Hankotrade Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 103rd  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and private investors, employs a specialized algorithm for thorough evaluations of brokerage services. Their analysis focuses on key areas such as:

|

Hankotrade Review

Forex brokers play a crucial role in the world of currency trading, acting as intermediaries between traders and the global financial markets. Hankotrade, a notable player in this arena, is an STP (straight-through processing) broker. They cater to both retail and professional traders, offering a range of trading options including contracts for differences (CFDs) on currencies, metals, and cryptocurrencies.

This review delves deep into Hankotrade, shedding light on what sets it apart and any potential challenges it may present. Our aim is to offer an exhaustive evaluation, covering the broker’s diverse account options, its deposit and withdrawal mechanisms, commission structures, and other essential aspects. Combining expert analysis with real trader experiences, we provide a balanced view that will help you decide if Hankotrade aligns with your trading needs.

What is Hankotrade?

Hankotrade stands out in the Forex market as an ECN (Electronic Communication Network) broker. This distinction highlights their commitment to offering traders exceptional trading conditions, such as tight spreads and no commission fees, coupled with some of the industry's most competitive commissions.

As an ECN Forex broker, Hankotrade’s main function is to efficiently route client orders straight to liquidity providers. This process ensures swift execution of trades, making it a key feature for traders seeking quick and reliable market access. The company’s focus on providing direct market access aligns with its goal of fostering a transparent and efficient trading environment.

Safety and Security of Hankotrade

Safety and security are paramount in Forex trading. Hankotrade, despite operating outside the purview of regulatory bodies, implements several measures to ensure the security of its clients. This information is based on thorough research by Dumb Little Man.

One key aspect of Hankotrade’s security measures is the segregation of traders' funds from the broker's own capital. This separation provides an added layer of safety, ensuring that traders’ investments are not used for any other purpose. Additionally, Hankotrade has an automated negative balance protection feature, safeguarding traders from losing more than their account balance.

Hankotrade also adheres to AML (Anti-Money Laundering) principles, demonstrating their commitment to legal and ethical trading practices. This compliance helps in preventing financial crimes. Furthermore, the broker is transparent about its practice of gathering personal information, which is a standard procedure in the industry to maintain security and client identification.

Pros and Cons of Hankotrade

Pros

- MetaTrader 4 (MT4) and MT5 access

- Desktop, mobile, and web platforms

- Bonuses available

- PAMM/MAM passive investment

- Asset-based flexible spreads

- Strategy testing demo accounts

Cons

- Unregulated broker

- Mandatory verification

- Few withdrawal methods

Sign-Up Bonus of Hankotrade

Hankotrade‘s Sign-Up Bonus offers a significant opportunity for clients to increase their account margins. By opting for this bonus, clients can boost their trading funds. The process is simple: with a minimum deposit of $100, Hankotrade matches the deposit amount, crediting it directly to the client's trading account.

This offer is designed to enhance the trading experience by providing additional leverage. It's important to note that while the matching bonus itself cannot be lost, it serves as an additional margin for trading activities. Such a feature can be particularly advantageous for traders looking to expand their market positions with Hankotrade.

Minimum Deposit of Hankotrade

Hankotrade has set a remarkably low minimum deposit requirement, making it accessible for a wide range of traders. With just $10, individuals can start trading, opening the door to the Forex market for both new and experienced traders. This low barrier to entry is a significant aspect of Hankotrade's commitment to inclusivity in the trading world.

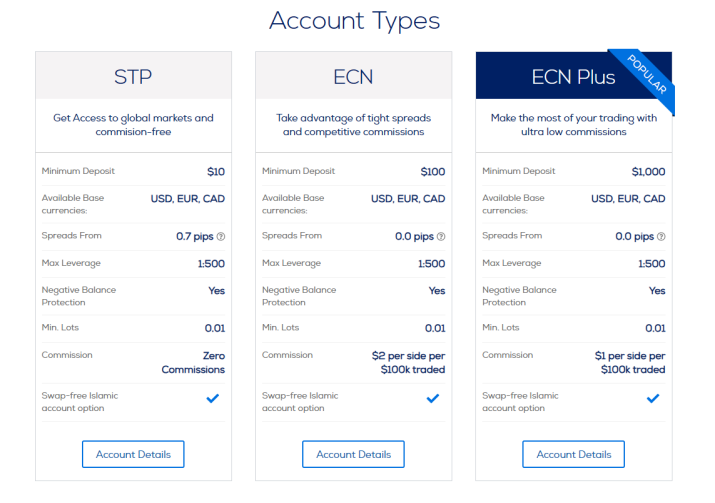

Hankotrade Account Types

Based on thorough research and testing by our team of experts at Dumb Little Man, Hankotrade offers three distinct account types, each tailored to different trading preferences and requirements:

STP Account

- Minimum Deposit: $10

- Account Currencies: USD, EUR, CAD

- Minimum Spread: 0.7 pips

- Maximum Leverage: 1:500

- Negative Balance Protection: Available

- Minimum Order: 0.01 lots

- Additional Trading Fees: None

ECN Account

- Minimum Deposit: $100

- Basic Currencies: USD, EUR, CAD

- Spread: From 0 pips

- Maximum Leverage: 1:500

- Negative Balance Protection: Yes

- Fee: $2 per $100,000 turnover in each direction

ECN Plus Account

- Minimum Deposit: $1,000

- Main Account Currencies: USD, EUR, CAD

- Spread: From 0 points

- Maximum Leverage: 1:500

- Negative Balance Protection: Yes

- Fee: $1 per $100,000 turnover in each direction

Each account type offers unique features, providing flexibility and options for traders at different levels of experience and investment capacity.

Hankotrade Customer Reviews

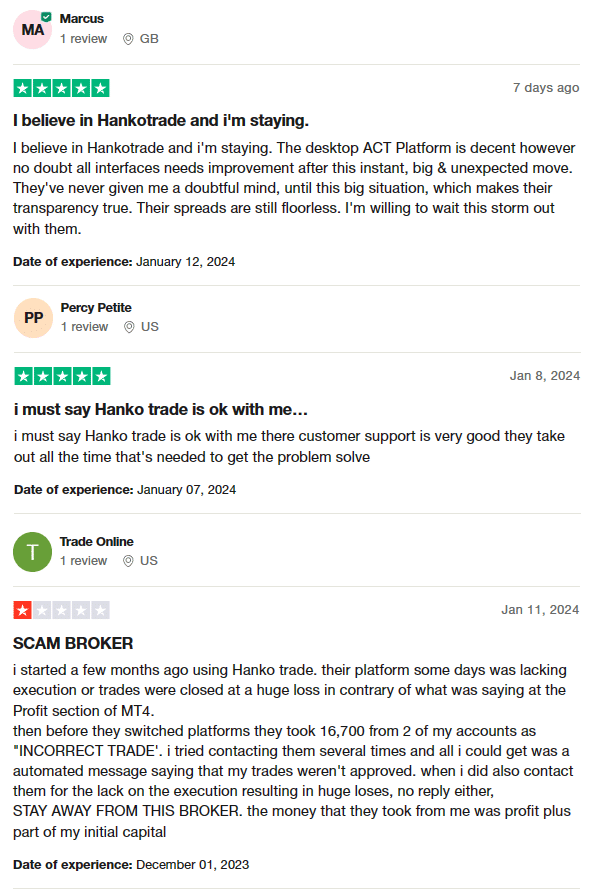

Customer reviews on Hankotrade reveal mixed experiences. Some traders express strong trust and satisfaction, particularly praising the broker’s customer support and the ACT Platform. They appreciate the transparency of Hankotrade, even during challenging times, and are impressed by its consistent spreads. These clients are willing to continue their trading journey with Hankotrade, highlighting successful withdrawals and the possibility of adding more funds.

On the other hand, there are reports of negative experiences, especially concerning platform performance and trade execution. Some traders have faced significant losses due to execution issues or trades closing at a loss contrary to their expected profits. Concerns also arise from instances where funds were removed from accounts for “incorrect trade” reasons, with customers receiving only automated responses and lacking proper support in resolving these issues. These contrasting reviews suggest that while Hankotrade has aspects that some traders find reliable, others have encountered significant challenges that lead them to advise caution.

Hankotrade Fees, Spreads, and Commissions

Hankotrade adopts a straightforward approach to fees, spreads, and commissions. The broker is notable for not imposing non-trading fees, making it a cost-effective choice for many traders.

In terms of spreads, Hankotrade offers variable spreads that depend on the type of assets being traded. Specifically, for STP accounts, the spreads are tied to the asset in question. For those opting for ECN and ECN Plus accounts, the possibility of zero spreads exists, subject to market conditions. However, these accounts do incur a fee per lot traded. The fee structure is $2 for ECN accounts and $1 for ECN Plus accounts.

Moreover, Hankotrade implements swap accounts and swap fees. These fees are a consideration for traders holding positions overnight, adding an additional dimension to the cost structure of trading with Hankotrade. The swap fees vary depending on the specific financial instrument and market conditions.

Deposit and Withdrawal

Based on an in-depth analysis by a trading professional at Dumb Little Man, Hankotrade‘s deposit and withdrawal processes present unique features and requirements.

For withdrawals, Hankotrade has set a minimum amount of $50. The brokerage company is efficient, in processing withdrawal requests within 24 hours. However, traders need to be aware that a withdrawal request might be rejected if not confirmed within 48 hours. Additionally, withdrawals can be declined if the account has insufficient margin or if the wallet details are incorrect.

