SuperForex Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved.

|

SuperForex Review

SuperForex is a well-established global broker that has been serving clients worldwide since 2013. Regulated by the International Financial Services Commission (IFSC), the company offers a comprehensive range of trading and investment services to both individual and corporate clients in over 150 countries.

One of the key strengths of SuperForex is its extensive selection of financial instruments. Clients have the opportunity to trade and invest in a diverse range of assets, including currencies, commodities, indices, cryptocurrencies, and more. This wide variety of options allows traders to diversify their portfolios and explore different market opportunities.

The company takes pride in its highly professional team, which is dedicated to the continuous development and improvement of SuperForex’s products and services. This commitment to excellence is reflected in the broker’s user-friendly trading platforms, educational resources, and customer support. Traders can access a range of trading platforms, including MetaTrader 4 and 5, which are renowned for their advanced features and reliability.

In this in-depth review of SuperForex, we aim to provide a detailed evaluation of the company, highlighting its strengths and weaknesses. Our objective is to furnish you with comprehensive information about this broker, covering various aspects such as account options, deposit and withdrawal procedures, commission structures, and more. By presenting a well-rounded perspective that incorporates expert analysis and real trader experiences, our aim is to empower you with the knowledge necessary to make an informed decision about investing with SuperForex.

What is SuperForex?

SuperForex is a renowned and globally recognized broker that has been operating since 2013. With a presence in over 150 countries, the company has established itself as a reliable and accessible platform for traders and investors around the world.

One of the key features of SuperForex is its wide range of financial instruments available for trading. Clients have the opportunity to engage in trading activities across various markets, including the foreign exchange market (Forex), commodities, indices, cryptocurrencies, and more. This extensive selection allows traders to diversify their portfolios and explore different investment opportunities based on their preferences and strategies.

Regulation is an important aspect when choosing a broker, and SuperForex is regulated by the International Financial Services Commission (IFSC). This regulatory oversight ensures that the broker operates in compliance with established standards, providing a level of security and transparency for clients.

Furthermore, SuperForex caters to the diverse needs of its clients by offering different types of trading accounts. From beginner-friendly accounts with low minimum deposit requirements to accounts designed for professional traders with specific needs, there are options available to suit individual preferences and trading strategies.

Safety and Security of SuperForex

SuperForex prioritizes the safety and security of its clients’ funds and personal information. As an online Forex and CFD broker, SuperForex operates under the regulation of the International Financial Services Commission (IFSC) in Belize. This regulatory oversight ensures that the company adheres to established standards and practices, providing a level of trust and accountability.

To safeguard clients’ funds, SuperForex implements a segregated funds policy. This means that client funds are kept separate from the company’s own funds. By storing client funds in separate accounts, SuperForex ensures that they are not used for the broker’s operational activities. This segregation provides an added layer of protection, as clients’ funds remain unaffected even in the unlikely event of any financial difficulties faced by SuperForex. In such cases, clients would still have full access to their funds and be able to withdraw them without any issues.

In terms of data protection, SuperForex employs Secure Sockets Layer (SSL) encryption technology. SSL is a protocol that enables secure communication between clients’ devices and the SuperForex website. By establishing a trusted connection, SSL ensures that sensitive data entered by clients, such as personal information and financial details, are encrypted and protected from unauthorized access. This encryption safeguards clients’ data and helps prevent any potential tampering or fraudulent activities.

SuperForex emphasizes the importance of client verification to ensure maximum account protection. The comprehensive verification process includes email verification, ID scanning for data verification, address verification, and phone number verification. By combining these methods, SuperForex ensures that clients’ accounts are fully protected and secure. This multi-layered verification process helps to prevent unauthorized access to client accounts and adds an extra level of security to the trading experience.

Sign-Up Bonus of SuperForex

SuperForex provides an enticing sign-up bonus in the form of a welcome offer. New clients have the opportunity to take advantage of a +50% bonus program upon signing up with the broker. This means that when making their initial deposit, clients will receive an additional 50% of the deposited amount as a bonus.

