Pattern Day Trader Rule Workaround: 11 Most Important Tips [Updated 2024]

By J Maver

January 10, 2024 • Fact checked by Dumb Little Man

The world of day trading is quite amazing. You never know what kind of opportunity you might come across in a single day.

And trust me, by the word ‘opportunity', I mean an opportunity that can change your life completely for good.

Before diving deep into the world of Pattern Day Trader Rule and how it works, here are some key points that you must understand before hand,

How day trades actually work?

If you ask an expert of the field about the simplest possible definition of day trading, there's hardly a chance that you are going to get it.

The reason behind this is that day trades are way more complex and diverse than regular trading branches.

The complete setup of day trading is about speculating the exact security and stock dynamics and trading with them within the same trading day.

The Pattern Day Trade Rule also helps you to speculate the upcoming surge in the market and act accordingly.

Pattern day trade : A brief intro

The Pattern Day Trade is not some kind of trading platform or a program that allows you to regulate the day trades or your cash account with the help of some financial tools and stuff like that.

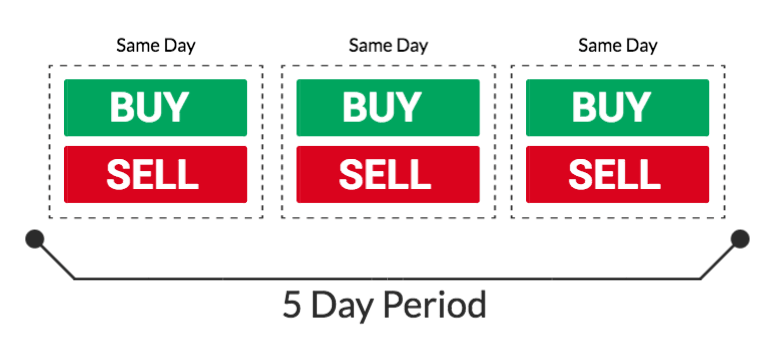

The Pattern Day Trading Rule can be defined as the way of executing four and higher trades within a five day time.

All the day trades must be done through a single account for these five days. As a result of this peculiar nature of trading, Pattern Day Trade and Pattern Day Trader Rule is also considered illegal sometimes.

Expert review on day trading

According to experts and the US Government Finance Regulating Bodies, pattern day trader or pattern day trade is not illegal.

Day trades will be allowed by someone flagged as a pattern day trader.

However, the risk involved in being a pattern day trader is far more greater than any other type of day trades.

The Pattern Day Trader Rule allows the trader to put the capital of investors on a high risk campaign. That's why, majority of the traders doesn't even fully understand how the Pattern Day Trader Rule works with respect to day trades.

Things to mark tick before starting your journey

Remember, as a pattern day trader, there's a high possibility for you to get involve in day trades that are way more risky than a usual cash account.

But greater the risk means greater will be the reward.

Being a pattern day trader allows you t get access to international markets and deal with high risk stocks/options/securities that need high level of understanding.

Make sure to thoroughly go through the successful working models used by a successful pattern day trader. It will help you a lot in the long run.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Pattern Day Trader Rule Workaround: Full Guide

Welcome to Pattern Day Trade 101!

A trader with a pattern day trade account isn't labelled as someone similar to a cash account. The US Securities and Exchange Commission makes sure that everyone on the market platforms knows about someone dealing in pattern day trade.

Also, the financial industry regulatory authority in the US as well as other global market powers doesn't allow the pattern day trade enthusiasts to use a a cash account.

Instead they are confined to a margin account to deal with the stock market.

All you need to know

As a pattern day trader, your approach for dealing with the stock market through your margin accounts will be different from rest of the day traders. There's a high possibility as well that you might be considering pattern day trading illegal or something like that.

Be assured, there's nothing like that.

Instead of a cash account, you will be making 4 or higher trades in a period of 5 days through your margin account or margin accounts in case of some very high end deals.

How Pattern Day Trade works?

Once you are labelled as a ‘pattern day trader' by your respective trading platform, you will no longer be using a regular cash account to deal with the stock market.

You will be switched to margin accounts from where you can make 4 or higher trades within a five day period.

The US financial law doesn't hold any kind of regulation that declares pattern day trading illegal.

However, your margin account trades must represent more than six percent of the total trade volume within these five days.

Is it in accordance with FINRA?

