The Wyckoff Method Explained By An Expert (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The Wyckoff Method is a technical analysis approach that helps investors decide the type of stocks to buy and when to buy those stocks, as well as helps investors make concrete decisions on whether to buy or sell stocks at a particular time.

The Wyckoff Method consists of principles and trading strategies initially focused on the stock markets. Still, it is now an effective market analysis tool for all financial markets and in every freely traded market.

For this article, we have Ezekiel Chew with us, a world-renowned and seasoned forex mentor, teacher, and expert, to further elaborate on the Wyckoff Method in more explicit terms. Read through the paragraphs of the article below to understand the laws of the Wyckoff Method as an investor so that you can also begin to apply its rules to your investment.

What is the Wyckoff Method

The Wyckoff Method is a technical analysis tool created by Richard Wyckoff that helps investors assess the market index and market performance based on the data provided by the Wyckoff Method, which consists of the connection between the factors that determine supply and demand. The Wyckoff Method is a whole lot that comprises Wyckoff's theories, trading strategies, and rules for trading that investors use to determine market trends, decide on investments, and time the placement of trades.

Investors and technical analysts need theories and methods like the Wyckoff Method that define the stock market's structure and cycles, given that different forces influence the market. The Wyckoff Method is essentially based on price action in the stock market based on supply and demand; the price of any asset either moves vertically upward or turns downward depending on the predominant forces in the market.

Investors and traders can use the data from the Wyckoff Method technical analysis to locate the forces influencing the market's price action. With that information, traders can also take a position and predict price movements. Also, the Wyckoff Method can help traders make less emotional and more concrete decisions about when to buy or sell stocks and understand the market cycles.

The Wyckoff Method is based on monitoring the activities of professional and successful traders because they possess the relevant information about the state of the industry, which, in turn, influences the market's future trend.

Wyckoff Trading Strategy

Investors can use the Wyckoff Method to identify the current market cycle, and with that information, they can prepare a trading strategy that will be effective in the price cycle.

#1. Trade Entry

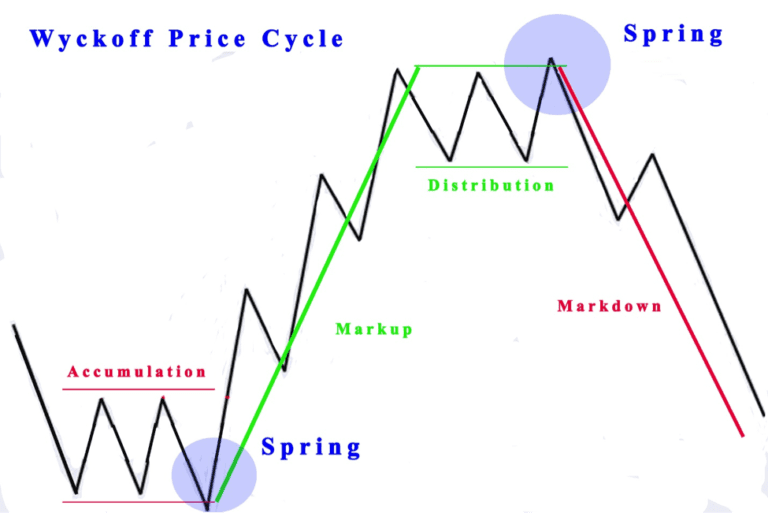

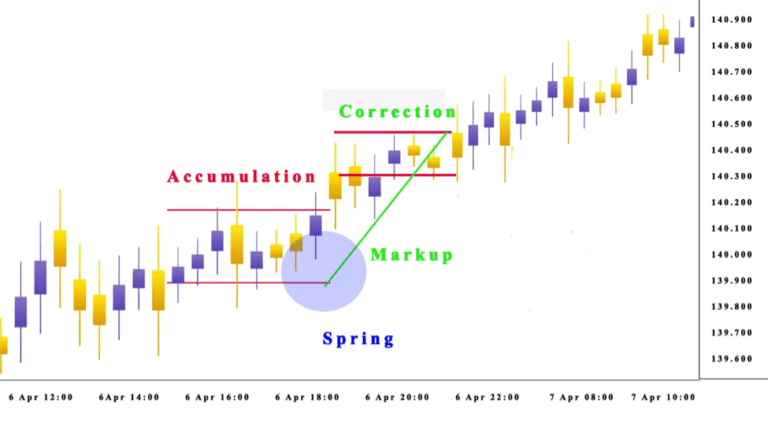

The first thing is for investors and traders to verify the present phase with chart patterns. After that, they can begin to trade when the price action starts moving from the accumulation phase to an uptrend and from distribution to a downtrend.

