Basics For Swing Trading Strategies: How To Make Money From It

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Swing traders are among the most popular cohort of traders you'll find thriving. In as much there's no limitation if whether you can find success among the other forms. It's crucial that a trader can describe the strategy they are following. And it starts with knowing the timeframes they target in the markets, plus entry and exit positions.

In this post, we'll purpose to expound more regarding swing trading. As part of the approach, you'll find a few expanded strategies, which all befit the scope of swing trading. Reading on, you'll find the kind of markets that swing trading helps you profit sustainably.

We always strive to approach content from an expert's point of view. Therefore, to lead us in the in-depth coverage, we'll seek the indulgence of Ezekiel Chew from Asia Forex Mentor – an expert trader, trainer, mentor, and global Forex events guest speaker.

As part of giving back to society, Ezekiel offers insightful perspectives about many trading indicators and strategies. At other levels, he shares the actual strategies and approaches he uses to bank profits in situations where most newbie traders fail.

Basics for Swing Trading Strategies for Forex and Other Markets

Having gone past the basics to do with swing trading, we'll need to cover a more practical approach as to how it's done. Of course, the best approach is to work with a reliable strategy.

With a reliable swing trading strategy in place, you are ready to make the analysis and check if the situation fits your trading plan in light of entry and exit points or price levels.

We apply a generalist rule, every time you dive into the markets with whatever strategy, ensure you protect the capital first. Always have an exit route should things go in a direction contrary to your trading expectations.

As part of this introductory post, we'll cover very basic strategies to identify trading opportunities for swing trading strategies. And those will go a long way at helping you figure out and even trade practically as a swing trader. Also, as of foremost importance, get to know how to swing trade by analyzing price action.

On most occasions, the platforms or brokerage firms you trade on do not matter to a great extent. What matters most is your analytical insights, capital protection, and profiting after in that order.

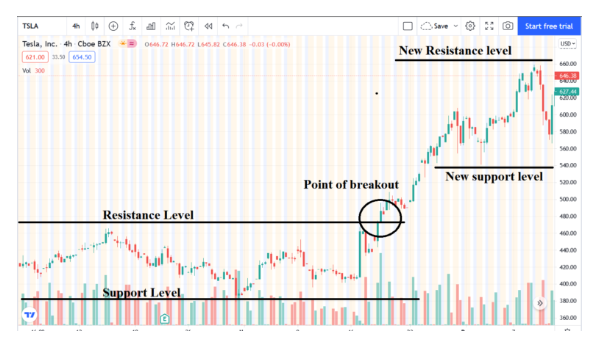

#1. Support and Resistance Levels in Swing Trading Strategies

The swing trading opportunities are easy to spot, with support and resistance being very common among traders. One key distinction with the strategy is that there's no indicator involved. What a trader needs here is a skillful ability with pattern recognition regarding price breaks in light of applicable time frames.

Support and resistance is a good swing trading strategy that brings very great ease for newbie traders. What it all requires is the deployment of analysis using two phenomena: the support and resistance levels of prices in the target timeframes.

Let's get a little deeper into this with bull markets and bear market

First is the distinction of the support level in swing trading. In other words, it's the price floor- an area where prices never get past in a bear market. Traders locate the price floors by finding the lowest price -points over the past timeframes. And when prices hit the floors, it's a great opportunity to buy or go long. Chances are, the prices will shoot upwards, rejecting the low levels on the chart.

Conversely, the resistance level is also the price ceiling. These are extremely high prices of an asset on a stock chart. And prices mostly never get past that zone in bull markets. Regarding market opportunities, it's usually a sell signal. There's high selling pressure, and it's a moment to go short or enter sell transactions. Having the elaborate picture of the support and resistance in mind, there's more we require to make clear.

Financial markets react differently and concurrently to various price action variables. Therefore, even as prices theoretically adhere to the scopes of resistance and support levels, at times, market prices drive past them.

By extension, when markets break past resistance levels, they transform them into support – as newer and higher zones of support come into the picture. And the same applies to support – broken support levels turn into resistance levels in that order. The key reason for making mention of this is to bring traders onto the realistic nature of the prices, and that adds to the risks that traders have to wrench within the markets as they make swing trades.

