Traders Trust Review 2025 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 114th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, consisting of financial experts, experienced traders, and personal investors, utilizes sophisticated algorithms to conduct detailed evaluations of brokerage services. Their analysis concentrates on key elements such as:

Incorporating real user feedback, they provide an unbiased and comprehensive perspective. Their exhaustive investigation points to Traders Trust as a reliable option for those in search of a strong financial partner. However, Dumb Little Man recommends that potential clients carefully review their extensive report to understand any possible limitations associated with the broker. |

Traders Trust Review

As platforms for trading currencies globally, “forex brokers” are essential to the global financial industry. In this cutthroat market, Traders Trust stands out by offering a platform for people to trade Forex. One of these is Trader's Trust.

With over 30 years of expertise in the financial services industry, Nicola Berardi founded Traders Trust, which operates with Swiss ideals of integrity and dependability. To provide readers with a comprehensive understanding of Traders Trust's services and performance in 2023, this evaluation explores the broker's offers and is supported by professional findings and experiences.

What is Traders Trust?

A seasoned professional with more than thirty years of experience in the financial services sector, Nicola Berardi founded the Forex brokerage company Traders Trust. Originating in Switzerland, the company specializes in offering trustworthy trading services and represents the integrity and trust of the area.

The goal of Traders Trust is to support traders' long-term travels by prioritizing the needs of its clients. The company is committed to building a solid foundation that stands by its clients and guarantees that they always come first. Traders Trust's client-centric approach forms the basis of its working philosophy.

In terms of mission, Traders Trust works to democratize access to the financial markets by making sure that everyone may use extensive tools and features like trading calculators, to interact with the markets, irrespective of background or financial situation. The company is committed to its clients' success; it celebrates their accomplishments and offers resources to improve trading capabilities.

Security and transparency are at the core of Traders Trust's objectives. The brokerage puts a lot of effort into upholding openness in its business practices and safeguarding investments by taking steps like segregating client and corporate funds and putting them in reputable banks.

Furthermore, negative balance protection is offered, guaranteeing that clients will not lose more than their account balances even in volatile market conditions. Traders Trust's dedication to safety and openness demonstrates its commitment to providing a trustworthy and safe trading environment for every one of its clients.

Safety and Security of Traders Trust

The strong regulatory framework and open operational structure of Traders Trust serve as important reminders of its commitment to safety and security. This data, painstakingly collected following an extensive investigation by Dumb Little Man, demonstrates the company's dedication to offering a safe trading environment.

Incorporated under Cyprus securities. Seychelles legislation, Traders Trust Ltd owns a Securities Dealer License (SD141) issued by the Financial Services Authority (FSA). Because of this governmental control, Traders Trust can operate under stringent restrictions and provide its clients with a certain level of security and reliability. The company's genuine standing in the financial arena is further reinforced by its Seychelles registered office.

Furthermore, Traders Trust's subsidiary, TTCM Traders Capital Limited (TTCM BM), is incorporated in Bermuda in accordance with the Companies Act of 1981. The firm's commitment to openness and legal compliance in several jurisdictions is demonstrated by its registration with the Registrar of Companies and its adherence to Bermuda's regulatory standards.

With opportunities in a variety of markets, such as Forex, stocks, cryptocurrencies, indices, metals, and oil, Traders Trust encourages investors to trade with confidence. The brokerage offers benefits that set it apart in the highly competitive world of online trading, emphasizing the value of dealing with a trustworthy broker. Because of its emphasis on integrity, safety, and security, Traders Trust is seen as a trustworthy global partner by traders.

Pros and Cons of Traders Trust

Pros:

- Competitive spreads and commissions

- Variety of account types

- Flexible deposit and withdrawal options

- Multilingual customer support

- Attractive affiliate program

- Regulatory compliance

Cons:

- Limited weekend support

- Withdrawal fees for certain methods

- Potential trading fee for inactivity

- Geographical restrictions

Sign-Up Bonus of Traders Trust

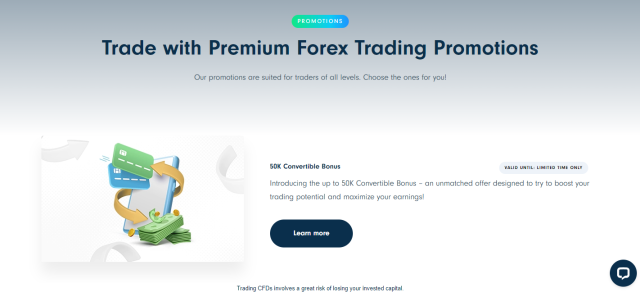

Traders Trust seeks to improve its customers' trading experience and earning potential by providing alluring sign-up bonuses to both new and current customers. Because these benefits are tailored to fit the needs of all levels of traders, from beginners to seasoned investors, Traders Trust is a desirable choice for anyone trying to get the most out of their trading tactics.