Another way to determine the present phase is with a “spring.” This is the transitional price action attitude that frequently occurs between the cycle phases. The trade occurs when the price action breaks the range in the direction of the predicted price move.

#2. Stop-Loss Order

Traders always have to place a stop-loss in the market trend; in an uptrend, the stop-loss should be positioned under the lowest level of the accumulation phase, while in a downtrend, the stop-loss should be positioned above the highest level of the distribution stage.

#3. Take Profit

A price action analysis is an excellent way to coordinate trades in Wyckoff's price cycle, and investors can use this price action analysis to coordinate the take profit points. The market has many signals indicating points to take profit and exit.

When traders observe a bearish spring signal on the chart, they can take a profit and leave the trade because the price action is now in the late phase of the distribution curve. Another option is to observe the developing chart and candlestick patterns such that a reversal indicates that there could be a shift in market trends.

Investors can use the Wyckoff trading strategy to detect a potential future trend in the general market and price movements. They can help them make logical decisions to protect themselves from market fluctuations. Richard Wyckoff's trading strategy is to ascertain the market movements of smart money and determine the direction of the price moves based on the fractal of the price range. Once investors understand the Wyckoff market cycle theory, the current market cycle will be apparent to them.

Wyckoff Method Rules for Financial Markets

The Wyckoff Method rules are derived from Wyckoff's studies and personal experiences from charting the stock market, which is based on price action and the different cyclical stages of the market. Before investors can jump into the Wyckoff Method, it is crucial to understand the rules behind the method implemented in the trading strategies.

Rule 1: The first rule states that the market is unique, which implies that the price action will never repeat past moves. The market and individual securities never repeat past movements twice; price trends unfold through a wide array of price patterns that indicate variations in extension, size, and details.

Rule 2: The second rule is related to the first rule and states that the original nature of every price move reveals itself only when compared to preceding price behavior. This means that a price trend never repeats itself, and trends must be considered in relation to past behavior.

As an investor, one of the best ways to evaluate the price action of each daily trade is to compare it to the previous price behavior that happened the day before, last week, or last month.

Understanding the Meaning of Wyckoff Laws

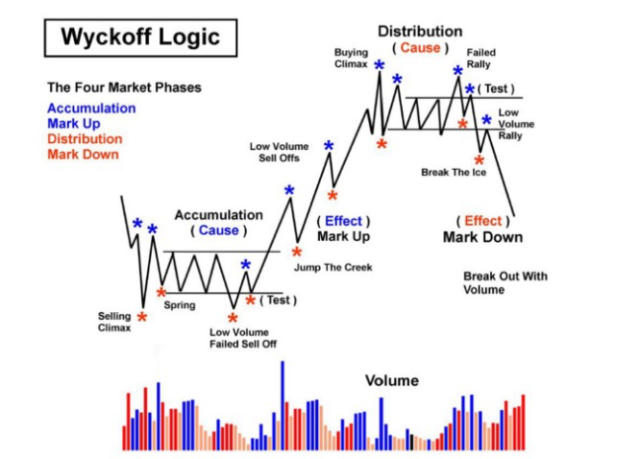

It is known that the Wyckoff Method trading strategy is to monitor and understand the plans of successful traders on the stock market. With this, the Wyckoff Method showed that the dynamic identified through the high volume and price movements was enough to predict future trends and market moves.

This concept gave birth to the three fundamental Wyckoff laws known; the law of demand and supply, the law of cause and effect, and the law of effort and result. These laws are fundamental principles of financial markets that investors must follow to predict price action and market moves. There are three Wyckoff laws in the Wyckoff Method trading strategy. To further understand the laws in more detail, scroll down the paragraphs below where we have explained each law in simpler terms.

