AssetsFX Review 2024 with Rankings By Dumb Little Man

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 80th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, composed of individual traders, financial advisors, and trading experts, carries out comprehensive analyses of brokerage services. Their evaluation process involves a proprietary algorithm that measures brokers against consistent parameters such as:

They also integrate client feedback into their final assessments. This approach merges professional critiques with actual user testimonials to offer a balanced perspective, ensuring that the review remains impartial and free from individual predilections. Upon meticulous scrutiny, AssetsFX has been recognized as a viable choice for those in search of a dependable brokerage partner. Nevertheless, the platform's commendable performance is tempered by certain concerns, notably its lack of regulatory compliance. It is recommended that prospective clients examine the detailed article to grasp these caveats thoroughly. |

AssetsFX Review

Currency trading intermediaries, commonly known as Forex brokers, serve as crucial conduits for market access, enabling the purchase and sale of international currencies. Within this competitive arena, AssetsFX has carved out a reputation for itself by delivering expedited and effective trade facilitations via its ECN and STP frameworks. These jargons are indicative of a broker’s pledge to provide swift and dependable client trading encounters.

Yet, AssetsFX is distinct in its prioritization of transaction efficiency over educational support, a stance that might not fully accommodate the requirements of Forex novices. The lack of connection with regulatory bodies presents a possible concern for new traders desiring a more structured and safer foray into Forex markets. This critique intends to thoroughly explore the characteristics and offerings of AssetsFX.

The objective of our analysis is to meticulously unravel the complex aspects of AssetsFX, casting a spotlight on its range of services and the mechanisms of its operations. We aim to thoroughly explore everything from the different account options to the specifics of the financial transactions and fee structures. Merging expert insights with real user feedback, our intention is to present a comprehensive and impartial critique of AssetsFX, providing essential knowledge for traders to assess whether it meets their trading requirements.

What is AssetsFX?

AssetsFX is a Forex broker that distinguishes itself in the dense market of Forex brokerage with its proficiency in ECN and STP executions, ensuring that its traders engage in rapid and streamlined transactions that are characteristic of premium trading settings. By facilitating a direct pathway to the market, AssetsFX cuts out the middle entities, leading to quicker trades and the potential for lower expenses.

Established in 2013, AssetsFX concentrated initially on internet-based currency exchange and advanced into an all-inclusive broker by 2018. Presently, it provides a broad spectrum of trading tools, including forex, along with CFDs on precious metals, market indices, and equities from the American and European markets. With a clientele surpassing 180,000 traders worldwide, AssetsFX has garnered esteem within the industry, as evidenced by a series of distinguished awards.

The broker’s comprehensive influence and its decorated history of accolades underscore AssetsFX as a formidable force that is transforming the digital trading domain. It’s not just about the provision of trading services; AssetsFX is pioneering new benchmarks for the operational and service standards of trading platforms.

Safety and Security of AssetsFX

AssetsFX operates under the umbrella of AssetsFX Global Ltd, based in St. Vincent and the Grenadines, a jurisdiction that doesn’t require a brokerage license. This information, thoroughly researched by Dumb Little Man, underscores the absence of regulatory oversight, a crucial consideration for traders looking to safeguard their investments.

The absence of oversight from any regulatory authority is a notable issue for AssetsFX, indicating that its operations are not under the scrutiny of any official financial watchdogs. This absence could be a cause for concern among traders who prioritize the presence of regulatory bodies to ensure equitable trading practices.

In light of such information, a prudent stance would be to be wary of brokers like AssetsFX that operate without regulation. Such brokers may not provide transparency regarding the handling of client funds, including whether they maintain segregated accounts. It is crucial for traders to take these considerations into account when assessing the risk and security associated with their investments at AssetsFX.

Sign-Up Bonus of AssetsFX

AssetsFX provides a compelling enticement for newcomers: a tradable deposit bonus of 30%. This welcome offer is valid for all deposits, substantially enhancing the trading capabilities for those embarking on their Forex venture with the platform.

Choosing AssetsFX allows traders to benefit from this bonus with each funding, bolstering their trading execution power. It offers a direct method for traders to bolster their investment resources from the very beginning.

The provision of this 30% bonus reflects AssetsFX’s dedication to afford its traders a head start, reinforcing the financial leverage available for their trading approaches.

Minimum Deposit of AssetsFX

AssetsFX presents an easy entry point into the Forex market, offering minimum deposit options starting as low as $1, depending on the trader’s selected account type. This minimal entry barrier enables a broad spectrum of investors to start trading, appealing to both beginners and those wishing to explore the platform without significant initial outlay.

The varied deposit options show AssetsFX’s commitment to serving a wide range of traders. This approach allows participants to access the financial markets without the need for a substantial upfront investment, positioning AssetsFX as an attractive option for those looking to step into the world of Forex trading.

