What Is Quantitative Trading – A Complete Expert’s Guide 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Quantitative trading is a technique that uses mathematical models and algorithms to identify trading opportunities and make decisions, usually in the financial markets. If you are a trader and have not heard of quantitative trading before, don’t worry – you are not alone. Even experienced traders may be hazy about quantitative trading and how it works.

The field of quantitative trading is extremely complex. This article will attempt to simplify things and give you a basic introduction to quantitative trading. Ezekiel Chew, founder, and CEO of Asia Forex Mentor will share his take on quantitative trading.

Ezekiel is a self-made millionaire who started his forex trading journey and has become one of Asia's most sought-after mentors. So let's hear what he has to say about quant trading. In this guide, we will discuss quantitative trading, how it works, the best quantitative trading strategies, quantitative trading systems, and more.

What is Quantitative Trading?

Quantitative trading (QT) is buying and selling securities, usually stocks, that mathematical models and algorithms drive. It is also referred to as Quant trading or Algorithmic trading.

As the name implies, quant trading relies heavily on mathematical models and statistical analysis to identify trading opportunities. These models are then used to generate trading signals that a computer program can execute. Also, this strategy focuses on using quantitative analysis to make decisions rather than human judgment.

The goal of quant trading is to reduce the amount of human emotion and bias that can cloud our judgment when making investment decisions. By removing as much subjectivity from the equation as possible, QT practitioners hope to achieve better results over time.

Quantitative trading strategies are used by financial institutions and hedge funds to make better investment decisions. In addition, these strategies are now employed by private individuals, known as quant traders. As a trader, it is essential to have a good understanding of quantitative trading to be successful.

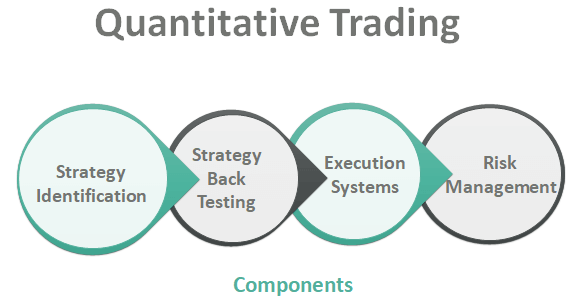

Remember that four distinct elements are required for a successful quantitative trading business. These elements include strategy identification, backtesting, execution mechanisms, and risk management. These components are all linked from one to the next in a step-by-step fashion, making it impossible to function without them.

How does Quantitative Trading work

Quantitative trading is based on statistics and mathematics to assess the likelihood of certain events. It necessitates a lot of computing power for a thorough investigation and makes definitive theories from many numerical data sets.

This is why quant trading has long been the province of large financial institutions and high-net-worth individuals. Nonetheless, in recent days, it is becoming more popular among individual investors as well.

An example of a quantitative model is analyzing bullish pressure on McDonald's Share (MCD) on the NYSE during lunch hours, performed by a quant. A program would then be created to examine this pattern throughout the stock's history.

If a pattern occurs 90% of the time, and this rate is consistent, then the quantitative trading model will anticipate that the pattern will repeat 90% of the time.

Quantitative Trading Strategies Explained

There are several quant strategies that different traders must know before starting to trade. Below are the six most common quantitative strategies that you should adopt to guide your trading decisions:

#1. Mean Reversion

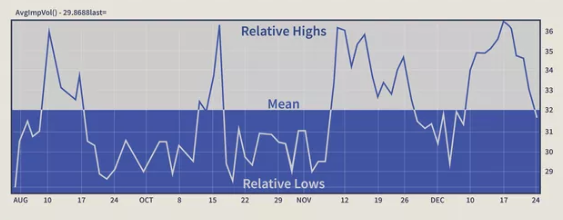

The mean reversion trading strategy seeks to take advantage of the dynamic price fluctuations that come with buying and selling stocks or securities. This capitalizes on the principle that prices will always return to their average levels after an extreme move.

The name for this phenomenon originates from how the prices around the average price tend to fluctuate. However, even though there is a lot of movement, the price always returns to its original position.

