TNFX Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 104th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and private investors, employs a specialized algorithm for thorough evaluations of brokerage services. Their analysis focuses on key areas such as:

|

TNFX Review

Forex brokers play a pivotal role in the global trading landscape, offering platforms for individuals and institutions to buy and sell foreign currencies. Amidst this dynamic market, TNFX emerges as a notable brokerage firm. Established in 2019, TNFX has carved its niche by providing comprehensive trading services globally. Based in the Middle East, along with offices in St. Vincent and the Grenadines and Seychelles, the company extends its reach across international borders.

TNFX specializes in offering access to a variety of trading instruments. Traders can engage in trading currencies, stock indices, stocks, and commodities as Contracts for Difference (CFDs). This versatility is further enhanced by the inclusion of leverage options, broadening the scope for traders with different strategies and risk appetites. TNFX's multi-faceted approach positions it as a versatile choice in the Forex trading sector.

Our comprehensive review of TNFX aims to deliver an in-depth evaluation of the broker. We focus on outlining its unique selling points and highlighting any potential drawbacks. This review is designed to offer crucial insights into TNFX's operations, including account options, deposit and withdrawal processes, and commission structures. By blending expert analysis with real trader experiences, our goal is to equip you with all the necessary information. This ensures a well-informed decision-making process when considering TNFX for your Forex trading needs.

What is TNFX?

TNFX, established in 2019, positions itself as an Electronic Communication Network (ECN) brokerage firm. This categorization signifies their commitment to providing direct access to other participants in currency markets. They specialize in facilitating the trading of a wide array of financial instruments, including currencies, stock indices, stocks, and commodities, primarily through Contracts for Difference (CFDs).

The broker boasts an extensive range of currency pairs, offering more than 50 options to traders. This is complemented by the provision of high leverage, reaching up to 1:400, enhancing the trading capabilities for various investor types. TNFX's leverage options represent a key feature for those looking to maximize their trading potential.

In terms of trading technology, TNFX integrates the widely acclaimed MetaTrader platforms. These platforms are renowned for their user-friendly interface and robust functionality, including advanced charting tools and automated trading capabilities. Features like Trading Central charts and AutoChartist further augment the trading experience. Additionally, TNFX stands out for its competitive low spreads, starting from as low as 0 pips. This aspect makes it an attractive option for traders seeking cost-effective trading solutions.

Safety and Security of TNFX

The safety and security of TNFX, a key aspect for any trader, has been thoroughly researched by Dumb Little Man. This review reveals the regulatory framework that underpins TNFX's operations in various jurisdictions. In Seychelles, TNFX operates under a license issued by the Financial Services Authority of Seychelles, ensuring compliance with local financial regulations.

In the United Arab Emirates, specifically in Dubai, TNFX's operations are regulated by the Dubai Economic Department. This regulatory oversight contributes to the broker's credibility in the Middle Eastern market. Additionally, TNFX maintains a presence in St. Vincent and the Grenadines, where it is registered. Although the local regulator does not issue specific licenses for international companies, TNFX is included in the country's general register, providing a form of regulatory recognition.

TNFX demonstrates a strong commitment to following the rules of financial regulatory authorities. This adherence includes the implementation of negative balance protection, a critical feature that safeguards traders from losing more than their account balance. Furthermore, the regulators overseeing TNFX do not impose restrictions on the use of cryptocurrencies and electronic payment systems. This openness to modern payment methods aligns TNFX with current financial trends and trader preferences.

Pros and Cons of TNFX

Pros

- Extensive range of currency pairs

- Access to MetaTrader trading platforms

- Guaranteed negative balance protection

- Elevated leverage for key currency pairs

- Competitive spreads across all accounts

- Availability of Cent and demo accounts

- Passive income opportunities

Cons

- Dispute resolution confined to broker's location

- Minimum deposit requirement of $100

- Lack of social media engagement with traders

- Absence from compensation funds

Sign-Up Bonus of TNFX

Currently, TNFX does not offer a sign-up bonus for new clients. This information is accurate as of the latest update, emphasizing the broker's current policy on welcoming incentives. While sign-up bonuses can be a significant draw for new traders, TNFX's decision to not provide such a bonus reflects their current strategy.