AssetsFX Account Types

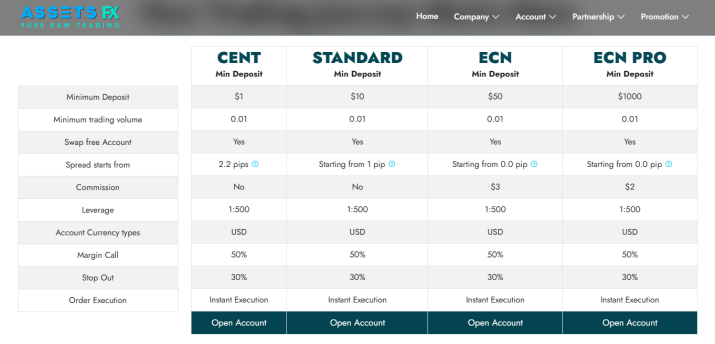

AssetsFX has an array of trading accounts to cater to diverse trading preferences and financial capacities. The following account classifications have been evaluated by Dumb Little Man’s experts through detailed examination and testing:

- Cent Account: An entry-level option that allows traders to start with as little as $1. This account has spreads starting at 2.2 pips, no commission fees, and up to 1:500 leverage, as well as the benefit of instant transaction execution.

- Standard Account: Designed for more assured traders, it requires a minimum balance of $10. This account type is characterized by narrower spreads beginning at 1 pip and maintains the leverage ratio of 1:500.

- ECN Account: The ECN Account is designed for traders seeking more direct engagement with the financial markets, necessitating a minimum deposit of $50. It boasts spreads starting at zero pips and offers leverage up to 1:500, with a commission of $6 per trade.

- ECN Pro Account: For the more seasoned market participants, the ECN Pro Account requires a $1,000 minimum deposit. It retains the offering of zero-pip spreads and reduces the commission to $4, thus optimizing the cost for higher volume trading, along with a leverage ratio of 1:500.

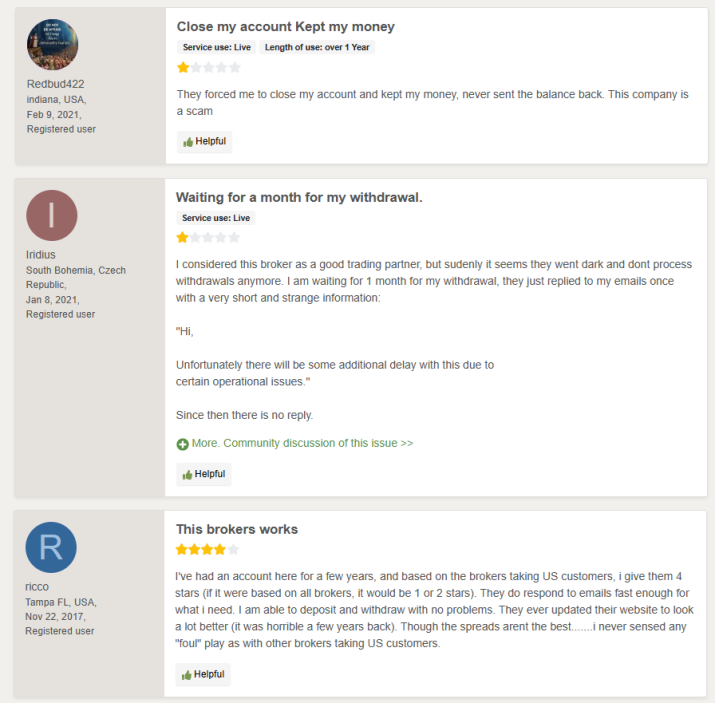

AssetsFX Customer Reviews

Reviews from AssetsFX users present a spectrum of perspectives about the firm’s reliability and quality of customer service. Some customers have voiced concerns, casting doubt on the firm’s reliability due to issues like account terminations and unreturned funds. There are also accounts of protracted withdrawal times and lackluster communication, often citing unspecified “operational issues” with no further clarification.

In contrast, long-term clients have reported positive experiences with the promptness of customer service and the seamless handling of both deposits and withdrawals. These clients also commend the progressive improvements in the user-friendliness of the platform. Nevertheless, despite these affirmative accounts, particularly from U.S.-based clients, the broker’s overall reputation is perceived to lag behind that of its competitors in the broader brokerage landscape.

AssetsFX Fees, Spreads, and Commissions

AssetsFX implements a tiered fee structure that correlates with the type of account a trader uses, as well as the prevailing market conditions. The Cent and Standard accounts primarily operate on a spread model, starting from 2.2 pips and 1 pip respectively. In contrast, ECN accounts offer tighter spreads, beginning from 0 pips, with the trade-off being a commission charge of $6 per lot for ECN and a reduced rate of $4 per lot on ECN Pro accounts.

