy enables analysts to graphically represent two trendlines on a channel pattern. The trendlines mostly define the support and resistance levels of an asset where it trades in the market. As a result, this technical indicator helps traders and investors to make investment decisions while keeping in mind the stable trend in the market movement.

Channel trading mostly relies on the two parallel lines of support and resistance levels. The support level is where the price of an asset is supposed to stop declining and bounce back up. Whereas the resistance level is in the opposite direction of the trendlines where prices drop after a constant rise.

Consequently, in channel trading, the support channel indicates the traders buying assets. On the other hand, traders are advised to sell assets at the resistance channel.

The strategy of channel trading is not only useful for traders when making a long-term investment decision but is also beneficial during day trading transactions. The chart patterns using the channel trading strategy can indicate the low price and high price swings at multiple support and resistance levels. For this reason, financial experts consider channel trading strategy as an integral part of the overall technical analysis.

How to Trade using Channel Trading

The channel trading strategy is simple yet very effective in technical analysis. Investors and traders who seek risk management are often advised by financial experts to opt for channel trading strategies. Usually, there are two parallel lines in channel trading which are trend continuation or channel breakout.

In the trend continuation pattern, traders follow the trend channel and make investments by the trend to earn maximum profits. For instance, if the trend channel is showing a bullish pattern then the traders will get the signal to buy assets when the price is low at the support line. The reason behind this approach is that traders will predict the rising price action and will be able to buy assets before time to gain profits.

The same goes for the bearish trend channel. Only this time the traders will sell their securities knowing that the price will decline in the coming time. Hence, channel trading enables traders to make informed decisions regarding their investments which reduces risks and increase their chances to earn maximum profits.

The other technical indicator in channel trading is the break-out pattern. The price action of any asset reaches a point where it reverses after a continuous trend line. This position is known as the break-out when the prices transcend their support and resistance levels. Hence, through channel trading strategy traders can visually apprehend the break-out point in the chart pattern and then make their move.

Many traders wait for the break-out trend channel because as the prices consolidate and move in the opposite direction there are better chances for the traders to make big investments and gain massive profits. However, this move could also be risky because there is no guarantee of the duration of the price action. The price can easily quickly move to its original direction before the investor can take advantage of the situation.

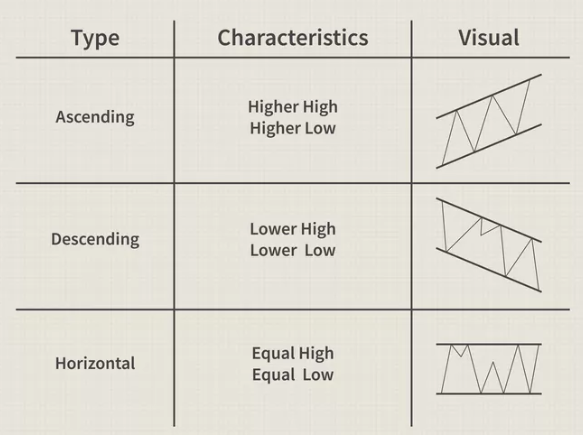

Different Types of Trading Channels

There are multiple types of trading channel strategies that are categorized according to the price movement of the assets as well as the overall market condition. Some of the most effective and widely used types of trading channels are discussed below.

#1. Ascending Channels

The ascending channel pattern occurs when there is a bullish market trend. During the technical analysis, when traders locate the ascending channels it suggests that the price movement is going up and will continue to rise steadily. This is the time when the investors take the chance and seize this opportunity.

After ascertaining that the price action will go up, investors usually take a long position and buy assets to gain profits by selling them at a higher price later at their resistance level. Similarly, some traders also take a short position to hedge against any risks of buying during any market volatility or disruption.

It is easy to read an ascending channel as it shows two elevating parallel lines on a graph. These lines suggest the upward price movement of the asset and are located next to the support and resistance levels.

#2. Descending Channels

Descending channels are as the name suggests the opposite of ascending channels. Consequently, these channels are trading indicators for a bearish trendline. The descending pattern usually appears when the price of an asset is dropping and indicates a constant decline in the chart pattern.

During descending trends, investors are given sell signals due to which they try to sell securities at resistance level before it reaches their bottom end. Most selling takes place during the descending channel as investors want to avoid suffering from the losses of the lower price swings. Additionally, there are also more openings for short positions as traders want to hedge against any long positions they had previously.

The two negative-sloping lines indicate a descending channel on a chart pattern. However, this pattern is considered to be finished when the price encompasses the resistance line and closes at this point.

#3. Horizontal Channels

Horizontal channels are also known as flat channels. These channel patterns have neither an upward trendline nor a downward trendline but two parallel lines moving sideways. For this reason, horizontal channels are used when investors are not looking for upward or downward price movement but a sideways trend.