Traders considering TNFX should note this absence of a welcome bonus. It's important for potential users to factor this into their decision-making process when evaluating the overall offerings and benefits of using TNFX for their trading needs.

Minimum Deposit of TNFX

TNFX sets its minimum deposit amount at $100 starting with the Cent Account. The $100 minimum deposit is designed to be accessible for a wide range of traders, from beginners to more experienced ones, providing an entry point into the world of trading without a significant financial barrier.

TNFX Account Types

Our team of experts at Dumb Little Man conducted thorough research to test and evaluate the different account types offered by TNFX. The findings are organized below:

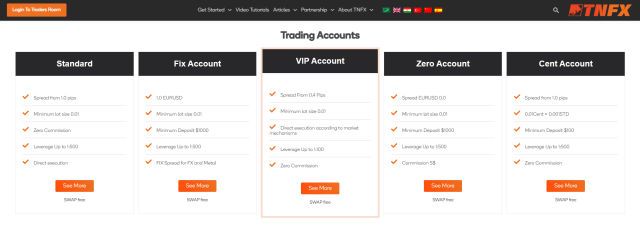

Cent Account

- Type: Cent account

- Minimum Deposit: $100

Standard Account

- Type: Standard with floating spreads

- Commission: Zero per lot

- Minimum Deposit: $300

Fix Account

- Type: Fixed spreads with zero commission

- Minimum Deposit: $500

Zero Account

- Type: Suitable for experienced traders

- Features: Floating near-zero spreads

- Commission: $5 per lot

- Minimum Deposit: $500

VIP Account

- Type: Professional trading account

- Features: Very narrow spreads

- Commission: Zero per lot

- Minimum Deposit: $100,000

These account options cater to a range of traders, from beginners to professionals, providing flexibility and varied trading conditions to suit different trading strategies and preferences.

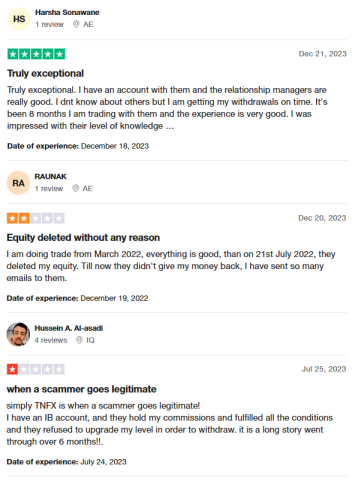

TNFX Customer Reviews

Customer reviews of TNFX present a mixed picture. Some clients praise the broker's exceptional service, particularly noting the efficiency of relationship managers and timely withdrawal processes. These positive experiences, lasting several months, highlight satisfaction with the knowledge and support provided by TNFX.

Conversely, other clients have faced significant challenges, including issues with equity deletion and unresolved financial disputes despite numerous communications. Additionally, there are instances where clients, especially those with an IB account, have experienced difficulties in receiving their commissions and upgrading their account levels, leading to prolonged and unresolved issues.

TNFX Fees, Spreads, and Commissions

TNFX distinguishes itself in the Forex market by not imposing non-trading fees for deposits and withdrawals. This approach positions TNFX as a cost-effective option for traders. However, the trading fees vary depending on the type of account held by the trader.

For Cent and Standard accounts, traders encounter floating spreads starting from 1 pip. This variable spread is a common feature in forex trading, offering flexibility in response to market conditions. On the other hand, the VIP account benefits from even lower spreads, beginning at just 0.4 pips, appealing to more experienced traders seeking tighter cost control.

The Fix Account offers fixed spreads, also starting from 1 pip. This fixed spread provides predictability in trading costs, which can be advantageous for certain trading strategies. In contrast, the Zero account is unique with its 0 pip spread for major pairs like EUR/USD and USD/JPY. However, it compensates by charging a $5 commission per lot.

For all other account types at TNFX, the commission per lot and any additional fees are conveniently included within the spread. This inclusive approach simplifies the fee structure, making it easier for traders to understand and calculate their potential trading costs.

Deposit and Withdrawal

A trading professional at Dumb Little Man conducted tests to assess the deposit and withdrawal processes of TNFX. According to these findings, only verified users who have successfully passed the Know Your Customer (KYC) procedures are eligible to withdraw funds. This verification process ensures security and compliance with financial regulations.

