Everything You Need To Know About the 3 Bar Play

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Several trading methods are being presented to the market, but 3 Bar Play is the most significant for trend reversal. This approach is unquestionably a fantastic addition to the successful 1 Minute Opening Range Breakout (ORB) strategies that may have been seen while trading.

Numerous well-known traders, including top FX trader and trainer Ezekiel Chew, have employed the 3 Bar Play method. In his emphasis, he said that the three-bar approach, which bases reversal detection on three bars that indicate a bullish or bearish trend after a persistent run in the opposite direction, is practical and straightforward.

This post will cover three bar plays, how to recognize this pattern, and the context required for a profitable trade. It can be a robust risk management approach when the market is volatile and open, and if applied correctly, it can produce significant profits.

What is 3 Bar Play

The 3-bar reversal pattern is a technical indicator to identify trend reversal signals. The pattern consists of three successive candlesticks, the movement of which indicates whether or not a trend reversal is likely to occur.

The three-bar trend helps provide information, but traders must decide whether to place a trade. This decision should not be made just based on what is visible on the chart; it must also be supported by extra information.

Using the 3 bar reversal pattern in conjunction with support, resistance, and other patterns is good practice. The middle candle must also be visible if more than three candles are used.

3 Bar Play: Explained for Rookie Traders

As a rookie, do your research. Create a list of the shares you'd like to own, stay up with the markets and the firms you've chosen, read a business newspaper, and frequent reputable financial websites. Making an educated choice is preferable.

Using a combination of loose take-profits and strict stop-losses, establishing a positive overall risk, and changing the projected win percentage by being tighter or more flexible, as discussed previously, all contribute to the method's chance for payback.

Novice investors may find it difficult to completely profit from 3-bar plays due to the substantial additional data analysis required to decide whether the set-up may be used in a trade and when it cannot.

3 Bar Play and ORB Strategy

After the market opens, the opening range is high and low for that period. Typically, the first 30 or 60 minutes of trade constitute this time. It is one of the most crucial chart patterns for stock market profit.

During this time, we must determine the day's highs and lows. Additionally, since these levels are a magnet for price activity once the market opens, we also need to recognize pre-market highs and lows.

In this manner, traders employ the opening range to establish entry targets and anticipate and forecast the day's price movement.

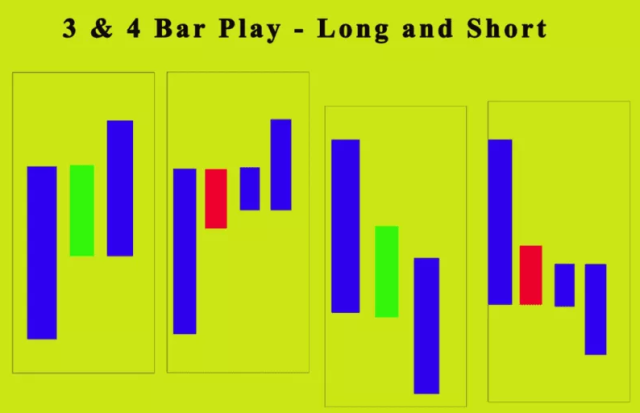

The 3-bar strategy works as follows:

- The first bar is an unusually long non-extended move with a wide range of igniting bars over a substantial pivot

- Bar 2 must have a limited range and be in the upper 30% to 50% of bar 1

- Bar 2 is unable to rise over bar 1's peak (several pennies is fine)

- Bar 3 breaks above the highs of bars 1 and 2

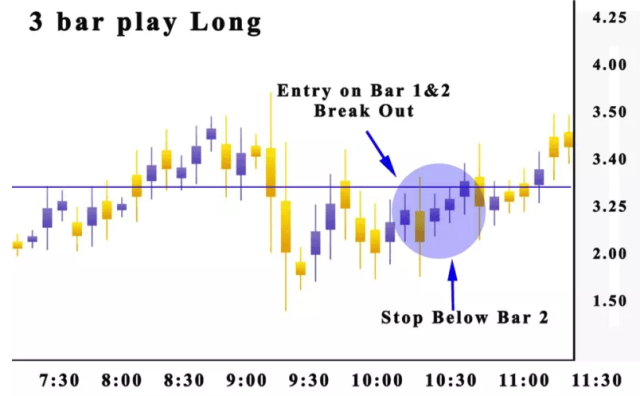

3 Bar Play Long

The 3-bar play is best utilized as a continuation pattern in the market. Traders require a continuous price over resistance from a fundamental market level if the asset extends.