Yes, just like a cash account based trading transactions, the pattern day trade is also regularized by the FINRA. US Financial Industry Regulatory Authority (FINRA) is the main US Government based body that deals in legally regulating such trading dynamics.

Whether you are doing a cash account based trading or a margin account based trading, FINRA will be the Government based body you will be dealing with.

Even with all the approved regulations, your margin account must maintain a minimum 25,000 USD balance all the time. A regulation that is not mandatory for a cash account of any kind.

Legal overview of the Pattern Day Trading setup

S, you have a margin account in your hand. You think you have got it all figured out and are ready to dive dive right in money trading stocks and futures trading.

But there's one thing that's still preventing you from getting your margin account in action according to pattern day trade dynamics.

Whether or not the pattern day trade account is legal or not?

Let me answer this question in very simple words. As long as your margin account is going to follow the rules devised by FINRA, pattern day trade is legal.

Can I trade options as well?

From futures trading to swing trading, pattern day trade allows you to access and deal with any financial opportunity within legal business days.

You might be thinking how you will be utilising your margin account to do such a thing? Well, most of the financial securities have an embedded leverage system.

This allows them to be dealt with according to the pattern day trade rule.

Plus futures trading and swing trading become much more accessible through the pattern day trade approach and setup.

Cash accounts and Pattern Day Trading

This is by far the most tricky concept of this whole article that even I find quite hard to explain. As discussed earlier, pattern day trade is applicable for margin accounts only within five business days duration.

But in case of day trading penny stocks and strategies like gap and go for swing trading can also fall under the banner of pattern day trades.

Within certain business days, you can even use the margin account influence with multiple accounts and respective brokerage firm.

11 Key Points To Effectively Utilize The Power of Pattern Day Trading!

1) Pool as much money together as possible

According to pattern day trading rules, you need to pool as much money as you can. Unlike cash accounts, you are going to need a solid 25,000 USD minimum account balance to get recognized according to legal pattern day trader rules.

For beginner traders, this step can be the most hard one in the long run.

After all, pooling up money from your friends and family for your brokerage account as a beginner is not an easy job at all.

2) Use a funded trading account

Instead of going with the pooling option to get around the pdt rule, the other best option to start your pattern trade journey is getting access to a funded trading account.

Of course such an account will only be given to you after evaluating your past performance as a trader if you don't have the required assets in your hand yet.

But compared to pooling up funds, showing your talent and track record is a much easier alternative.

Most of the companies today offer funded trading account with a 80-20 profit sharing where you keep the 80% of the profit margin.

3) Work with more than one brokerage accounts

When trying to get around the pdt rule, the five day period looks quite short for a successful campaign. That's why, experts suggest to use multiple trading accounts in this situation.

However, you must be ready to own risk associated with all such accounts as well.

Once you have multiple accounts in hand, you can set the offsetting positions for same day activity and get the perfect opportunity to trade things up.

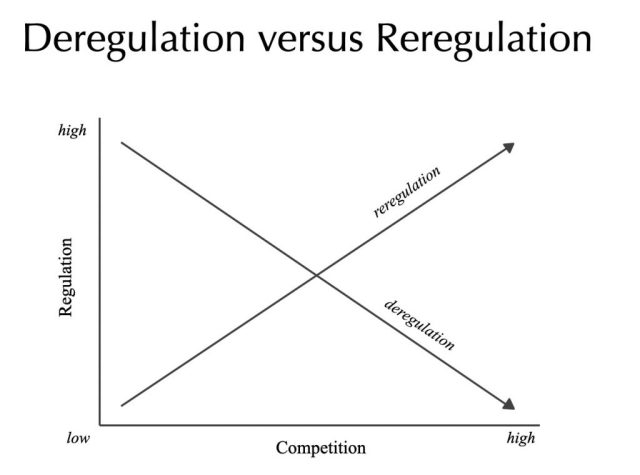

4) Focus on markets with low regulations

Pattern trade requires you to make four or higher transactions within the same five day period.

With the amount of risk involved in such deals, things can easily get out of hands if you decide to go with the same day approach with a margin account.

Here's an easy solution to this problem.

Switch to brokerage firm that resides in a region with lower regulations than the US. This will allow you to circumvent the pattern trade around the pdt rule for your own benefit with lower same day trading risks included.

5) Get a day trading firm membership

Although this option is quite out of reach for most of the traders because of their limited skill and buying power, but joining a trading firm is definitely going to help you a lot in the long run.