For withdrawals, TNFX offers multiple options. Users can transfer their funds to a bank account, credit card, electronic wallet, or cryptocurrency wallet. This variety caters to the diverse preferences and needs of traders. The minimum withdrawal amount is set at $50 for all methods, which is a standard threshold in the industry.

In terms of processing time, once a withdrawal request is approved, the funds are typically credited to the designated account or card within 24 hours. This prompt processing demonstrates TNFX's efficiency in handling transactions. It's also important to note that withdrawals are processed in USD, making it a crucial point for traders to consider, especially those dealing in other currencies.

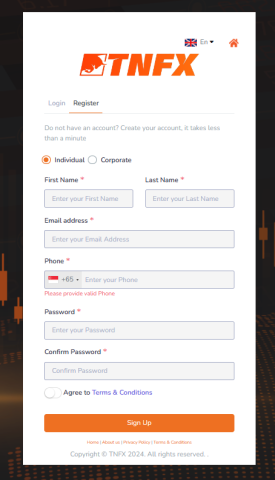

How to Open a TNFX Account

- Visit TNFX‘s homepage and click on ‘Open Live Account'.

- Choose ‘Individual account' on the registration form and input your personal details including first name, last name, email, and phone number.

- Set a password, agree to the Terms and Conditions, and solve the CAPTCHA.

- Verify your phone number by typing in the One-Time Password received.

- Enter the OTP sent to your email for email verification.

- Alternatively, use the verification link in the TNFX email.

- Log into your user account with your email and password.

- Follow these steps to finalize your TNFX trading account setup.

- Ensure all information provided is accurate and up to date.

TNFX Affiliate Program

TNFX offers a diverse Affiliate Program designed to cater to different types of partners and their unique needs in the Forex market.

- Introducing Brokers (IB): This program is tailored for qualified entities and companies aiming to represent TNFX in their respective countries. As an IB, the reward ranges from $5 to $10 per standard lot traded by clients they refer.

- White Label & Liquidity Provider: Ideal for institutional clients who wish to offer brokerage services under their own brand. This program allows them to leverage TNFX technologies while operating independently.

- PAMM Manager: A solution specifically for experienced traders who are interested in managing investor funds. They can do this through PAMM accounts, a popular tool for pooled money forex trading.

These programs underscore TNFX's commitment to providing flexible partnership options, catering to a wide range of affiliates from individual brokers to large institutional clients.

TNFX Customer Support

TNFX‘s Customer Support system, as experienced by Dumb Little Man, is noteworthy for its accessibility and efficiency. The support is available through multiple channels, catering to different needs and preferences of traders.

The Live Chat feature stands out for offering instant assistance. It's particularly beneficial for real-time problem-solving and handling quick queries. This immediacy makes it a popular choice for traders needing fast responses.

For issues requiring more in-depth discussion or urgent attention, phoning their support team proves to be highly effective. The team is known for being both responsive and knowledgeable, ensuring that clients receive comprehensive assistance. Additionally, traders have the option to send requests via email, which is ideal for situations that are less time-sensitive or require detailed documentation.

Furthermore, traders with an active TNFX account benefit from the added convenience of raising support tickets directly from their user profile. This integrated feature simplifies the process of seeking help, ensuring that issues are systematically tracked and resolved, thereby enhancing the overall customer support experience.

Advantages and Disadvantages of TNFX Customer Support

| Advantages | Disadvantages |

|---|---|

TNFX vs Other Brokers

#1. TNFX vs AvaTrade

TNFX, established in 2019, is a relatively new player compared to AvaTrade, which has been in the market since 2006. AvaTrade boasts a larger global presence with over 300,000 customers and offers a wider range of financial instruments. AvaTrade's heavy regulation and multiple locations, including Ireland and Japan, provide a robust trading environment. In contrast, TNFX offers high leverage and a variety of account types but has a more limited global reach and regulatory oversight.

Verdict: AvaTrade is better for traders seeking a well-established, globally recognized broker with a broader range of instruments and stronger regulatory backing. TNFX may appeal to those seeking higher leverage and diverse account options but lacks AvaTrade's extensive global presence and track record.