Regarding deposits, Hankotrade allows traders to make a deposit without going through verification. However, for withdrawals exceeding $5,000, the company reserves the right to request proof of identity. It’s also important to note that Hankotrade may refuse to compensate the transfer fee if there has been no activity on the trading account.

A significant point to consider is that Hankotrade only permits the withdrawal of funds in cryptocurrencies. This specificity in the withdrawal method aligns with the evolving digital finance landscape but also requires traders to be comfortable and familiar with cryptocurrency transactions.

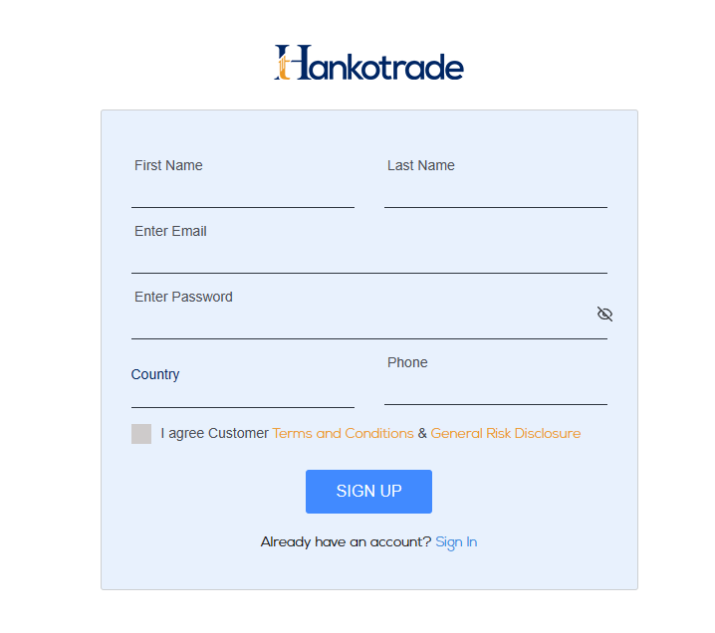

How to Open a Hankotrade Account

- Visit the Hankotrade website.

- Click “Register Live Account”.

- Complete the registration form.

- Receive a confirmation code via email.

- Use the code to confirm your account.

- Access the opened user account automatically.

- Click “Add Live Account” within your user account.

- Choose your preferred trading account and platform from the menu.

- Set your desired leverage.

Hankotrade Affiliate Program

Hankotrade’s Affiliate Program offers a lucrative opportunity for both individuals and companies to earn by introducing new clients to their platform. As an Introducing Broker with Hankotrade, you can profit from the trading activities of clients you refer. This opportunity is not limited to companies and individuals alone; any trading activity generated from your recommendations can lead to bonus profits.

Hankotrade stands out with its high commission rates for affiliates, offering a 40% share of the total commission charged to the clients you introduce. This rate is notably competitive compared to many other forex trading firms. Moreover, affiliates have the chance to earn additional income by referring other affiliates. For more details on this aspect of the program, Hankotrade encourages potential affiliates to reach out to their staff.

The appeal of becoming an introducing broker with Hankotrade is enhanced by the company’s advanced funding options and a comprehensive collection of trading tools. These features make it easier for affiliates to attract new traders, thereby maximizing their potential earnings through the affiliate program.

Hankotrade Customer Support

Hankotrade's Customer Support is accessible through various channels, ensuring clients have multiple ways to seek assistance. This information is based on the experience of Dumb Little Man with their customer support.

Clients can instantly reach out to Hankotrade representatives via the live chat feature on the website, providing a quick and convenient way to resolve queries. Alternatively, writing an email is another effective method for those who prefer more detailed communication.

For account-specific issues, clients can use the “Account Operation” section within their user account. This option allows for a focused approach to account-related queries. Additionally, creating a support ticket directly in the user account is another structured way to get assistance, particularly for more complex or technical issues. These diverse support options underscore Hankotrade's commitment to responsive and comprehensive customer service.

Advantages and Disadvantages of Hankotrade Customer Support

| Advantages | Disadvantages |

|---|---|

Hankotrade vs Other Brokers

#1. Hankotrade vs AvaTrade

Hankotrade, recognized for its low minimum deposits and cryptocurrency withdrawal options, offers a distinct approach to Forex trading. In contrast, AvaTrade, established in 2006, caters to a broad clientele with its extensive range of financial instruments. It's heavily regulated and has a significant global presence, though it does not serve US traders. While Hankotrade is known for its accessibility and cryptocurrency features, AvaTrade stands out for its regulatory compliance and diverse offerings.

