Varchev Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 120th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Varchev Review

Forex brokers play a pivotal role in the global financial landscape, offering platforms where traders and investors can buy and sell foreign currencies and other financial instruments. These brokers act as intermediaries, providing access to the Forex market, which is the largest financial market in the world. Among the numerous brokers in the market, Varchev stands out as a significant player.

This review aims to delve deep into Varchev's offerings, highlighting both its strengths and areas for improvement. With a focus on unique selling propositions and potential drawbacks, we intend to provide readers with a balanced and insightful analysis. From account options and deposit/withdrawal processes to commission structures, our evaluation covers essential aspects you need to consider. Our goal is to arm you with the knowledge needed to decide if Varchev aligns with your investment goals and preferences, making it your broker of choice.

What is Varchev?

Varchev is an international Forex broker recognized for its long-standing presence in the financial services market. With 29 years of experience, it has been a go-to platform for individuals and institutions looking to trade in a variety of financial instruments. Founded by Biser Varchev, the company has established a strong foothold in the trading community, offering access to Forex instruments, indices, stocks, commodities, and exchange funds.

One of the key features of Varchev is its regulatory compliance, being overseen by the Bulgarian FSC. This ensures that the company operates within the strict guidelines set forth by regulatory authorities, offering a secure and transparent trading environment. Furthermore, Varchev's operations are in line with the European directive MiFID, highlighting its commitment to adhering to high standards of financial conduct and integrity. The broker's association with the Investor Compensation Fund (ICF) offers an added layer of security, ensuring that clients' investments are protected under certain conditions.

Safety and Security of Varchev

After an in-depth analysis by Dumb Little Man, Varchev's safety and security measures have been highlighted as robust and reliable. Varchev is registered with the Financial Supervision Commission (FSC), underlining its commitment to regulatory compliance and operational integrity. This registration, alongside adherence to the Markets in Financial Instruments Directive (MiFID), reinforces Varchev's reliability as a broker.

The broker prioritizes the safety of client funds by keeping them in separate accounts, distinct from the company's own funds. Varchev utilizes reputable banks like Barclays, Unicredit, Citi Bank, and IG Markets for this purpose. Additionally, it's permissible for the broker to hold funds with liquidity providers and prime brokers, offering an extra layer of security. The collaboration with the Investor Compensation Fund (ICF) provides further reassurance, guaranteeing compensation to investors should Varchev face insolvency.

Moreover, Varchev employs automated systems to protect accounts against negative balances, effectively mitigating the risk of significant losses for traders. This proactive approach to loss prevention demonstrates the broker's dedication to client security and responsible trading practices.

Pros and Cons of Varchev

Pros

- Wide selection of trading instruments

- Competitive commissions lower than market average

- Educational resources available for free

- Negative balance protection for added security

- Offline office in London for in-person visits

- Multiple deposit and withdrawal options, including electronic payments

- Mobile trading capability for on-the-go access

Cons

- Bonuses restricted to professional clients

- Few customer support channels

- No passive income investment programs

Sign-Up Bonus of Varchev

Varchev currently does not offer a sign-up bonus for new clients. This means that individuals looking to open an account with Varchev won't receive any immediate financial incentives or rewards upon registration. While the absence of a sign-up bonus might seem like a drawback, it's important for potential clients to evaluate the broker's overall value proposition, including its competitive commissions, diverse trading instruments, and educational resources.

Minimum Deposit of Varchev

The minimum deposit required to open an account with Varchev is $200. This initial deposit amount is set to ensure that clients have sufficient funds to begin trading across the various financial instruments offered by the broker. The $200 minimum deposit strikes a balance, making it accessible for beginners while ensuring a level of commitment for serious trading. This requirement aligns with the broker's aim to cater to a broad range of traders, from novices to experienced investors, seeking access to the global financial markets.

Varchev Account Types

Our team of experts at Dumb Little Man conducted thorough research and testing on Varchev's account types. Here's a concise and clear overview of the findings:

1. Real Account:

- Designed for trading in real market conditions.

- Requires specification on whether the client wishes to be categorized as a professional client, affecting trading conditions.