The asset increases on the first candle, and if it consolidates for one bar, it expands throughout the extended candle.

The other candle in the pattern represents an orderly retreat on decreased volume. Investors should position their entry over this candle and the opening candle after the breakout. The breakout makes a good profit from your entry in a short time.

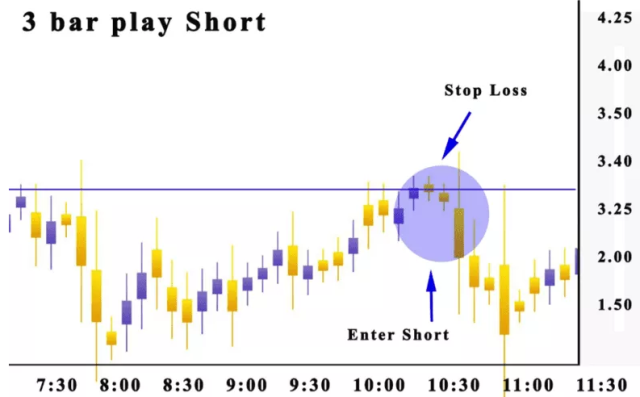

3 Bar Play Short Example

Brokers can utilize the 3-bar play method in the opposite way, which is the most incredible alternative. Investors may be looking for assets that are rising or falling away from the daily time frame; a similar strategy may be utilized for stock division.

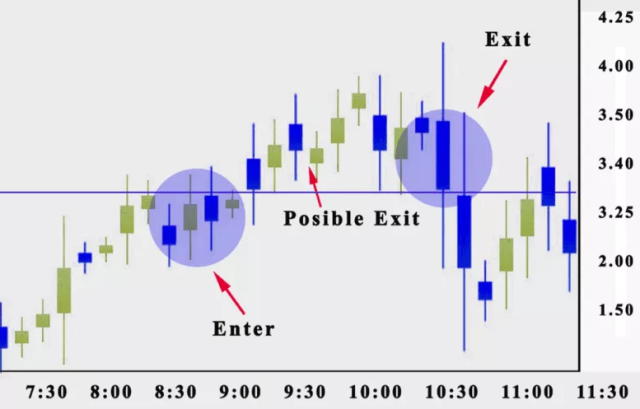

An example of an entry point is shown in the above price patterns for a short position.

Brokers can readily look for variances at the start of the day due to the technique's benefit. When the market opens, they must look at the longer time frame in search of a solid continuation move.

Practicing the 3 Bar Play

The three-bar play will consist of three candles; a high momentum candle followed by an indecision candle and a high momentum candle in the opposite direction. This first demonstrates that a move with considerable momentum has occurred. Following some market uncertainty that lets you know a struggle is now in progress, you will notice considerable momentum moving in the opposite direction, alerting you to the possibility of a reversal.

In short, a three-bar reversal consists of three things.

- High momentum candle

- Indecision candle “pause”

- High Momentum candle in the opposite direction

When it comes to entry reasons, remember that all you are trying to do is read the story of the market and see if it is telling you a story that aligns with your higher time frame bias. Now that you know how to read candles, read the momentum, and put the three candlesticks together to read the combo story, let's talk about how to apply it all.

There are essentially two trading scenarios, or “styles,” that a trader should aim for. The first is trend trading, and the second is what is referred to as counter-trend structure trading. An individual who recognizes price is trading at a level of structure and who anticipates some relief is on the way and wants to participate in the “bounce” is said to be a counter-trend structure trader.

