One Royal Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

2.5 2.5/5 | 63rd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of retail traders, financial consultants, and trading specialists, conducts thorough reviews of brokerage firms. They use a specialized algorithm to assess brokers based on uniform criteria like:

Customer opinions are also incorporated into the final evaluation. We combine expert viewpoints with user experiences to provide a well-rounded outlook, minimizing individual biases for an unbiased review of the broker. After evaluating One Royal using these metrics, we found it to be a credible option for those seeking a dependable financial broker. However, the article will outline specific drawbacks that potential users should be aware of. |

One Royal Review

Intermediaries who help with currency trading are known as forex brokers. They provide traders with access to exchange markets so they can buy and sell foreign currencies. One Royal is a fully operational online trading broker. It offers over 180 currency pairs in Contracts for Difference (CFDs), one of the several trading products available.

One Royal offers services beyond currencies. Exchange-traded funds, cryptocurrencies, indices, commodities, oil, stocks, and more are among the marketplaces on which traders can trade. It can thus be used as a one-stop shop for a variety of trading needs.

One Royal is thoroughly analyzed in this article. It aims to conduct a thorough examination of the features and services provided by the platform. We'll focus on One Royal's advantages over competitors and any possible drawbacks.

The trading gurus at Dumb Little Man and real consumer experiences provided the insights for this assessment. Our goal is to present an impartial viewpoint. The review includes commission structures, deposit and withdrawal procedures, account selections, and other important information. You'll be better able to choose One Royal as your chosen broker after reading this information.

What is One Royal?

One Royal is a prominent name in the online trading industry. Founded in 2006, the broker has consistently aimed to offer top-notch trading services. Its reputation proliferated, leading to expansion in the Middle East in 2008 and Australia in 2014.

A pivotal moment for One Royal came in 2016 when it received licensing from the Cyprus Securities and Exchange Commission (CySEC). This license is proof of One Royal’s dedication to regulation, transparency, and a secure trading environment for its clients.

However, One Royal takes a cautious approach to global expansion. Due to regulatory restrictions, it does not offer services in specific countries like the USA, North Korea, Iran, and Japan. This careful approach underlines One Royal’s commitment to legal compliance and establishes it as a reliable broker in the trading sector.

Safety and Security of One Royal

One Royal is owned by three distinct companies: Royal Financial Trading Pty Ltd, Royal ETP LLC, and Royal CM Limited. These companies are subject to various regulations. The first is regulated by ASIC, the second by the local FSA in Saint Vincent and the Grenadines, and the third by VFSC. Additionally, CySEC also licenses the broker. This information comes after thorough research by Dumb Little Man.

Technical support is accessible to traders using One Royal. Clients have the option to seek guidance and assistance when needed. This shows One Royal’s commitment to providing a supportive trading environment.

As for regulatory oversight, clients can address issues with ASIC, FSA, VFSC, and CySEC. However, it's worth noting that traders can only reach out to financial controllers within these specified jurisdictions. There's also no possibility to contact regulatory organizations not monitoring One Royal's activities. This limitation could be a factor for traders eyeing global trading activities.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Sign-Up Bonus of One Royal

One Royal provides a strong incentive to sign up in terms of rewards. With a 100% bonus, new traders can quadruple their first deposit. This indicates that One Royal offers an identical amount as a bonus when signing up and making a first deposit.

Your trade strength is considerably increased by this perk. You are entitled to an additional $5,000 in free margin through One Royal. With this additional margin, traders have the freedom and capacity to execute more trades, thereby boosting earnings.

Minimum Deposit of One Royal

Joining One Royal is relatively accessible for traders at all levels. The broker sets a minimum deposit of $50 to start trading. This low entry point makes it convenient for those new to trading or cautious about committing large sums.

The $50 minimum deposit is beginner-friendly and manageable for seasoned traders. It offers an easy way to test the platform’s features before making more extensive financial commitments.