By joining a proper firm , you get free from the minimum balance and fewer trades clause imposed by FINRA.

You become a part of a solid financial team and will be supported through a funded account that covers all the regulations regarding the minimum balance.

6) Increase your ability to hold your position

Stock market in general is not a place for a penny stock trader who wants to become a millionaire overnight just because he/she has trading some stocks first time in his/her life.

Many traders, specifically swing traders try to get around the pdt rule with a shorter margin call and a hasty trading approach.

Instead going with such approaches, the best option every pdt rule trader must have is to hold his/her position throughout the day and wait for the perfect opportunity.

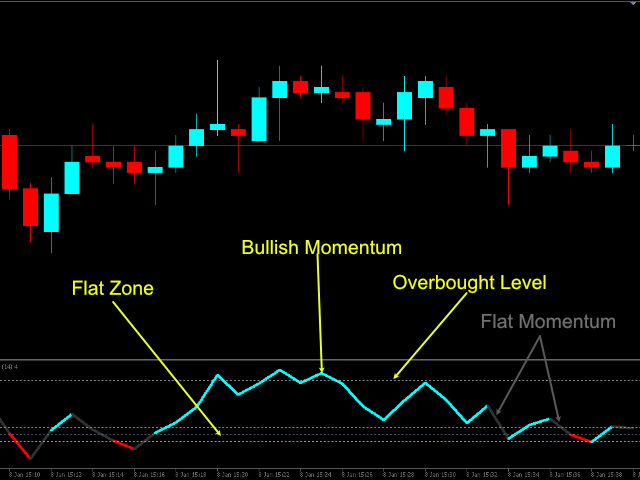

7) Capitalize the momentum

Many traders and day traders to be exact still doesn't fully understand what it means by capitalizing the momentum of the market.

If you have worked with only the best setups related to trading over the years, them you understand what market momentum is.

No once can successfully predict when the market will be in momentum again. But once this phenomenon occurs, you will be watching day traders and offshore brokers from every corner of the globe getting active on the platform.

This is the perfect time for capitalizing the position you have been holding for so long now.

8) Master hedging currency

Besides trading options and securities, the best way of utilizing pdt rule is to use an offshore broker to hedge overseas currency margin call successfully.

With the help of an exchange, you can trade currency features as well as lock in a conversion rate for a certain time.

Don't worry about the pdt rule and whether or not this dealing will fall under the legal flag or not. The offshore broker will be in action to deal with the pdt rule related restrictions.

9) Keep an eye on ‘marks-to-market' indicators

Pdt rule is all about finding the perfect way of financing your approach for trading. As a trader, this is the only thing that is going to determine whether your pdt rule campaign is successful or not.

Keeping minimum equity in hand, accessing funded trading accounts, getting enrolled in a day trading firm, and understanding the ‘marks-to-market' approach. All the factors necessary to master the pdt rule approach.

The ‘marks-to-market' approach will also help you better plan about the additional maintenance margin within five business days of trade.

10) Learn to deal with small capital

Don't worry if you don't have huge resources of capitals in your trading accounts.

Although the risks involved under the pdt rule with low capital are quite high, but you can always outshine the odds with perfectly crafted approaches.

You might be needed to keep a minimum 25,000 USD balance in your account, but this pdt rule can be resolved by circumventing the FINRA regulations through international brokerages.

Also, don't be hasty. You might be trading the best round of your life in the first three days and may lose it all on a fourth day trade. Dealing with small capital with pdt rule is truly an art.

11) Learn as much as you can

Last but probably the most important tip to trade futures and get access to global financial markets through the pdt rule. Learn as much as you can and get day trading training as much as you can possibly digest related to pdt rule.

Remember, knowledge is the only thing thing that is going to decide the future of all your money in the market.

