Apex Trader Funding Review with Rankings 2024 By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

Apex Trader Funding Review

Proprietary trading firms, commonly known as prop firms, are institutions that use their own capital to invest in the financial market. They typically offer traders resources, tools, and even funding, enabling them to pursue higher risks and rewards than they could with their own funds.

Apex Trader Funding, based in the United States, is one such firm that has made a significant mark in this sector. Established in 2021, Apex Trader Funding has swiftly risen to prominence, offering unparalleled support to traders worldwide.

This article aims to deliver an in-depth review of Apex Trader Funding, drawing insights from the trading experts at Dumb Little Man and integrating genuine customer feedback. Readers will gain an understanding of the advantages and disadvantages, customer experiences, bonuses, security measures, features, and other critical aspects related to this prop firm.

This comprehensive review intends to arm traders and investors with the knowledge they need, spotlighting the firm’s strengths and potential areas of improvement ensuring a well-informed decision when selecting a prop trading partnership.

What is Apex Trader Funding?

Apex Trader Funding is a creation of Darrell Martin, who started his journey as a rancher and later delved into day trading. Since 2008, Darrell’s passion for trading has led him to establish a vast community, connecting over 30,000 traders from over 150 countries.

He recognized the limitations of existing funding models in the trading industry. He was driven to introduce a more flexible and beneficial model, emphasizing trader independence.

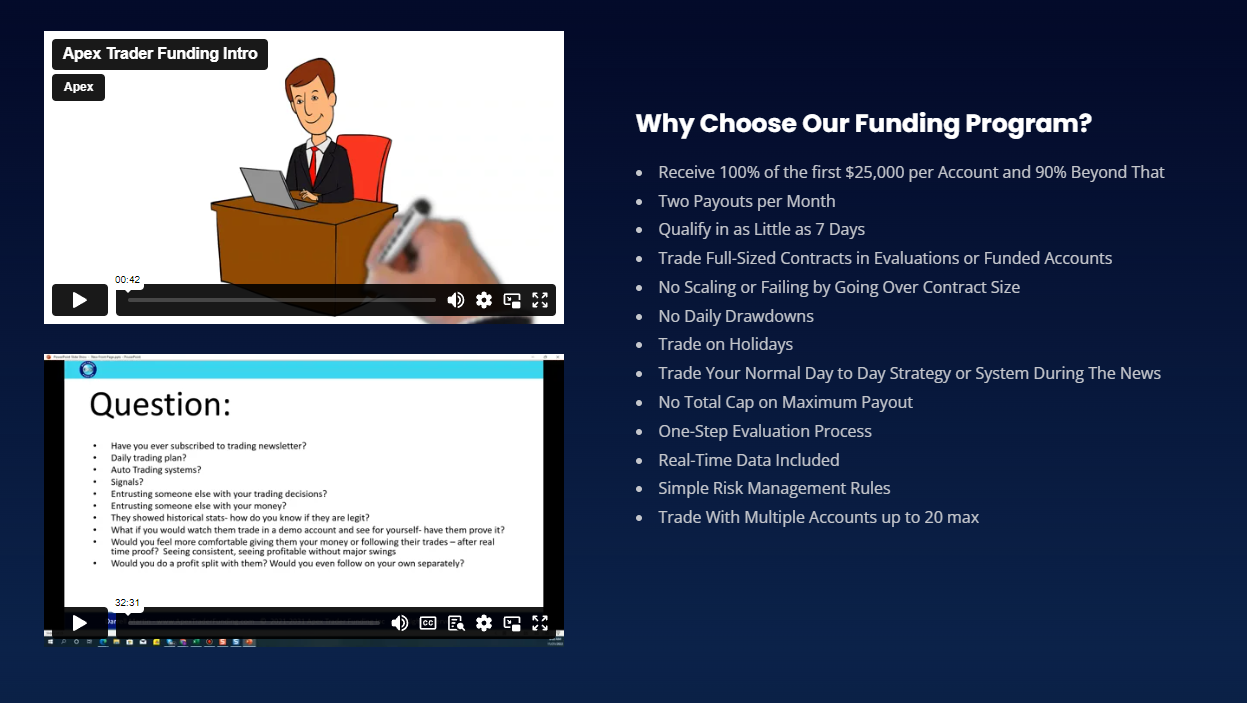

One of the standout characteristics of Apex Trader Funding is its trader-centric approach. The firm offers funding models that are cost-effective and easy to navigate, boasting some of the highest contract plans in the industry. Their unique system motivates traders to aim for performance accounts, creating avenues for steady income generation.

