Trade245 Review 2024 with Rankings By Dumb Little Man

By Wilbert S

March 24, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 128th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Trade245 as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Trade245 Review

Forex brokers are pivotal in providing access to the global financial markets. They serve as intermediaries between retail traders and the vast world of forex market. Among these brokers, Trade245 stands out as a significant player. Based in Johannesburg, South Africa, Trade245 was established in 2020. This brokerage firm is renowned for offering a diverse range of digital trading options. It encompasses various financial instruments, including Forex, Indices, Stocks, CFDs for Commodities, and Cryptocurrencies.

The aim of this review is to deliver a comprehensive evaluation of Trade245. We focus on the broker’s unique selling points and potential limitations. Providing essential insights is our main objective. We cover various account options, deposit and withdrawal processes, commission structures, and more. This balanced analysis combines expert opinion with actual trader experiences. It ensures you have all the necessary information to consider Trade245 as your preferred brokerage service provider.

What is Trade245?

Trade245 is a Forex broker established in 2020. It operates under a license from the FSCA, South Africa’s most esteemed regulator. This credential underscores the broker’s dedication to upholding the highest financial standards and integrity, positioning it as a trustworthy partner for traders.

The platform offers a wide array of trading options, including Forex and CFDs on diverse asset classes such as stocks, metals, commodities, cryptocurrencies, and stock indices. This variety caters to a broad spectrum of trading preferences and strategies. Trade245 provides access to the MetaTrader 4 and 5 platforms, renowned for their advanced functionalities and ease of use. With leverage of up to 1:500 and various account types designed to accommodate different trading needs, Trade245 emerges as a versatile choice for traders at all levels of experience in the financial markets.

Safety and Security of Trade245

The safety and security of trading platforms are paramount for investors and traders. Trade245 stands out in this regard, backed by comprehensive oversight and regulatory compliance. Managed by Red Pine Capital (PTY) Ltd, and authorized as a financial services provider with FSP No. 46044, Trade245 operates under the strict guidance of the Financial Sector Conduct Authority (FSCA) in Johannesburg, South Africa. This information, thoroughly researched by Dumb Little Man, underscores the broker’s commitment to maintaining high standards of financial integrity and operational transparency.

Trade245 prioritizes the safety of its clients’ deposits by using segregated bank accounts. This essential measure ensures that traders’ funds are kept separate from the company’s capital, safeguarding them against the misuse of funds for corporate expenses. Additionally, the brokerage includes negative balance protection in all accounts, a critical feature that protects traders from owing more than their account balance. While the FSCA’s regulation permits trading with high leverage and supports the use of e-wallets and cryptocurrencies for payments, it’s important to note that Trade245 is not a member of a compensation fund. This detail emphasizes the need for traders to consider the available safety nets and the extent of their coverage.

Pros and Cons of Trade245

Pros

- Negative balance protection for every account type

- Competitive narrow floating spreads

- Regulated by a reputable authority

- Access to MT4 and MT5 platforms

- Educational and cent accounts for new traders

Cons

- $100 minimum deposit, including for beginner-focused cent accounts

- No online chat for instant customer service support

- Deposit bonuses limited to one account type

Sign-Up Bonus of Trade245

Trade245 offers an enticing sign-up bonus structure with two specific accounts designed to integrate bonus offerings into the trading experience. These are the Bonus 100 account and the Bonus Rescue account. Both accounts are uniquely structured to not only provide bonuses but also grant full access to the broker’s comprehensive trading features. This includes leverage options, variable spreads, and unrestricted use of the MetaTrader 4 platform.

The Bonus 100 account lives up to its name by offering a 100% Bonus, while the Bonus Rescue account introduces a tiered bonus structure to cater to different trading strategies and preferences. It’s important to note that these bonuses are exclusive to these accounts and are not available for other Trade245 broker accounts.

