All You Need To Know About Pullback Trading – 2024 Guide

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The forex and stock market are considered to be the most fluctuating markets in the world of finance. Therefore, even at times of certainty, the market participants always anticipate sudden flux. The major cause of this unpredictability is the varied intention of market buyers and sellers which affects the supply and demand of the assets.

The rising demand for financial assets can lead to a continuous upward trend line. However, any deviating from the market participants can suddenly pause this trend. This pause in the rising trend line is known as a pullback. To understand the concept of pullback trading better we've got Ezekiel Chew who is an eminent trader and credible forex trainer.

Ezekiel considers Pullback trading a great opportunity for investors and traders to gain maximum profits from their forex investments. However, pullbacks are always identifiable for traders who are well aware of the market conditions. As a result, to take advantage of pullback conditions one must be knowledgeable about how the financial market behaves.

This review aims to understand the basic concept of pullback trading and its benefits for traders in the forex and stock market. Additionally, some pullback trading strategies are put forward through this review so that traders can put them into effect to earn considerable profits.

What is Pullback Trading

In the forex market, the price action of the underlying assets always depends on their demand. Consequently, any hike in the demand for the asset results in a continuous upward trend. This bullish trend in the financial market may result in a tremendous capital gain for some traders however, it is usually a hurdle for new traders to enter the market.

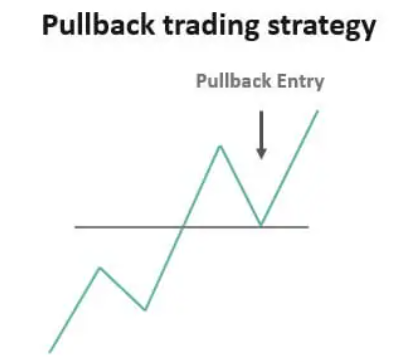

No matter how long the upward trend remains, there is always a pause or a price drop at some point. This price decline does not start a downward trend line however, temporarily halts the constant price hike for a few sessions. This phase of short-term price adjournment is often called pullback or retracement.

Pullbacks or retracements are considered to be a great window for new investors to barge into the trading market. As pullbacks are supposed to be a momentary phase and it is assumed to be followed by an upward trend again. For this reason, traders can expect better returns through pullback trading.

It is important to identify pullbacks or retracements before time to take advantage of this opportunity. Traders can take the help of financial advisors or technical experts who can predict the possible pullbacks during an upward trend line. With the help of various tools such as charts, patterns, and other technical assessments such as Fibonacci retracements or mathematical probabilities traders may be able to spot the pullbacks on time to earn profits.

Types of Pullbacks

Once a trader points out the possible pullbacks, it is time to decide which pullback strategy would suit their trading needs. There are many pullback trading strategies advised by financial experts however, each of them has different specifications. These strategies help traders to figure out the right time to approach the market so that they can gain maximum returns.

#1. Breakout Pullback

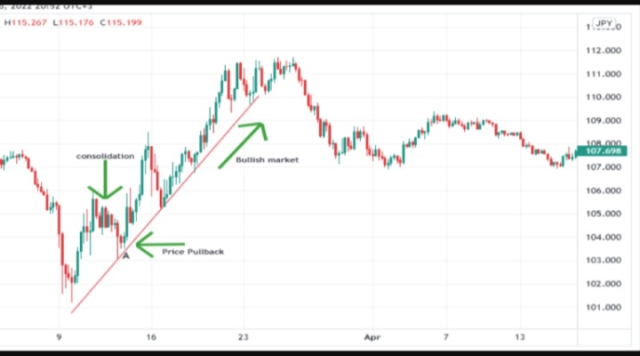

The most commonly used pullback strategy is the breakout which emerges during the initial shift in the market price. The change in the price movement can be identified through many consolidation patterns on the price chart. Hence traders can use the breakout strategy to earn a significant profit however, it is recommended to place a stop loss to be safe from market volatility.

#2. Fibonacci Pullback

Another pullback strategy is using the Fibonacci ratios for price retracements. The Fibonacci ratios are based on a sequence of numbers whose ratios provide the exact movement of price levels. Hence traders can predict the precise time to enter the market through technical analysis using Fibonacci retracement.

The advantage of Fibonacci retracement is that it provides the most accurate market turning points which allow traders to make an informed decision regarding market entry and exits. Moreover, day traders who make short-term investments can benefit from this pullback strategy as they would get precise price movements.

#3. Horizontal Steps

Horizontal steps are also a pullback trading strategy which is similar to the breakout strategy. The only difference is that rather than appearing during the initial turning point of the price consolidation, horizontal steps occur at a later stage. This allows the traders to not worry about price fluctuation as the price action is confirmed till this point.

#4. Moving Average

Traders also use the moving averages as a pullback trading strategy. Moving averages is a technical indicator that points out the movement of the price either going upward or downward trend lines. However, it is suggested to use the long-term moving averages as they are more accurate and reliable while short-term averages may be misleading for some traders.