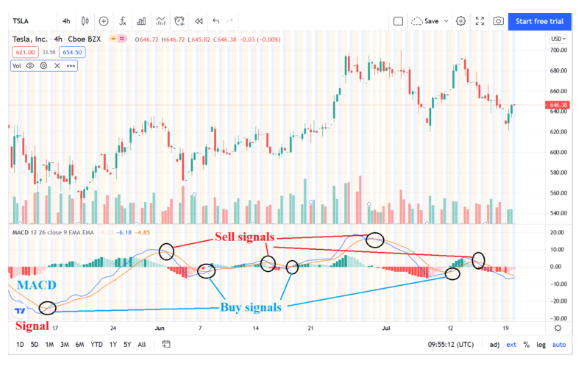

#2. MACD Crossover Swing Trading Strategy

First, for newbies, MACD stands for the Moving Average Convergence Divergence indicator. Traders have to enable the indicator if they plan to take on the MACD strategy for trading decisions. MACD is accessible for free with charting software the broker provides for trading.

MACD makes it easier for traders to observe the trail of scores and spot trading opportunities for Swing traders. And the indicator is able to figure out the current trend in light of any impending reversals – right before they occur. It's the main reason traders refer to it as a leading indicator. Monitoring price trends with MACD is a handy technique for noting when trends are getting ready to shift in an opposite direction.

Practically, the MACD indicator with the concept of a moving average. And two moving averages feature here. First, it shows the MACD line – where moving averages oscillate above or below the Signal line. Secondly, it shows the Signal line. And the rule of thumb is – whenever the MACD line (moving averages) crosses the signal line, it's time to enter a transaction as applicable.

In specific terms, if the MACD makes a crossing to the upper side of the signal line, it's an opportunity to go long or buy the underlying asset or currency pair. And the reverse applies for sell signals – the MACD line crosses below the signal line, and it's an opportunity to go short or sell the underlying asset or currency pair.

Therefore the starting point of the MACD strategy is the convergence and eventual cross-over between the signal and the MACD lines. Once the traders open positions appropriately, they hold until another cross-over happens – and that's when they exit the markets.

Let's take a practical example – targeting the Apple stocks via the MACD cross-over trading strategy

Your exact point of opening the trades with swing trading is observing the MACD indicator, and whenever a cross-over occurs, you open the relevant transactions or trades. In other words, when the MACD lines crosses to the upper side of a signal line, (buy trade) go long on your Apple stocks. Next, whenever the MACD line makes another cross-over against the signal line, that's the exit point. Therefore, close the transaction from swing trading and take your profit.

How to Swing Trade – Swing Trading for Beginners

If you already have some practical experience trading the markets, we'll still go over the basics for the sake of those pretty new to everything. Swing traders take on a trading style that focuses on the technical analysis of price action to take the opportunities from short-term trades to those lasting into the medium terms. In most instances, swing trades remain open for a few days from entry, and exit points extend to a few weeks.

In other words, swing trading is primarily intraday trading, save for the longer time scale that few of the trades may last before closure. And to give more emphasis again, swing trading relies heavily on the insights of traders from technical analysis for stock traders.

On a retrospective note, the fundamental analysts target gauging the future value of an asset. And this mainly applies to the stock markets. Arming themselves with prior knowledge helps traders know where they want to put the money – with tremendous opportunities with actively traded stocks.

Therefore, as part of the fundamental analysis, traders take time to analyze as much information as possible regarding a company's performance and its stocks. And they stick with the firms with the best odds in the long-term perspectives. If traders buy a stock that is undervalued, the chances are high that they will gain when prices go up soon. It's, therefore, a straightforward investment strategy, save that it takes long time frames to materialize.

From a unique perspective, swing trading, with technical analysis onboard, omits the long-term picture in the investment timeframes. Traders typically do not count on the long-term potential of an underlying asset. Therefore, technical analysts from the swing trader's category are not interested in the price directions of a stock. Their interest is simply a movement in the prices. And looking keenly, swing traders look for profits in the direction of the prices at the moments they make their trades.

Undoubtedly, if you remove the long-term picture of the direction of prices and trade correctly, you have huge chances of bagging profits. As such, the nexus with swing trading is looking for a current price and approaching it in light of the historical charts. It's a critical portion of technical analysis to note price trends and patterns that form within the applicable timeframes. Of course, the ingredient of key technical indicators comes in handy at sniffing the impending trends before they spark the markets.

