9 Best Broker For Short Selling In 2025!

By J Maver

January 5, 2025 • Fact checked by Dumb Little Man

Nowadays, trading is becoming more and more popular among those who want to make a sufficient amount of money easily.

The reason is that it gives people the opportunity to earn money without making huge efforts. Before starting to trade, you should first decide what you want to trade in the financial market.

You can make money by options trading, futures trading, forex trading, stock trading. Many traders consider that the best way of making money in financial markets is trading stocks.

The list of 9 short-selling best brokers

Top-consumer's choice: Interactive Brokers

- Best broker for short-selling: Firstrade

- Best for the construction of the trading strategy: Webull

- Best for the live trading: Tradestation

- Best trading software: Cobra

- Best for stock trades: Charles Schwab

- Best broker for analyzing the financial market: Moomoo

- Best for unexperienced traders: TD Ameritrade

- Best for active and day traders: TradeZero

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Broker For Short Selling: Detailed Analysis

Stock market and the advantages of stock trades

The stocks market is the place where you have an opportunity to become a shareholder of worldwide famous companies, such as Apple, Tesla, Amazon, Microsoft, Netflix, Google, Facebook, and earn money in this way.

You are not even required to be professional and experienced in finances to make profitable trade in the stock market, as popular companies that are counted as the favorite ones of millions of people have been benefiting their shareholders for many years.

The reason is that the stock prices of such companies tend to increase regularly. It means that even if you purchase the share of one famous company, you will most probably gain profit after some time.

I think that it is the main reason why both experienced traders, beginner traders prefer stock trading software. In addition, in my opinion, it is the major advantage of trading stocks over futures trading, options trading, currency trading, and so on.

The modern and more easy way of making money on stock trading

But what if I say that there are several ways of making money by trading stocks and one of these ways offers you a more easy way of making money compared to other ones?

The way which allows earning money more easily is the short-selling stocks. By finding out the beneficial sides of the short-selling stocks more and more investors who consider that it is better to hold the stock for long(even stock traders who normally prefer to get rid of stocks after the first grow) are changing their trading strategies.

As a result, nowadays most of them prefer to be engaged in short-selling stocks.

It is normal if you have a question sort of what is short-selling stocks and for what reason many investors and traders starting to be interested in that.

So now, let's first elaborate on what is short-selling stocks.

How to make money by short-selling

To make money by short-selling you should first choose one stock which price in your opinion, will go down after some time.

First step: borrow shares

After deciding which stock will get cheaper, you can use the broker to agree with the owner of that stock to lend you the stock he owns.

In that case, you have to give the stock back to its owner at a predetermined date. Now you are the temporary owner of the stock you predicted to get cheaper.

However, it does not mean that it is possible to borrow the share at absolutely no charge, even you will give it back after a while.

Anyways, when you borrow shares, you are required to pay trading program fees which without you are not able not only to borrow shares but also have access to important and helpful features of the trading platform at all.

It should be mentioned that the amount of pee you have to pay might be different, more expensive, or in contrast cheaper depending on the trading platform you use.

Second step: instantaneously selling what you borrowed

Then, in the second step of earning money by short sales you should better sell what you borrowed instantaneously.

Otherwise, you might miss the chance to sell the stock borrowed at an appropriate time.

You get some money when you have sold the share. Simply hold that and avoid purchasing some other stocks with the money you got from selling a borrowed share.

Third step: wait for the falling moment of borrowed stock price

As the borrowed stock price goes down, take advantage of the opportunity and just purchase it for cheaper. While doing that, the faster you act, the better it is.

I know that the majority of those who have a desire to make money by short-selling are unsuccessful in acting fast like that. Therefore, I would like to recommend it.

Fourth Step: you bought the share you borrowed at first at a lower price and made a profit

After the stock's price decreased, you purchased for cheaper what you borrowed at the more expensive price at first. Spontaneous meaning of it that you are in profit. Now, the only thing left is getting earned money for yourself and enjoy this amazing advantage of shorting stocks.

Market value

Market value is the price for a particular financial tool. Market value is set by major partakers of the trading process. These major partakers are buyers and sellers.

Who is a pattern day trader

According to the financial industry regulatory authority, pattern day trader makes at least four trades during a 5 business days period. Pattern day traders use a margin account.