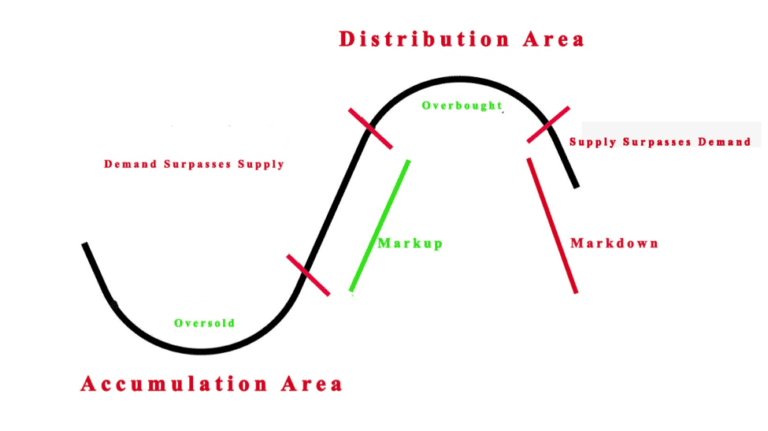

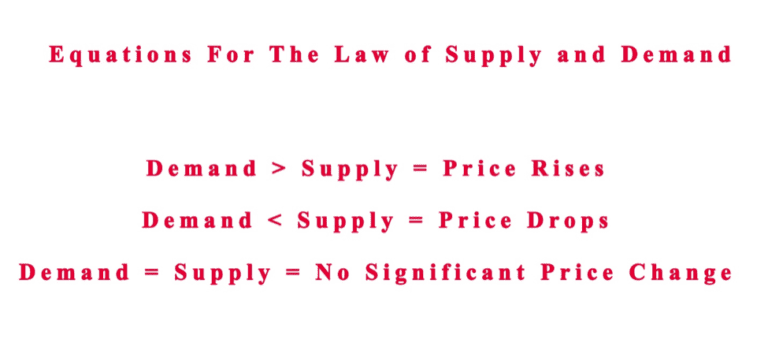

First Law: Demand and Supply

Wyckoff's first law states that if demand exceeds supply, stock prices will rise. This implies that if the increasing demand is higher than supply, the stock prices will increase; if the decreasing order is lower than supply, i.e., supply exceeds demand, the stock prices will decline. An increase in price signals more investors buying than selling, while a decline in price signals more investors selling than buying.

- Demand > Supply = Price increases

- Demand < Supply = Price decreases

- Demand = supply = No significant price change

Wyckoff created a chart pattern and provided practical trading strategies for indicating trading targets based on the extent of accumulation and distribution over time. The investors who follow Wyckoff's first law compare the market's high volume and price action to determine the relationship between supply and demand better. This gives an insight into the next market moves.

Second Law: Cause and Effect

Wyckoff's second law states that the differences between supply and demand are not random or coincidental; instead, they precede preparation periods due to significant news and events. According to the Wyckoff Method, a period of distribution phase (cause) eventually results in a downtrend (effect). In contrast, a period of accumulation phase (cause) eventually leads to an uptrend (effect).

Wyckoff created an original chart pattern to determine the potential effects of accumulation and distribution schematics in the stock market and also formulated methods of defining trade targets based on the extent of accumulation and distribution periods.

Also, this second law tries to predict the possible moves of accumulation and distribution phases in the new trend. A point and figure chart can be used to determine the cause, the accumulation phase, and the distribution phase, as well as predict the level of its effect, either in bear markets or otherwise.

Third Law: Effort and Result

Wyckoff's third law states that the trading volume is an effort that contributes to the changes in the stock price. In a stock market, when the price action aligns with the volume, there is a strong tendency that the trend will continue, but when the price action widely varies from the trading volume, the price trend will either change its direction or stop.

For instance, using the Bitcoin market, imagine that the Bitcoin market begins to consolidate with very high volume after a long bearish trend. The high volume implies a significant effort, but the sideways movements indicate a small effort. Hence, no more significant price drops, but there are a lot of Bitcoin transactions going on, and in cases like this, there is a likelihood of a change in the current market momentum.