How Swing Trading Strategy Works

In ordinary occurrences, swing traders hold positions for more than a single trading session or time zones. Towards the extremes, the trends remain to live for a short period, utmost several weeks but not exerting two months. Therefore, not more than two months is your applicable timespan as a swing trader. And to make further emphasize, swing traders straddle the comfort between intra-day traders and long-term investments.

In other words, the aim of awing trading is to take the opportunities that price movements of stock prices bring into the trading arena for traders. There are no set standards or limits. Whatever price moves the markets make and to your advantage in profits, take them up. Agreeably, some traders enjoy trading in the high tides of turbulence and volatility. Conversely, another cohort thrives within calmer charts in the markets. Therefore, whatever matters is the correct prediction of the flow in prices of an asset you target.

In the best sense, swing trading thrives on the nexus of reliably predicting a direction in process and making requisite preparations to take them up. Swing traders work on the approach of carefully taking on the risks against the rewards they target. After analyzing the markets through past and current time price action, their target is to spot an opportunity and capitalize on it. Of course, it's attacking a market with a target profit and an exit with adequate capital protection, should the markets rise in opposition to your prediction.

The risk to rewards ratios with a swing trade vary from one trader to another. Therefore, while some swing trade to make three times the amount it costs to open a trade, others will go for twice the same or 50% of the target reward. Therefore, the key fact is to find risk and reward tolerance that you can work with, plus ensure you stick to it as part of your strategy.

Best Forex Trading Course

If you are looking for a way to create wealth, learn a new skill, or diversify your portfolio; then one core program is for you. What is one core program? It is a forex/CFD trading course specially packaged by Ezekiel Chew and available from the Asia forex mentor website. It is the best forex trading course available today. It is comprehensive and requires no prior trading knowledge.

Who is Ezekiel Chew? He is a renowned forex trader and facilitator who have trained several bank traders, forex managers, and successful traders. He has been trading forex and other financial markets for the last 20 years. He has become a multimillionaire and has also made other people millionaires from his training.

What is the content of the program? The program comprises over 50 video lessons where the course is taught in simple clear language. The strategies taught in the program are based on mathematical probability which produces efficient results. His students are already making millions from trades using the strategies learned from the program. You too can join and become a millionaire.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: How to Swing Trade

Here, we've attempted to dig into the ins and outs of swing trading comprehensively. We can only cover so much within a single post for a vast topic. For sure, traders can seek to expound further by following various books and other material which zeroes down on swing trading strategies.

There are many strategies out there, starting with your understanding that no one size fits all. Nevertheless, the guiding facts here in this post are the fundamental pillars of the entire scope of things around – swing trading.

Swing trading and building on technical analysis can be the missing ingredient to your successful trading career. However, tackling it successfully requires effort in analysis and patience to test what works for your case. However, with tons of resources available, it remains for you to explore further and sift out what does not fit your case.

And to give it more emphasis, read wide to start swing trading. But practice will take you to another level. It's also good to emphasize that newbies can access demo accounts and try things out within a risk-free model – with free virtual capital. Only after adequate practice with entry and exit can you fund like accounts and trade successfully.

Swing trading and other trading strategies require time to master and launch your careers successfully for a lifetime. Most traders scour the internet helplessly. Also, one downside is the huge loads of information one has to sift through. The best and quick way would be to take a course and, better still, work with a mentor who'll guide you on the sure path to trading successfully.

How to Swing Trade FAQs

Is it profitable to swing trade?

The profitability of swing trading depends on a trader on a per individual trading results. First, it depends on the approach of the time spans. A successful swing trader may hold trades for several days to around two months for those lasting longest. Therefore, for success, it will mean holding and closing every swing trade from the most actively traded stocks

with reasonable profits – over and above protecting the capital

Making mention of the profitability will also depend on the swing trading markets the trader targets. And most probably, choosing assets with reasonable volatility helps to add to the profitability – of course, with correct risk management.

Is Swing trading good for beginners?

Swing trading can be good for traders if they choose the correct trading strategy. Supposing they go for the support and resistance swing trading strategy, – it's pretty straightforward and simple to analyze and trade into profits as a beginner.

On the other hand, attempting swing trading for its sake with a harder and rare pattern like the bat chart pattern only makes things complex for no good reason. Worse, in an instance where the trader is a beginner in swing trading with shallow experience with Fibonacci numbers or ratios.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.