What you should also know about before starting short selling

The importance of selecting an appropriate trading platform

Undoubtedly, the trading platform chosen matters when it comes to making a profitable trade on short selling.

While existing tons of trading platforms, selecting the appropriate one should be a sort of difficult task. In my point of view, many traders, particularly beginner ones face difficulty in using a comprehensive trading platform.

If we take into account that such trading platforms contain a lot of trading tools, while the majority of them are advanced and difficult to use, that seems to be normal for not only inexperienced traders but also professional traders and active day traders who have been being engaged in trading for many years.

The importance of choosing an appropriate broker

In addition, you should better select a reliable broker firm which work is regulated by national authorities.

In this way, you can make sure that your money is in reliable hands. There are lots of options for those who have a desire to be engaged in short-selling.

In this article, you will get familiar with the best brokers for short selling that can be a good helper in your trading journey.

If you ask me to count the 9 best brokers for short selling, they would be Firstrade, TradeStation, TradeZero, CobraTrading, Interactive Brokers, TD Ameritrade, Charles Schwab, Webull, Moomoo.

Another thing you should take into consideration is the margin account. The process of borrowing shares has similarities with the process of getting a loan.

Like if you want to get a loan, you are required to have a margin account in the process of borrowing stocks you have to have a margin account.

Without a margin account, it is impossible to borrow shares, as this account is considered one of the major and important things for those who want to make money through short selling.

What is momentum trading?

There is one amazing strategy called momentum trading. Traders who use this strategy buy financial tools which are regularly increasing and then simply sell them when they are at their peak. Such traders are called momentum traders.

What makes a broker good?

In my opinion, the main factor making broker good is that it should provide you with access to all financial markets, such as stock, bond, options, exchange-traded funds(ETFs), and mutual fund markets(non-proprietary mutual funds and proprietary mutual funds)

In addition, the amount of minimum deposit you are required to pay before starting to trade shouldn't be very high.

Because of the high minimum deposit requirement, many brokers fail to attract a great number of traders.

Also, a good broker should provide its users with the opportunity to purchase stocks at the international markets. It is also important that the broker should offer you a handy way of removing funds from your trading account to your cash account.

1. Firstrade

If you use Firstrade, you are provided with the service of Robo-advisor which gives you helpful advice that helps you in deciding what stock to buy.

It should be mentioned that this broker has beneficial sides for both investors and active traders. It does not matter which trading strategy you choose, it would be short-selling or holding stocks for long you will love and enjoy using Firstrade.

In addition, Firstrade offers free trades for those who want to be engaged in short selling and make a large amount of money in this way.

Advantages of Firstrade

- Firstrade is so easy and handy to use that even absolute beginners can understand its interface and how to trade on it. In my opinion, it is the major advantageous side of Firstrade attracting many of those who would like to earn money by short sales.

- Traders who have a desire to use Firstrade as their helper in the journey to the trading world have an opportunity to do free trades if we do not take into consideration some platform fees available on Firstrade. But, on almost every trading platform you are required to pay some fees. For that reason, it is OK that Firstrade also requires you to pay some fees. So, enjoy free trades of Firstrade!

- The understandable interface of Firstrade makes it easy to find out if your portfolio is effective enough. This feature of Firstrade is especially helpful in making a profitable trade.

- Trading tools which might help you during the trading process are available in Firstrade. The availability of the fundamental analysis tools can attract lots of people who want to be engaged in short sales

Disadvantages of Firstrade

- Firstrade does not offer its service 24/7. It means that you are limited to use this broker whenever you want.

- The second drawback of Firstrade is that on this broker, you have an opportunity to purchase only the stocks of American companies. I think that it is the most significant disadvantage of Firstrade since you might prefer to buy the stock of a non-American company. In addition, some short-sellers are used to making a profit by borrowing shares on global markets.

The mobile app of Firstrade

Firstrade offers a mobile app for those who want to be engaged in mobile trading. Nowadays, because of the development in technology, mobile trading is more popular than trading on Personal Computer, Laptop and so on.

Taking into consideration that, Firstrade makes many helpful functions available in its mobile app also. In this mobile app, you can use all trading tools of Firstrade. That also contributes to making Firstrade one of the best brokers for short selling.

There is also the navigator of Firstrade. This navigator helps day traders in managing their portfolios, doing market research, and keeping informed about current financial news and the changes in stock prices.