To avail of the deposit bonus, traders are required to make a Forex deposit through an account manager. This step comes after accepting the terms & conditions and receiving approval for their application. This process ensures that traders fully understand the bonus criteria and the commitments involved, aligning expectations for both the broker and the client.

Minimum Deposit of Trade245

Trade245 sets the minimum deposit amount at $100. This requirement applies across its range of trading accounts, ensuring traders have a clear entry point to begin their trading journey. Establishing a minimum deposit is a standard practice in the brokerage industry, and Trade245’s threshold is designed to be accessible for a wide audience of traders, from beginners to more experienced individuals. This approach balances the need for accessibility with the broker’s commitment to offering a professional and comprehensive trading environment.

Trade245 Account Types

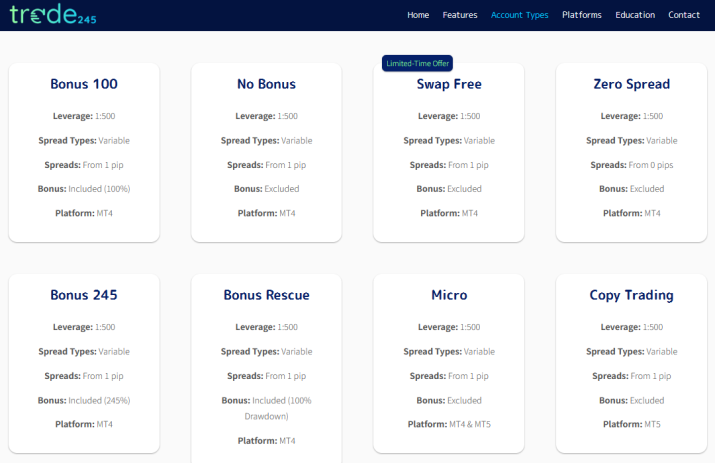

Our team of experts at Dumb Little Man conducted thorough research and tested the various trading account types offered by Trade245. Here’s a concise and organized list of the account types they found:

- Bonus 100 Account: Offers a 100% bonus with variable spreads starting from 1 pip. It features high leverage of 1:500 for those willing to take on more risk. Trading is conducted on the MT4 platform.

- No Bonus Account: Does not include a bonus offer but provides the same high leverage of 1:500 and variable spreads from 1 pip. This account also uses the MT4 platform.

- Swap Free Account: Designed for traders looking to avoid swap or rollover charges, this account offers high leverage of 1:500, variable spreads from 1 pip, and no bonuses. It operates on the MT4 platform.

- Zero Spread Account: Distinguished by offering spreads from 0 pips for cost-effective trading, it also features a leverage of 1:500 and operates on the MT4 platform without bonuses.

- Cent Account: Ideal for micro-trading with variable spreads from 1 pip, a leverage of 1:500, and no bonuses. This account allows trading in smaller increments and is available on the MT4 platform.

- Weekend Traders Account: Specifically designed for traders active during weekends, offering variable spreads from 1 pip and high leverage of 1:500. This account is unique as it operates on the MT5 platform, excluding bonuses.

Trade245 Customer Reviews

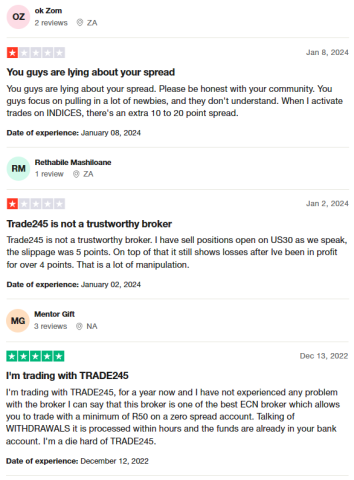

Customer reviews of Trade245 reveal a mixed reception from the trading community. Some traders express concerns over spread discrepancies, particularly when trading indices, where they have observed additional spreads of 10 to 20 points. Accusations of slippage and market manipulation are also mentioned, with specific instances of sell positions on US30 experiencing slippage and discrepancies in profit and loss calculations.