Setting it apart from many competitors, Apex Trader Funding ensures traders aren’t confined by stringent rules. They are free to trade even during holidays. They can operate within a broad timeframe, granting them flexibility and freedom in their trading endeavors.

>> Also Read: Forex Trading for Beginners • Step by Step

Apex Trader Funding Pros and Cons

Pros

- Comprehensive training provided to traders before funding

- A variety of tradable assets are available, like energy and interest rate futures

- Capability to trade full contract sizes with minimal daily drawdown

- Trading is permitted during flexible hours, including holidays

- The funded account for starters is up to $25,000, with larger accounts available as experience grows

Cons

- Best suited for highly skilled traders.

- Limits on the maximum position size for live accounts.

- Some funding rules might be overwhelming for average individuals.

Safety and Security of Apex Trader Funding

Based on research conducted by Dumb Little Man, it’s evident that Apex Trader Funding places a high priority on security. The firm employs robust payment processing tools, ensuring that clients’ details remain protected and are not compromised.

Interestingly, potential traders can breathe a sigh of relief knowing they aren’t required to share sensitive financial information when initiating an account with the firm.

Apex Trader Funding has garnered a reputation for its swift payout process, which suggests the possibility of a segregated mechanism for client funds.

While it’s speculated that the company uses advanced cybersecurity software to protect its digital environment, specific details about these security measures remain undisclosed.

Furthermore, information regarding the legal regulation of Apex Trader Funding has yet to be made explicitly available to the public as of this research.

Apex Trader Funding Bonuses and Contests

Apex Trader Funding is extending a generous offer of 50% off to new entrants. However, such discounts are temporary and only available for a short duration. Beyond this promotion, the firm currently provides no other bonuses or contests tailored for new traders.

It’s worth noting that most proprietary trading firms, including Apex Trader Funding, roll out limited-time promotions and offers. Therefore, potential and existing traders should make a habit of periodically checking the firm’s official website. This ensures they remain informed about any forthcoming bonuses, promotions, or contests that might be introduced.

[wptb id="128818" not found ]Apex Trader Funding Customer Reviews

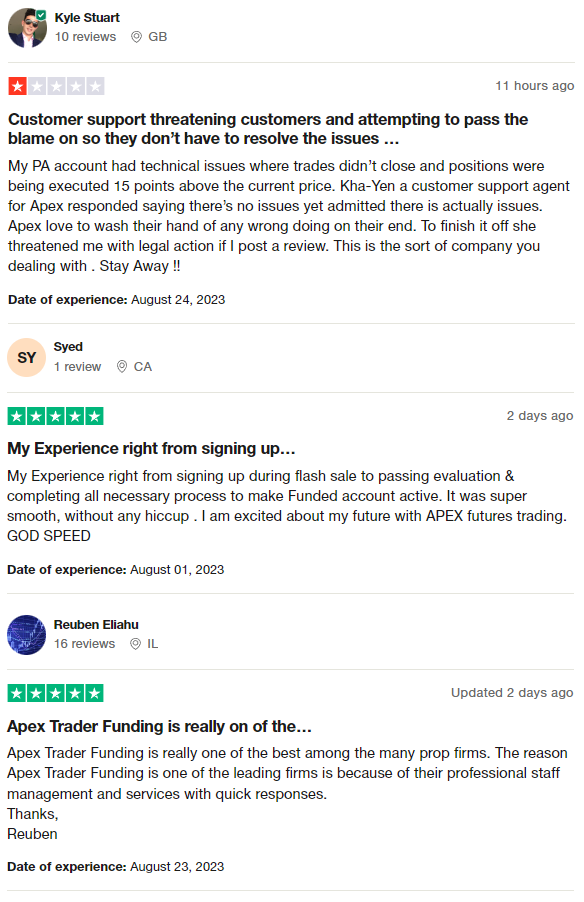

Based on a mix of customer feedback, experiences with Apex Trader Funding vary. Some traders have expressed concerns over technical issues and have yet to have satisfactory interactions with certain customer support representatives, even facing threats over posting reviews.

Conversely, other traders have highlighted a smooth onboarding experience, especially during promotional periods. They are optimistic about their future with the firm. Many also commend Apex Trader Funding for its professionalism and prompt customer service, ranking it among the top proprietary trading firms.

Apex Trader Funding Commissions and Fees

The cost structure at Apex Trader Funding is primarily based on the specific trading program one opts for. For those just starting out with the $25k program, there’s a monthly fee of $137.