The reason is that Firstrade regularly provides you with important market data, advanced charts, and equity ratings which are particularly helpful for shorting stocks.

I would like to recommend you learn how to use equity ratings and advanced charts to make profitable trades before getting started on short sales.

It should be mentioned that the navigator of Firstrade is specially designed for those who would like to make money by active trading. Therefore, Firstrade can be counted as one of the best brokers for not only short-sellers but also active day traders.

That's why if you have a desire to make money by shorting stocks and are looking for an appropriate broker for short selling as the helper in becoming successful on short sales.

CLICK HERE TO READ MORE ABOUT FIRSTTRADE

2. TradeStation

Another good choice for short-sellers might be TradeStation. Most traders know TradeStation as the broker offering advanced tools for professional and skilled day traders.

But, TradeStation realized that there are a great number of beginner day traders who want to use TradeStation, but are not experienced enough to understand how to use advanced tools available on its platform.

For that reason, TradeStation started to offer professional and advanced tools which are particularly intended for novice traders.

It doesn't matter if you are a novice short seller or investor who prefers to hold stock for long, as TradeStation is considered as one of the best brokers for short selling and it made its platforms easy to use for short-sellers.

If you think that it will be challenging for you to use the advanced tools of TradeStation, you have an opportunity to create a TD GO account that is specially designed for novices.

Advantageous sides of TradeStation

- Firstly, if you want to be a successful short-seller and see TradeStation as the best broker for short selling, you do not have to pay for securities and exchange commission.

- Secondly, beginner short sellers can take advantage of helpful and effective resources available in TradeStation. Thanks to these resources, they have an opportunity to master their trading and short selling skills before starting to trade.

- The platform of TradeStation is very handy to use. Some trading brokers' platforms are inconvenient to use, especially for short-sellers. But, unlike such brokers, TradeStation offers a handy platform for all sorts of traders and investors, including short sellers. Maybe it also proves that TradeStation is counted as one of the best brokers for short selling.

- On TradeStation, you can trade almost everything you want, cryptocurrencies, futures contracts, stocks ETFs, options, and so on.

Disadvantages of TradeStation

- In my opinion, TradeStation has only one drawback. This disadvantage is that it might be difficult for beginners to create a margin account on TradeStation.

Margin interest in TradeStation

If there are less than 50000 United States Dollars in your margin account, rates of margin trading are at least 9.5% for your account, while the margin trading rate for a margin account with more than 2 million United States Dollars is accounted for 3,5%.

On TradeStation, the amount of money you have to pay for the margin interest depends on how high the share price you borrowed moves.

CLICK HERE TO READ MORE ABOUT TRADESTATION

3. TradeZero

TradeZero is also considered one of the best brokers for short selling. It claims that it provides its users with the best tools. These tools are particularly intended for short selling.

Trade Zero's significant advantage is that users of it do not have to pay fees in a large amount. Also, TradeZero has one of the innovative software among existing ones.

As I mentioned above TradeZero has the tools and functions which are specially designed for making short sellers' trades more profitable.

For that reason majority of people who have a desire to make money by short-selling select TradeZero, as its attention to short-sellers makes it one of the best ones among other short-selling brokers.

Beneficial sides of TradeZero

- Platforms available on TradeZero are proved to be reliable and they are controlled by many influential government authorities, such as financial industry regulatory authority

- It does not matter how much money you have, you can still afford to trade on TradeZero since the amount of minimum deposit you are required to pay is low.

- On TradeZero, you don't have to spend a large amount of money to pay for securities and exchange commissions.

- To attract as many active traders as possible TradeZero gives its users to trade on TradeZero without paying high fees.

Drawbacks of TradeZero

- On TradeZero, if you want to make your deposit through international wire transfers, you are required to pay a fairly large amount of money for wire transfer fees.

- The features that TradeZero offers for active traders differentiate. It depends on which country they are from. On TrdeZero, there are special features available for American active traders. Unfortunately, international traders can't use those features of TradeZero.

More about TradeZero

As I mentioned above TradeZero caters especially to those who have a desire to make money by short selling.

Therefore, TradeZero can be counted as one of the few brokers for short-selling designing, especially for short-sellers.

Those who prefer to use TradeZero get the opportunity to make their trade more profitable with the help of the short stock availability tool. This tool, without doubt, is considered one of the most helpful and important ones for active traders and those who want to be engaged in short-selling.