One Royal Account Types

Our team of experts at Dumb Little Man conducted thorough research and testing on One Royal‘s account options. The broker offers two primary account types: ECN Account and Zero Commission Account. These are further subdivided into six sub-accounts, each with its own features and conditions.

Zero Commission Accounts

Zero Classic Account

- Minimum deposit: $50 to $19,999

- Features: Commission-free trading, spreads from 1.4 pips, MetaTrader 4, WebTrader, and Multi-Terminal access, account opening in multiple currencies, live market news, and social competitions.

Zero Premium Account

- Minimum deposit: $20,000 to $99,999

- Features: Commission-free trading, spreads from 1.0 pips, all benefits of the Zero Classic Account, plus access to an Account Manager and Trading Central, along with MetaTrader 4 Tools and Plugins.

Zero VIP Account

- Minimum deposit: Over $100,000

- Features: Commission-free trading, spreads from 0.6 pips, all benefits of the Zero Premium Account, and access to the Dow Jones Newswire.

ECN Accounts (Core Accounts)

Core Classic Account

- Minimum deposit: $50 to $19,999

- Features: Trading with spreads from 0.0 pips, commissions charged at $7.

Core Premium Account

- Minimum deposit: $20,000 to $99,999

- Features: Trading with spreads from 0.0 pips, commissions charged at $5.

Core VIP Account

- Minimum deposit: Over $100,000

- Features: Trading with spreads from 0.0 pips, commissions charged at $3.5.

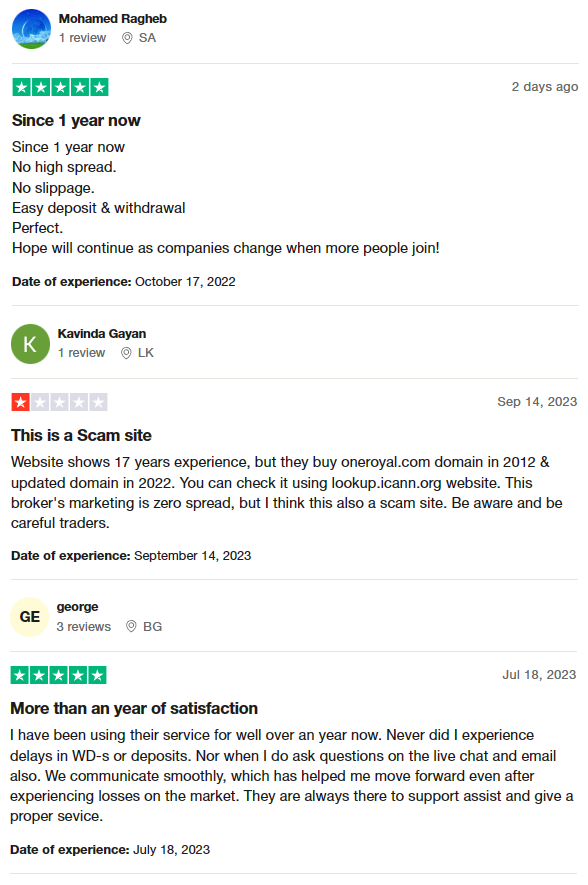

One Royal Customer Reviews

Customer feedback for One Royal presents a mixed bag of experiences. Many users praise the platform for its low spreads, no slippage, and easy deposit and withdrawal processes. These traders appreciate the platform's reliability and hope the quality of service continues as the company grows.

However, concerns about the broker's marketing claims are raised, advising caution in believing zero-spread promises. Given the domain registration date, there also needs to be more skepticism regarding the company's stated 17-year experience.

Despite this, One Royal receives positive remarks for its educational materials, which help newcomers assimilate quickly. Users also commend the timely and supportive customer service, stating that quick responses on live chats and emails have helped them recover from market losses.