The broker stands out for not imposing deposit or withdrawal fees, which can be a relief for traders. However, it is important to note that external payment systems might levy their own charges. Swaps, or fees for holding positions overnight, are applied to all accounts with the exception of Islamic accounts. When compared to the industry standard, AssetsFX’s average commission of $2.6 USD is on the higher side, signaling an additional cost consideration for traders.

Deposit and Withdrawal

The processes for funding and retrieving money from AssetsFX are designed to suit the varied needs of its clientele. For withdrawals in USD, traders have the option to use Perfect Money, cross-border bank transactions, and digital currencies, whereas converting to other currencies necessitates using a domestic bank. This data comes from thorough analysis conducted by a financial expert from Dumb Little Man.

When initiating a withdrawal, traders are poised to see their funds promptly reflected in their Perfect Money accounts or digital currency wallets. However, for those transferring to a bank account, the process may take up to a single business day. Notably, while AssetsFX does not charge a fee for withdrawing funds, additional charges may be levied by payment gateways, banking institutions, and digital currency networks, which are out of the broker’s purview and can differ based on the involved financial entity.

How to Open an AssetsFX Account

- The trader begins by clicking the “Open Account” or “Start Trading” buttons on the AssetsFX website.

- Personal details are entered and a secure password is created.

- A confirmation pin is sent to the provided email, which is required to activate the account.

- Logging into the user account is done using the registered email and newly created password.

- A new live trading account is set up within the user’s dashboard for asset trading.

- The trader deposits funds to enable trading activities.

- Identity verification steps are completed to secure the account.

- Withdrawal requests are submitted through the user account interface.

- Two-factor authentication is enabled for added security, and transaction history is accessible for review.

AssetsFX Affiliate Program

AssetsFX‘s Affiliate Program offers multiple avenues for partners to earn commissions, tailored to different levels of engagement and commitment. The Introducing Broker (IB) scheme pays out varying fees based on the account type managed; $4 per full lot on ECN, $1 on ECN Pro, $10 on Standard, and $12 on a Cent account.

For a more involved partnership, the Regional Representative role entails establishing a local office under the AssetsFX banner, with the potential to earn up to $10 per lot from client trades. This option is designed for partners looking to build a more substantial presence.

The Multi-Level Partnership program offers up to 56% of spreads from trades made by referrals. This tiered system rewards partners with an additional 10% fee increase for referral profits of $100-$4,999, 15% for $5,000-$29,999, and 20% for profits exceeding $30,000, creating significant earning potential through a loyalty program.

AssetsFX also incentivizes top-performing partners with tourist trips and gadgets, using metrics such as the net capital of clients, the volume of new clients, and their trading activity to determine the most efficient partners. This competitive edge adds a tangible reward to the partnership experience with AssetsFX.

AssetsFX Customer Support

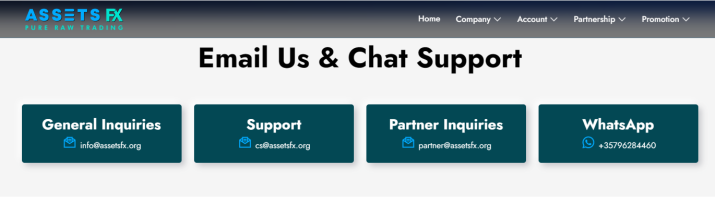

AssetsFX‘s customer support framework reveals certain limitations, particularly in its language offerings. The broker’s website is exclusively available in English, a point of concern for a platform aspiring for global reach. This was notably highlighted in Dumb Little Man’s experience with customer support.

Regional support at AssetsFX is limited due to the lack of an extensive array of local support hubs. Customers can reach out to the support team via telephone or an online contact form. The addition of a live chat feature now enables immediate dialogue with the broker’s agents.

While support is available around the clock, the lack of services in multiple languages and regulatory monitoring might complicate support for traders globally. The analysis by Dumb Little Man indicates that such limitations might cause dissatisfaction among users who choose to trade with AssetsFX.

Advantages and Disadvantages of GKFX Customer Support

| Advantages | Disadvantages |

|---|---|

AssetsFX vs Other Brokers

#1. AssetsFX vs AvaTrade

AssetsFX is known for its ECN and STP transaction mechanisms, as well as its considerable leverage. Nonetheless, it operates with a less stringent legal framework and a more limited selection of customer support services. In contrast, AvaTrade, which was founded in 2006, provides a wide range of financial tools and platforms to a large global client base. AvaTrade’s adherence to regulation in many territories demonstrates its devotion to trading security and dependability.

Verdict: AvaTrade is frequently the favored alternative for a significant number of traders because it provides good regulatory adherence, a broad operational scope, and a variety of trading resources. These components work together to produce a trading environment that is more safe and adaptive than what AssetsFX may offer.

