Purple Trading Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 118th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Purple Trading Review

Forex brokers play a pivotal role in the global trading landscape, acting as intermediaries that allow traders to buy and sell currencies. These platforms are essential for both novice and experienced traders who wish to navigate the volatile Forex market. Purple Trading, distinguished by its Straight Through Processing (STP) technology, emerges as a notable player in this competitive arena. With a license from the CySEC Cypriot regulator, it assures traders of its reliability and adherence to strict regulatory standards.

This review aims to dissect Purple Trading thoroughly, spotlighting its unique selling propositions and potential limitations. Our comprehensive analysis is designed to unveil every aspect of Purple Trading, from account options to deposit and withdrawal processes, commission structures, and more. By integrating expert analysis with real trader experiences, we strive to present a balanced view that empowers you with all the necessary details to decide if Purple Trading aligns with your trading aspirations.

What is Purple Trading?

Purple Trading stands as a distinguished Forex broker, renowned for its CySEC Cypriot regulator license and its adoption of Straight Through Processing (STP) technology. Established in 2016 in Cyprus, it has expanded its presence with representative offices in the Czech Republic and Slovakia, showcasing its growing influence in the European trading sphere.

This broker extends its services beyond traditional Forex trading, offering clients the opportunity to trade various types of CFDs and currency pairs. Moreover, Purple Trading distinguishes itself by allowing the buying and selling of real shares of Italian companies and investing in ETFs. This broadens the investment options available to traders, catering to a wide range of trading preferences and strategies.

Safety and Security of Purple Trading

According to an exhaustive investigation by Dumb Little Man, Purple Trading ensures safety and security for its clients through stringent regulatory compliance and insurance mechanisms. The brand, owned by L.F. Investment Limited, boasts authorization from CySEC (Cyprus Securities and Exchange Commission), affirming its credibility and reliability in the financial trading domain.

Further solidifying its stance on security, Purple Trading is registered with 11 other European commissions, including BaFin, and falls under the regulatory purview of ESMA (European Securities and Markets Authority). These affiliations highlight the broker's commitment to adhering to the highest standards of financial conduct and investor protection across Europe.

Importantly, every Purple Trading client benefits from insurance against potential bank insolvency, safeguarding their funds up to €100,000. Additionally, being a CySEC license holder, the company is a part of the Investor Compensation Fund (ICF), providing retail clients with an insurance guarantee up to €20,000 per person in case of financial failure of L.F. Holding Investment Limited. This multi-layered approach to security underscores Purple Trading's dedication to ensuring a safe and secure trading environment for all its clients.

Pros and Cons of Purple Trading

Pros

- Funds in segregated accounts at leading European banks

- Negative balance protection for leveraged trading

- Regulation by CySEC and 11 European entities

Cons

- Account verification mandatory for trading

- Available only to EU residents

- ICF insurance exclusion for professional traders

Sign-Up Bonus of Purple Trading

Currently, Purple Trading does not offer a sign-up bonus for new accounts. This absence of an initial incentive might be a factor for potential clients to consider when choosing Purple Trading as their brokerage service.

Minimum Deposit of Purple Trading

At Purple Trading, the minimum deposit amount required to open a trading account is $100. This relatively low entry barrier makes it accessible for a wide range of traders, from beginners to more experienced individuals, to start trading.

Purple Trading Account Types

Our team of experts at Dumb Little Man conducted thorough research and testing on Purple Trading‘s account types. Here's a simplified breakdown of what they discovered:

STP Account

- Direct Market Access Account

- Trade all available currency pairs and CFDs (excluding CFDs on cryptocurrencies)

- Minimum deposit: $100 USD/EUR

- Spreads vary by status:

- Starter and Standard: from 1.6 pips

- Prime: from 1.4 pips

- VIP: from 1.1 pips

ECN Account

- Offers spreads from 0.5 pips

- Supports cryptocurrency trading via MT4

- Minimum deposit: $100 USD/EUR

- Commission per lot varies by status:

- Starter and Standard: $10

- Prime: $8

- VIP: $5

PRO Account

- Exclusive to clients with Professional status

- Opportunity to trade with increased leverage

- Leverage depends on account balance:

- Up to €10,000: 1:500

- €10,000 to €100,000: 1:200

- Over €100,000: 1:100

Purple Trading Customer Reviews

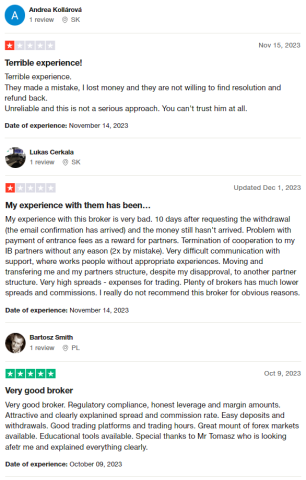

Customer reviews of Purple Trading reveal a mixed bag of experiences. Some traders have expressed dissatisfaction, citing terrible experiences, unreliable services, and challenges with withdrawals and communication with support. Concerns were also raised about high spreads and trading expenses, comparing unfavorably with other brokers. Issues with partnership management and the transference of structures without consent further contributed to the negative feedback.

However, on a positive note, other users have highlighted the broker's friendly team, regulatory compliance, honest leverage and margin amounts, and attractive spread and commission rates. The ease of deposits and withdrawals, quality of trading platforms, and availability of educational tools were also praised. This dichotomy in reviews suggests that while Purple Trading has areas of strength, particularly in regulatory adherence and platform usability, it also faces significant challenges in customer service and operational transparency.

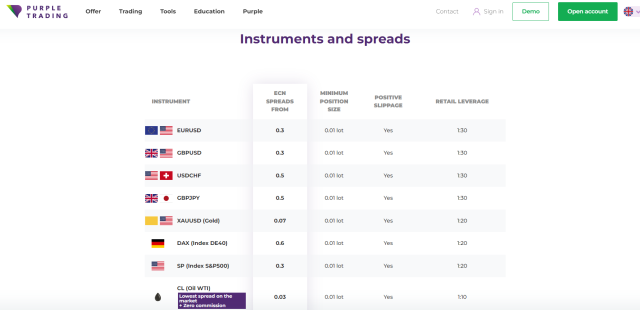

Purple Trading Fees, Spreads, and Commissions

Purple Trading implements floating spreads across all account types, catering to the dynamic nature of the Forex market. For ECN accounts, the broker charges a commission per lot traded, which is determined by the deposit amount and can range from $5, $8, or $10 per lot for currency pairs. When it comes to stock CFDs, the brokerage commissions are notably competitive, set at $0.02 for each American share and 0.1% of the transaction's face value for other shares. Furthermore, commissions on CFDs on futures are fixed at $10 per lot traded, and there's a 0.25% commission on transactions involving real shares.

A significant advantage for traders is that Purple Trading does not impose deposit or withdrawal fees, providing several free options for both transactions, primarily through bank transfers. However, it's important to note that using electronic systems like Skrill and Neteller incurs fees for both deposits and withdrawals. Another aspect to be aware of is the inactivity fee; an account that shows no activity for over 6 months is subject to a 15 EUR/USD charge, applied once every quarter.

Deposit and Withdrawal

A trading professional at Dumb Little Man rigorously tested Purple Trading's deposit and withdrawal processes, confirming the company's commitment to efficient financial transactions. Purple Trading guarantees the processing of withdrawal requests within 1 working day, highlighting their dedication to prompt service. However, it's important for clients to be aware of the withdrawal fees: €7 per card transaction, 2% for Neteller, and 1% for Skrill withdrawals. On a positive note, internal bank transfers in Czech crowns, euros, and zloty are offered free of charge, with a modest fee for international transfers capped between €5 and €100, or completely waived for withdrawals over 25,000 PLN.

The timelines for money transfers vary based on the method chosen. Domestic transfers in kroons, euros, and zloty typically complete within 1-2 business days, while international transfers may take 3-5 business days. Withdrawals to cards can take anywhere from 2 to 14 business days, contrasting with the near-instantaneous transfer to electronic wallets, which takes just a few minutes. Transaction limits are also in place, with up to PLN 25,000 allowed per local bank transfer at one time and a monthly ceiling of PLN 100,000. Card withdrawals must be at least €8, not exceeding the deposited amount, while electronic wallets require a minimum withdrawal of €3.