One Royal Fees, Spreads, and Commissions

In the trading sector, One Royal is renowned for having a competitive price structure. The broker distinguishes itself from several rivals by providing tight, floating spreads. For example, the well-known EUR/USD currency pair has an average spread of just 0.2 pip, which is far less than the 1.2 pip industry average. This rate is a desirable option for traders because it is applicable to all main currency pairs and other well-liked trading products.

In terms of transparency, One Royal performs admirably. The broker offers cheap and transparent pricing on a range of trading products. Notably, there are no unstated costs associated with starting, stopping, or inactive accounts. Traders should be aware, nevertheless, that depending on the financing method and registration country, fees might be charged for both deposits and withdrawals. It is therefore advised to do extensive study on the relevant fees.

Deposit and Withdrawal

One Royal aims to offer a seamless and flexible transaction experience for its clients. According to tests conducted by trading professionals at Dumb Little Man, the broker provides a variety of funding options for both deposits and withdrawals. These options span traditional methods like bank wire transfers, credit/debit card transactions, and popular online payment systems such as Skrill and Neteller.

When it comes to transparency, One Royal continues to excel. The broker maintains clear guidelines and imposes no hidden fees on transactions. However, traders should note that specific requirements, limitations, and potential fees could vary. These factors depend on the chosen funding method, financial institution, and country of residence. As a result, conducting a thorough review of the transaction details is highly recommended to avoid any unexpected charges or limitations.

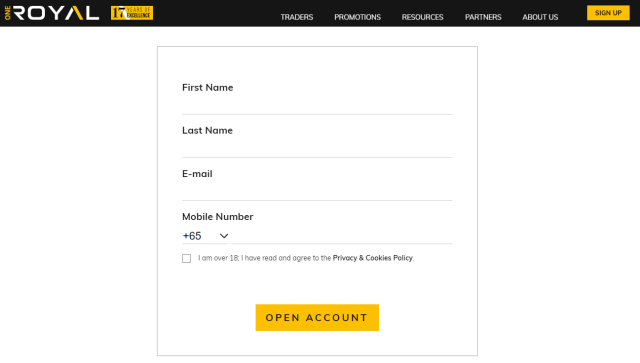

How to Open a One Royal Account

- Visit the official One Royal website.

- Locate the Sign-Up button in the upper right corner of the home page.

- Click the button to start the account creation process.

- Fill out a form that requires your details.

- Double-check the information for accuracy.

- Submit the form to complete registration.

- Check your registered email inbox for an account verification email.

- Follow the instructions in the email to verify your account.

- Log in to your new account and start trading with One Royal.

One Royal Affiliate Program

If you want to maximize your earnings, consider One Royal‘s Affiliate Program. The program features the Introducing Broker option, letting you earn up to 60% on all spread and commission-based accounts. It's a high-revenue opportunity that targets both Zero Commission and ECN accounts.

For those aiming to outperform, partnering with One Royal could be your ticket to increased income. The program has exceeded Pays, allowing you to earn up to $500 in cash incentives.

The affiliate program also presents special offers to encourage new client introductions. You can get a $150 cash bonus for every ten clients you introduce to One Royal. To sweeten the deal for your clients, they get a 5% client discount as cashback on spreads and commissions at month-end. For those who contribute significantly to trading volume, a $500 cash bonus is rewarded for every 2000 round lots traded.

One Royal Customer Support

Based on the experience of the team at Dumb Little Man, One Royal offers top-tier customer service available 24/5. Support channels include Live Chat, Social Media, Email, and Phone, making it convenient for traders to get the help they need. The customer support team is staffed with experienced trading professionals capable of addressing a wide range of issues. Whether you encounter technical glitches, need market analysis advice, or have general questions, One Royal's customer support is well-equipped to assist you effectively.