Verdict: AvaTrade is better for traders seeking a regulated, globally recognized broker with a broader range of instruments, whereas Hankotrade suits those who prefer cryptocurrency transactions and lower entry requirements.

#2. Hankotrade vs RoboForex

Hankotrade offers ECN and STP accounts and primarily focuses on cryptocurrency withdrawals. RoboForex, operational since 2009, prides itself on a vast selection of trading platforms and services suitable for different trading styles and volumes. While Hankotrade offers a straightforward trading approach with its ECN/STP accounts, RoboForex provides a more diverse platform experience and is known for its customized trading conditions.

Verdict: RoboForex is better for traders seeking diverse platform choices and tailored trading terms, while Hankotrade caters more to those interested in ECN/STP trading and crypto transactions.

#3. Hankotrade vs FXChoice

Hankotrade is known for its simple account types and cryptocurrency withdrawal facilities, catering to a range of traders. On the other hand, FXChoice, established in 2010, targets professional traders with its tight market spreads and specialized trading services. FXChoice‘s focus on experienced traders is evident in its trading conditions and offerings. In comparison, Hankotrade maintains a more straightforward and accessible approach.

Verdict: FXChoice is preferable for experienced traders due to its professional focus and tight spreads, while Hankotrade appeals more to those looking for simplicity and crypto withdrawal options

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're aiming to establish a rewarding career in forex trading and are driven to realize significant financial returns, Asia Forex Mentor is your go-to for top-notch forex, stock, and crypto trading courses. The foundation of Asia Forex Mentor is the expertise of Ezekiel Chew, a distinguished figure behind the training of trading institutions and banks. Ezekiel himself consistently secures seven-figure trades, distinguishing him as a truly exceptional educator. Here's why we highly recommend Asia Forex Mentor:

Comprehensive Curriculum: Asia Forex Mentor's thorough educational program spans stock, crypto, and forex trading. This curriculum is designed to arm budding traders with essential knowledge and skills for success in these varied markets.

Proven Track Record: The efficacy of Asia Forex Mentor is evident in its history of producing consistently profitable traders in different market segments. This record underscores the value of their educational approach and mentorship.

Expert Mentor: Students at Asia Forex Mentor gain insights from Ezekiel Chew, a seasoned mentor with a proven track record in stock, crypto, and forex trading. His personalized mentorship boosts students' confidence in tackling market challenges.

Supportive Community: Enrolling in Asia Forex Mentor means joining a collaborative community of traders focused on stock, crypto, and forex markets. This network enhances learning through mutual support, idea exchange, and peer-to-peer education.

Emphasis on Discipline and Psychology: Trading success hinges on mental fortitude and discipline. Asia Forex Mentor emphasizes psychological training to help traders control emotions, manage stress, and make well-reasoned trading decisions.

Constant Updates and Resources: With ever-changing financial markets, Asia Forex Mentor keeps students informed of the latest trends, strategies, and insights. Ongoing access to these resources ensures traders stay competitive.

Success Stories: Asia Forex Mentor boasts numerous success stories, with students achieving financial autonomy through its comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands as the foremost option for those seeking the best in forex, stock, and crypto trading education. Its all-encompassing curriculum, seasoned mentors, practical approach, and nurturing community equip aspiring traders with the tools and guidance needed to evolve into successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Scandinavian Capital Markets Review with Rankings 2024 By Dumb Little Man

Conclusion: Hankotrade Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of Hankotrade, highlighting both its strengths and areas of concern. Hankotrade stands out for its low minimum deposit requirements, making it an accessible option for a wide range of traders. The availability of MetaTrader 4 and MetaTrader 5 platforms, along with cryptocurrency withdrawal options, enhances its appeal to modern traders.

However, potential users should be aware of certain drawbacks. The lack of regulatory oversight can be a significant concern for those prioritizing security and stability in their trading endeavors. Additionally, the limited withdrawal methods, mainly focused on cryptocurrencies, may not suit all traders.

Hankotrade Review FAQs

Is Hankotrade a regulated broker?

Hankotrade operates without the oversight of regulatory bodies. This absence of regulation is an important consideration for traders who prioritize security and regulatory protection in their trading activities. While the broker offers various attractive features, the lack of regulatory oversight remains a key factor to consider.

What are the deposit and withdrawal options at Hankotrade?

Hankotrade allows deposits and withdrawals primarily in cryptocurrencies. The minimum deposit is remarkably low, making it accessible for many traders. However, the focus on cryptocurrency for withdrawals may not be suitable for all traders, especially those who prefer traditional banking methods.

What types of trading accounts does Hankotrade offer?

Hankotrade provides different account types to suit various trading needs, including STP, ECN, and ECN Plus accounts. These accounts differ in terms of minimum deposit requirements, spreads, leverage, and commission structures. This variety allows traders to choose an account that best fits their trading style and financial goals.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.