To be eligible for the sign-up bonus, clients must make a minimum deposit of just $1 USD. This low minimum deposit requirement makes the bonus accessible to traders with varying budget sizes, accommodating both experienced traders and those who are new to the world of Forex and CFD trading.

The +50% bonus program offered by SuperForex allows clients to boost their trading capital significantly. For example, if a client makes a deposit of $100 USD, they will receive an additional $50 USD as a bonus, bringing their total trading capital to $150 USD. This additional bonus amount can be utilized for trading activities, potentially enhancing trading opportunities and strategies.

Minimum Deposit of SuperForex

At SuperForex, the minimum deposit requirement is set at a remarkably low amount of $1, or its equivalent in other currencies. This low barrier to entry makes it highly accessible for traders with various budget sizes to open an account and start trading.

With a minimum deposit of $1, clients can enjoy the benefits of trading with SuperForex, including access to a wide range of financial instruments and trading opportunities. Whether clients are beginners who want to test the waters of the financial markets or experienced traders looking for a broker with flexible deposit options, SuperForex caters to their needs.

In addition to the low minimum deposit requirement, SuperForex offers leverage of up to 1:1000 for trading. Leverage allows traders to amplify their trading positions and potentially increase their potential profits. However, it’s important to note that leverage also magnifies the risk, as losses can be multiplied. Therefore, clients should carefully consider their risk tolerance and use leverage responsibly.

The minimum deposit account type at SuperForex is compatible with all the bonuses offered by the broker. This means that clients who choose to open an account with the minimum deposit are still eligible to receive and benefit from the various bonuses provided by SuperForex. These bonuses can include the sign-up bonus, deposit bonuses, or other promotional offers that enhance trading capital and provide additional incentives for clients.

SuperForex Account Types

SuperForex offers a variety of account types to cater to the diverse needs and preferences of traders. Each account type is designed to provide specific features and benefits, ensuring that traders can find an account that suits their trading style and objectives. Here are the details of the different SuperForex account types:

Standard Account

The Standard Account is suitable for beginners in the Forex market. It offers flexible trading conditions and a low minimum deposit requirement of $1. Traders can choose their preferred leverage between 1:1 and 1:1000. Standard Account holders also have access to attractive bonuses provided by SuperForex. This account type follows market standards with swaps and fixed spreads.

Swap-Free Account

The Swap-Free Account is designed for traders who wish to avoid swaps, making it ideal for religious reasons or for those looking to avoid interest rates. With this account, traders can eliminate swaps and associated fees. The account can be tailored to suit individual needs and is suitable for long-term trading strategies.

No Spread Account

The No Spread Account offers the possibility to trade without paying any spreads when opening new deals. Instead, traders pay fixed commission fees. This account type is valid for all trading instruments offered by SuperForex. Traders can enjoy no spreads on their trades and benefit from up to 25% lower commission rates. The transparent commission fees can be calculated in advance, making it suitable for both new and existing customers.

Micro Cent Account

The Micro Cent Account is designed for traders who prefer to work with small investments. It allows traders to start trading with as little as $1 and eliminates concerns about volume or free margin requirements. This account type is particularly suitable for those who want to trade with minimum risk and provides a perfect learning environment for beginners.

Profi STP Account

The Profi STP Account is tailored for traders with larger deposits and a desire to engage in high-stakes trading with large volumes. This account type offers unparalleled access to liquidity and enables trading with high volumes. Traders can benefit from specialized customer service, take advantage of up to 1:3000 leverage, and enjoy low-margin requirements to maximize their trading potential.

Crypto Account

The Crypto Account is specifically designed for traders interested in Forex trading with cryptocurrencies. It provides access to popular cryptocurrencies and allows traders to execute trades using the well-known MetaTrader 4 platform. This account type is suitable for any trading strategy and can be used with expert advisors (EAs) and other trading software.