#2. TNFX vs RoboForex

RoboForex, operating since 2009, stands out with its extensive trading options (over 12,000) and a wide selection of trading platforms including MetaTrader, cTrader, and RTrader. Its emphasis on cutting-edge technology and personalized trading terms cater to a wide array of traders. TNFX, while offering high leverage and a range of account types, doesn't match RoboForex's diversity in trading options and platform selection.

Verdict: RoboForex is better for those who value a wide range of trading options and platform choices. TNFX, although offering competitive leverage and account diversity, falls short in matching RoboForex's comprehensive offerings and technological edge.

#3. TNFX vs FXChoice

FXChoice, established in 2010, is known for its commitment to business integrity and customer focus, offering both classic and professional ECN accounts. FXChoice's trading conditions are tailored for experienced traders, with no cent accounts or zero spreads, and a limited validity demo account. In contrast, TNFX provides a range of account types, including cent accounts, and seems more accessible to a wider range of traders, including beginners.

Verdict: FXChoice is better for experienced traders looking for a broker with a strong focus on business integrity and professional trading conditions. TNFX, with its broader range of account types, including those suitable for beginners, might be a better fit for new or diverse trading styles.

Choose Asia Forex Mentor for Your Forex Trading Success

If you're committed to building a successful career in forex trading and aim for significant financial gains, Asia Forex Mentor is your go-to for the top forex, stock, and crypto trading course. Led by Ezekiel Chew, a renowned figure in the trading world, Asia Forex Mentor is backed by his expertise and successful track record, including his own seven-figure trades. Here's why we highly recommend them:

Comprehensive Curriculum: Offering a thorough program in stock, crypto, and forex trading, Asia Forex Mentor prepares you with essential skills and knowledge for these markets.

Proven Track Record: Their record of creating consistently profitable traders across different markets stands as proof of their effective training and mentorship.

Expert Mentor: Under Ezekiel's mentorship, you get firsthand insights from a seasoned trader in stock, crypto, and forex markets, helping you navigate these fields with greater confidence.

Supportive Community: Join a network of traders who are on the same journey in stock, crypto, and forex markets, fostering collaboration and shared learning.

Emphasis on Discipline and Psychology: Recognizing the importance of mindset in trading, Asia Forex Mentor focuses on psychological training to help manage emotions and stress for rational decision-making.

Constant Updates and Resources: Stay informed with the latest market trends and strategies, as Asia Forex Mentor provides ongoing access to key resources.

Success Stories: Celebrate numerous success stories where students have drastically improved their trading careers and achieved financial independence through their comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor is the ideal choice for anyone seeking a top-notch course in forex, stock, and crypto trading. Its all-around approach, combining a comprehensive curriculum, experienced mentorship, and a supportive community, equips aspiring traders to become successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Conclusion: TNFX Review

In conclusion, the TNFX review conducted by the team of trading experts at Dumb Little Man presents a comprehensive view of this broker. TNFX offers a range of benefits, such as a wide selection of currency pairs, various account types, including cent and demo accounts, and competitive spreads. Additionally, its high leverage and efficient customer support make it an attractive choice for traders.

However, it's important to approach TNFX with awareness of its limitations. The broker's limited interaction with traders on social media, restricted support hours, and absence from compensation funds are notable drawbacks. These factors might affect traders looking for more engagement and comprehensive support.

>> Also Read: Hankotrade Review with Rankings 2024 By Dumb Little Man

TNFX Review FAQs

What is the minimum deposit required to start trading with TNFX?

The minimum deposit to open a trading account with TNFX is $100. This amount is consistent across various account types and is designed to be accessible for a wide range of traders.

Does TNFX offer any educational resources for beginners?

TNFX provides educational resources for traders at different levels, including beginners. These resources are aimed at enhancing trading knowledge and skills. However, the depth and extent of these resources should be evaluated by each trader based on their individual learning needs.

How reliable is TNFX's customer support?

TNFX's customer support is noted for being efficient and accessible, with multiple channels like live chat, phone, and email. The support team is responsive and knowledgeable, offering assistance during business hours on weekdays. However, it's important to note the absence of 24/7 support and limited language options.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.