Conversely, a segment of the trading community praises Trade245 as a top-notch ECN broker, highlighting the ability to trade with minimal deposits on zero spread accounts and lauding the quick withdrawal process that sees funds deposited into accounts within hours. This polarized feedback suggests a variance in trader experiences, ranging from issues of trust and transparency to satisfaction with the broker’s services and efficiency.

Trade245 Fees, Spreads, and Commissions

Trade245 sets itself apart in the market through competitive and flexible spreads. Notably, spreads can start from as low as 0 pip, with the EUR/USD pair — one of the Forex market’s most traded currency pairs — having an average spread of 1 pip. However, traders should be aware that these trading conditions, including spreads, may vary depending on the specific entity of the broker. It is vital for traders to fully grasp the spread conditions offered by Trade245 and consider how these align with their own trading strategies.

In terms of fees and commissions, Trade245 offers a pricing structure that is competitive across most of its services. For certain account types, there is a commission fee of $10 per lot traded. Furthermore, traders might encounter fees related to depositing or withdrawing funds, with the exact amounts varying based on the chosen payment method.

Traders must also consider additional costs that may impact their trading activities. Swap or rollover fees are examples of potential additional charges, contingent on the nature and duration of the trades. Therefore, it is crucial for traders to thoroughly review Trade245’s fee structure and terms and conditions. This comprehensive understanding of all potential fees and charges is essential for traders aiming to navigate their trading endeavors more effectively and strategically.

Deposit and Withdrawal

Trade245 has been thoroughly reviewed by a trading professional from Dumb Little Man, focusing on its deposit and withdrawal processes. The findings indicate that client withdrawal requests are processed within a few hours, showcasing the broker’s efficiency and dedication to providing quick access to funds. Notably, Trade245 does not levy any fees for deposits or withdrawals, enhancing its appeal by reducing the financial burden on traders.

The broker supports a variety of withdrawal methods, including bank accounts, e-wallets, cards, and even cryptocurrencies, offering flexibility to meet diverse client preferences. In cases where a withdrawal is made to a card, Trade245 ensures that the amount deposited through this method is returned in the same manner. Should there be a request for a larger amount, the excess is transferred to a bank account. When opting for a bank transfer, the time it takes for funds to be credited varies depending on the financial institution. Funds are credited to the First National Bank account within a few hours, whereas transfers to other banks may take between 1-5 business days. Furthermore, the broker upholds a strict policy of not processing withdrawals to third-party accounts, prioritizing security and compliance.

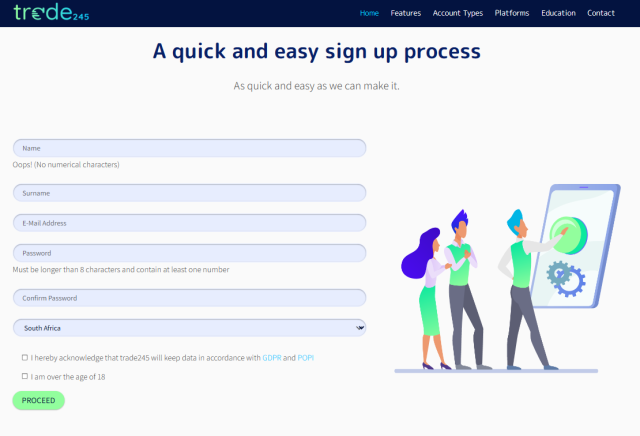

How to Open a Trade245 Account

- Visit the Trade245 website and find the registration form slightly below the main page.

- Fill in your name, surname, email address, choose your country, and create a password.

- Verify you are over 18 and press the “Register now” button.

- Check your email for a confirmation link from Trade245 immediately after registering.

- If the email isn’t in your inbox, look in your “Spam” folder or check if your email account is full.

- Click the confirmation link in the email to complete the setup of your account.

- After confirming, go back to the Trade245 website and click “Login”.

- Log in by entering your email address and password.