On the other hand, seasoned traders looking to engage with the premium $300k program should anticipate a monthly cost of approximately $675.

Concerning profit sharing, Apex employs a 90-10 profit split approach. This allocation ensures traders receive 90% of their profits while the firm retains 10%.

Notably, an added benefit for traders is that the trader retains the entire amount for the initial $25,000 in profits. Such a generous profit split, particularly the 90-10 ratio, is a testament to Apex Trader Funding’s commitment to prioritize and uplift its trading community, making it one of the most competitive offers in the market.

Apex Trader Funding Account Types

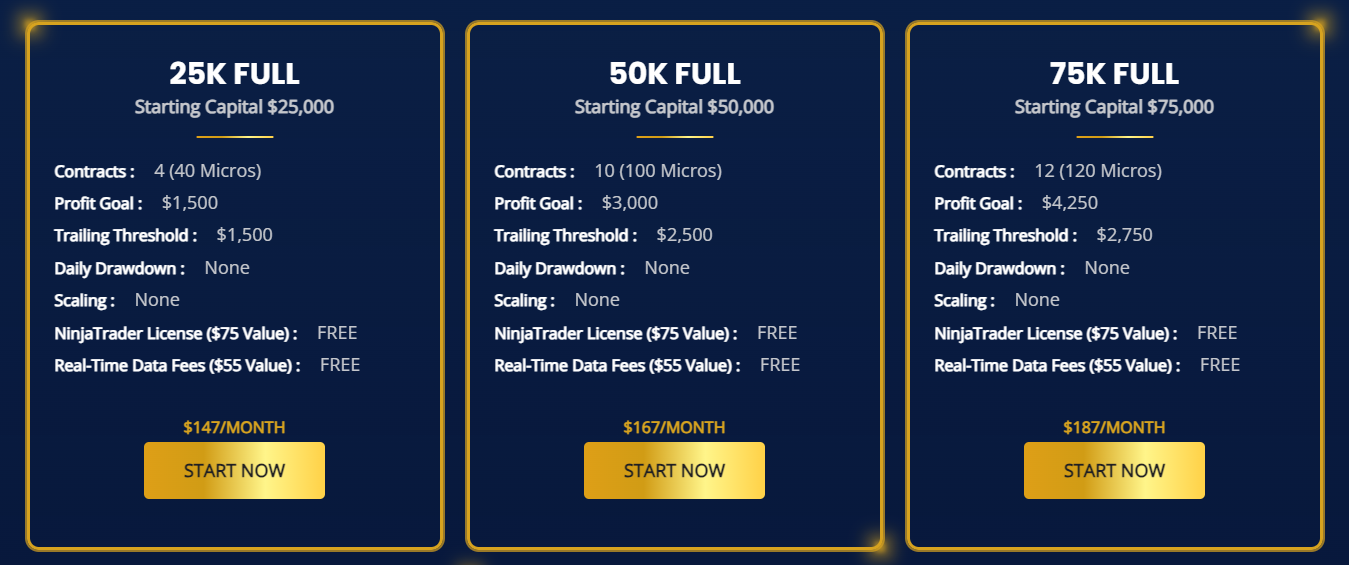

Apex Trader Funding’s e account types primarily differ based on the trading capital they offer:

$25k Full Plan

- Trading Capital: $25,000

- Profit Target (10 days): $1,500

- Trailing Drawdown: $1,500

$50K Full Plan

- Trading Capital: $50,000

- Monthly Fee: $167

- Profit Target: $3,000

$75K Full Plan

- Trading Capital: $75,000

- Monthly Fee: $187

- Profit Target (10 days): $4,250

$100K Full Plan

- Trading Capital: $100,000

- Monthly Fee: $137

- Profit Target: $6,000

$150k Full Plan

- Trading Capital: $150,000

- Monthly Fee: $297

- Profit Target: $9,000

$250K Full Plan

- Trading Capital: $250,000

- Monthly Fee: $517

- Profit Target: $15,000

$300k Full Plan

- Trading Capital: $300,000

- Monthly Fee: $657

- Profit Target: $20,000

$100K Static Plan

- Trading Capital: $100,000

- Monthly Fee: $137

- Profit Target: $2000

- Total Drawdown: $625

Opening an Apex Trader Funding Account

- Visit the official Apex Trader Funding website.

- Locate the “Signup” option at the top left corner, next to the “Login” button.

- Click on the “Signup” option and follow the on-screen prompts.

- Provide the necessary personal details as requested by Apex.

- Complete the verification process.

- Choose the desired account size; newcomers might prefer starting with a smaller account.