- For professional clients, leverage can reach up to 1:500.

- Non-professional clients have a leverage limit of up to 1:30.

- No minimum deposit for professional clients.

- Non-professional traders need a minimum deposit of USD/EUR/GBP 200 or BGN 400.

2. Cent Account:

- Allows trading with minimum amounts, ideal for beginners or those looking to trade with less risk.

- Deposits are shown in cents, turning a $200 deposit into 20,000 cents.

- Offers a unique way to manage funds and understand trading dynamics with lower financial commitment.

These account options provide flexibility and cater to a wide range of traders, from those new to the market to seasoned professionals seeking higher leverage options.

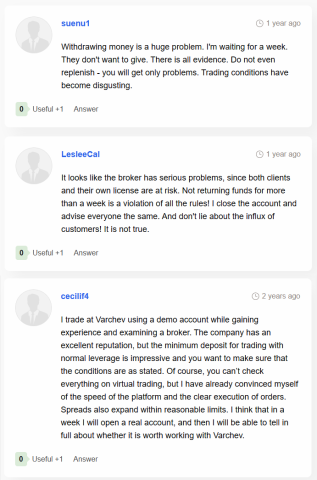

Varchev Customer Reviews

Customer reviews on Varchev reveal a mixed bag of experiences. Some users express significant concerns about withdrawal processes, claiming that obtaining their funds has been difficult, with waits extending beyond a week. These issues raise questions about the broker's financial stability and adherence to regulations, prompting some clients to advise against opening accounts with Varchev. On the other hand, there are individuals who appreciate the broker's platform speed and order execution clarity while using a demo account. These users highlight Varchev's reputation and the reasonableness of spreads, indicating a level of satisfaction with the trading conditions offered. Such contrasting views suggest that while some traders encounter hurdles, particularly with withdrawals, others find value in the broker's services, especially for those in the initial stages of exploring the Forex market.

Varchev Fees, Spreads, and Commissions

Varchev distinguishes itself in the competitive brokerage industry with its transparent fee structure. Commission rates for order execution on Varchev.com are competitively low, starting from 0.03% per stock and 5% per trade for stock trading. This approach ensures traders can manage their costs effectively while engaging in stock transactions.

Notably, Varchev stands out for not imposing platform fees, account maintenance fees, or quote fees, which is a significant advantage for traders looking to minimize overhead. The absence of hidden fees further reinforces the broker's commitment to transparency, making it easier for traders to calculate their potential returns without worrying about unexpected charges.

Moreover, Varchev applies a fixed commission (swap) for the rollover of positions to the following day, which is a common practice in the industry for trades that remain open overnight. Starting from 0.1 pips, spreads on Varchev are tight, contributing to cost-effective trading conditions that can enhance profitability for active traders. This fee structure, combined with the lack of various common charges, positions Varchev as an attractive option for traders prioritizing cost efficiency and clear terms.

Deposit and Withdrawal

A trading professional at Dumb Little Man conducted thorough tests to evaluate Varchev‘s deposit and withdrawal processes, revealing a diverse and flexible system. Varchev offers multiple methods for deposit and withdrawals, including credit/debit cards (Visa, MasterCard, Maestro), wire transfers (via Raiffeisen, UniCredit, UBB, Fibank), and various electronic payment systems (PayPal, ePay.bg, Skrill, Neteller, Ucash, GiroPay, Itau, Bitcoin). This broad selection ensures traders can easily manage funds according to their preferences.

To initiate a withdrawal, traders must complete a withdrawal request form and submit it via fax or email to Varchev's office. The efficiency of the process varies by method: electronic payment systems generally offer instant processing, Bitcoin withdrawals are completed within a few hours, and wire transfers require 2-5 working days. Transactions using bank cards are typically processed within one business day, providing a quick turnaround for traders.

Remarkably, Varchev imposes no deposit or withdrawal fees, aligning with its commitment to transparency and affordability. However, it's important to note that fees may be applied by the chosen payment system, which are the trader's responsibility. Additionally, Varchev mandates the provision of verification documents at account opening, a standard security measure in the industry. Financial transactions are permitted only post-verification, ensuring a secure trading environment for all clients.