#5. Trendline Pullback

Trendline pullback strategy is yet another method that can be used for retracements. A trendline as the name suggests is a simple technical analysis tool that confirms a certain price movement. It is a straight line that indicates the market trends. Moreover, it is an effective tool for locating the key support and resistance levels.

This strategy is also the same as horizontal steps however, trendline validation takes one step further and a trend is confirmed price is stable for more than 3 sessions in a row. With trend lines, traders can be sure of the price turning point however it may take longer to make decisions using the trend lines strategy.

Each pullback trading strategy can be used to locate the market turning points and attain maximum profits. However, for best results it is advisable to use these strategies in combinations such as Fibonacci ratios and moving averages together can provide the most accurate market positions. In the same way, pullback traders can also use all these strategies together to make risk-free investments.

How to Trade Pullbacks

The most crucial part of forex or stock trading is to accurately identify the market situation and make the best possible entry and exit from the market. For this reason, pullbacks are considered to be an incredible position to make a profitable trade investment.

Pullbacks happen when there is a short pause before the market price continues again on its course. This sudden stop can be due to a variety of reasons, however, it poses a chance for investors to buy or sell the underlying assets before the pullback breaks and the trend line continues as before.

To trade pullbacks and reversals profitably, it is important to recognize the market trends appropriately. If the market has a bullish trend which means that the prices are anticipated to go up then it is better to trade pullbacks by buying assets. Conversely, during the bearish trend Lines, sellers are more at advantage.

For successful pullback trading, it is vital to enter the market at the perfect time. Traders can use different pullback strategies to spot the resistance and support levels. This will provide them with the right opportunity and risk-free investment. As pullbacks are temporary it is usually an indication of the trend origin to continue and trading with this knowledge can help traders to earn maximum profits.

Pullback Trading Explained

Pullbacks are known to be a great chance for investors to earn profits. Some investors may trade without pullbacks however, that may turn out to be quite risky. As a market prevailing trend can change at any time investment without pullbacks can be unpredictable. In contrast, when traders identify a pullback traders are in a good position to make trading decisions without putting much risk.

For instance, a stock price action is going on an upward trend line and during this time there is a pullback. As pullbacks are short pauses, this is the time investors can buy stocks become they would be aware that the price action will continue its origin after the pullback. Hence being informed of the market position, traders can earn considerable returns through pullback trading.

The limitation of pullback trading is that sometimes it is difficult to differentiate between a pullback or a genuine reversal. A reversal is a change in the market trend in the opposite direction and it can last for a long period. For this reason, if traders make a mistake in identifying a pullback from a reversal they can face massive losses.

The best way to single out a pullback from reversal is to use effective pullback trading strategies. To be more sure traders can use all the strategies at the same time before concluding pullbacks. Thus a proper technical analysis can make traders more confident in pullback trading resulting in significant capital gains.

Best Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You'll be able to trade forex profitably with a skilled trader's help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew's teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It's not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines' second-largest state-owned corporation.

Due to his strategy's effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Pullback Trading

When it comes to forex or stock trading, investors are usually doubtful regarding their investments. Moreover, new traders are also hesitant before stepping into the financial market. The reason behind this uncertainty is the volatility of the market position. Hence, traders are cautious while making investment decisions.

In such a scenario pullback trading is considered to be a golden opportunity for new traders and experienced investors alike. As traders and investors are familiar with the market position they are in a better position to make future predictions. Therefore, Pullback trading enables traders and investors to make informed and planned decisions regarding their investments and earn the expected profits.

During the upward or downward trend line, the pullback is a temporary break off of the trend line where the price consolidates for a short time. However, the advantage of pullback is that the traders are already aware that this pause is short-lived and the trendline will continue its course again. Consequently, the traders can prepare themselves by buying or selling assets during the pullback knowing the price movement beforehand.

Pullback Trading FAQs

What is a Pullback in Trading?

Pullback trading is trading in the forex or stock market when there is a short pause in the price movement. There is discontinuation in the upward or downward trend line however, this stop is transitory where the price again moves in its previous momentum after a limited time.

In pullback trading, this cessation is considered to be a chance for investors to make their trading decisions by buying and selling assets as they know that this brief pause will be over and the price action will continue as before. Hence, pullback trading allows traders to enter or exit the market during turning points to gain profits.

Is Pullback Day Trading Profitable?

Pullback trading can be very profitable if the pullback is identified precisely and on time. As pullbacks are brief market turning points, it is only profitable if the investments are made well-timed. However, if the pullbacks are read wrongly and investments are made on their basis, it can lead to massive losses for the investors.

Conversely, accurately spotted pullbacks can turn out to be quite profitable as well. For instance, if the price of a stock is going through an upward trend and gets a pullback, the investor needs to be ready for the moment. In such a case, the investor can make considerable profits by buying the stock before the price action continues its course.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.