Platforms to switch to as a Pattern Day Trader

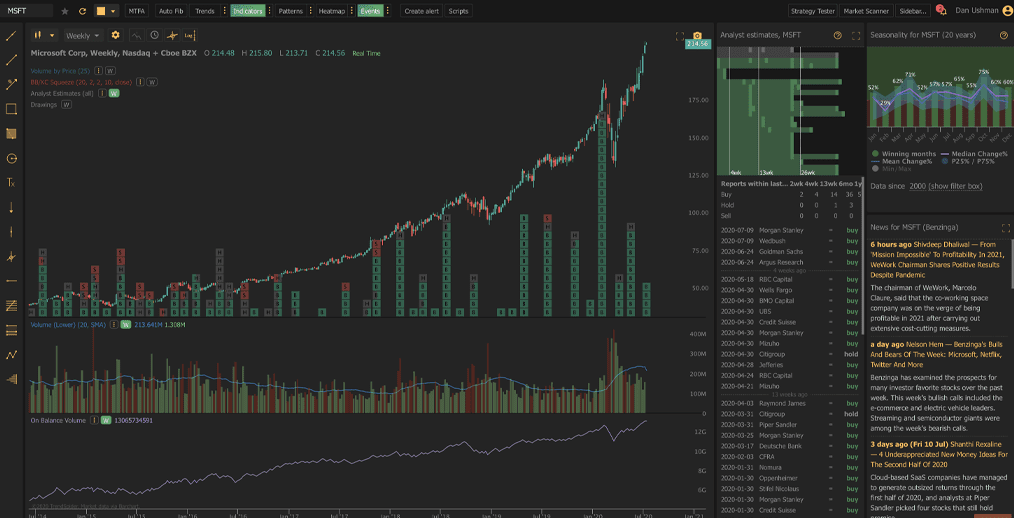

TrendSpider

For pattern based day traders worldwide, I don't think there's a better automated platform available that's as good a TrendSpider! Loaded with international traders and trading activity, TrendSpider offers automated technical analysis as well as automated dynamic price alerts.

The trading activity can also be monitored according to the pdt rule with the help of countless technical analysis tools available for the user.

Plus, you can also enjoy completely free one-on-one trading activity analyzing sessions held by different brokers and mentors.

CLICK HERE TO READ MORE ABOUT TRENDSPIDER

Asiaforexmentor

Dedicated to deal with the Asian market dynamics, Asiaforexmentor hosts the largest number of different brokers residing in the Asian region. The platform also offers a huge amount of content related to manage the rolling five day period under the pdt rule and related articles.

From intraday trades to currency risk alerts, the platform is quite friendly even for the new traders.

Plus, Asiaforexmentor is also known for indicating any direct or consequential loss associated with the particular options trading under the pdt rule and foreign currency dealings.

CLICK HERE TO READ MORE ABOUT ASIAFOREXMENTOR

TradingView

The platform that hardly needs any introduction for the amazing services it offers in the trading world. From currency risk evaluation to indicating the inherent risks involved with the upcoming trade, TradingView is the platform for an experienced trader and a sharp market analyst.

The chart analysis setup that is offered by the Trading View program is also something that even experts believe have some magical powers of market projections.

But unfortunately, the TradingView interface does get slow when more than one scripts are added for market evaluation.

CLICK HERE TO READ MORE ABOUT TRADINGVIEW

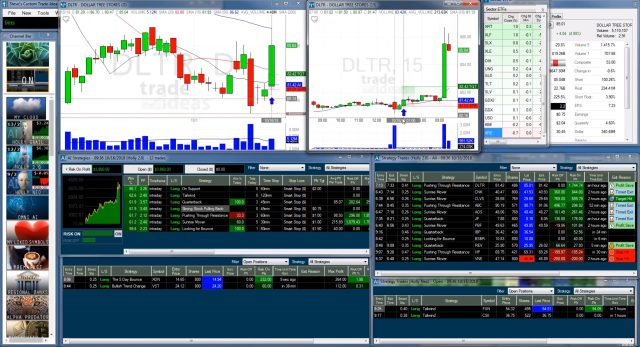

Trade Ideas

One of the most prestigious and popular trading platforms to ever exist. From foreign broker dealing to keeping the trade regulated under the pdt rule, Trade Ideas suite contains every feature that a trader can wish for.

The platform is loaded with TI university content and financial education live seminars always encouraging the users to focus on in depth market analysis.

With its AI powered work system, Trade Ideas can also successfully predict how many trades are currently in line. You can also get the unlimited trades feature within the pdt rule under special Trade Ideas work conditions.