The horizontal or flat channels are interpreted differently than ascending and descending channels. The graph may show two parallel trendlines without any highs or lows, so the investors look only at the support and resistance lines as technical trading indicators.

When the price reaches the resistance level in a horizontal channel, it is a signal for investors to start selling commodities to avoid more losses. Therefore, most investors take a short position at the price resistance line.

On the contrary, the support line is an indication for buying an asset and so investors take a long position at this point. The major difference between horizontal and other channels is that price breaks are occasional at support and resistance levels.

#4. Enveloping Channels

Enveloping channels are the most comprehensive graphical chart pattern consisting of statistical levels. Unlike all other types of trading channels, enveloping channels do not have two parallel trend lines as the technical indicator. Instead, enveloping channels depict two trend lines of standard deviation and average true range line and there is also a third line in the center which represents the moving average.

Enveloping channels are used to present the correlation between the asset's price and the market volatility. For this reason, different market volatility indexes such as the Fibonacci ratios, Bollinger bands, Donchian channels, Kelter channel indicator, and exponential moving averages are used in the enveloping channels.

The most well-known and commonly used enveloping channels are the Bollinger bands and the Donchian channels. Mostly these measuring methods of market volatility are used in enveloping channels to gauge the long-term price movements of the underlying asset. For this reason, enveloping channels provide an in-depth view of the overall market situation in the technical analysis.

Pros and Cons of Channel Trading

Pros of Channel Trading

- It enables traders to predict the upward and downward trends

- Channel trading connects an asset's support and resistance levels

- Helps investors in financial decision making

- Increases the chance of earning more profits

Cons of Channel Trading

- Cannot predict sudden market volatility

- False signals

Best Forex Trading Course

The best forex trading course on the internet today is the ‘One core program' by Ezekiel Chew. It is available on the Asia Forex Mentor website. Ezekiel affirms that the program was designed with the same system that he has been using to train bank workers and institutional traders for several years. This trading system is highly effective as it yields 6-figures per trade for him.

The best part is that prior knowledge of the financial markets or trading experience is not needed. One core program is a comprehensive program that covers everything from scratch to advanced levels of forex trading. You only need to be a committed learner. Ezekiel developed this proprietary trading system after several years of learning, trading, and teaching.

Like all traders, he started by blowing his accounts, but over the years, he developed a highly rewarding system based on mathematical probability. His fortunes changed and he began generating millions of dollars from forex trading. Over the years, he has taught numerous students who are equally millionaires courtesy of the one core program. He is also a renowned speaker at major forex events.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Channel Trading

When it comes to financial investment forex and stocks, the biggest hurdle for investors is the challenging market volatility. The constant price fluctuations make it very difficult for traders to reduce investment risks and make profitable investments. Therefore, financial analysts are always using various strategies to gauge price movements. One such effective strategy is channel trading.

The trading channels strategy is used to graphically and statistically represent the price action of the underlying assets. Most technical analysts use trading channels for identifying the key position of support and resistance levels. The support trend line is the point at which the price action pause during a downward price movement. Whereas resistance lines are the opposite and denote the pause from an upward trend.

Many different methods are used as channel trading indicators such as ascending, descending, and horizontal channels. All of these indicators have parallel lines on the price analysis chart patterns. These two lines represent the highest and lowest price of an asset which helps traders to figure out the right time for their investments.

There are also enveloping channels which is a strategy different from the others. This strategy uses three lines with upper and lower bands and also a moving average line. There are many other popular enveloping trading channels like the Bollinger bands and Dochian channels which offers accurate price chart for investors.

Channel trading can turn out to be a great trading strategy for the money markets. These days channel trading strategies are quite in demand for financial technicians as it is easier to use and provides the best results. By using channel trading strategies, investors can get accurate chart readings regarding price movement. This enables them to learn the precise moment to enter and exit the market.

Channel Trading FAQs

Is Channel Trading Profitable?

Channel trading is used specifically as a strategy to indicate price movements in the financial world. For this reason, channel surfing is considered to be a significant overlay that analysts use to predict the price action of assets. This eventually allows investors to make investments with minimum risks. Furthermore, with the help of channel trading investors are in a better position to take informed financial decisions regarding the buying and selling of securities and entering or exit from the market.

For all the above-mentioned reasons, yes channel trading is advantageous for investors as it provides opportunities to make profits from predicted market fluctuations.

How can you use channels to trade stocks?

Channel trading is unlike many other technical indicators, as it is not only an effective strategy limited to forex. Any trading channel can be used for any kind of asset be it stocks, commodities, securities, or forex.

Investors can use trading channels to trade stocks in the same way as any other underlying asset. All types of channel trading strategies such as ascending channel, descending channel, and horizontal or enveloping channels can be used to read the price action of the stocks. The focal point for using this strategy is to look for the support and resistance points to find out the best buying and selling position.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.