The first bonus, called the 50K Convertible Bonus, is an exceptional deal that gives traders a big opportunity to increase their trading potential. Traders who deposit money or use existing holdings are eligible to qualify for and get a 100% bonus on their investment, up to $50,000. This bonus turns into withdrawable cash once trading requirements are met, providing a lucrative opportunity to boost one's trading capital.

In addition, Traders Trust introduced a Loyalty Program that gives its associates monthly financial rewards based on the net deposits of their direct clients. This program encourages partners to grow their clientele by automatically crediting up to 3% of their clients' monthly net deposits as cash incentives within the first ten days of each month.

The third incentive is the Cashback Rebate, which offers traders with high-volume trades a daily maximum of $2,000. After opening a Classic or Pro trading account and meeting the minimum trading volume requirement, traders are eligible for rebates on all trading instruments available on Traders Trust. To maximize their profits on transactions and benefit from this cashback rebate, active traders are highly motivated to increase their trading activity.

When taken as a whole, these bonuses provide a wealth of advantages that demonstrate Traders Trust's commitment to helping its customers achieve their trading goals, making it an appealing choice for traders looking for more value and support from their broker.

Minimum Deposit of Traders Trust

With a $50 minimum deposit needed for a Classic account, the Forex Broker Traders Trust has established an approachable entry point for investors looking to begin their trading career. A broad spectrum of people, from novices to more seasoned traders wishing to investigate the Forex market and other financial products, can trade thanks to this low threshold.

The Classic account option makes it simpler for traders to enter the trading market without having to make a big financial commitment by catering to those who want to start trading with a small initial investment. This strategy supports Traders Trust's mission to empower people financially and is consistent with its mission to make financial markets accessible to all.

Traders Trust Account Types

To meet the various needs of traders, our team of professionals at Dumb Little Man has conducted extensive research and testing and has produced comprehensive information on Traders Trust account kinds. Every account type is made to accommodate varying degrees of experience and trading tactics, so traders may choose the one that best suits their needs.

Demo Account

A risk-free option allowing traders to practice with up to $200,000 in virtual funds. It is ideal for beginners to familiarize themselves with trading platforms without financial risk.

Here's how to access the Demo Account:

- Simply fill out the from to set preferences.

- Receive via email for access.

- Download MT4 and use the provided credentials to log in.

- Explore MT4 features with virtual trading.

Live Accounts

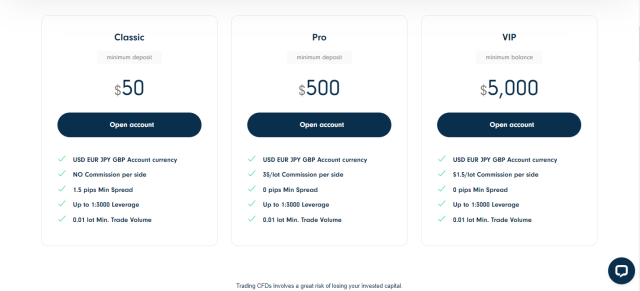

Classic

- Minimum Deposit: $50

- Account Currency: USD, EUR, JPY, GBP

- Commission: No commission per side.

- Minimum Spread: 1.5 pips

- Leverage: Up to 1:3000

- Minimum Trade Volume: 0.01 lot

Pro

- Minimum Deposit: $500

- Account Currency: USD, EUR, JPY, GBP

- Commission: $3/lot per side.

- Minimum Spread: 0 pips

- Leverage: Up to 1:3000

- Minimum Trade Volume: 0.01 lot

VIP

- Minimum Balance: $5,000

- Account Currency: USD, EUR, JPY, GBP

- Commission: $1.5/lot per side.