- Familiarize yourself with the platform and system.

- The entire setup process typically takes just a few hours.

Apex Trader Funding Customer Support

Trading with a proprietary firm comes with its set of regulations. Traders need a dependable support team to turn to when challenges arise. Based on the experience of Dumb Little Man, it’s clear that Apex Trader Funding has made significant investments in its customer support.

They boast a well-equipped team dedicated to assisting traders in every step of their journey. However, some feedback indicates that there’s potential for improvement. Several users have pointed out that the responses from the support team can sometimes be generic, and representatives might lack in-depth knowledge about the firm’s intricacies.

Advantages and Disadvantages of Apex Trader Funding Customer Support

[wptb id="128820" not found ]Apex Trader Funding Withdrawal Options

At Apex Trader Funding, users are presented with various withdrawal options. A trading professional at Dumb Little Man tested these options and found that individuals can easily access their funds through multiple avenues.

Whether through traditional credit and debit cards, direct bank transactions, or even utilizing their cryptocurrency wallets, Apex facilitates a smooth process. Notably, they stand out by offering payouts in stablecoins, a feature not commonly found in many prop firms.

In addition to the mainstream withdrawal methods, Apex caters to users who prefer digital platforms, like Skrill. Another commendable aspect is that Apex doesn’t levy any withdrawal fees.

However, it’s worth noting that particular bank or transactional fees might come into play depending on the withdrawal method or if there’s a need for currency conversions.

Apex Trader Funding Challenge Difficulties

Short Timeframe for Profit Goals

Apex Trader Funding sets a challenging precedent by giving traders only ten days to achieve their profit objectives. Depending on the chosen account or contest, the requirement is between 8-10%. Meeting such ambitious targets can only be easy by embracing significant risks.

Monthly Subscription Costs

The financial commitment to the Apex trading program isn’t insignificant, with monthly charges ranging from $137 to a hefty $657. While regular and high returns can offset these costs, the unpredictable nature of trading means there are no guarantees. Consequently, keeping up with these subscription costs can become burdensome for some traders.

Restrictive Daily Drawdown Limits

The imposed daily drawdown, dictated by the account type, ranges from 2% to 5% of the total capital. This constraint means traders need more wiggle room, especially when faced with adverse market conditions. Such limitations can curtail a trader’s strategic flexibility, making it harder to navigate volatile periods.

[wptb id="128821" not found ]>> Also Read: 8 Ways to Become a Successful Day Trader

How to Pass Apex Trader Funding’s Evaluation Process

Successfully navigating Apex Trader Funding’s evaluation process requires a solid understanding of trading fundamentals and specialized training. A dedicated training program is paramount to heighten your odds of mastering the handling of your evaluation account.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Those determined to excel in the Apex Trader Funding’s challenge should consider the expertise offered by Asia Forex Mentor. Highly recommended by the trading experts at Dumb Little Man, Asia Forex Mentor has guided thousands of traders through various prop firm evaluations.

Established by the renowned Ezekiel Chew, a forex trading expert known for hitting six figures per trade, Asia Forex Mentor stands out in the realm of trading education. With over 20 years of trading experience, Ezekiel is also the Golden Eye Group founder.

He developed the proprietary One Core Program, specifically designed to train individuals in effective forex trading strategies like news trading strategies. The creation of Asia Forex Mentor was fueled by Ezekiel’s passion for sharing his vast knowledge, starting with informal teaching sessions for close friends, which then evolved into a comprehensive online platform.

How Could Asia Forex Mentor Help You Pass Apex Trader Funding’s Challenge?

Asia Forex Mentor’s track record speaks volumes about its potential to guide traders through the demanding evaluation process of Apex Trader Funding. Here’s why this platform stands out:

- Unparalleled Course Depth: Investopedia, a renowned financial content platform, recognized Asia Forex Mentor’s One Core Program for its depth. It described the program as “as extensive as you will find,” crowning it as the Best Comprehensive Course Offering.

- Top Recommendation for Beginners: When it comes to helping beginners navigate the complex world of forex trading, Asia Forex Mentor’s One Core Program shines brightly. Benzinga, another authoritative voice in the financial sector, named it the Best Forex Trading Course for Beginners. They further highlighted its suitability for traders ranging from beginners to advanced levels.

- Mentorship Excellence: In 2021, the BestOnlineForexBroker website honored Asia Forex Mentor by naming it the Best Forex Mentor. They accentuated the platform’s ability to guide traders in achieving “massive gains from forex.”