#2. AssetsFX vs RoboForex

RoboForex, which launched in 2009, has won praise for its cutting-edge technology and favorable trading terms. RoboForex, which is regulated by the FSC, provides a diverse range of trading choices across numerous asset classes. Its platform portfolio comprises MetaTrader, cTrader, and RTrader, which are designed to fulfill the needs of diverse traders. AssetsFX, in comparison, does not provide the same range of trading platforms or the same level of regulatory oversight as RoboForex.

Verdict: RoboForex is regarded as the better option due to its regulatory compliance, a large range of trading chances, and different trading platforms. This gives it more adaptability and security than AssetsFX for traders of all levels of experience.

#3. AssetsFX vs FXChoice

FXChoice, which was established in 2010 and is regulated by the International Financial Services Commission of Belize, caters to experienced traders with a variety of account types, including conventional and ECN accounts with affordable spreads. The broker also offers automated trading and a loyalty program for high-volume traders. While AssetsFX provides ECN accounts, it does not provide the same level of regulatory security or specialized services for expert traders as FXChoice.

Verdict: For traders with extensive experience, FXChoice is the better option due to its regulatory compliance, commitment to providing seasoned traders with appropriate account types and trading conditions, and extensive range of instruments and services – features that AssetsFX does not provide.

Choose Asia Forex Mentor for Your Forex Trading Success

For those passionate about forging a lucrative path in forex trading and aiming for significant economic rewards, Asia Forex Mentor is the prime platform for premier forex, stock, and cryptocurrency trading instruction. The brainchild of Ezekiel Chew, known for his strategic influence on trading entities and financial institutions, powers this educational hub. Ezekiel himself is a testament to success, regularly securing trades in the million-dollar range, distinguishing him from his contemporaries in the educational sphere. The following are the key factors that solidify our endorsement:

- Extensive Learning Program: Asia Forex Mentor’s curriculum is comprehensive, tackling the essentials of forex, stock, and cryptocurrency trading, and providing learners with the necessary expertise to thrive in these varied financial arenas.

- Established Success: The track record of Asia Forex Mentor is stellar, with a history of cultivating traders who consistently perform profitably across different trading environments, attesting to their effective teaching and mentorship strategies.

- Seasoned Guidance: Under Asia Forex Mentor, individuals receive tutelage from a mentor with a significant successful trading history in stocks, crypto, and forex. Ezekiel’s tailored assistance empowers traders to adeptly navigate market complexities.

- Collaborative Network: Enrollment in Asia Forex Mentor includes entry into a community dedicated to success in trading, promoting cooperative learning, and the exchange of ideas, which enriches the educational journey.

- Focus on Mindset and Discipline: Recognizing the mental aspects of trading, Asia Forex Mentor emphasizes the development of a resilient psychological framework and disciplined tactics, essential for managing trading pressures and maintaining decision-making clarity.

- Ongoing Learning and Tools: With the ever-evolving nature of financial markets, Asia Forex Mentor keeps its traders informed with current trends and strategies, providing continuous learning materials to stay competitively informed.

- Narratives of Triumph: The platform celebrates numerous narratives where individuals have reshaped their trading pursuits into financially autonomous successes through their robust education in forex, stock, and crypto trading.

Asia Forex Mentor is distinguished as the ultimate educational resource for those intent on mastering forex, stock, and cryptocurrency trading to secure a prosperous financial future. The institution’s depth in curriculum, expertise in mentorship, practical training approach, and empowering community lays down the foundations for transforming eager learners into skilled market participants.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: AssetsFX Review

AssetsFX is praised for its ECN and STP trading platforms, which allow for speedy and efficient deals. Both new and experienced traders are drawn to the low minimum deposit requirement and the possibility of a transferable bonus.

However, caution is recommended for prospective clients. The lack of regulatory oversight and the restricted language support are considerable drawbacks that could influence the trading experience and introduce potential risks. Furthermore, the broker’s limited selection of trading platforms may detract from its appeal, especially for those seeking a broad range of trading tools and platforms.

>> Also Read: FXFlat Review 2024 With Rankings By Dumb Little Man

AssetsFX Review FAQs

What execution methods are available at AssetsFX?

AssetsFX is adept in ECN and STP executions, aiming to facilitate swift and dependable access to the market, thereby boosting the effectiveness of trade operations.

Is AssetsFX under any regulatory oversight?

As of now, AssetsFX is not under the purview of any leading regulatory authorities. This detail is essential for traders to consider since it may influence the security and credibility of their trading engagements.

Does AssetsFX offer learning resources for newcomers?

AssetsFX is geared more towards trade execution, with less emphasis on instructional support. Hence, the educational resources for beginners might not be as expansive as those offered by other brokers, which provide a more comprehensive educational framework.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.