The benefits of this strategy are that the quant trader can make a profit when prices go up and laws when prices are low. The one drawback to this strategy is it does not function in every financial market.

The Quantitative trader creates codes to identify markets that have a long-standing mean. Once found, the system highlights any time it diverges from the mean. The system will calculate the probability of a profitable short trade if there is an upwards divergence. Alternatively, if there is a low divergence, it will do the same for a long position.

#2. Trend Following

The trend-following strategy, also called the momentum strategy, is one of the most basic and commonly used strategies. It simply captures an asset’s price movement in a given direction and seeks to profit from it.

This strategy is based on the assumption that once an asset starts moving in a certain direction, it will continue to do so for some time. Of course, this is not always the case, but by catching a trend early on, the trader can ride it out until it reverses.

This method is a good example of monitoring traders at a major financial institution's sentiments. Due to this monitoring, a model may be built to forecast when big institutional investors would likely buy or sell a stock in large amounts.

#3. Statistical Arbitrage

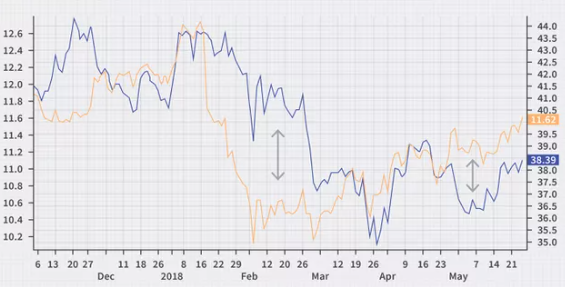

This trading strategy relies on the concept of mean reversion. This is a profitable strategy that takes advantage of the fact that when a group of stocks is similar, they will tend to have similar performance in the financial markets.

Conversely, when there is a stock that doesn't perform like these other stocks, it indicates that there is a great potential for profits. This strategy only works if the average stock price is calculated for a group of stocks that experience similar market conditions.

The disadvantage of statistical arbitrage, like with every method, is that sometimes elements can be used for a single asset that the rest of the group cannot utilize. Because of this, long-term variations occur, preventing the average price from reverting. The trader would need to employ HFT algorithms to capitalize on extremely brief-term market imperfections as a risk management technique.

#4. Algorithmic Pattern Recognition

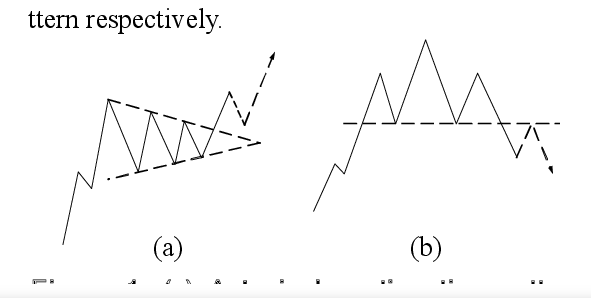

With this strategy, a trader can identify market patterns and use them to their advantage. This can be done by analyzing past data and then using that information to predict future market movements.

There are a few different ways to do this, but one of the most popular is using technical indicators. These are mathematical formulas that are designed to identify certain patterns in the market.

Algorithmic pattern recognition is the practice of developing a model that can identify large corporate or institutional traders who intend to execute a major trade with the goal of trading against them.

Institutional trading is often carried out via algorithms, and this approach allows you to easily recognize and isolate the institutional investors' custom execution patterns. For example, HFT firms commonly use the Algorithm pattern recognition strategy to detect large sales before they happen. This allows market makers to buy or sell the stock before it drops, ensuring they get a good price.

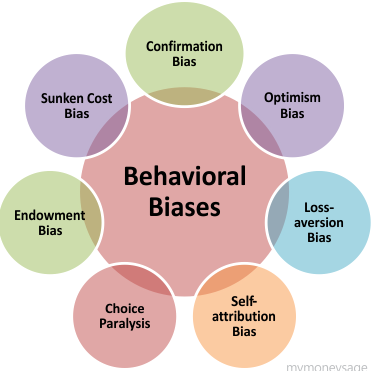

#5. Behavioral Bias Recognition

Behavioral bias recognition is a type of trading strategy that looks for patterns in investor behavior. These patterns can be used to predict future market movements.