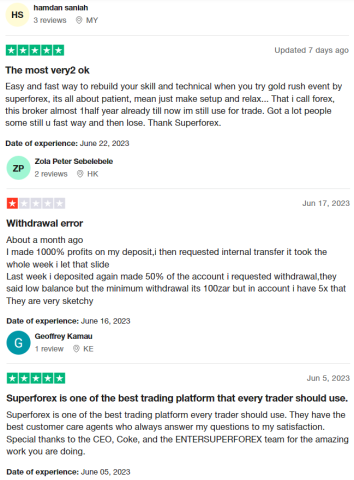

SuperForex Customer Reviews

Based on the customer reviews, it can be observed that SuperForex receives mixed feedback from its users. One review highlights the positive experience of participating in the gold rush event and the ease of rebuilding trading skills. The reviewer also expresses satisfaction with using SuperForex for trading.

On the other hand, there is a negative review mentioning a delay in internal transfer and a withdrawal issue. The user feels that the broker’s actions are questionable and expresses concerns about their transparency.

There is also a positive review praising SuperForex as one of the best trading platforms, particularly highlighting the excellent customer care and expressing gratitude towards the CEO and the team.

Overall, the customer reviews indicate a range of experiences with SuperForex. While some users have positive experiences and appreciate the platform’s features and customer support, others have encountered issues or expressed concerns about certain aspects of the broker’s services.

SuperForex Spreads, Fees, and Commissions

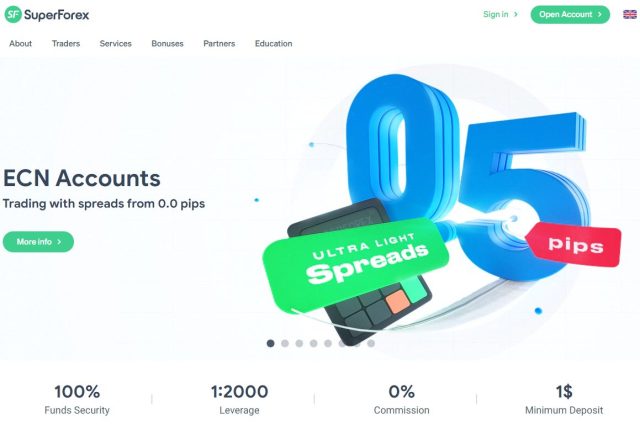

SuperForex offers competitive trading conditions with regard to spreads, fees, commissions, leverage, and stop-out levels. Here’s an expanded explanation of each aspect:

Spreads

SuperForex provides tight spreads on various financial instruments. The spreads start from 0 pips, which means traders can benefit from highly competitive pricing. Lower spreads allow for more cost-effective trading, enabling traders to potentially maximize their profits.

Fees

Trading with SuperForex involves fees that start from as low as $0.2 USD. The specific fee amount may vary depending on the trading instrument and account type chosen by the trader. It’s important for traders to review the fee structure to have a clear understanding of the costs associated with their trades.

Commissions

SuperForex offers commission-free trading on certain account types. This means that traders can execute trades without incurring additional commission charges. However, it’s worth noting that certain account types, such as the No Spread Account, may have fixed commission fees instead of spreads. Traders should carefully review the commission structure associated with their chosen account type to have a comprehensive understanding of the costs involved.

Leverage

SuperForex provides leverage options of up to 1:2000. Leverage allows traders to amplify their trading positions and potentially increase their trading opportunities. However, it’s important to note that while leverage can magnify profits, it also amplifies the risk of losses. Traders should exercise caution and use leverage responsibly, considering their risk tolerance and implementing appropriate risk management strategies.

Stop Out

The stop-out level at SuperForex is set between 30% and 40%. The stop-out level refers to the margin level at which a trader’s positions may be automatically closed to prevent further losses. If a trader’s account equity falls below the specified stop-out level, the broker will close open positions to protect the trader from further losses. It is important for traders to monitor their margin levels and ensure they have sufficient funds in their accounts to avoid reaching the stop-out level.