- Once logged in, your Trade245 account is set up and ready to use.

Trade245 Affiliate Program

Trade245 extends a partnership opportunity through its Introducing Broker affiliate program. In this program, the Introducing Broker earns a rebate fee for the trading activities of clients they introduce to Trade245. The specifics of the remuneration are tailored and discussed on an individual basis, ensuring that each partnership is aligned with the interests and contributions of the broker and the affiliate. This approach allows for flexibility and potential mutual benefits, emphasizing Trade245’s commitment to fostering strong, collaborative relationships with its partners.

Trade245 Customer Support

Based on the experience of Dumb Little Man, Trade245 prioritizes exceptional customer support. Available from Monday to Friday, around the clock, clients have access to a dedicated team of experts via phone or email. This ensures that professional assistance is readily available whenever needed.

The Trade245 support team is equipped to handle a variety of inquiries and issues. Whether clients face technical challenges on the trading platform, seek advice on market analysis, have questions about their accounts or services, or require immediate help with operational concerns, the team is prepared to offer guidance and effective solutions. Trade245’s commitment to customer service significantly contributes to a seamless trading experience, enabling traders to confidently navigate the complexities of the financial markets.

Advantages and Disadvantages of Trade245 Customer Support

| Advantages | Disadvantages |

|---|---|

Trade245 vs Other Brokers

#1. Trade245 vs AvaTrade

Trade245 and AvaTrade cater to traders with different preferences and requirements. Trade245, established in 2020, offers a variety of account types including unique options like Bonus 100 and Bonus Rescue accounts, catering to traders who appreciate flexible bonus structures. AvaTrade, on the other hand, has been a stalwart in the online Forex and CFD trading community since 2006, boasting a large international clientele and a vast array of over 1,250 financial instruments. AvaTrade’s extensive regulatory compliance across multiple jurisdictions offers a high level of security and trust.

Verdict: AvaTrade is better for traders looking for a well-established broker with a wide range of instruments and who value regulatory security. Trade245 might be preferred by those seeking innovative account benefits and higher leverage options.

#2. Trade245 vs RoboForex

Trade245 and RoboForex both provide access to the MetaTrader platforms, but they differ significantly in their offerings and market focus. Trade245 is known for its straightforward approach, offering competitive spreads and leveraging options up to 1:500. RoboForex, established in 2009, stands out for its technological prowess and wide selection of trading options across eight asset classes, catering to a diverse range of trading preferences and strategies. RoboForex also features unique contests on demo accounts, providing a novel way for traders to gain experience and rewards without risk.

Verdict: RoboForex is better for traders who value technological innovation, a vast array of trading instruments, and the opportunity to participate in trading contests. Trade245 suits traders looking for simple, competitive trading conditions in South Africa.

#3. Trade245 vs FXChoice

Comparing Trade245 with FXChoice, the latter established in 2010 and regulated by the International Financial Services Commission of Belize, highlights differences in market experience, regulatory environments, and service focus. FXChoice emphasizes quality brokerage services with a focus on active and passive trading, offering ECN accounts with tight market spreads, appealing to experienced traders. Trade245 offers a broader range of account types, including those with bonuses and high leverage, catering to a wide spectrum of traders including beginners.

Verdict: FXChoice is better for experienced traders seeking professional ECN accounts and those who prioritize a broker licensed by a strict regulator. Trade245 may appeal more to traders looking for varied account types, including those with bonus structures and higher leverage options.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those passionate about forging a lucrative career in forex trading and aiming for significant financial rewards, Asia Forex Mentor is the premier choice for top-tier forex, stock, and crypto trading education. The mastermind behind this esteemed platform is Ezekiel Chew, a highly respected figure among trading institutions and banks. Notably, Ezekiel consistently secures seven-figure trades, a feat that distinguishes him from his peers in the educational arena. The following points highlight why we recommend this program:

Comprehensive Curriculum:Asia Forex Mentor delivers a thorough educational experience, spanning forex, stock, and crypto trading. The curriculum is designed to arm budding traders with the essential knowledge and skills to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its history of nurturing traders who consistently achieve profitability across different market environments. This success underscores the effectiveness of their educational and mentorship approaches.

