NZD/USD IG Client Sentiment: For the first time since Feb 19, 2024…

By John V

February 28, 2024 • Fact checked by Dumb Little Man

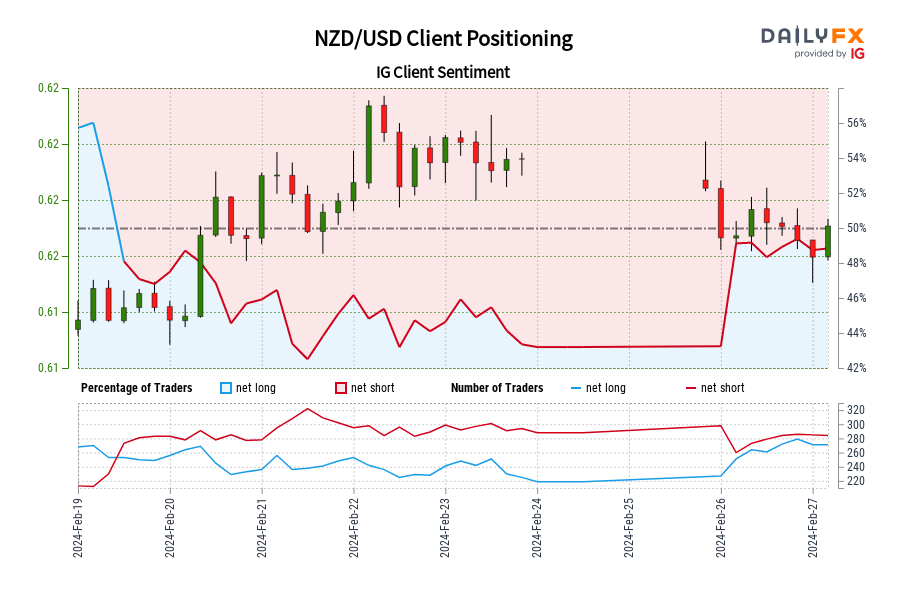

The NZD/USD currency pair has seen a notable shift in trader sentiment, with retail trader data revealing that 50.26% of traders are now net-long, marking the first instance of a net-long position since February 19, 2024, when the NZD/USD was trading near 0.61.

This change in positioning indicates a slight increase in bullish sentiment among traders, as the ratio of traders long to short stands at 1.01 to 1. Since that pivotal date, the price of NZD/USD has experienced a modest ascent of 0.52%. Interestingly, the quantity of traders adopting a net-long stance has surged by 9.47% compared to the previous day and by 7.43% from the past week.

Conversely, the count of traders net-short has risen by 4.76% since yesterday, but it has declined by 1.72% from last week’s figures.

This pivot towards a net-long orientation suggests a nuanced shift in market dynamics. Traditionally, a contrarian perspective to crowd sentiment implies that if the majority of traders are net-long, there might be a potential for prices to decline.

The current sentiment, coupled with recent shifts towards a more net-long bias among traders, strengthens the argument for a bearish outlook on the NZD/USD pair from a contrarian viewpoint. The increased net-long positions, both from the previous day and week, alongside a decrease in net-short positions from last week, underscore a growing optimism among traders.

However, this optimism, when viewed through a contrarian lens, could hint at an impending downward pressure on the NZD/USD prices, inviting traders to consider this sentiment shift in their strategies.

Traders are advised to keep a close watch on these dynamics as they navigate the forex market, adjusting their positions to align with the evolving sentiment and market trends.

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.