Cycle of Wyckoff Price Cycle in Freely Traded Market

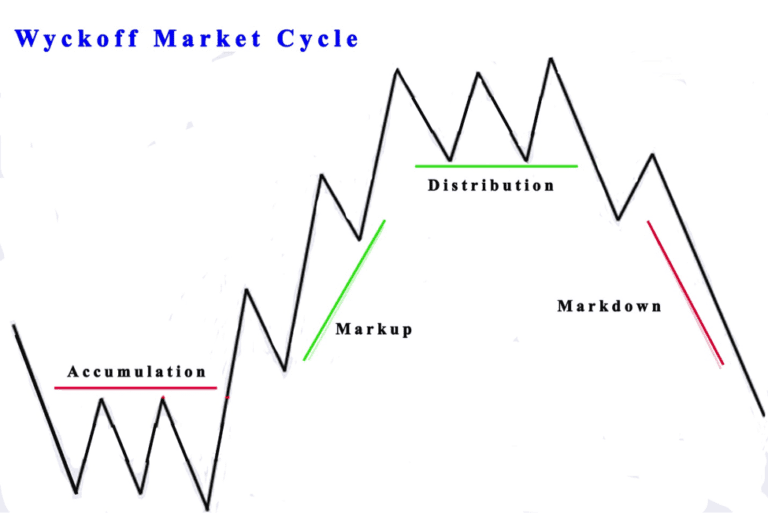

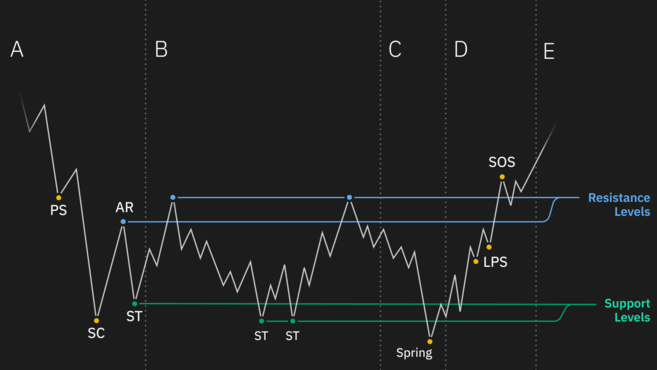

The price cycle of the Wyckoff cycle is divided into four stages: the accumulation and distribution phases, the uptrend, and the downtrend.

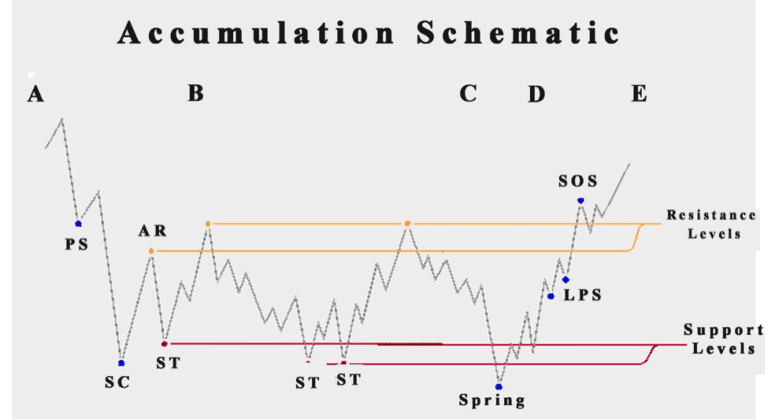

Accumulation phase

This is the first phase of the market cycle that results from demand. The bulls are consistently increasing their influence, which leads to a situation where they can drive the prices higher. The chart shows that the price action is still flat despite the bull's power on the increase in the accumulation phase. A rising bottom is the best way to know the accumulation phase.

Uptrend

There are many accumulation phases in the uptrend phase, and the bigger market trend can stop and consolidate before progressing with an upward movement. Therefore, the uptrend in the market indicates that traders should buy more stocks, leading to an increase in demand and an equal level of supply.