Expert Mentor: Enrollees at Asia Forex Mentor receive mentorship from an adept mentor, Ezekiel Chew, whose impressive trading achievements in stocks, crypto, and forex markets are unparalleled. His personalized guidance empowers students to confidently tackle market complexities.

Supportive Community: Membership in Asia Forex Mentor includes integration into a collaborative community of traders striving for success in the forex, stock, and crypto realms. This environment promotes mutual learning, idea exchange, and collaborative growth, enriching the learning journey.

Emphasis on Discipline and Psychology: Mastery in trading requires not just technical skill but also a disciplined mindset and psychological resilience. Asia Forex Mentor emphasizes psychological training to aid traders in managing emotions, stress, and making informed decisions under pressure.

Constant Updates and Resources: Given the ever-evolving nature of financial markets, Asia Forex Mentor ensures students stay informed about the latest trends, strategies, and insights. Ongoing access to key resources positions traders to stay competitive.

Success Stories: The legacy of Asia Forex Mentor is adorned with numerous success stories of individuals who have revolutionized their trading careers and attained financial independence through this all-inclusive forex, stock, and crypto trading education.

Asia Forex Mentor stands out as the definitive selection for those seeking an unparalleled forex, stock, and crypto trading course. With its detailed curriculum, seasoned mentors, practical strategies, and a nurturing community, Asia Forex Mentor equips aspiring traders with the tools and guidance necessary to evolve into proficient professionals in the diverse landscape of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Trade245 Review

In conclusion, the team of trading experts at Dumb Little Man has conducted an exhaustive review of Trade245, revealing a broker with several compelling advantages yet accompanied by noteworthy limitations. Trade245 stands out for its competitive spreads, flexible account types, and access to both MT4 and MT5 platforms, making it a solid option for traders of varying experience levels seeking diversified trading opportunities.

However, potential traders should approach with awareness of the broker’s drawbacks. The minimum deposit requirement of $100 may pose a barrier to entry for some beginners, and the absence of a 24/7 customer support and a live chat feature could impact the responsiveness and immediacy of assistance when needed.

>> Also Read: Admiral Markets Review 2024 with Rankings By Dumb Little Man

Trade245 Review FAQs

What types of trading accounts does Trade245 offer?

Trade245 offers a diverse range of trading accounts to suit different trader needs and preferences. These include the Bonus 100 Account, which offers a 100% bonus on deposits, and the Bonus Rescue Account with a tiered bonus structure. Other account types available are the No Bonus Account, Swap Free Account for those looking to avoid swap or rollover charges, the Zero Spread Account for lower trading costs, and the Cent Account ideal for micro-trading. The Weekend Traders Account caters to those preferring to trade over the weekend, offering flexibility across different trading strategies and experience levels.

How does Trade245 ensure the safety and security of its clients’ funds?

Trade245 prioritizes the safety and security of client funds through several measures. It operates under the regulation of the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring compliance with strict financial standards. Additionally, clients’ deposits are stored in segregated bank accounts, safeguarding them from being used for any corporate expenses. The inclusion of negative balance protection across all account types further protects traders from losing more than their account balance, offering a layer of financial safety during volatile trading periods.

Are there any fees or commissions charged by Trade245?

Trade245 is known for its competitive and flexible spreads, starting as low as 0 pip, with an average spread of 1 pip for the EUR/USD pair. While the broker offers a transparent fee structure, certain account types may incur a commission fee of $10 per lot traded. Additionally, traders should be aware of potential deposit and withdrawal fees, which vary depending on the chosen payment method, as well as possible swap or rollover fees for holding positions overnight. Traders are advised to review the broker’s detailed fee structure and consider how these costs may affect their trading strategy and overall investment costs.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.