There are a variety of different behavioral biases that traders can exploit. Some of the most common include:

- Herding: Investors tend to follow the crowd when making investment decisions. This can lead to prices becoming artificially inflated or deflated.

- Overconfidence: Investors often believe they better understand the market than they do. This can lead to them making poor investment decisions.

- Anchoring: Investors tend to base their investment decisions on past information, even if it is no longer relevant.

Behavioral bias recognition is a strategy that individual investors and institutions can use. However, it is important to remember that not all bias is bad. Some biases, such as overconfidence, can lead to higher returns. It is only when these biases are taken to extremes that they become dangerous.

#6. ETF Rule Trading

Exchange Traded Funds, or ETFs, are a type of investment that has become increasingly popular in recent years. The ETF rule trading strategy is based on profiting from the relationship between an index and the ETFs that track it.

ETF rule trading is a trading strategy that looks for patterns in how prices move. These patterns can be used to predict future market movements.

By understanding how stocks are added to and subtracted from indices and using ultra-fast trade execution systems, quant funds can take advantage of this process and make trades before others are forced to buy.

Quantitative Trading System

Below is a list of resources that will help you get started with your quantitative trading system:

#1. Strategy Identification

Quantitative trading strategies are based on mathematical models that analyze market data and identify trading opportunities. These models generate trading signals that a computer program can execute.

The quantitative trading strategy is based on four major components. One of the four major components that comprise quant trading is strategy identification. The trader's goal here is to discover trading openings by creating a hedge and working out how often would be best to trade.

The first step in developing a successful quant trading strategy is research. Only through study can certain key factors be incorporated. These crucial variables include selecting a strategy, putting the strategy into the appropriate portfolio, using data mining to evaluate the strategies, and improving the strategy to achieve greater returns.

Multiple sources are an excellent method for locating high-yielding or profitable methods. Trade journal is a great illustration of this since it offers trading strategies that a quantitative researcher may require. Mean reversion, statistical arbitrage, and other well-known techniques are among the most popular.

It's crucial to note that one of the most significant components of quant trading is known as the frequency of trading. The frequency may be either high or low, depending on the risk involved with the technology. High-frequency trading is concerned with maintaining assets intraday; low-frequency trading, on the other hand, is concerned with keeping assets for a period exceeding a day.

On the other hand, ultra-high-frequency trading techniques entail keeping assets for seconds or milliseconds. After a strategy has been discovered, records must be audited to ensure profitability.

#2. Strategy Backtesting

The second component of quant trading is backtesting. It's critical because it must verify that the strategy proposed is profitable with historical and non-study data.

The trader uses historical and out-of-sample data to assess the best technique, after which they gain knowledge of methods to employ based on past and out-of-sample information. However, before these strategies may be applied in reality, they must be cross-checked. This is where strategy backtesting comes into play.

The three main components to successful backtesting are availability and cleanliness of historical data, imputing realistic transaction costs, and deciding the best efficient backtesting platform. Therefore, every backtesting procedure uses Excel, Platform, Trade Station, or Python software.

New quantitative traders, especially retail investors, should use the free data set provided by Yahoo Finance to avoid incurring enormous costs. The data's quality, depth, and timeliness can sometimes depend on how much you're willing to spend.

#3. Execution System

To act implies that we must have an execution system comprising traders' techniques to send and execute a list of orders after the strategy has been created and tested. Quantitative trading is defined by it.

The execution system requires traders to take note of certain technical indicators, such as the interface to the brokerage and the minimization of transaction costs. Furthermore, there should be a divergence between the live system and back-tested performance.

The execution system is the only way brokers can send and execute the trading list. This means it could be carried out manually, semi-automatic, or fully automatic. However, due to the higher precision levels required for these trades, most Low-Frequency Trading techniques use manual or semi-manual methods to get things done.

It's crucial to consider transaction cost minimization in the execution system, which entails commissions (a tax levied by a broker), slippage (the difference between the intended filled order and the actual filled order), and spread (the gap between the asking price of the security being traded).