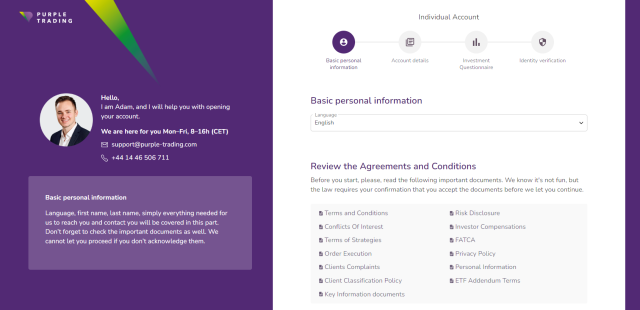

How to Open a Purple Trading Account

- Navigate to the Purple Trading website and click on Open Account.

- Complete the registration form with your personal details including first name, last name, email, country, and phone number.

- Select the currency you wish to use for your account.

- Log in to your newly created member's area with your email and password.

- Submit the required identification documents for account verification.

- Wait for the verification process to complete, which ensures the security of your account.

- Once verified, deposit funds into your account, adhering to the minimum deposit requirement.

- Choose a trading platform that suits your trading style and preferences.

- Start trading by selecting your desired financial instruments and executing trades.

Purple Trading Affiliate Program

The Purple Trading Affiliate Program offers two distinct pathways for individuals looking to earn through the platform: the Introducing Broker (IB) and the Strategy Provider.

As an Introducing Broker (IB), you act as a liaison between prospective traders or investors and Purple Trading. This role enables you to earn referral fees by successfully connecting new clients with the broker, leveraging your network to promote Purple Trading’s services.

On the other hand, a Strategy Provider is tailored for adept traders who wish to profit from sharing their successful trading strategies. Providers can earn through three types of commissions: a management fee, a percentage of the investors' income, or a percentage of the deposited amount. This setup not only benefits the Strategy Provider through additional income streams but also offers investors the chance to connect with proven strategies.

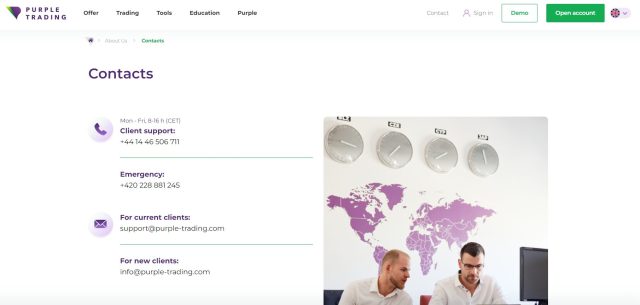

Purple Trading Customer Support

Based on the experience of Dumb Little Man with Purple Trading Customer Support, the service is accessible from 8:00 to 16:00 CET, Monday to Friday. It's important for traders to note that technical support is not available on weekends or holidays, which could impact those seeking immediate assistance during these times.

Clients have multiple channels to reach Purple Trading Support. You can make a phone call using the number provided in the Contact section, engage in online chat directly on the website, send an email, or reach out through social media platforms like Facebook, LinkedIn, and Twitter. This variety ensures that traders can choose the most convenient way to get the help they need.

Advantages and Disadvantages of Purple Trading Customer Support

| Advantages | Disadvantages |

|---|---|

Purple Trading vs Other Brokers

#1. Purple Trading vs AvaTrade

Purple Trading is known for its conditional approval status, no additional commission for floating spreads, and charitable donations from inactive accounts. AvaTrade, on the other hand, excels with a strong regulatory framework, a wider range of financial instruments (over 1,250), and global presence except in the US.

Verdict: AvaTrade is better for traders seeking a highly regulated environment and access to a wider range of trading instruments. Purple Trading may appeal to those looking for innovative account features and lower commission structures.

#2. Purple Trading vs RoboForex

Purple Trading offers unique features like earning passive income through investment programs and no account maintenance fees. RoboForex, established in 2009, is recognized for its advanced technology, broad range of trading platforms, and ContestFX for demo account contests.

Verdict: RoboForex is a better choice for traders who value technological sophistication and a variety of trading platforms. Purple Trading, however, is more suited for traders interested in investment program opportunities and lower operational costs.

#3. Purple Trading vs FXChoice

Purple Trading has a strong focus on the Asia-Pacific region, with no additional commission for floating spreads and no account maintenance fees. FXChoice, founded in 2010 and regulated by FSC Belize, is tailored for experienced traders, offering ECN accounts with tight market spreads and a 90-day demo account.