- Minimum Spread: 0 pips

- Leverage: Up to 1:3000

- 70.01 lot

Traders Trust Customer Reviews

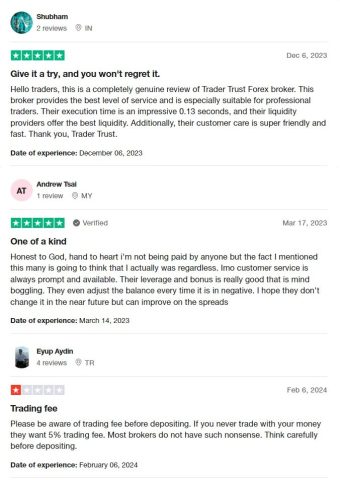

Reviews for Traders Trust are mixed and highlight different areas of the company's offerings. Numerous consumers praise the broker for its outstanding service quality, highlighting, in particular, its excellent liquidity, 0.13-second market execution speed, and suitability for professional traders. Many people compliment the customer service for being polite and prompt, and they also mention how generous the leverage and bonus options are—including the ability to alter a negative balance.

Reviews do, however, highlight a possible drawback about trading fees—more specifically, a 5% fee on accounts with no trading activity, which is not typical among all brokers. This combination of comments implies that although Traders Trust has a lot to offer, like fast customer support and favorable trading circumstances, potential customers should think about the charge schedule before deciding.

Traders Trust Fees, Spreads, and Commissions

With a variety of account types that come with varied fees, spreads, and commissions, Traders Trust caters to a wide range of trading styles and experience levels. The brokerage guarantees traders can access the markets under advantageous conditions by offering competitive floating spreads for all CFDs.

If you choose a Classic account, you can trade all instruments with an all-inclusive spread that starts at 1.5 pips and comes with no additional commission. This account, which has a $50 minimum deposit and leverage up to 1:500 based on a STP/NDD execution strategy, is suitable for beginners in trading. It's made to be simple and easy to use for people who are new to trading.

With a $3 lot (per side) fee, the Pro account, which caters to experienced traders, offers raw spreads on FX and metals beginning at 0.0 pip. This ECN account, which has a $2,000 minimum deposit and a 1:500 leverage ratio, is attractive to traders who want quick execution and direct access to the market.

VIP accounts are perfect for experienced traders because they feature spreads as low as 0.0 pip and a $1.5 lot commission. Experienced traders who engage in significant trading volumes would benefit most from this professional ECN account, which has a greater minimum deposit of $20,000 and a lower leverage ratio of 1:200.

All account types are subject to withdrawal commissions via bank transfer; Classic accounts cost $15, while Pro and VIP accounts cost $1. This pricing structure demonstrates Traders Trust's dedication to offering an open and flexible trading environment that can be tailored to meet the needs and preferences of a broad range of traders.

Deposit and Withdrawal

A Dumb Little Man trading specialist looked over Traders Trust's flexible and secure deposit and withdrawal process in detail. Through partnerships with specific payment providers worldwide, the brokerage guarantees that clients can deposit money in a convenient and safe manner utilizing a variety of methods.

Bank transfers, credit/debit cards, Bitcoin, USDT, Skrill, and Neteller are just a few of the payment options that Traders Trust accepts for deposits. Traders Trust accepts the following currencies: USD, EUR, GBP, JPY, CHF, CNY, and PLN. The majority of choices offer instant processing timeframes, except bank transfers, which can take up to three business days. The platform's no-fee policy for deposits, which offers traders freedom and convenience of use with a minimum of $/€50 and no maximum limit, is noteworthy.

Withdrawals are meant to be easy and rapid, and Traders Trust guarantees that requests will be processed in as little as one business day. The same currencies and methods that are available for deposits are also available for withdrawals. There is mention of a minimum withdrawal amount of $50, €50, or £50, but no commission fee schedule.

It's important to note that the brokerage lists circumstances under which extra costs might be charged, including withdrawals in situations with little trading activity, fraudulent behavior, or when the client's bank cancels a transfer.