I believe that because TradeZero has a short stock availability tool, it has an important advantage over other short-selling brokers.

Dealers of TradeZero

TradeZero has two dealers. One of these dealers is called TradeZero. This dealer is particularly intended for international brokers and is situated in the Bahamas.

The second dealer called TradeZero America is designed for American traders.

CLICK HERE TO READ MORE ABOUT TRADEZERO

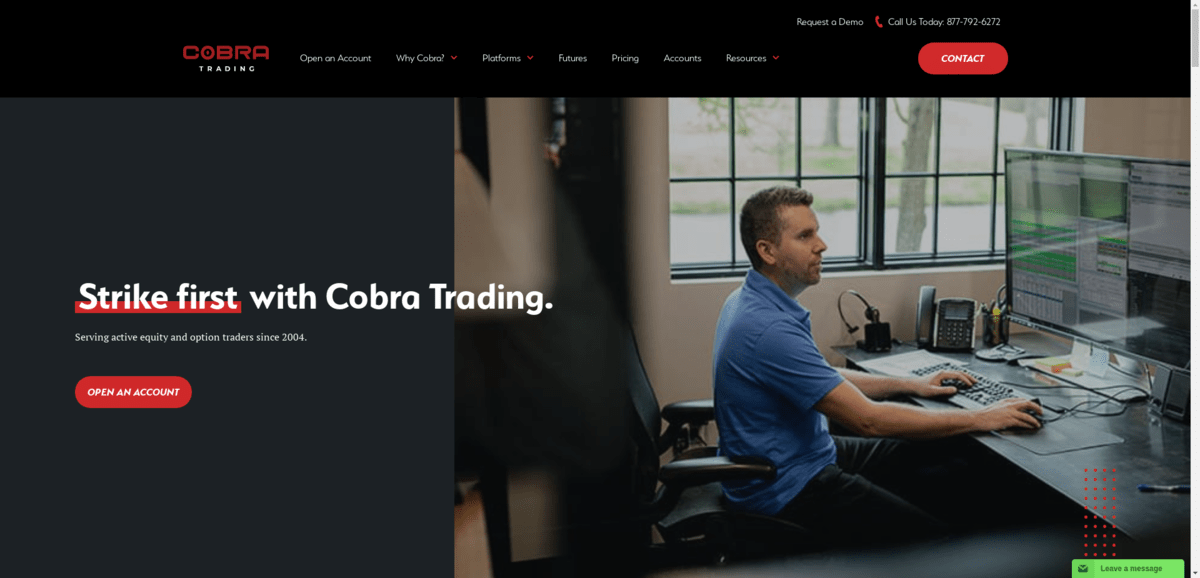

4. Cobra Trading

Cobra Trading is a direct access broker. Cobra is a very reliable broker, as it has been working in the financial industry for almost 20 years.

Because Cobra Trading is a direct access broker, you do not have to make payment for order flow, if you use this broker.

In my point of view, Cobra Trading is one of the best direct access brokers. It is also one of the few brokers which does not require you to pay for order flow.

Cobra Trading is very handy for traders to do market research since it regularly provides you with important market data.

Advantageous sides of Cobra Trading

- If you use Cobra, you can buy penny stocks. Penny stocks are very cheap stocks that allow you to earn a large amount of money in a very fast way. But, it should be mentioned that trading penny stocks is extremely risky. For that reason, many traders who have an interest in making money by stock trades try to avoid trading penny stocks.

- There is a direct access routing on Cobra. With the help of direct access routing(DAT), you have an opportunity to trade stocks and other financial instruments with professionals or market makers. Undoubtedly, this feature of Cobra makes it one of the best financial products among existing ones.

- Cobra pays special attention to improve its support service. It means that when you have any problems relating to Cobra or stock trading, you can get help from the client service of Cobra Trading anytime.

- Cobra provides you with the opportunity to use DirectAccessTrading systems.

Disadvantages of Cobra

- The amount of money that traders have to pay for using Cobra might not be affordable for novice traders. If you want to start trading on Cobra, you must first pay 30000 United States Dollars fee. As you know the majority of beginner traders most probably can't afford to invest money in that amount.

CLICK HERE TO READ MORE ABOUT COBRA TRADING

5. Interactive Brokers

Interactive Brokers is one of the most popular brokers in the world. Interactive Brokers has been working in the financial industry for more than 40 years.