Verdict: FXChoice is better for experienced traders seeking tight spreads and advanced account types. Purple Trading, however, may appeal to a broader range of traders, especially those in the Asia-Pacific region, looking for lower cost structures and flexible trading options.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those determined to build a successful career in forex trading and attain significant financial returns, Asia Forex Mentor is the leading choice for comprehensive forex, stock, and crypto trading courses. At the helm of Asia Forex Mentor is Ezekiel Chew, a celebrated figure in the realm of trading education for institutions and banks. Notably, Ezekiel regularly secures seven-figure trades, a feat that distinguishes him from his peers in the educational sector. The key factors that solidify our endorsement include:

Comprehensive Curriculum: Asia Forex Mentor provides an extensive educational program encompassing stock, crypto, and forex trading. The curriculum is meticulously designed to furnish aspiring traders with essential skills and knowledge for success in these varied markets.

Proven Track Record: The effectiveness and credibility of Asia Forex Mentor are underscored by its history of nurturing traders who consistently profit in different market segments. This success reflects the strength of their training and mentorship approaches.

Expert Mentor: Students at Asia Forex Mentor benefit from the expertise of an accomplished mentor in stock, crypto, and forex trading. Ezekiel's personalized guidance empowers students to confidently tackle the complexities of each market.

Supportive Community: Enrolling in Asia Forex Mentor grants access to a community of ambitious traders focused on excelling in stock, crypto, and forex markets. This environment encourages mutual learning, sharing of ideas, and collaboration, enriching the learning process.

Emphasis on Discipline and Psychology: The program recognizes the importance of mental fortitude and discipline in trading. Asia Forex Mentor emphasizes psychological training to aid traders in emotion management, stress handling, and making informed decisions.

Constant Updates and Resources: With the ever-evolving nature of financial markets, Asia Forex Mentor ensures students stay informed about the latest trends and strategies. Ongoing access to valuable resources is provided to keep traders at the forefront of market developments.

Success Stories: Numerous students of Asia Forex Mentor have successfully reshaped their trading careers and attained financial independence, showcasing the impact of their holistic education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the top selection for aspiring individuals seeking the finest forex, stock, and crypto trading courses. It offers an all-round educational experience, combining a thorough curriculum, expert mentorship, practical learning, and a supportive community, positioning Asia Forex Mentor as an essential platform for developing proficient traders in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Purple Trading Review

The team of trading experts at Dumb Little Man have found that Purple Trading stands out as a notable forex broker, especially for clients in the Asia-Pacific region. The broker's no additional commission for floating spreads, innovative investment programs, and insurance against inappropriate advice or fraud are significant advantages that enhance the trading experience.

However, it's important for potential traders to be aware of the lack of regulation by independent authorities. This could pose a risk, and it's crucial for traders to consider this factor seriously before engaging with the broker. Additionally, while Purple Trading provides a broad range of deposit and withdrawal options, the fees associated with certain methods like bank transfers and cryptocurrency transactions should be noted.

>> Also Read: IFX Brokers Review 2024 with Rankings By Dumb Little Man

Purple Trading Review FAQs

Is Purple Trading a Regulated Forex Broker?

No, Purple Trading is not regulated by independent authorities. The company holds an offshore license, which may not provide the same level of protection as regulation by reputable financial watchdogs. Traders should exercise caution and thoroughly research before choosing to trade with Purple Trading.

What Are the Deposit and Withdrawal Options at Purple Trading?

Purple Trading offers a variety of deposit and withdrawal options, including MasterCard, Visa, electronic payment systems like Skrill and Neteller, cryptocurrency, bank transfers, and local transfers for clients from specific regions. While most withdrawal fees are covered by the broker, it's important to note that bank transfers, cryptocurrency funding, and certain Neteller transactions may incur fees.

Are There Any Inactivity Fees for Purple Trading Accounts?

Yes, Purple Trading charges inactivity fees if a trader does not use their account for more than 180 days. The fee is either $5 per month or the amount of the account balance, whichever is less. Inactivity fees continue until the account balance reaches $0, at which point the funds are sent to a charitable cause supported by Purple Trading.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.