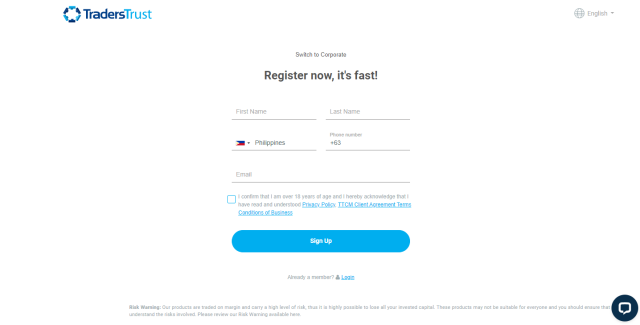

How to Open a Traders Trust Account

Opening a Traders Trust account is a straightforward process designed to be quick and user-friendly. Follow these nine simple steps to start your trading journey with one of the most reliable Forex brokers in the market.

- Select your country of residence from the drop-down menu.

- Input your phone number correctly.

- Provide your email address.

- Confirm you are over 18 and accept the privacy policy, along with the client agreement terms and conditions.

- Check your email for a pin confirmation.

- Use the received pin to agree to the company policy and proceed.

- Choose whether to open a Demo Account or a Live Account,

- Deposit and start trading.

Traders Trust Affiliate Program

Through the Affiliate Program that Traders Trust provides, users can make money from their networks by introducing new traders to the platform. You may turn your influence into a steady stream of money by becoming an independent agent or an introducing broker. You can get up to $10 per traded lot for each trade your referrals make.

Because of the program's multi-level reward system, your earnings can expand exponentially. You earn commissions on new introducing brokers (IBs) up to five tiers of sub-partners that sign up through your recommendation and grow the network. You may be confident that your earning potential is virtually endless with this multi-level method.

Additionally, Traders Trust rewards loyalty with its Partner Loyalty Program, which offers monthly earnings of up to $50,000. This bonus, which is determined by the monthly trading volume of your clients, is in addition to your regular IB commission. It is added to your account automatically, and the more trading volumes you get from your referrals, the higher your rank and the greater your monthly bonus will be. This is truly limitless commission.

Traders Trust Customer Support

Traders Trust Customer Support strives to be incredibly responsive and approachable so that clients can receive assistance anytime they need it. This support system, which is available five days a week, twenty-four hours a day, and provides a range of channels to meet different user expectations and preferences, is based on Dumb Little Man's experience.

Consumers can utilize the Live Chat feature to get assistance immediately because customer support agents are on hand to respond to inquiries. Because it is available 24/7, this service is a good option for real-time help.

For those who would like to connect in writing, sending an email to [email protected] to their broker Traders Trust is another effective way to get in touch. The team responsible for customer service is committed to offering comprehensive answers to all of the clients' questions, ensuring their satisfaction and comprehension.

Furthermore, those who would prefer to speak with an expert directly may do so by contacting support. Language barriers won't affect the level of service because Traders Trust offers multilingual help in an effort to serve customers worldwide. Customers can easily get in touch with support representatives by calling +44 203 1295899.

This multi-channel support system's availability, reactivity, and linguistic diversity show how committed Traders Trust is to providing exceptional customer service and meeting the wide range of needs of its clients.

Advantages and Disadvantages of Traders Trust Customer Support

| Advantages | Disadvantages |

|---|---|

Traders Trust vs Other Brokers

#1 Traders Trust vs AvaTrade

AvaTrade is not within the Financial Conduct Authority's (FCA) authority, despite having a robust regulatory framework and being created in multiple jurisdictions. AvaTrade is renowned for its innovative technology, such as AvaProtect, and educational resources. On the other hand, Traders Trust takes pleasure in offering competitive spreads, low minimum deposit requirements, and an easy-to-use trading interface.

Verdict: AvaTrade might be a better option for traders looking for a large selection of trading instruments and training materials. But Traders Trust distinguishes out for individuals who value competitive spreads and attentive customer care.

#2 Traders Trust vs RoboForex

RoboForex appeals to traders seeking versatility in their trading software because it provides a wide choice of trading platform, such as MT4, MT5, cTrader, and R Stock Trader. Traders Trust focuses mainly on traders interested in financial empowerment and earning potential through referrals, offering competitive account types, safe and flexible deposit and withdrawal options, and a multi-level affiliate network.

Verdict: If platform diversity and tailored trading conditions are priorities, RoboForex may be the preferable option. For those valuing a straightforward trading environment with robust affiliate opportunities, Traders Trust is likely the better choice.