Deposit and Withdrawal

SuperForex understands the importance of providing convenient and efficient deposit and withdrawal options for its clients. Traders can choose from a wide range of deposit methods to fund their trading accounts. Here are the various deposit options available:

Bank Wire Transfer

Traders can initiate a bank wire transfer to deposit funds into their SuperForex trading account. This method allows for secure and direct transfer of funds from the trader’s bank account to their trading account.

Credit/Debit Cards

SuperForex accepts major credit and debit cards, including Visa and Mastercard, for quick and convenient deposits. By using a credit/debit card, traders can fund their accounts instantly and start trading without any delays.

Electronic Payments

SuperForex supports popular electronic payment systems such as Skrill, Neteller, and Perfect Money. These payment methods offer fast and secure transactions, allowing traders to deposit funds into their trading accounts with ease.

Cryptocurrencies

SuperForex recognizes the growing popularity of cryptocurrencies and allows traders to deposit funds using digital currencies such as Bitcoin, Ethereum, and Litecoin. This option provides an additional layer of security and anonymity for those who prefer using cryptocurrencies for their transactions.

Local Payment Options

SuperForex provides local payment options tailored to specific regions, making it more convenient for traders from different countries to deposit funds. These options may include local bank transfers or payment systems that are popular in specific regions.

SuperForex Money

SuperForex has its own payment system called SuperForex Money. Traders can use this system to deposit funds directly into their trading accounts, providing a seamless and efficient deposit method.

When it comes to withdrawals, SuperForex aims to process them in a timely manner. The withdrawal time frame can vary depending on the chosen withdrawal method. In some cases, withdrawals may be processed instantly, allowing traders to access their funds promptly. However, in certain circumstances, such as bank wire transfers, the withdrawal process may take up to 4 business days to complete.

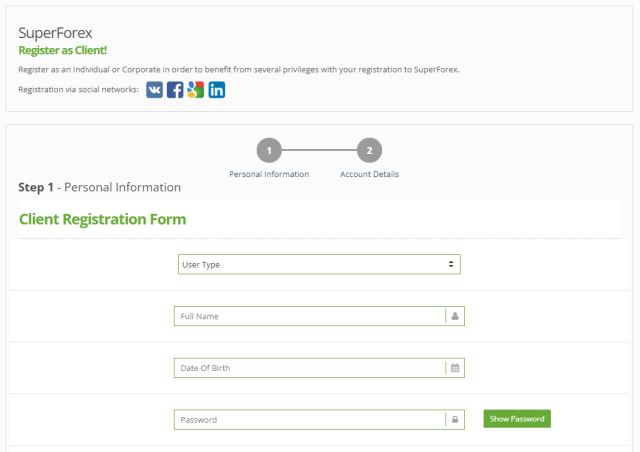

How to Open a SuperForex Account

To open a SuperForex trading account:

- Visit the SuperForex website.

- Click on “Open Account” or “Register.”

- Choose the account type that suits your needs.

- Fill in the registration form with accurate information.

- Read and agree to the terms and conditions.

- Complete the verification process (email, ID, address, phone number).

- Fund your account using the available deposit methods.

- Download and install the SuperForex trading platform.

- Log in to your account and start trading.

SuperForex Affiliate Program

The SuperForex Affiliate Program is a partnership opportunity that allows individuals and businesses to earn commission by referring clients to SuperForex.

Registration

To participate in the Affiliate Program, individuals need to register as an affiliate through the SuperForex website. The registration process is typically straightforward and requires providing basic information.

Referral Link and Marketing Tools

Upon registration, affiliates receive a unique referral link. This link is used to track the clients referred by the affiliate. Additionally, SuperForex provides various marketing tools such as banners, landing pages, and promotional materials to assist affiliates in their promotional efforts.

Commission Structure

The SuperForex Affiliate Program offers competitive commission rates. Affiliates can earn commissions based on the trading activity of the referred clients. The commission structure may vary and can be based on factors such as the trading volume, the number of referred clients, or the revenue generated by the clients.

Real-Time Statistics and Reporting

SuperForex provides affiliates with access to real-time statistics and reporting tools. Affiliates can monitor their referral activity, track their commissions, and analyze the effectiveness of their marketing campaigns.