When backtesting, strategy performance sometimes varies greatly from what was originally predicted due to bias. This can be a problem because it's difficult to tell how the system will perform during live trading. Additionally, there may be unseen bugs in both the system and the strategies, which come up only when trading for real.

#4. Risk Management

Quantitative trading requires risk management to assess potential roadblocks to success. Some risks, like bias during backtesting or a system malfunction due to being offline, can be planned for. Others, like brokers going bankrupt, are more difficult to predict.

In addition, the quantitative trader must also consider the risk of their hard disks failing when making trade decisions. Other factors that need to be considered include optimal capital allocation and dealing with one’s psychological profile.

Advantages of Quantitative Trading

There are several advantages to quantitative trading, which is why it has become so popular in recent years.

One of the quantitative trading's major benefits is that it employs solely mathematical models, eliminating personal biases and emotional decision-making while focusing on existing data.

Another significant advantage is that quantitative trading can be automated, meaning a computer program can carry it out with little human intervention. This is extremely beneficial because it saves time and energy and can be executed without error.

Quantitative trading is not limited by geographical location, as it can be done anywhere in the world. Furthermore, quant trading is more efficient and accurate than traditional methods of trading, which often involve a lot of guesswork.

Disadvantages of Quantitative Trading

We've looked at the advantages of quantitative trading, and now it's time to discuss some potential drawbacks.

One significant disadvantage is that quant trading can be quite costly. Software and data can be expensive, and you can quickly rack up a large bill if you're not careful.

Additionally, quantitative trading can be quite complicated. You need to have a good understanding of statistics, computer programming, and financial markets to be successful.

If you're uncomfortable with complex concepts, quant trading may not be for you. Moreover, it has limitations in the number of strategies deployed simultaneously.

Last but not least, quantitative trading is not without risk. Like any other type of trading, there's always the potential for loss.

Quantitative vs. Algorithmic Trading

Although Quantitative trading and Algorithmic trading are quite similar, there are some key distinguishing features between the two. The most notable difference is that Quantitative trading relies on mathematical models to uncover potential trades.

Algorithmic trading businesses use automated trading systems or traditional technical analysis to analyze chart patterns and find new positions. Because of this, algorithmic trading can automate decision-making processes in a business, which leads to it being faster and more accurate than Quantitative Trading.

Best Forex Trading Course

Ezekiel Chew is a highly respected figure in the forex trading industry. He is a successful trader, a popular coach and trainer, and the founder of Asia Forex Mentor. He also has two decades of experience in the forex market and is a highly sought-after speaker and trainer.

Ezekiel's programs are designed to help traders of all levels, and his trading methods are backed by mathematical probability. In addition, His programs are comprehensive and cover everything from beginner to advanced concepts.

So, if you plan to kickstart your career as a professional forex trader, then Asia Forex Mentor is the perfect place to start. With Ezekiel's experience and expertise, you can be sure you are getting the best forex trading course.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Quantitative Trading

Although quantitative trading is interesting, it's very complex and difficult to learn. To have any chance of success, quantitative traders must be good at math and computing. Besides that, they would also need to know how to code and use machine learning.

You may begin data gathering, backtesting, and other elements of Quantitative trading before you are ready to start a quant trading business once you have a solid statistics and econometrics foundation.

Since the financial markets constantly fluctuate, traders and investors need to use risk management when implementing quantitative trading techniques. This way, they can ensure their risk tolerance is properly met.

Quantitative Trading FAQs

Do quant traders make a lot of money?

Yes, quant traders can make a lot of money. Some of the world's most successful hedge fund managers are quants. However, it's important to remember that quantitative trading is not without risk. There is always the potential for loss, so it's important to know the risks involved before starting.

How do I become a quant?

There are a few ways. Firstly, you could do an undergraduate or graduate degree in a relevant field such as mathematics, computer science, engineering, or physics. Alternatively, you could join a financial institution or company that offers training programs for quants. Moreover, you could also self-study by reading books and articles or taking online courses.

What do I need to know to start quantitative trading?

You'd need a deep understanding of programming, statistics, what an automated trading system is made of, the components of quantitative trading, and all other relevant information. Online courses or reading books teach about risk management and execution systems.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.