CLICK HERE TO READ MORE ABOUT TRADE IDEAS

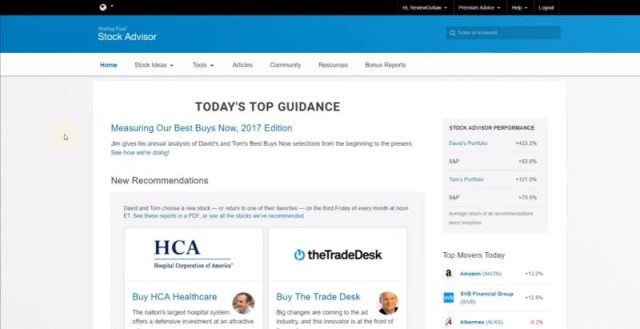

Motley Fool

A platform specifically designed for traders with years of experience in the market, Motley Fool suite contains a trading world of its own within the program. Although the subscription charges of the platform are quite high, but no one can question the accurate market evaluation strategies opted by the Motley Fool suite.

Not only this, the platform also offers verified global market news that can heavily your next trading decision.

But for beginners, using Motley Fool work interface can surely be a hard job to get familiar with.

CLICK HERE TO READ MORE ABOUT THE MOTLEY FOOL

Binance

Known for its crypto trading related services and latest market new authenticity, Binance is also included in the list of best platforms you can opt for pdt rule based transactions.

Over the years, Binance has proved that it is not just another crypto and commodities specific platform that doesn't know much about other trading options.

The platform hosts a global community of investors and traders which are getting quite open to pdt rule trading over the years gradually.

CLICK HERE TO READ MORE ABOUT BINANCE

Conclusion

With all that being said, now you understand the complete secret of pattern based day trading and why most traders consider this approach as illegal in the United States specifically.

Well, every trading dynamic has pros and cons of its own. Where pdt rule offers you large profits in a matter of days, we can't possibly ignore the large number of risks involved to do so.

Also, you need to have a solid trading platform in your hand to successfully carry out pdt rule trading approaches. According to experts of the field, Trade Ideas will be the best option in this regard.

CLICK HERE TO GET TRADE IDEAS AT A DISCOUNTED PRICE!

What have we learned so far?

Trading is not as easy as it looks like. Whether its pdt based or general stocks and commodities trading, you just can't hit the jackpot overnight in trading even with years of experience. I think that's the very thing that makes the whole trading concept so awesome.

Effort, knowledge, and instinct, the three key factors that are going to determine whether or not you will become a one of a kind trader in the near future or not.

Also, we can't ignore the minimum capital you need in order to successfully begin your trading journey.

Your approach to become a top day trader

As discussed earlier, four things are going to decide whether or not you are going to succeed in the world of trading or not.

First, the amount of effort you are willing to put in building your career. You can put as much money as you want but as long as you are not piloting your trade setup from the front, nothing will work.

Second, the knowledge and experience you have gained by going through hundreds of resources online. The higher your knowledge regarding the market will be the better you will be able to understand how the market will react.

Third, your sheer instinct and approach to act at the right moment and seize the opportunity. Remember, being too hasty in this business can become your downfall more sooner than you would like it to happen.

And fourth, the capital you need to invest in your trading dream and begin your journey with a solid start.

FAQs

What happens if you are a Pattern Day Trader?

Nothing significant is going to happen if you are a pdt. Well, you might be labelled as a pdt because of your immense focus towards this approach, but besides that, you will still be referred as a day trader.

In terms of profit, you might be able to bag large profits than your fellow traders.

But remember that pdt comes with high risk vulnerability and a very short time span of action.

You will be forced act within five days and make a move or bear a solid loss.

Who is considered as a Pattern Day Trader?

As a pdt, your whole trading operations get restricted to a five days window. That's why, the traders whose record show four or higher trade deals within the five day window are labelled as pattern day traders.

But this doesn't mean that you can't switch to other trading dynamics or opportunities.

Although you will be asked to have a minimum 25,000 USD capital in a margin trading accounts to keep your pdt approach legal. You can still deviate from the respective regulations.

All you need to do is get access to a foreign brokerage and collaborate your way in the pdt world through bypassing the US margin account regulations.

How many day trades one can make in a day?

That's a really good question. Well, in terms of general trading dynamics other than pdt, there's not a definite number of trades you can make in a day.

Even if there is a definite number, it varies from region to region and can't be confined to a singular unit.

However, in case of pdt, the maximum number of day trades per five day period is confined to four or higher number. Any trader with a four or higher trades locked and executed within a five day time limit is labelled as a pdt.

J Maver

Passionate in tech, software and gadgets. I enjoy reviewing and comparing products & services, uncovering new trends and digging up little known products that deserve an audience.