Flexible Payout Options

SuperForex provides various options for withdrawing affiliate commissions. Affiliates can choose from a range of payout methods, such as bank wire transfers, electronic payment systems, or cryptocurrencies, depending on their preferences and location.

The SuperForex Affiliate Program provides a mutually beneficial partnership opportunity, allowing individuals and businesses to monetize their network and earn commission by referring clients to SuperForex. Affiliates benefit from competitive commission rates, marketing tools, real-time tracking, support, and flexible payout options. SuperForex gains exposure and acquires new clients through the efforts of its affiliates.

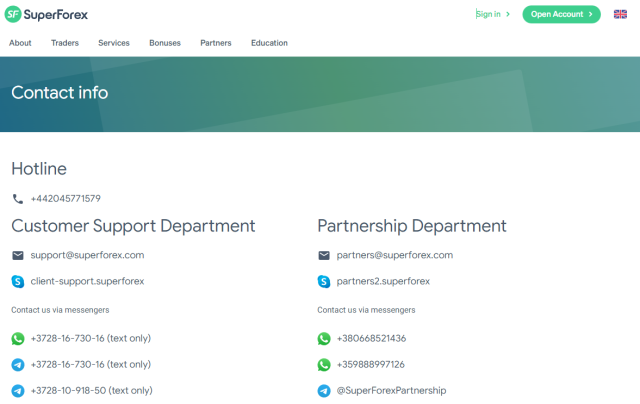

SuperForex Customer Support

SuperForex takes customer support seriously and offers various channels for clients to reach out and receive assistance.

Contact Methods

SuperForex provides multiple contact methods for clients to reach their support team. These include phone calls, emails, Skype, WhatsApp, and Telegram. The specific contact details and addresses can be found on the SuperForex website’s home page.

Availability

SuperForex’s support team is available during specific hours, from 7:00 AM to 5:00 PM (GMT+0). During this time, clients can expect timely responses to their queries and concerns.

Multilingual Support

SuperForex understands the importance of effective communication and offers multilingual support. When contacting the support team via email or live chat, clients can receive assistance in their native language, ensuring clear and accurate communication.

Social Media Support

In addition to traditional contact methods, SuperForex maintains a presence on various social media platforms. Clients can freely refer to SuperForex’s official Instagram, Facebook, YouTube, Twitter, LinkedIn, and Pinterest accounts for more information and updates. These channels may also provide an additional means to reach out to the support team.

Advantages and Disadvantages of SuperForex Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

SuperForex vs. Other Brokers

#1. SuperForex vs. AvaTrade

SuperForex:

- Regulation: Regulated by the International Financial Services Commission (IFSC) in Belize.

- Account Types: Offers a variety of account types, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, and Crypto accounts.

- Trading Instruments: Provides access to a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

- Trading Platforms: Supports the popular MetaTrader 4 (MT4) platform, available for desktop, web, and mobile devices.

- Customer Support: Offers customer support through various channels, including phone, email, Skype, WhatsApp, and Telegram.

AvaTrade:

- Regulation: Regulated by multiple reputable authorities, including the Central Bank of Ireland, ASIC in Australia, FSCA in South Africa, and more.

- Account Types: Offers various account types, such as Standard, Options, Spread Betting, and Professional accounts.

- Trading Instruments: Provides a broad selection of trading instruments covering forex, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies.

- Trading Platforms: Provides various platforms, including MT4, MT5, AvaOptions, and their proprietary AvaTradeGO app.

- Customer Support: Provides customer support through phone, email, live chat, and an online contact form.

Verdict: Choosing between SuperForex and AvaTrade depends on individual preferences. AvaTrade holds regulations from more authorities, providing clients with an added level of security. SuperForex offers a diverse range of account types and supports the popular MT4 platform. Traders should consider factors such as regulation, account types, trading instruments, platforms, and customer support to make an informed decision based on their specific requirements.

#2. SuperForex vs. RoboForex

SuperForex:

- Regulation: Regulated by the International Financial Services Commission (IFSC) in Belize.