#3 Traders Trust vs FXChoice

By giving users access to forex and CFD trading with an emphasis on emerging markets and enabling trading in uncommon forex pairs and commodities including crude oil, silver, and gold, FXChoice presents a distinctive offering. On the other hand, Traders Trust provides a simple forex trading environment with competitive spreads, fund security, and a dedication to trader success and customer support.

Verdict: FXChoice is an appealing service for traders who want to learn more about commodities and emerging markets. Traders Trust, however, can be a better choice for people looking for a concentrated forex trading experience with aggressive terms and committed assistance.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor comes highly recommended by Dumb Little Man's trading experts for anyone hoping to turn forex trading into a lucrative career. Ezekiel Chew, the man behind this platform, is not your typical instructor; not only is he a seasoned trader, but he routinely closes seven-figure deals, which distinguishes him in the trading education space.

Broad Curriculum: The website offers a thorough curriculum that covers trading in stocks, foreign exchange, and cryptocurrencies. Giving traders the core skills and information they need to be successful in a range of financial markets is the aim of this curriculum.

Proven Track Record: Asia Forex Mentor's effectiveness is demonstrated by its consistent ability to generate profitable traders. This achievement shows how important and high-quality their training and direction were.

Expert Mentor: Ezekiel Chew offers students invaluable insights thanks to his unparalleled expertise of equities, cryptocurrencies, and foreign exchange trading. His personalized guidance instills confidence to effectively navigate the obstacles of the trading sector.

Friendly Community: Access to a peer community is another benefit of becoming a member of Asia Forex Mentor. This network acts as a solid support system, fostering an environment that is conducive to growth and learning.

Emphasis on Psychology and Discipline: Because the course recognizes the critical role mentality plays, it places a heavy emphasis on psychological training. This enables traders to effectively manage their emotions and make logical choices even under duress.

Regular Updates and Resources: In order to provide students a competitive edge in their trading endeavors, Asia Forex Mentor ensures that they are aware of the most recent strategies and trends. This is because financial markets are dynamic in nature.

Success Stories: Several students on the site have attained remarkable financial independence through their education in stocks, forex, and cryptocurrency trading.

The greatest educational choice for someone who is serious about becoming a professional trader is Asia Forex Mentor. Its comprehensive approach, guided by a renowned mentor and supported by a dynamic community, equips traders for success in the competitive world of finance.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Fusion Markets Review 2024 with Rankings by Dumb Little Man

Conclusion: Traders Trust Review

The Dumb Little Man team of trading specialists has emphasized Traders Trust's competitive spreads and commissions in their thorough assessment, making it an appealing broker for traders on a budget. The broker's dedication to providing a simple and safe trading environment is highlighted by its tight regulatory compliance, flexible deposit and withdrawal choices, and other features.

Potential customers should, however, also take into account the disadvantages, which include the lack of weekend service, the existence of withdrawal costs, and possible inactivity penalties. After weighing the benefits and drawbacks, Traders Trust is a great option for traders looking for a competitive and dependable platform. Enrolling in courses like Asia Forex Mentor can skyrocket your chances at success in forex trading.

>> Also Read: FXGiants Review 2024 with Rankings by Dumb Little Man

Traders Trust Review FAQs

What trading platforms does Traders Trust offer?

TTCM Traders Trust Capital makes it easy to use the MetaTrader 4 (MT4) platform, which is renowned for its dependability, user-friendly design, and robust analytical capabilities. MT4 is a favorite among traders because to its advanced charting features, automated trading systems (Expert Advisors), and customization options. This platform offers traders of all skill levels a stable environment for trading FX and CFDs.

How do I choose the right trading account with Traders Trust?

Your trading expertise, capital, and strategy will all play a role in selecting the best trading account with Traders Trust. Due to its wider spreads and lower minimum deposit, the Classic account is more accommodating to novice traders and is a good place for them to start. Pro or VIP accounts, which offer tighter spreads and reduced commissions for larger volumes, may be preferred by seasoned traders. Selecting the best account type for you will be aided by evaluating your trading frequency, style, and risk tolerance.

Can Traders Trust accommodate various trading strategies?

Indeed, TTCM Traders Trust is made to support a variety of trading techniques, such as swing, day, and scalping trading. The broker is appropriate for strategies that depend on speedy market entry and exit because it uses STP/NDD technology, which guarantees fast execution speeds. Additionally, traders can successfully implement a wide range of complicated strategies because to the platform's adjustable leverage options and availability of a comprehensive selection of products.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.