Also, it should be mentioned that Interactive Brokers is so successful company that it made its founder one of the richest men across the world.

In General, this broker is one of the most famous investment firms among existing ones.

Advantages of Interactive Brokers

- Very appropriate for active traders, as it offers its service for an affordable price.

- Reliability. The reason is that this broker is very successful, popular, and has been working for 43 years.

- Margin rates are so low.

- A Variety of financial tools are available to purchase for both traders and investors.

CLICK HERE TO READ MORE ABOUT INTERACTIVE BROKERS

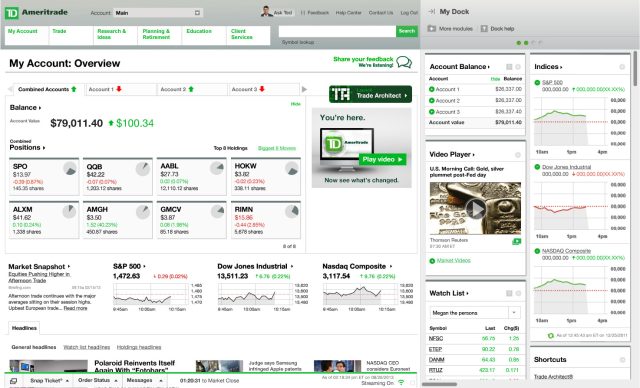

6. TD Ameritrade

If you are looking for a broker which can help you in becoming a successful trader TD Ameritrade is absolutely for you, as in my opinion, it can contribute to making your trades more profitable.

Tools available on TD Ameritrade are very convenient and understandable to use and it is considered as the major advantage of this broker.

Advantages of TD Ameritrade

- A Platform of TD Ameritrade suits both beginner and professional traders.

- Availability of state-of-the-art trading tools which are free to use.

- No requirements to make payment for stock trading.

- The opportunity to purchase options and futures without restrictions.

CLICK HERE TO READ MORE ABOUT TD AMERITRADE

7. Charles Schwab

If you want to do ideal market research which helps you in making lots of money through short selling Charles Schwab might be the best choice for you. Trading tools available on Charles Schwab and its platform are very helpful for those who have a desire to be successful on short selling.

Advantages of Charles Schwab

- The Trading platform of Charles Schwab is very handy.

- Fairly low commissions for trading stocks.

- State-of-the-art financial instruments which are very helpful in researching the financial market are available in Charles Schwab.

CLICK HERE TO READ MORE ABOUT CHARLES SCHWAB

8. Webull

Webull's main advantage is that it allows traders to be engaged in short selling without any fee requirements. It means that you can trade on Webull absolutely at no charge. You can not only trade stocks, but also ETFs on this broker. Webull has a very handy mobile app. I think that the mobile platform of Webull is the most convenient to use.

Advantages of Webull

- Fast and understandable process of account creating.

- Availability of the best platforms.

- Webull is a commission-free platform.

CLICK HERE TO READ MORE ABOUT WEBULL

9. Moomoo

Moomoo is designed for those who want to be engaged in mobile trading. Moomoo is a mobile app offering traders the opportunity to be engaged in short selling without paying any trading fees and commissions.

Advantages of Moomoo

- Firstly, on Moomoo you can create a trading account in a very fast way.

- Secondly, Moomoo as well as being a commission-free broker doesn't require its users to pay any fees.

- Trading instruments available on Moomoo are high quality and helpful for all sorts of traders and investors.

CLICK HERE TO READ MORE ABOUT MOOMOO

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion

In conclusion, all brokers I presented you, Firstrade, TradeStation, TradeZero, Cobra Trading, Interactive Brokers, TD Ameritrade, Charles Schwab, Webull, Moomoo have their advantageous sides. Neither of these brokers will let you down regardless of your option.

But, I would personally prefer to use Firstrade, since I think that it is the best choice for those who would like to make money by short selling.

The reason is that Firstrade has more advantages compared to TradeStation, TradeZero, Cobra Trading, Interactive Brokers, TD Ameritrade, Charles Schwab, Webull, Moomoo.

Moreover, Firstrade has a very huge potential to grow and in my opinion, it will become the most famous broker in the future.

J Maver

Passionate in tech, software and gadgets. I enjoy reviewing and comparing products & services, uncovering new trends and digging up little known products that deserve an audience.