- Account Types: Offers a range of account types, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, and Crypto accounts.

- Trading Instruments: Provides access to a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

- Trading Platforms: Supports the popular MetaTrader 4 (MT4) platform, available for desktop, web, and mobile devices.

- Customer Support: Offers customer support through various channels, including phone, email, Skype, WhatsApp, and Telegram.

RoboForex:

- Regulation: Regulated by multiple reputable authorities, including the International Financial Services Commission (IFSC) in Belize and the Cyprus Securities and Exchange Commission (CySEC).

- Account Types: Offers several account types, including Pro-Standard, ECN, Prime, and R Trader accounts.

- Trading Instruments: Provides a wide range of trading instruments, including forex, stocks, indices, commodities, cryptocurrencies, and ETFs.

- Trading Platforms: Offers various platforms, including MT4, MT5, and their proprietary R Trader platform.

- Customer Support: Provides customer support through phone, email, live chat, and an online contact form.

Verdict: Both SuperForex and RoboForex are reputable brokers with their own strengths. SuperForex offers a diverse range of account types and supports the popular MT4 platform. RoboForex is regulated by multiple authorities and provides a variety of account types, including ECN accounts. The choice between the two will depend on individual preferences and priorities.

#3. SuperForex vs. FXChoice

SuperForex:

- Regulation: Regulated by the International Financial Services Commission (IFSC) in Belize.

- Account Types: Offers a range of account types, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, and Crypto accounts.

- Trading Instruments: Provides access to a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

- Trading Platforms: Supports the popular MetaTrader 4 (MT4) platform, available for desktop, web, and mobile devices.

- Customer Support: Offers customer support through various channels, including phone, email, Skype, WhatsApp, and Telegram.

FXChoice:

- Regulation: Regulated by the International Financial Services Commission (IFSC) in Belize.

- Account Types: Offers multiple account types, including Classic, Pro, and VIP accounts.

- Trading Instruments: Provides a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies.

- Trading Platforms: Supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available for desktop and mobile devices.

- Customer Support: Provides customer support through phone, email, and live chat.

Verdict: Both SuperForex and FXChoice are regulated brokers based in Belize. They offer a variety of trading instruments and support the popular MT4 platform. The choice between the two will depend on individual preferences and priorities. SuperForex provides a wider range of account types and additional support channels like Skype, WhatsApp, and Telegram. On the other hand, FXChoice offers multiple account types and supports the MT5 platform.

Conclusion: SuperForex Review

In conclusion, SuperForex is a globally operating broker regulated by the International Financial Services Commission (IFSC) in Belize. With over a decade of experience, SuperForex offers a wide range of trading services to individual and corporate clients in over 150 countries.

While SuperForex provides attractive features and services, it is important for traders to consider their own preferences and requirements before choosing a broker. Conducting thorough research, comparing different brokers, and considering factors like regulations, account types, trading instruments, platforms, and customer support will help traders make an informed decision that aligns with their trading goals.

SuperForex Review FAQs

Can I trade with SuperForex if I have little trading experience?

Yes, SuperForex offers a Standard account type that is suitable for beginners. With a low minimum deposit of $1 and flexible trading conditions, it provides a great starting point for those new to forex trading. Additionally, SuperForex offers educational resources and support to help traders improve their skills and knowledge.

Is my personal and financial information safe with SuperForex?

Yes, SuperForex takes the security of your information seriously. The company utilizes SSL encryption to protect data transmission on its website, ensuring that your personal and financial details are kept confidential. Furthermore, SuperForex follows strict privacy policies and maintains a segregated funds policy, keeping client funds separate from the company’s operational funds for added protection.

Can I access SuperForex’s trading services from my mobile device?

Yes, you can. SuperForex offers a mobile trading option through the MetaTrader 4 (MT4) platform. This allows you to trade on the go using your smartphone or tablet. The mobile platform offers full functionality, including real-time market quotes, charting tools, order execution, and account management features. It provides convenience and flexibility for traders who prefer to monitor and manage their trades while away from their desktop computers.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.