How to Open a Varchev Account

- Visit Varchev‘s official website and click on the Open Real Account button.

- Enter your personal details such as name, address, birth date, and birth place.

- Provide citizenship information, tax identification number, and tax residence.

- Choose statements that match your trading activity.

- Indicate your trading experience with various financial instruments.

- Detail any financial sector employment, select your financial education level, and acknowledge trading risks.

- Submit contact details, select your trading platform, currency, leverage, and if opting for professional client status.

- Mention how you found Varchev and upload ID documents.

- Agree to legal terms and submit your application to open an account.

Varchev Affiliate Program

Varchev offers an affiliate program with two primary partnership models: Introducing Broker (IB) and White Label. In the IB model, financial companies partner with Varchev, granting their clients access to trading platforms without the partners having to manage organizational or technical issues. This model enables partners to earn income based on their clients' trading activities, providing a mutually beneficial relationship.

The White Label program offers companies the opportunity to provide their clients with Varchev's trading benefits, while also branding the trading instruments with their own logo. This approach allows Varchev to broaden its market reach, while partners gain a bonus for facilitating access as intermediaries.

Payment terms for these partnership programs are tailored to each client, ensuring a flexible and individual approach. Companies interested in joining Varchev's affiliate program are encouraged to reach out directly via phone or email for more comprehensive details and to discuss specific arrangements. This direct line of communication ensures that potential partners can fully understand the benefits and obligations of the program.

Varchev Customer Support

Based on the experiences of Dumb Little Man, Varchev's Customer Support offers several channels for traders to get in touch. Traders can contact Varchev through a phone call using one of the provided numbers, ensuring direct and immediate communication. Alternatively, a feedback form on the website offers a convenient way to send inquiries or requests, suitable for less urgent matters.

For those seeking in-person assistance, Varchev maintains an offline office in London, where traders can visit for face-to-face support. Additionally, once a trader opens a real trading account, they gain access to a live chat with a dealer. This feature facilitates real-time assistance and is particularly valuable for resolving trading-specific queries or issues promptly.

Advantages and Disadvantages of Varchev Customer Support

| Advantages | Disadvantages |

|---|---|

Varchev vs Other Brokers

#1. Varchev vs AvaTrade

Varchev and AvaTrade both cater to a wide audience with their diverse financial instruments and trading platforms. However, AvaTrade stands out due to its extensive global presence, operating in more than 150 countries with a significant user base of over 300,000 customers. Its heavy regulation and multiple licenses across different jurisdictions offer a layer of security and trust. On the other hand, Varchev provides a unique blend of services with its competitive commissions and wide array of trading instruments. While AvaTrade might be more appealing for traders looking for a globally recognized and regulated broker, Varchev is more suited for those seeking tailored financial services with specific market access.

Verdict: AvaTrade may be better for traders prioritizing a well-established, heavily regulated broker with a global footprint. Varchev appeals to those looking for competitive fees and personalized services.

#2. Varchev vs RoboForex

RoboForex and Varchev offer technology-driven trading services, but RoboForex shines with its emphasis on cutting-edge technology and a broad selection of trading platforms, including MetaTrader, cTrader, and RTrader. With over 12,000 trading options and eight asset classes, RoboForex caters to a diverse range of trading preferences and styles. Varchev competes with its comprehensive offerings and competitive conditions, particularly appealing to traders focused on European markets.

Verdict: RoboForex edges out for traders who value technological diversity and a wide range of trading instruments. Varchev remains a strong contender for those looking for specialized market access and competitive trading terms.

#3. Varchev vs FXChoice

Both FXChoice and Varchev cater to a specific trader demographic, with FXChoice focusing on active and passive trading and favoring experienced traders with its ECN accounts and professional trading conditions. FXChoice‘s commitment to expanding its trading instruments and services, especially in automated trading, contrasts with Varchev‘s broader access to different financial markets and instruments, including a more flexible account setup that appeals to both novice and experienced traders.