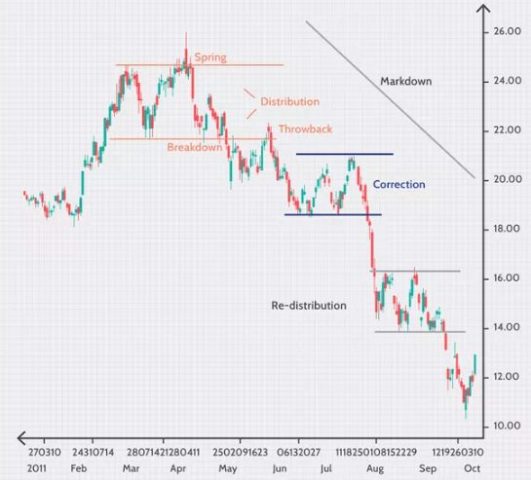

Distribution phase

This is the phase of the market cycle in which, as a result of supply, the bears consistently increase their influence, leading to a situation where they can take control of the market. At this phase, the chart patterns show that the price action is still flat, just like in the accumulation phase.

The inability to form higher bottoms on the chart signals that the market is in its distribution phase. The price action produces lower tops and tends toward selling rather than buying.

Downtrend

This is the final phase in the market cycle known as the downtrend, and it signals that the bears have fully taken over the market and are gradually driving the price lower. During this phase, the supply exceeds the demand, creating a downtrend, which makes the price action break under the distribution stage.

The downtrend signals the completion of the cycle when the bearish trend is over. Once the final phase of the Wyckoff cycle is completed, the new accumulation phase kicks off again to commence the beginning of another cycle that generates a trading range.

How Effective Is The Wyckoff Method In Stock Market

The stock markets do not always follow these models the way they are, such that the accumulation and distribution schematics occur in different patterns and ways. Hence, Richard Wyckoff offered several trading strategies that were from his experience and market rules as well.

However, the Wyckoff Method provides various reliable tools and trading strategies through which institutional investors and traders can assess markets and time trades. They can also use the Wyckoff Method to determine market trends, identify the time professional traders are accumulating and distributing stocks, and most importantly, know when to enter and exit the market.

No doubt that Wyckoff's Method is a fine theoretical principle, but in reality, it doesn't conform as the market takes a random course and acts unexpectedly. Still, the theory is a useful technical analysis tool. That being said, all his rules and schematics are very practical in understanding the normal price cycle of the financial markets.

Best Forex Trading Course

Ezekiel Chew is a renowned forex trader, trainer, and industry expert. He has trained professional and retail forex traders as well as corporate finance players like bank traders, money managers, and asset investors. From his trading experience drawn from over 20 years of trading the forex markets, he has created a comprehensive forex trading course known as “the one core program”.

Ezekiel asserts that the one core program is designed for the ‘committed learner', so previous trading knowledge or experience is not required before you can enroll in the program. The program comprises over 60 video lessons that teach proprietary trading strategies that are backed by mathematical probability and technical analysis principles.

The one core program has been proven to be highly efficient as it has generated millions of US dollars for Ezekiel Chew and his students. There are numerous testimonials from students that have graduated from the program and are now making six-digit figures per trade just by applying the techniques learned from the program. The one core program is available on the Asia Forex Mentor website; which is a forex trading blog that has been existing for over a decade.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Wyckoff Method

Richard Wyckoff's Method has been in existence for many years now. However, its relevance to this century is still as significant as before because it combines different principles, concepts, and theories that institutional investors and traders can use to explore market movements and determine price action.

The bottom line of the Wyckoff Method is to assist experienced traders in making less emotional and better-informed decisions. One important thing about his method is that it can be implemented at any time within any market. Therefore, the best investment advice any investor can receive is a practical understanding of the Wyckoff Method and knowing how to apply it.

With the Wyckoff Method, retail investors and traders can monitor the market movements using the price chart, which will help them to know the market movements and accurately predict the market trends; by doing this, they can become successful traders. So, I do hope you find this article very helpful as you start to apply the Wyckoff Method.

Wyckoff Method FAQs

Is Wyckoff Method Effective?

Yes, the Wyckoff Method is an effective technical analysis tool that offers techniques and other reliable tools for identifying price targets for both long and short-term trades.

What time frame is best for Wyckoff?

The Wyckoff Method is useful in intraday time frames and can also be used in the short-term and long-term.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.