- Strategically Designed Curriculum: When top forex traders and platforms conducted an exhaustive review of premier forex courses, Asia Forex Mentor emerged at the forefront. The recognition stems from the platform’s impactful trading strategies and comprehensive trading system.

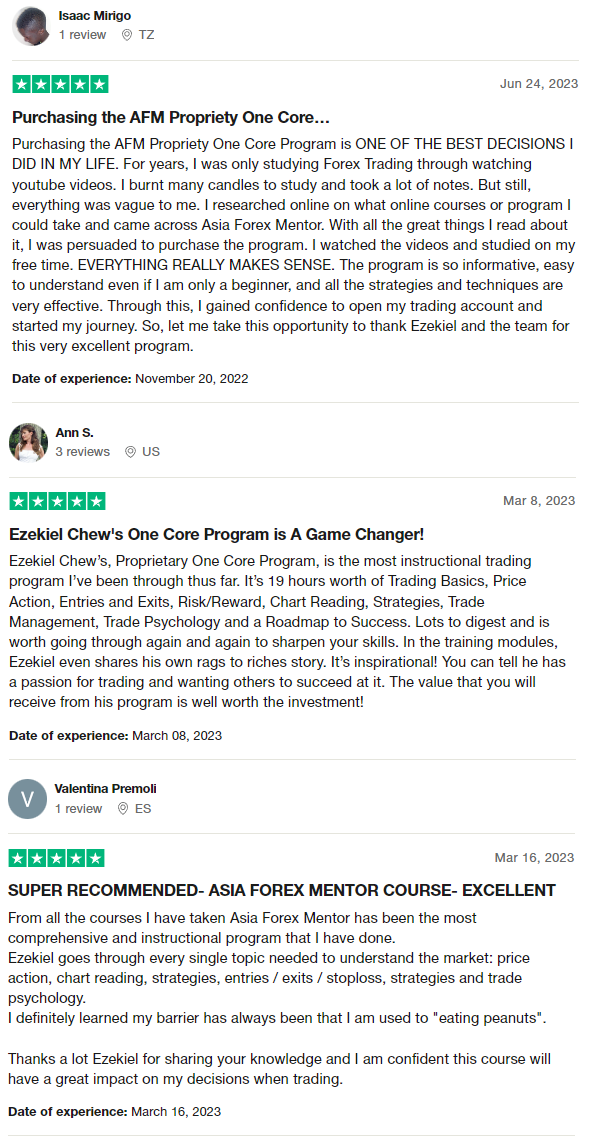

Asia Forex Mentor Members’ Testimonials

Members of the Asia Forex Mentor program consistently praise its effectiveness, highlighting how transformative it has been for their trading journey. Many have expressed that enrolling in the One Core Program, spearheaded by Ezekiel Chew, was a game-changer.

While some were previously lost despite countless hours spent on other resources, they found clarity, comprehensive instruction, and actionable strategies in this course.

The content spans from basics to intricate strategies and trading psychology and is repeatedly described as invaluable. Ezekiel’s personal narrative and dedication to the success of others not only inspire but also instill confidence in members.

Gratitude towards Ezekiel and his team is a common sentiment, as many credit their trading accomplishments to the insights and skills they acquired from the program.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Apex Trader Funding Review

Based on the in-depth analysis by the team of trading experts at Dumb Little Man, Apex Trader Fundingemerges as a commendable platform for traders. The platform offers diverse trading account sizes and a fairly structured evaluation process, catering to various skill levels.

However, like every platform, it has its downsides. Some users have expressed concerns regarding the customer support team’s grasp of the firm’s workings and the challenges in the evaluation process.

While the ten-day window to achieve profit targets can be rigorous, it’s not insurmountable, especially with the proper training.

Enrolling in premier courses like Asia Forex Mentor can be invaluable for those aiming to maximize their chances of success. Ezekiel Chew’s One Core Program has been praised for its comprehensive coverage and actionable insights, making it a potent tool for traders navigating the waters of Apex Trader Funding’s evaluation.

Apex Trader Funding Review FAQs

What are some challenges faced in Apex Trader Funding’s evaluation process?

Traders have a ten-day window to achieve specific profit targets, and daily drawdown limits can be restrictive.

How can a trader increase their chances of passing the evaluation?

Enrolling in top-tier courses like Asia Forex Mentor can enhance their knowledge and trading strategies.

What are the main concerns about Apex Trader Funding’s customer support?

Some users feel the support team needs to gain in-depth knowledge of the firm, and their responses can be generic.

[wptb id="128822" not found ]RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.