Verdict: FXChoice is preferable for seasoned traders seeking advanced trading conditions and automated trading options. Varchev offers a more versatile approach, suitable for traders at different levels of experience looking for a wide range of financial instruments.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're aiming for significant achievements in forex trading and want to ensure a prosperous future, Asia Forex Mentor is your top pick for premier forex, stock, and crypto trading education. The mastermind behind this leading platform, Ezekiel Chew, is recognized for his unparalleled expertise and success in the trading world. Notably, Ezekiel consistently secures seven-figure trades, distinguishing him significantly from his peers.

The core strengths of Asia Forex Mentor include:

- Comprehensive Curriculum: Offering a holistic educational suite, Asia Forex Mentor prepares traders for success in forex, stock, and crypto markets with a robust curriculum.

- Proven Track Record: The platform's solid reputation is bolstered by its history of nurturing consistently profitable traders, highlighting the effectiveness of its teaching and mentorship approach.

- Expert Mentor: Under Ezekiel's mentorship, students gain insights from a seasoned trader, fostering confidence across different trading environments.

- Supportive Community: Membership grants access to a network of ambitious traders, encouraging mutual support, knowledge exchange, and collective growth.

- Emphasis on Discipline and Psychology: Recognizing the mental challenges of trading, the program emphasizes psychological resilience and disciplined decision-making.

- Constant Updates and Resources: Students stay informed on market dynamics with ongoing updates and resources, ensuring they remain competitive.

- Success Stories: Asia Forex Mentor is celebrated for its numerous success stories, with many students achieving financial independence through their comprehensive education.

For those dedicated to excelling in forex, stock, and crypto trading, Asia Forex Mentor stands out as the definitive choice. With its in-depth curriculum, seasoned mentors, and a focus on practical application, the platform equips traders with the tools and support needed to navigate the complexities of various financial markets successfully.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Varchev Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a thorough review of Varchev, uncovering a mix of strengths and areas for caution. Varchev excels with its competitive commissions, wide array of trading instruments, and accessible educational resources, positioning it as a strong contender in the brokerage industry. These advantages make it an appealing option for traders seeking diverse market access and cost-effective trading conditions.

Moreover, the broker's commitment to safety and security, demonstrated through compliance with regulatory standards and the protection of client funds, reinforces its credibility and reliability. The availability of different account types and flexible deposit and withdrawal options further enhances the trading experience, catering to a wide range of trader needs and preferences.

However, potential clients should be aware of the broker's limitations, including restrictive bonus programs and limited customer support channels. These cons, while significant, do not overshadow the broker's overall value but should be considered when making an informed decision about opening an account with Varchev.

>> Also Read: Purple Trading Review 2024 with Rankings By Dumb Little Man

Varchev Review FAQs

What types of accounts does Varchev offer?

Varchev provides several account options to cater to the diverse needs of traders, including Real Accounts and Cent Accounts. Real Accounts are designed for trading under actual market conditions, with distinctions between professional and non-professional clients, particularly in terms of leverage and minimum deposit requirements. Cent Accounts allow traders to deal in minimum amounts, converting deposits into cents for more granular control over trading volumes. This range of accounts ensures that both novice and experienced traders can find a setup that suits their trading style and goals.

How does Varchev ensure the safety and security of client funds?

Varchev prioritizes the safety and security of its clients' funds through strict adherence to regulatory standards. The broker is registered with the FSC (Financial Supervision Commission) and complies with the MiFID (Markets in Financial Instruments Directive), enhancing its reliability. Furthermore, client funds are kept in segregated accounts in reputable banks such as Barclays and Unicredit, and additional protection is provided through the broker’s partnership with the ICF (Investor Compensation Fund). These measures are in place to safeguard client assets and ensure financial integrity.

Are there any fees or commissions I should be aware of when trading with Varchev?

Varchev is transparent about its fee structure, charging competitive commissions starting from 0.03% per stock and 5% per trade for stock trading. Importantly, there are no platform, account maintenance, or quote fees, and hidden fees have not been discovered. However, the broker does apply a fixed commission for position rollovers to the next day (swap). Traders should also note that while Varchev does not impose deposit or withdrawal fees, the selected payment system might apply charges. Being mindful of these fees will help traders manage their trading costs effectively.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.