Conversely, a trend trader makes pullback-style entries and rides the market's momentum. It might involve making a true trending move, watching for a pattern's pullback, or even leveraging the pullback to signal reversals. A style rather than a technique, trend trading. Think pullback trading when considering a trend.

Methods of Trade Management

Untold amounts of stress and market failure can be attributed to trading without an edge. The Trade Management Methods will govern your interactions with the market. While it might seem like a minor distinction, this is how the play is defined. Traders who enter the market without following these guidelines only play a game of chance. Even just having them in front of you will serve to remind you that you have a strategy for extracting earnings, which is why result-driven traders must establish their management strategies.

Your total position size will define how emotionally invested you are in the trade. After determining your position size, you should consider your timeframe. We also assess probable trading scenarios that are important for managing your limit and stop orders. When a sizable profit is made, the deal should be closed.

There are numerous ways to manage deals, each with benefits and drawbacks. To recognize potential revenues, a trader must be able to identify the most successful tactics.

Disadvantages of using 3 Bar Play

Beginners should avoid 3-bar plays since it takes a significant amount of additional research to determine when a trade may be made and when it cannot.

When using structures like resistance levels, day traders must consider how they can ensure the level is real. You must choose the process you'll employ to establish stable levels because the indications you choose might not have any bearing on the market.

Best Forex Trading Course

Asia Forex Mentor is one of the most credible forex trading courses available today. It is headed by Ezekiel Chew, a trader making six figures per trade for over a decade. The trading methods are backed by mathematical probability and the trainer behind banks and trading institutions.

AFM PROPRIETARY ONE CORE PROGRAM is the core program that covers from beginner to advanced, and every segment must include the above points. The program is designed to make you confident and earn as quickly as possible in live markets.

It starts with the basics of forex trading and moves on to more advanced topics such as risk management, market analysis, and trade execution. The course also includes a live trading session where you can see the techniques being applied in real-time. If you're serious about learning forex trading, sign up now!

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: 3 Bar Play

Trading is challenging, and those with the patience and self-control to follow this powerful strategy can grow significantly in a highly cutthroat industry. Understanding the 3 Bar Play trading principles and how they connect with other principles will help a trader create a profitable trading enterprise.

A three-bar reversal pattern signals a market turning moment. Contrary to other reversal patterns available on the market, the three bars are one of the safer options. Because the market covers three bars and the third bar confirms that the market has shifted direction, it is a safe pattern to trade.

3 Bar Play FAQs

How can you tell a 3-bar play?

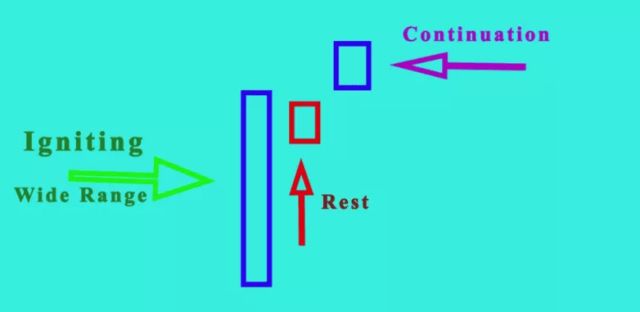

An abnormally long candle body (wide range igniting bar), one or two candle bodies that are resting, and then a high third candle body can be used to identify the pattern.

Let's examine the three critical criteria for determining a three-bar play.

The first bar must be an “igniting” bar, ideally a candle with a wide range and high volume.

The pullback bars, also known as bars 2 and 3 or rest bar, must have about identical highs and not exceed a 50% retracement of the first bar.

The expansion candle (or trigger bar) should be a lovely marubozu candle for new highs or lows.

What is a three-bar pattern?

The three-bar pattern, essentially a price action pattern, is used to show when a market trend, whether short-term or long-term, is about to reverse.

Three successive candlesticks form a pattern whose movement indicates whether or not a trend reversal is likely to occur. Traders trying to place trades against the trend frequently employ this pattern.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.