Advantages and Disadvantages of One Royal Customer Support

| Advantages | Disadvantages |

|---|---|

One Royal vs Other Brokers

#1. One Royal vs AvaTrade

AvaTrade has been a well-established broker since 2006, serving over 300,000 clients globally. They offer a broad range of financial instruments but are unavailable to US traders. One Royal, on the other hand, provides a more straightforward pricing structure and various account types. Both brokers are regulated, but AvaTrade operates under multiple global jurisdictions.

Verdict: One Royal may be a better choice for simple and flexible account options for traders. AvaTrade may appeal to those prioritizing global presence and a broad range of financial instruments.

#2. One Royal vs RoboForex

RoboForex stands out for its vast selection of trading platforms and its long history since 2009. They offer over 12,000 trading options across eight asset classes. One Royal offers fewer options but specializes in Forex and CFDs with competitive spreads. Both brokers are regulated, RoboForex by FSC and One Royal by reputable authorities.

Verdict: If you prioritize a wide selection of trading platforms and assets, RoboForex is better. For those focused on Forex and looking for tight spreads, One Royal is the superior choice.

#3. One Royal vs FXChoice

FXChoice, established in 2010, is more geared toward experienced traders, lacking features suitable for beginners, such as cent accounts. One Royal offers a range of accounts ideal for both beginners and professionals. FXChoice is regulated by the FSC of Belize, while One Royal is handled by reputable authorities.

Verdict: One Royal is better for a broader range of traders, including beginners, due to its flexible account options and competitive spreads.

Choose Asia Forex Mentor for Your Forex Trading Success

Want to master forex trading? Asia Forex Mentor is your go-to resource for top-notch training in forex, stock, and crypto, backed by Dumb Little Man experts. This platform sets you on the path to financial success.

Broad Course Selection: The platform provides a diverse range of courses that cover stock, crypto, and forex trading, making sure you're prepared for these markets.

Proven Track Record: Asia Forex Mentor has a history of creating successful traders, solidifying its reputation in trading education.

Expert Mentorship: Led by Ezekiel Chew, a seven-figure trader, the platform offers personalized guidance to understand complex market trends.

Vibrant Community: Being part of Asia Forex Mentor gives you access to a community of traders, enhancing your education and keeping you motivated.

Focus on Discipline & Mindset: In addition to market know-how, the platform stresses the importance of trader discipline and mental stability, key for trading success.

Frequent Updates & Content: Stay updated on market changes and new strategies thanks to their regular addition of new materials.

Success Stories: Numerous testimonials confirm traders achieving financial independence through this educational platform.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: One Royal Review

To sum up, One Royal presents a strong package for traders, according to Dumb Little Man's trading gurus. The site does a great job of offering cheap spreads, particularly for well-known currency combinations like EUR/USD, where the average spread is only 0.2 pip. It is a flexible option for both novice and experienced traders because of their clear pricing schedule, good trading instruments, and range of account options.

But prospective customers ought to proceed with care. Multiple funding options are provided by One Royal for seamless transactions; however, costs may differ according on the method and location selected. It's crucial to do extensive study on the relevant fees to prevent unpleasant surprises.

All things considered, One Royal offers a well-rounded product that is deserving of attention. It is a formidable competitor in the trading platform market since it combines an easy-to-use interface with aggressive trading conditions. But, it is advisable to do your research to make sure it fits your trading requirements and financial circumstances.

>> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

One Royal Review FAQs

What is the Minimum Deposit for One Royal?

$50 is the minimum deposit required to open an account with One Royal. Because of this, traders who would prefer to make little upfront investments can use it.

Does One Royal Offer a Sign-Up Bonus?

Yes, One Royal offers a 100% incentive on your first payment. This can increase your trading potential by doubling your initial stake up to $5,000.

How Reliable Are One Royal’s Customer Reviews?

Reviews for One Royal have been conflicting. The platform is praised by many users for its easy transactions and low spreads. However, some people are worried about the company's advertising claims. Before making a choice, it is advised that you read several reviews and conduct your own study.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.